China's ethanol market review in the first quarter of 2024

Market review

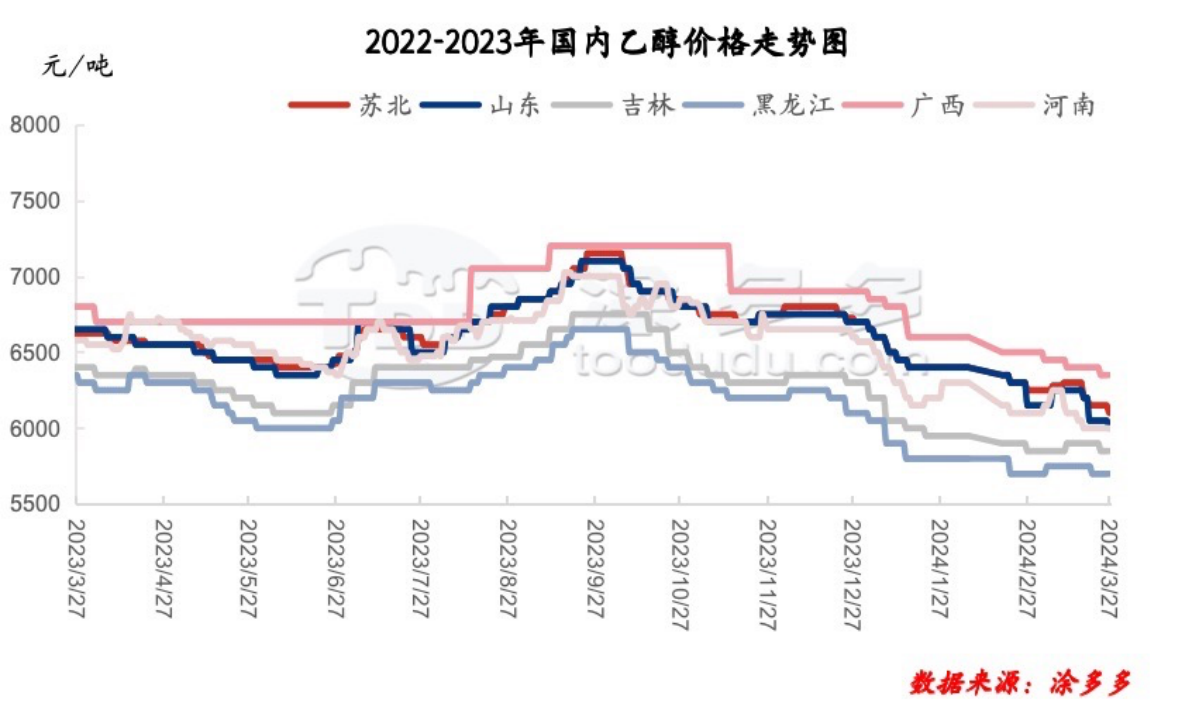

In January, the price of ethanol in China was weak and downward, the supply of large factories in Northeast China was sufficient, the shipping mentality was positive, the quotation continued to be weak, and the price tended to be stable at the end of the month; Henan corn ethanol first weakened and then rose, and the price continued to weaken when the price fell to a low point, arbitrage opened orders increased, and pre-festival stock began to be prepared, and prices rose; prices in East China continued to weaken, demand was general, and non-local supply advantages. Fuel ethanol first stabilized and then fell, the early main order delivery, in the middle and later period of enterprise shipping mentality positive price weakening. The coal ethanol market is weak downward, individual enterprises sell goods prices weak, large factory shipping mentality positive prices continue to weaken. In February, the price of ethanol in China was weak and downward, the supply of large factories in Northeast China was stable, the shipments were general before the Spring Festival, and there was normal production during the Spring Festival, but there was a situation of replenishment after the Spring Festival, but the prices of enterprises were weak under inventory. Henan corn ethanol first rose and then fell. After the price fell to a low last month, the order increased. After the price rose, the transaction of the new order was weak, the snowfall weather affected the delivery, the price was weak, and the equipment did not stop during the Spring Festival. After the festival, prices continued to weaken; prices in East China continued to weaken, demand was general, and some non-local sources were consumed. Fuel ethanol prices are weak, downstream pre-festival stock and post-festival replenishment, but the overall supply is adequate, individual large factory shipments Sendai positive price weakening. The price of coal-based ethanol is weak, and the equipment of large factories is normal, but the price of other ethanol is weaker, and the shipping mentality is positive and the price is weak under the increase of inventory. In March, the price of ethanol in China first stabilized and then rose, and after the rise, the price of new orders generally began to fall slightly. The price in the northeast region remained stable in the early stage, but later, due to the increase in procurement volume, the enterprise quotation rose, the transaction was limited, and the price fell; the price of corn ethanol in Henan fluctuated obviously, when there were not many vehicles in front of the door, and the price rose when the order increased; the start of construction in East China was limited, and some non-local sources of goods were consumed, and the price went up and down. The price of fuel ethanol is stable at first and then weak, some enterprises have a positive shipping mentality, and the price goes down. The price supply of coal-based ethanol increases, the market competition intensifies, and the price weakens obviously. By March 28th, the price of ethanol in China was 5600-5750 yuan / ton for general-grade ethanol in Heilongjiang, 5800-5900 yuan / ton for general-grade ethanol in Jilin, 6000 yuan / ton for superior-grade ethanol in Henan, and 6100 yuan / ton for cassava ethanol in eastern and northern Jiangsu.

Supply analysis

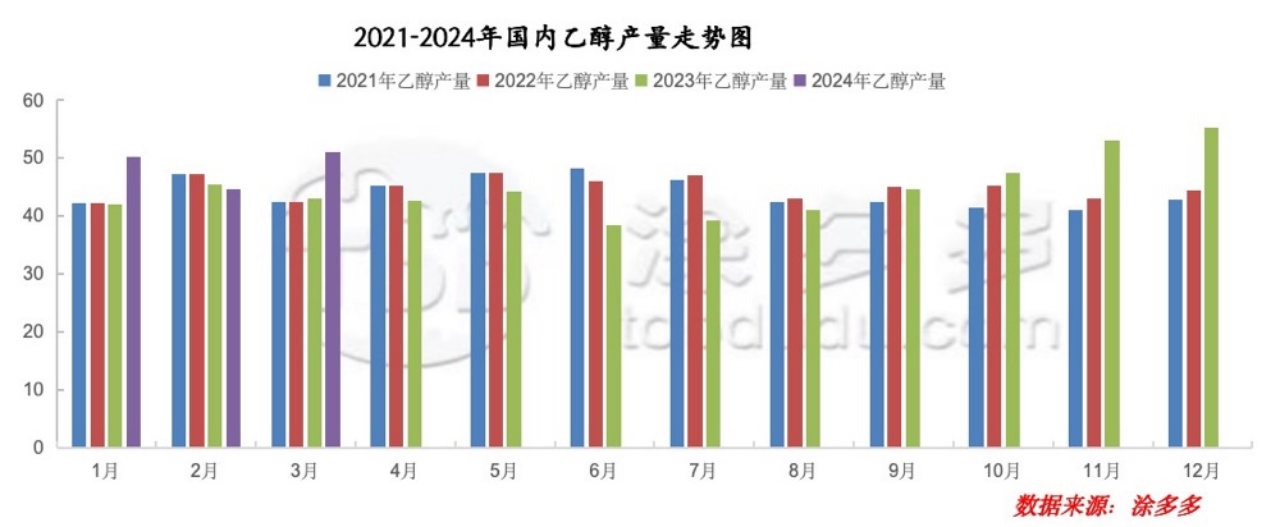

Supply side: 1.4608 million tons of edible and industrial ethanol in the first quarter. Fuel ethanol attack production of 958500 tons. In January 2024, China produced about 503240 tons of edible and industrial ethanol and 318500 tons of fuel ethanol in January. In February 2024, China produced about 446000 tons of edible and industrial ethanol and 330000 tons of fuel ethanol in February. China produced about 511560 tons of edible and industrial ethanol in March 2024 and 310000 tons of fuel ethanol in March.

Enterprise device dynamics

|

Enterprise name |

Production capacity (10,000 tons / year) |

Maintenance involves production capacity |

Maintenance start time |

Remarks |

|

Hongzhan (Jixian) |

60 |

60 |

Normal |

|

|

Jilin Fukang |

50 |

4 |

Normal |

|

|

Heilongjiang Hexing grain and oil |

3 |

3 |

Stop the machine |

|

|

Inner Mongolia Shuntong |

12 |

12 |

Shut down on January 23rd |

|

|

Heilongjiang Zhongke Green |

10 |

10 |

Normal |

|

|

Fulaichun, Shandong Province |

20 |

20 |

Stop the machine |

|

|

Jiangsu Dongcheng |

15 |

15 |

Stop the machine |

|

|

Guannan COVID-19, Lianyungang |

5 |

5 |

Stop the machine |

|

|

Jiangsu Haiyan |

15 |

15 |

Start up in the middle of May |

|

|

Jiangsu Maibo remittance |

8 |

8 |

Stop the machine |

|

|

Shuyang Guohua |

5 |

5 |

Stop the machine |

|

|

Anhui COFCO |

75 |

30 |

Universal downtime in January |

|

|

Anhui Wuhechun |

8 |

8 |

Stop the machine |

|

|

Jilin Xintianlong |

30 |

30 |

Normal |

|

|

Heilongjiang Sheng long |

15 |

15 |

Production after the Spring Festival |

|

|

Inner Mongolia Liniu |

10 |

10 |

Normal |

|

|

Hanyong, Mengzhou, Henan Province |

30 |

30 |

Normal |

|

|

Houyuan, Mengzhou, Henan Province |

50 |

50 |

Normal |

|

|

Jilin Dongfeng Hua Grain |

10 |

10 |

Normal |

|

|

National Investment Helen |

30 |

30 |

Normal |

Fuel fuel |

|

Guotou Jidong |

30 |

30 |

Normal |

Fuel fuel |

|

Zhenjiang Changxing |

10 |

10 |

The machine was shut down on January 31 and put in material on March 4th. |

|

|

Jin Changlin in Lianyungang |

5 |

5 |

Stop the machine |

|

|

Hongzhang, ha. |

60 |

30 |

Normal |

|

|

Fukang |

50 |

50 |

Normal |

|

|

Tianyu |

15 |

15 |

The anhydrous device was shut down on March 1st and other normal conditions. |

|

|

Cofco Zhaodong |

30 |

10 |

The food shutdown is expected to be fed on March 1. |

|

|

Chifeng Ruiyang |

8 |

8 |

Normal |

|

|

Hongzhan Tahiko |

30 |

30 |

Normal |

|

|

Wanli Runda |

60 |

60 |

Normal |

|

|

Lianyungang Longhe River |

10 |

10 |

Stop the machine |

|

|

Jiangsu sul alcohol |

12 |

12 |

Stop the machine |

|

|

Liaoyuan giant peak |

50 |

50 |

Stop the machine |

|

|

Zalantun |

10 |

10 |

Normal |

|

|

Shandong Yingxuan |

20 |

20 |

Normal |

|

|

Jilin fuel |

70 |

70 |

Normal |

|

|

Guotou Tieling |

30 |

30 |

Normal |

|

|

Henan Nanyang Tianguan |

30 |

30 |

The short stop for 3 months is normal. |

|

|

Romet. |

5 |

5 |

Stop the machine |

|

|

Fuyu Huihai |

5 |

5 |

Stop the machine |

|

|

China Colleen |

10 |

10 |

Normal |

|

|

Guotou Jidong |

30 |

30 |

Normal |

|

|

Hongzhan Huannan |

30 |

30 |

Normal |

|

|

Jiangsu Flower Hall |

25 |

25 |

The small line of the plant was restored on January 8, and all the east plants were restored in the middle of January. |

|

Ethanol start-up at the end of March: northeast construction: Dongning Hongda shutdown, Baoquanling shutdown, Luobei shutdown, Cofco Zhaodong production, Wanli plant is normal, Hongzhan 4 factories are normal, Heilongjiang Shenglong production, Zhongke Green production, Fuyu Huihai shutdown; Fukang production, Tianyu production, Shuntong shutdown, Dongfeng Huafeng production, Xintianlong normal, Liuniu production. Huadong Huatian production, Guannan shutdown, Jin Changlin shutdown, Guohua shutdown, Kant downtime, Changxing production, Longhe downtime, Romat production, sul shutdown, Fulaichun shutdown, canal wind production, Maybo Huihui shutdown, and MINUSTAH production. Hanyong, Mengzhou, Henan is normal, Huaxing is normal, Houyuan is normal. Jufeng shuts down. Chifeng Ruiyang production, Zhalantun production, Inner Mongolia Jietainuo plant production. Jilin fuel is normal, Guotou Tieling short stop. Tianguan Nanyang shutdown. Guotou Jidong production. State Investment Helen production. Ethanol production, a by-product of Baling Petrochemical.

Cost and profit

The average profit of corn ethanol in Heilongjiang region in the first quarter was 18 yuan / ton, corn prices fell at first and then rose, and the production costs of ethanol enterprises increased.

In the first quarter, the average profit of cassava ethanol in East China and Northern Jiangsu is-180.90 yuan / ton. After the price of cassava is higher and the cost of import increases, the price of ethanol continues to weaken, and the enterprise is losing money.