- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Weekly-20240418 issue

|

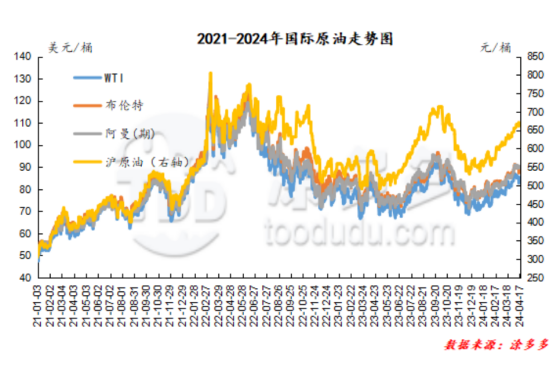

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20240412 |

85.660 |

90.450 |

90.240 |

90.350 |

665.300 |

-4.790 |

0.100 |

|

20240417 |

82.690 |

87.290 |

87.570 |

90.500 |

663.300 |

-4.600 |

-3.210 |

|

The rate of change compared with last week |

-3.47% |

-3.49% |

-2.96% |

0.17% |

-0.30% |

-3.97% |

-3310.00% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

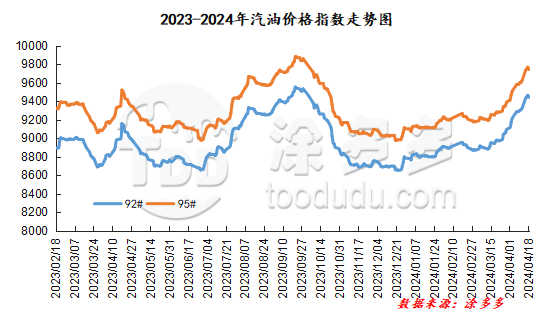

Wholesale prices of China's main units rose mainly this week (20240411-20240418), with an overall increase of between 30,400 yuan / ton. The ex-factory price of the refinery rose, with an overall increase of 80-440 yuan per ton. At the beginning of the week, crude oil weakens the mindset of bearish operators, the pace of downstream buyers entering the market slows down, refineries reduce prices and promote sales to ensure shipments, and the market trading atmosphere is mediocre. The price of crude oil rose in the middle of the week, and China's gasoline prices warmed up under the favorable news of geopolitical factors. In terms of demand in the Chinese market, the atmosphere of stock preparation during the May Day holiday is getting stronger, mainly in the middle and lower reaches, and refinery shipments are getting better.

According to Tudor data, as of April 18, China's gasoline price index was 9442.49, up 132.17 from last week, an increase of 0.01%, or 0.01%, from last week. The gasoline price index rose 132.22, or 0.01%, from last week. The 9-month and 9-month gasoline indices were both raised, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 301.41.

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

East China region |

92# |

9020-9600 |

9200-9630 |

180/30 |

2.00%/0.31% |

|

95# |

9210-9800 |

9350-9980 |

140/180 |

1.52%/1.84% |

|

|

South China |

92# |

9050-10380 |

9450-10330 |

400/-50 |

4.42%/-0.48% |

|

95# |

9550-10680 |

9650-10630 |

100/-50 |

1.05%/-0.47% |

|

|

North China region |

92# |

8870-9900 |

9150-10132 |

280/232 |

3.16%/2.34% |

|

95# |

9070-10274 |

9300-10514 |

230/240 |

2.54%/2.34% |

|

|

Northwestern region |

92# |

9000-10321 |

9300-10533 |

300/212 |

3.33%/2.05% |

|

95# |

9200-10955 |

9500-11146 |

300/191 |

3.26%/1.74% |

|

|

Northeast China |

92# |

8830-9300 |

9000-9400 |

170/100 |

1.93%/1.08% |

|

95# |

9085-9650 |

9210-9700 |

125/50 |

1.38%/0.52% |

|

|

Southwest China |

92# |

9300--10491 |

9300--10703 |

0/212 |

0.00%/2.02% |

|

95# |

9600-11102 |

9600-11326 |

0/224 |

0.00%/2.02% |

|

|

Central China |

92# |

9200-9750 |

9330-9900 |

130/150 |

1.41%/1.54% |

|

95# |

9400-10050 |

9500-10200 |

100/150 |

1.06%/1.49% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8850-9150 |

9000-9450 |

150/300 |

1.69%/3.28% |

|

95# |

8960-9300 |

9080-9600 |

120/300 |

1.34%/3.23% |

|

|

Northwestern region |

92# |

8850-9000 |

9020-9300 |

170/300 |

1.92%/3.33% |

|

95# |

9050-9200 |

9250-9500 |

200/300 |

2.21%/3.26% |

|

|

Northeast China |

92# |

8750-8900 |

9000-9020 |

250/120 |

2.86%/1.35% |

|

95# |

8950-8950 |

9200-9200 |

250/250 |

2.79%/2.79% |

|

|

East China region |

92# |

9200-9200 |

9150-9280 |

-50/80 |

-0.54%/0.87% |

|

95# |

9070-9140 |

9300-9390 |

230/250 |

2.54%/2.74% |

|

|

North China region |

92# |

8900-8900 |

9050-9150 |

150/250 |

1.69%/2.81% |

|

95# |

8980-9000 |

9150-9200 |

170/200 |

1.89%/2.22% |

|

|

Central China |

92# |

8980-8980 |

9420-9420 |

440/440 |

4.90%/4.90% |

|

95# |

9400-9400 |

9620-9620 |

220/220 |

2.34%/2.34% |

|

|

Southwest China |

92# |

9300-9300 |

9400-9400 |

100/100 |

1.08%/1.08% |

|

95# |

9450-9450 |

9550-9550 |

100/100 |

1.06%/1.06% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

9000-9000 |

9100-9100 |

100/100 |

1.11%/1.11% |

|

95# |

9450-9600 |

9600-9650 |

150/50 |

1.59%/0.52% |

|

|

Liaoning |

92# |

8830-9300 |

9050-9400 |

220/100 |

2.49%/1.08% |

|

95# |

9085-9600 |

9210-9700 |

125/100 |

1.38%/1.04% |

|

|

Heilongjiang Province |

92# |

9100-9100 |

9150-9150 |

50/50 |

0.55%/0.55% |

|

95# |

9400-9400 |

9400-9400 |

0/0 |

0.00%/0.00% |

(2) East China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

9170-9350 |

9200-9450 |

30/100 |

0.33%/1.07% |

|

95# |

9300-9550 |

9350-9650 |

50/100 |

0.54%/1.05% |

|

|

Shandong |

92# |

9090-9530 |

9250-9630 |

160/100 |

1.76%/1.05% |

|

95# |

9210-9750 |

9350-9980 |

140/230 |

1.52%/2.36% |

|

|

Jiangsu Province |

92# |

9380-9400 |

9380-9400 |

0/0 |

0.00%/0.00% |

|

95# |

9630-9650 |

9500-9550 |

-130/-100 |

-1.35%/-1.04% |

|

|

Zhejiang |

92# |

9350-9600 |

9350-9550 |

0/-50 |

0.00%/-0.52% |

|

95# |

9550-9800 |

9550-9750 |

0/-50 |

0.00%/-0.51% |

(3) Central China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

9200-9380 |

9350-9600 |

150/220 |

1.63%/2.35% |

|

95# |

9400-9580 |

9500-9800 |

100/220 |

1.06%/2.30% |

|

|

Jiangxi Province |

92# |

9400-9450 |

9500-9600 |

100/150 |

1.06%/1.59% |

|

95# |

9650-9700 |

9780-9800 |

130/100 |

1.35%/1.03% |

|

|

Hubei province |

92# |

9230-9750 |

9450-9900 |

220/150 |

2.38%/1.54% |

|

95# |

9430-10050 |

9650-10200 |

220/150 |

2.33%/1.49% |

|

|

Hunan |

92# |

9330-9450 |

9330-9550 |

0/100 |

0.00%/1.06% |

|

95# |

9530-9750 |

9530-9850 |

0/100 |

0.00%/1.03% |

(4) North China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

9100-9900 |

9300-10132 |

200/232 |

2.20%/2.34% |

|

95# |

9300-10074 |

9500-10514 |

200/440 |

2.15%/4.37% |

|

|

Beijing |

92# |

9450-9500 |

9650-9700 |

200/200 |

2.12%/2.11% |

|

95# |

9600-9650 |

9800-9850 |

200/200 |

2.08%/2.07% |

|

|

Tianjin |

92# |

8870-9100 |

9000-9200 |

130/100 |

1.47%/1.10% |

|

95# |

9070-9300 |

9200-9400 |

130/100 |

1.43%/1.08% |

|

|

Shanxi Province |

92# |

9150-9700 |

9510-9800 |

360/100 |

3.93%/1.03% |

|

95# |

9450-9700 |

9900-10200 |

450/500 |

4.76%/5.15% |

|

|

Hebei |

92# |

9070-9350 |

9150-9450 |

80/100 |

0.88%/1.07% |

|

95# |

9190-9550 |

9300-9650 |

110/100 |

1.20%/1.05% |

|

|

Henan |

92# |

9070-9300 |

9320-9630 |

250/330 |

2.76%/3.55% |

|

95# |

9350-9600 |

9570-9930 |

220/330 |

2.35%/3.44% |

(5) South China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

9400-10380 |

9450-10030 |

50/-350 |

0.53%/-3.37% |

|

95# |

9750-10680 |

9750-10630 |

0/-50 |

0.00%/-0.47% |

|

|

Hainan |

92# |

9350-9700 |

9450-9700 |

100/0 |

1.07%/0.00% |

|

95# |

9550-9900 |

9650-9900 |

100/0 |

1.05%/0.00% |

|

|

Fujian |

92# |

9350-9800 |

9450-9850 |

100/50 |

1.07%/0.51% |

|

95# |

9650-10000 |

9650-10050 |

0/50 |

0.00%/0.50% |

(6) Northwest China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

9000-9763 |

9300-9975 |

300/212 |

3.33%/2.17% |

|

95# |

9200-10131 |

9500-10351 |

300/220 |

3.26%/2.17% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9936-9936 |

10098-10098 |

162/162 |

1.63%/1.63% |

|

95# |

10507-10507 |

10681-10681 |

174/174 |

1.66%/1.66% |

|

|

Gansu |

92# |

9200-10321 |

9450-10533 |

250/212 |

2.72%/2.05% |

|

95# |

9550-10922 |

9950-11146 |

400/224 |

4.19%/2.05% |

|

|

Xizang Autonomous region |

92# |

9980-9981 |

10100-10101 |

120/120 |

1.20%/1.20% |

|

95# |

10430-10431 |

10550-10551 |

120/120 |

1.15%/1.15% |

|

|

Shaanxi |

92# |

9000-9715 |

9300-9805 |

300/90 |

3.33%/0.93% |

|

95# |

9200-10085 |

9500-10175 |

300/90 |

3.26%/0.89% |

|

|

Qinghai |

92# |

9380-9380 |

9520-9520 |

140/140 |

1.49%/1.49% |

|

95# |

9790-9790 |

9930-9930 |

140/140 |

1.43%/1.43% |

(7) Southwest China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

9600-9730 |

9800-10050 |

200/320 |

2.08%/3.29% |

|

95# |

10050-10280 |

10250-10400 |

200/120 |

1.99%/1.17% |

|

|

Sichuan |

92# |

9300-9500 |

9400-9690 |

100/190 |

1.08%/2.00% |

|

95# |

9700-9850 |

9800-9990 |

100/140 |

1.03%/1.42% |

|

|

Guangxi Zhuang Autonomous region |

92# |

9500-10491 |

9520-10703 |

20/212 |

0.21%/2.02% |

|

95# |

960-11102 |

9670-11326 |

8710/224 |

907.29%/2.02% |

|

|

Guizhou |

92# |

9550-9900 |

9700-9750 |

150/-150 |

1.57%/-1.52% |

|

95# |

9580-10200 |

10000-10050 |

420/-150 |

4.38%/-1.47% |

|

|

Chongqing |

92# |

9250-9500 |

9300-9600 |

50/100 |

0.54%/1.05% |

|

95# |

9600-9800 |

9600-10000 |

0/200 |

0.00%/2.04% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8750-8750 |

9000-9000 |

250/250 |

2.86%/2.86% |

|

95# |

8950-8950 |

9200-9200 |

250/250 |

2.79%/2.79% |

(9) East China geochemistry

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8950-9030 |

9150-9280 |

200/250 |

2.23%/2.77% |

|

95# |

9070-9140 |

9300-9390 |

230/250 |

2.54%/2.74% |

(10) Central China Refinery

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

9200-9200 |

9420-9420 |

220/220 |

2.39%/2.39% |

|

95# |

9400-9400 |

9620-9620 |

220/220 |

2.34%/2.34% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8830-8850 |

9050-9150 |

220/300 |

2.49%/3.39% |

|

95# |

8930-8930 |

9150-9300 |

220/370 |

2.46%/4.14% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8850-9150 |

9000-9450 |

150/300 |

1.69%/3.28% |

|

95# |

8960-9300 |

9080-9600 |

120/300 |

1.34%/3.23% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8850-9000 |

9100-9200 |

250/200 |

2.82%/2.22% |

|

95# |

9050-9150 |

9250-9250 |

200/100 |

2.21%/1.09% |

|

|

Shaanxi |

92# |

9000-9000 |

9050-9300 |

50/300 |

0.56%/3.33% |

|

95# |

9200-9200 |

9500-9500 |

300/300 |

3.26%/3.26% |

(14) Southwest Refinery

|

Province / city |

Model |

Price 4.11 |

Price 4.18 |

Rise and fall |

Amplitude |

|

Sichuan Province |

92# |

9400-9400 |

9550-9550 |

150/150 |

1.60%/1.60% |

|

95# |

9200-9200 |

9400-9400 |

200/200 |

2.17%/2.17% |

The main negative factors for the decline in international crude oil prices are: the conflict between Iran and Israel has not yet further escalated, geopolitical concerns have eased, and the expectation of Fed interest rate cuts has been postponed again, and the US dollar has performed strongly. From the demand point of view, with the approach of May Day holiday, the intention of middle and lower reaches merchants to prepare goods before the festival is gradually rising. From the supply side, the refinery performance pressure will increase in the middle and late next month, and the main units will produce more promotions. Generally speaking, it is expected that China's gasoline market will be stable and fluctuate in a narrow range in the short term.

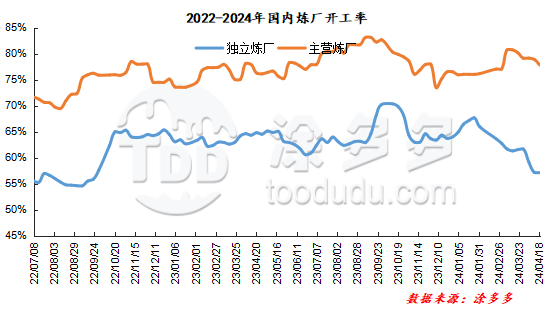

This week (20240411-20240418) the operating rate of independent refineries was 57.11%, down 0.05%; the operating rate of main units was 77.82%, down 1.06%.

|

Maintenance list of main refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

June 2024 |

Tentatively |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

350 |

March 1, 2024 |

March 26, 2024 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 18, 2024 |

June 18, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Wuhan Petrochemical Corporation |

Whole plant overhaul |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

April 1, 2024 |

May 30, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 10, 2024 |

May 22, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 3, 2024 |

August 31, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

April 1, 2024 |

May 15, 2024 |

|

China Asphalt Sichuan |

Whole plant overhaul |

60 |

March 17, 2024 |

April 9, 2024 |

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Aoxing petrochemical |

Rotation inspection |

240 |

May 2024 |

June 2024 |

|

Shandong Haihua |

Whole plant overhaul |

240 |

January 31, 2024 |

April 13, 2024 |

|

Shenchi chemical industry |

Whole plant overhaul |

260 |

January 25, 2024 |

At the end of April 2024 |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

April 1, 2024 |

2024 15 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

December 18, 2023 |

Late April 2024 |

|

Haiyou petrochemical |

Whole plant overhaul |

350 |

January 31, 2024 |

April 1, 2024 |

|

Zhonghe petrochemical |

Whole plant overhaul |

500 |

May 1, 2024 |

June 2024 |

|

Hubei Jinao |

Whole plant overhaul |

500 |

March 5, 2024 |

May 31, 2024 |

|

Liaoning Huajin |

Whole plant overhaul |

600 |

July 2024 |

September 2024 |

|

Dalian Hengli |

Atmospheric and vacuum decompression and reorganization |

1000 |

April 2024 |

June 2024 |

|

Dongchen Petrochemical |

Rotation inspection |

/ |

2024 / late February |

To be determined |