Tu Duoduo Gasoline Industry Weekly-No. 20240328

Gasoline Weekly-20240328 issue

I. International crude oil futures price

|

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20240321 |

81.62 |

86.25 |

86.08 |

86.18 |

635.6 |

-4.63 |

0.07 |

|

20240327 |

81.35 |

86.09 |

85.92 |

85.1 |

632.5 |

-4.74 |

0.99 |

|

The rate of change compared with last week |

0.35% |

0.36% |

0.20% |

-1.06% |

0.13% |

0.64% |

-530.43% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

II. Summary of gasoline market

Wholesale prices of main units in China this week (20240321-20240328) are mainly rising and mostly concentrated in low-end prices, with an overall increase of 70-180 yuan per ton. The ex-factory price of the refinery rose, with an overall increase of 50-150 yuan per ton. The main factors in the gasoline market: the rise in international crude oil prices this week, the rise in international crude oil during the week, good cost guidance, and boosted by the Qingming Festival short holiday, gasoline demand is supported at the bottom. OPEC+ production reduction position is firm, Russia promised to increase production cuts in the second quarter, and the geopolitical situation remains unstable.

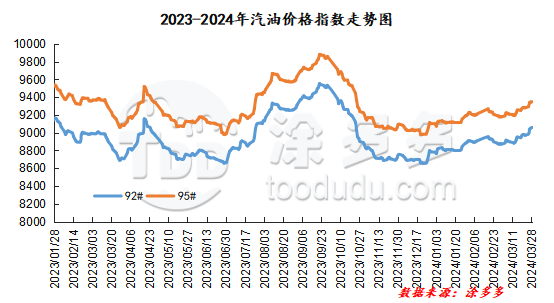

III. Gasoline price index

According to Tudor data, as of March 28, China's gasoline price index was 9059.97, up 81.97, or 0.91%, from last week. The gasoline price index was 9358.43, up 75.84, or 0.81%, from last week. The 9-month and 9-month gasoline indices were both raised, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 298.46.

IV. Spot market for gasoline

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8600-9708 |

8590-9708 |

10/0 |

0.10%/0.00% |

|

95# |

8800-10074 |

8830-10074 |

30/0 |

0.34%/0.00% |

|

|

South China |

92# |

8900-9880 |

9000-9950 |

100/70 |

1.01%/0.71% |

|

95# |

9100-10180 |

9200-10250 |

100/70 |

1.09%/0.69% |

|

|

Central China |

92# |

8880-9500 |

8980-9600 |

100/100 |

1.05%/1.05% |

|

95# |

9030-9800 |

9130-9900 |

100/100 |

1.10%/1.02% |

|

|

East China region |

92# |

8740-9150 |

8850-9300 |

110/150 |

1.20%/1.64% |

|

95# |

8840-9500 |

8980-9500 |

140/0 |

1.56%/0.00% |

|

|

Northwestern region |

92# |

8700-10109 |

8880-10109 |

180/0 |

1.78%/0.00% |

|

95# |

8900-10698 |

9000-10698 |

100/0 |

1.11%/0.00% |

|

|

Southwest China |

92# |

8950-10279 |

9050-10279 |

100/0 |

0.97%/0.00% |

|

95# |

9200-10878 |

9350-10878 |

150/0 |

1.60%/0.00% |

|

|

Northeast China |

92# |

8530-9000 |

8600-9020 |

70/20 |

0.78%/0.22% |

|

95# |

8730-9730 |

8835-9600 |

105/-130 |

1.19%/-1.34% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8400-8750 |

8500-8800 |

100/50 |

1.18%/0.57% |

|

95# |

8500-8900 |

8580-8950 |

80/50 |

0.90%/0.56% |

|

|

North China region |

92# |

8550-8610 |

8620-8700 |

70/90 |

0.81%/1.05% |

|

95# |

8600-8680 |

8690-8780 |

90/100 |

1.04%/1.15% |

|

|

Central China |

92# |

8900-8900 |

8980-8980 |

80/80 |

0.89%/0.90% |

|

95# |

9100-9100 |

9180-9180 |

80/80 |

0.88%/0.88% |

|

|

East China region |

92# |

8550-8660 |

8680-8810 |

130/150 |

1.50%/1.73% |

|

95# |

8670-8770 |

8800-8920 |

130/150 |

1.48%/1.71% |

|

|

Northwestern region |

92# |

8500-8700 |

8650-8800 |

150/100 |

1.73%/1.15% |

|

95# |

8650-8900 |

8800-9000 |

150/100 |

1.69%/1.12% |

|

|

Northeast China |

92# |

8500-8550 |

8600-8600 |

100/50 |

1.16%/0.58% |

|

95# |

8750-8750 |

8800-8800 |

50/50 |

0.57%/0.57% |

|

|

Southwest China |

92# |

8980-8980 |

9050-9050 |

70/70 |

0.77%/0.78% |

|

95# |

9130-9130 |

9200-9200 |

70/70 |

0.77%/0.77% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8750-8750 |

8850-8900 |

100/150 |

1.13%/1.71% |

|

95# |

9300-9600 |

9450-9600 |

150/0 |

1.56%/0.00% |

|

|

Liaoning |

92# |

8485-8900 |

8600-9020 |

115/120 |

1.34%/1.35% |

|

95# |

8650-9200 |

8835-9100 |

185/-100 |

2.09%/-1.09% |

|

|

Heilongjiang Province |

92# |

8755-8755 |

8750-8750 |

-5/-5 |

-0.06%/-0.06% |

|

95# |

9025-9025 |

9000-9000 |

-25/-25 |

-0.28%/-0.28% |

(2) East China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

8650-8800 |

8900-8950 |

250/150 |

2.84%/1.70% |

|

95# |

8800-9000 |

9050-9150 |

250/150 |

2.76%/1.67% |

|

|

Shandong |

92# |

8750-9100 |

8800-9160 |

50/60 |

0.57%/0.66% |

|

95# |

8850-9500 |

8850-9500 |

0/0 |

0.00%/0.00% |

|

|

Jiangsu Province |

92# |

8830-8850 |

9130-9130 |

300/280 |

3.29%/3.16% |

|

95# |

9080-9150 |

9380-9400 |

300/250 |

3.20%/2.73% |

|

|

Zhejiang |

92# |

8800-9000 |

9100-9300 |

300/300 |

3.33%/3.33% |

|

95# |

9000-9200 |

9300-9500 |

300/300 |

3.23%/3.26% |

(3) Central China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

8750-8950 |

8980-9100 |

230/150 |

2.56%/1.68% |

|

95# |

9100-9150 |

9130-9300 |

30/150 |

0.33%/1.64% |

|

|

Jiangxi Province |

92# |

9000-9100 |

9050-9120 |

50/20 |

0.55%/0.22% |

|

95# |

9230-9400 |

9250-9450 |

20/50 |

0.22%/0.53% |

|

|

Hubei province |

92# |

8850-9400 |

9000-9600 |

150/200 |

1.60%/2.13% |

|

95# |

9050-9700 |

9200-9900 |

150/200 |

1.63%/2.06% |

|

|

Hunan |

92# |

8850-9200 |

9150-9200 |

300/0 |

3.26%/0.00% |

|

95# |

9070-9500 |

9200-9500 |

130/0 |

1.41%/0.00% |

(4) North China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

8800-9581 |

8900-9708 |

100/127 |

1.04%/1.33% |

|

95# |

8900-10074 |

9100-10074 |

200/0 |

2.20%/0.00% |

|

|

Beijing |

92# |

9000-9050 |

9100-9150 |

100/100 |

1.10%/1.10% |

|

95# |

9150-9200 |

9240-9300 |

90/100 |

0.98%/1.09% |

|

|

Tianjin |

92# |

8500-8750 |

8590-8900 |

90/150 |

1.03%/1.71% |

|

95# |

8620-8900 |

8790-8900 |

170/0 |

1.93%/0.00% |

|

|

Shanxi Province |

92# |

8900-9050 |

8850-9100 |

-50/50 |

-0.56%/0.55% |

|

95# |

9100-9550 |

9100-9550 |

0/0 |

0.00%/0.00% |

|

|

Hebei |

92# |

8680-8940 |

8850-8990 |

170/50 |

1.90%/0.56% |

|

95# |

8800-9160 |

8950-9180 |

150/20 |

1.68%/0.22% |

|

|

Henan |

92# |

9170-9250 |

8900-9250 |

-270/0 |

-3.03%/0.00% |

|

95# |

9220-9550 |

9120-9550 |

-100/0 |

-1.05%/0.00% |

(5) South China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

9000-9650 |

9100-9950 |

100/300 |

1.10%/3.11% |

|

95# |

9150-9950 |

9250-10250 |

100/300 |

1.01%/3.02% |

|

|

Hainan |

92# |

8950-9200 |

9000-9200 |

50/0 |

0.56%/0.00% |

|

95# |

9150-9400 |

9400-9400 |

250/0 |

2.66%/0.00% |

|

|

Fujian |

92# |

8900-9050 |

9100-9500 |

200/450 |

2.20%/4.97% |

|

95# |

9100-9250 |

9200-9700 |

100/450 |

1.09%/4.86% |

(6) Northwest China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8800-9582 |

8900-9582 |

100/0 |

1.04%/0.00% |

|

95# |

9000-9944 |

9100-9944 |

100/0 |

1.10%/0.00% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9724-9724 |

9724-9724 |

0/0 |

0.00%/0.00% |

|

95# |

10283-10283 |

10283-10283 |

0/0 |

0.00%/0.00% |

|

|

Gansu |

92# |

8950-9977 |

9000-10109 |

50/132 |

0.50%/1.32% |

|

95# |

9450-10698 |

9450-10698 |

0/0 |

0.00%/0.00% |

|

|

Xizang Autonomous region |

92# |

9870-9870 |

9920-9921 |

50/51 |

0.50%/0.52% |

|

95# |

10320-10320 |

10370-10371 |

50/51 |

0.48%/0.49% |

|

|

Shaanxi |

92# |

8730-8897 |

8800-9540 |

70/643 |

0.79%/7.23% |

|

95# |

8900-9900 |

9000-9900 |

100/0 |

1.11%/0.00% |

|

|

Qinghai |

92# |

9270-9270 |

9300-9300 |

30/30 |

0.32%/0.32% |

|

95# |

9720-9720 |

9710-9710 |

-10/-10 |

-0.10%/-0.10% |

(7) Southwest China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

9250-9400 |

9250-9480 |

0/80 |

0.00%/0.85% |

|

95# |

9650-9850 |

9700-9930 |

50/80 |

0.51%/0.81% |

|

|

Sichuan |

92# |

9100-9250 |

9180-9330 |

80/80 |

0.87%/0.86% |

|

95# |

9450-9500 |

9550-9740 |

100/240 |

1.05%/2.53% |

|

|

Guangxi Zhuang Autonomous region |

92# |

8850-10279 |

9200-10279 |

350/0 |

3.41%/0.00% |

|

95# |

9000-10878 |

9350-10878 |

350/0 |

3.74%/0.00% |

|

|

Guizhou |

92# |

9200-9450 |

9250-9450 |

50/0 |

0.54%/0.00% |

|

95# |

9500-9750 |

9550-9750 |

50/0 |

0.51%/0.00% |

|

|

Chongqing |

92# |

8950-9320 |

9070-9200 |

120/-120 |

1.32%/-1.29% |

|

95# |

9300-9700 |

9400-9500 |

100/-200 |

1.06%/-2.06% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8430-8550 |

8680-8810 |

250/260 |

2.92%/3.04% |

|

95# |

8600-8750 |

8800-8920 |

200/170 |

2.27%/1.94% |

(9) East China geochemistry

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8550-8610 |

8780-8810 |

230/150 |

2.66%/1.73% |

|

95# |

8600-8680 |

8800-8820 |

130/50 |

1.48%/0.57% |

(10) Central China Refinery

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

8830-8830 |

8980-8980 |

150/150 |

1.67%/1.70% |

|

95# |

9030-9030 |

9180-9180 |

150/150 |

1.66%/1.66% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8540-8650 |

8655-8720 |

115/70 |

1.33%/0.81% |

|

95# |

8640-8700 |

8720-8800 |

80/100 |

0.92%/1.15% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8410-8930 |

8500-8800 |

90/-130 |

1.01%/-1.46% |

|

95# |

8440-9090 |

8580-8950 |

140/-140 |

1.63%/-1.54% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8550-8650 |

8650-8800 |

100/150 |

1.16%/1.73% |

|

95# |

8700-8800 |

8880-8950 |

180/150 |

2.03%/1.70% |

|

|

Shaanxi |

92# |

8550-8800 |

8650-8800 |

100/0 |

1.16%/0.00% |

|

95# |

8900-8900 |

8950-9000 |

50/100 |

0.56%/1.12% |

(14) Southwest Refinery

|

Province / city |

Model |

Price 3.21 |

Price 3.28 |

Rise and fall |

Amplitude |

|

Sichuan Province |

92# |

9150-9100 |

9000-9000 |

-100/-50 |

-1.10%/-0.55% |

|

95# |

9300-9300 |

9100-9100 |

-100/-100 |

-1.09%/-1.08% |

V. Future forecast

International crude oil closed higher, OPEC+ production reduction position is firm, Russia promised to increase production reduction efforts in the second quarter, and the geopolitical situation remains unstable. The overall outlook for the global economy and demand remains gloomy, or dampens the upward momentum in oil prices. As the temperature gradually picks up and the Qingming Festival holiday approaches, the enthusiasm of the middle and lower reaches should be enhanced, the willingness to raise prices will be enhanced, the shipments of refineries will gradually improve, and the market trading atmosphere will heat up. Taken together, it is expected that international oil prices may have room for a slight decline next week, and the gasoline market will rise within a narrow range.

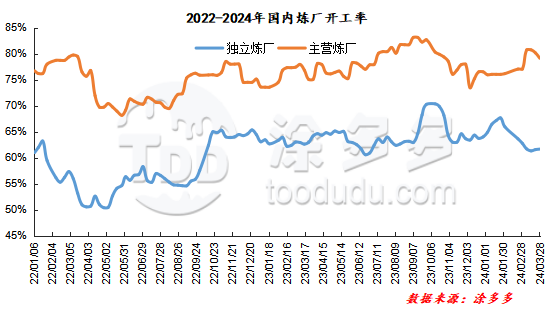

VI. Operating rate

This week (20240321-20240328) the maintenance operation rate of independent refineries increased by 0.1%; the operation rate of main units was 79.12%, down 1.03%.

VII. Plant maintenance schedule

|

Maintenance list of main refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

June 1, 2024 |

Tentatively |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

350 |

March 1, 2024 |

March 26, 2024 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 15, 2024 |

June 15, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Wuhan Petrochemical Corporation |

Whole plant overhaul |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

April 1, 2024 |

May 30, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 5, 2024 |

May 30, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 2024 |

August 31, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

April 1, 2024 |

May 15, 2024 |

|

China Asphalt Sichuan |

Whole plant overhaul |

60 |

March 17, 2024 |

April 10, 2024 |

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Aoxing petrochemical |

Rotation inspection |

240 |

2024 / May |

2024 / June |

|

Shandong Haihua |

Whole plant overhaul |

240 |

January 31, 2024 |

2024 / April |

|

Shenchi chemical industry |

Whole plant overhaul |

260 |

January 25, 2024 |

2024 / mid-April |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

April 1, 2024 |

2024 5way 15 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

December 18, 2023 |

April 20, 2024 |

|

Haiyou petrochemical |

Whole plant overhaul |

350 |

January 31, 2024 |

2024 / April |

|

Zhonghe petrochemical |

Whole plant overhaul |

500 |

2025 / May |

2024 / June |

|

Hubei Jinao |

Whole plant overhaul |

500 |

March 5, 2024 |

May 31, 2024 |

|

Liaoning Huajin |

Whole plant overhaul |

600 |

2024 / July |

2024 / September |

|

Dalian Hengli |

Atmospheric and vacuum decompression and reorganization |

1000 |

2024 / April |

2024 / June |

|

Dongchen Petrochemical |

Rotation inspection |

/ |

2024 / late February |

To be determined |