- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Weekly-20240201 issue

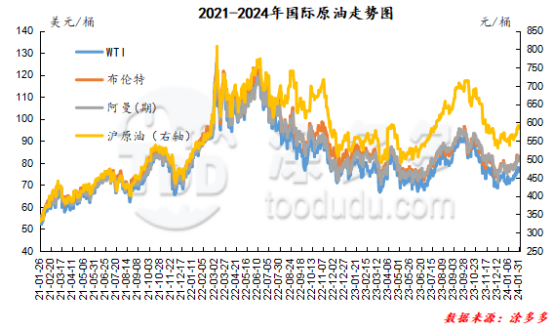

I. International crude oil futures price

|

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20240124 |

75.09 |

80.04 |

80.27 |

79.6 |

567 |

-4.95 |

0.44 |

|

20240131 |

75.85 |

81.71 |

81.42 |

81.57 |

583.1 |

-5.86 |

0.14 |

|

The rate of change compared with last week |

0.98% |

2.03% |

1.39% |

2.45% |

2.82% |

17.95% |

-14.42% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

II. Summary of gasoline market

This week (20240126-20240201) China's gasoline market rose as a whole, among which the wholesale prices of main units in various regions of China rose significantly, with adjustments mostly concentrated in 100-250 yuan / ton. The ex-factory price of the refinery also rose mainly, with an increase of 40-150 yuan per ton. The main factors in the gasoline market: the improvement of US economic data on international crude oil, and China's economic stimulus policy is good for oil prices, but the growth of US commercial crude oil stocks is bad for oil prices. This week is approaching the Spring Festival, is the final concentration stage of replenishment of traders in the middle and lower reaches, the monthly tasks of the main units have been completed one after another, the willingness to raise prices gradually, coupled with the week to increase the retail price limits of oil products to boost the oil market. The operation of pre-holiday stock preparation at terminal gas stations has increased. On the whole, gasoline demand performed well during the week, and the market trading atmosphere was active.

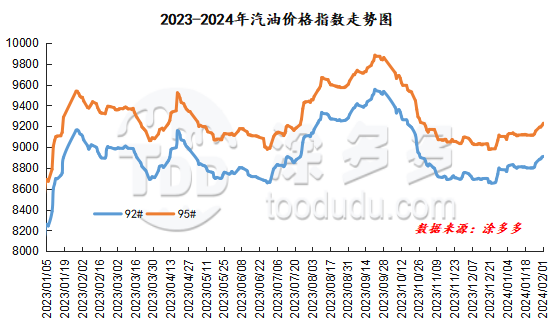

III. Gasoline price index

According to Tudor data, as of February 1, China's gasoline price index was 8910.73, up 101.46 from last week, an increase of 1.15%, or 1.15%, from last week. The gasoline price index rose 103.03, or 1.13%, from last week. The 9-month and 9-month gasoline indices were both raised, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 318.71.

IV. Spot market for gasoline

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8450-9364 |

8550-9581 |

100/217 |

1.18%/2.32% |

|

95# |

8650-9719 |

8750-9942 |

100/223 |

1.16%/2.29% |

|

|

South China |

92# |

8800-9570 |

8950-9880 |

150/310 |

1.70%/3.24% |

|

95# |

9000-9870 |

9050-10180 |

50/310 |

0.56%/3.14% |

|

|

Central China |

92# |

8750-9250 |

8800-9400 |

50/150 |

0.57%/1.62% |

|

95# |

8950-9550 |

8950-9700 |

0/150 |

0.00%/1.57% |

|

|

East China region |

92# |

8550-9100 |

8680-9100 |

130/0 |

1.52%/0.00% |

|

95# |

8750-9500 |

8900-9500 |

150/0 |

1.71%/0.00% |

|

|

Northwestern region |

92# |

8700-9765 |

8680-9977 |

-20/212 |

-0.23%/2.17% |

|

95# |

8850-10050 |

8880-10558 |

30/508 |

0.34%/5.05% |

|

|

Southwest China |

92# |

8900-9250 |

8980-9500 |

80/250 |

0.90%/2.70% |

|

95# |

9050-9700 |

9160-9900 |

110/200 |

1.22%/2.06% |

|

|

Northeast China |

92# |

8550-9000 |

8650-9000 |

100/0 |

1.17%/0.00% |

|

95# |

8730-9600 |

8730-9600 |

0/0 |

0.00%/0.00% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8270-8700 |

8350-8760 |

80/60 |

0.97%/0.69% |

|

95# |

8400-8860 |

8510-8920 |

110/60 |

1.31%/0.68% |

|

|

North China region |

92# |

8420-8430 |

8480-8530 |

60/100 |

0.71%/1.19% |

|

95# |

8470-8530 |

8530-8630 |

60/100 |

0.71%/1.17% |

|

|

Central China |

92# |

8640-8640 |

8670-8670 |

30/30 |

0.35%/0.35% |

|

95# |

8840-8840 |

8870-8870 |

30/30 |

0.34%/0.34% |

|

|

East China region |

92# |

8360-8500 |

8440-8540 |

80/40 |

0.96%/0.47% |

|

95# |

8480-8610 |

8560-8650 |

80/40 |

0.94%/0.46% |

|

|

Northwestern region |

92# |

8400-8500 |

8400-8600 |

0/100 |

0.00%/1.18% |

|

95# |

8550-8700 |

8550-8800 |

0/100 |

0.00%/1.15% |

|

|

Northeast China |

92# |

8300-8430 |

8400-8430 |

100/0 |

1.20%/0.00% |

|

95# |

8500-8600 |

8600-8600 |

100/0 |

1.18%/0.00% |

|

|

Southwest China |

92# |

8800-8800 |

8950-8950 |

150/150 |

1.70%/1.70% |

|

95# |

8950-8950 |

9100-9100 |

150/150 |

1.68%/1.68% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8600-8600 |

8700-8720 |

100/120 |

1.16%/1.40% |

|

95# |

9250-9600 |

9100-9600 |

-150/0 |

-1.62%/0.00% |

|

|

Liaoning |

92# |

8450-9000 |

8480-9000 |

30/0 |

0.36%/0.00% |

|

95# |

8750-9200 |

8750-9200 |

0/0 |

0.00%/0.00% |

|

|

Heilongjiang Province |

92# |

8650-8650 |

8700-8700 |

50/50 |

0.58%/0.58% |

|

95# |

8950-8950 |

8950-8950 |

0/0 |

0.00%/0.00% |

(2) East China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

8550-8750 |

8650-8900 |

100/150 |

1.17%/1.71% |

|

95# |

8750-8950 |

8850-9100 |

100/150 |

1.14%/1.68% |

|

|

Shandong |

92# |

8680-9100 |

8680-9100 |

0/0 |

0.00%/0.00% |

|

95# |

8830-9500 |

8830-9500 |

0/0 |

0.00%/0.00% |

|

|

Jiangsu Province |

92# |

8810-8830 |

8930-8930 |

120/100 |

1.36%/1.13% |

|

95# |

9060-9130 |

9180-9230 |

120/100 |

1.32%/1.10% |

|

|

Zhejiang |

92# |

8680-8950 |

8800-9100 |

120/150 |

1.38%/1.68% |

|

95# |

8880-9150 |

9050-9300 |

170/150 |

1.91%/1.64% |

(3) Central China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

8800-8900 |

8800-9120 |

0/220 |

0.00%/2.47% |

|

95# |

9000-9050 |

9000-9320 |

0/270 |

0.00%/2.98% |

|

|

Jiangxi Province |

92# |

8750-8870 |

8950-9050 |

200/180 |

2.29%/2.03% |

|

95# |

9000-9150 |

9200-9350 |

200/200 |

2.22%/2.19% |

|

|

Hubei province |

92# |

8750-9000 |

8830-9100 |

80/100 |

0.91%/1.11% |

|

95# |

8950-9300 |

9030-9300 |

80/0 |

0.89%/0.00% |

|

|

Hunan |

92# |

8750-8850 |

8880-9050 |

130/200 |

1.49%/2.26% |

|

95# |

8950-9100 |

9080-9350 |

130/250 |

1.45%/2.75% |

(4) North China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

8600-9364 |

8650-9581 |

50/217 |

0.58%/2.32% |

|

95# |

8750-9717 |

8800-9942 |

50/225 |

0.57%/2.32% |

|

|

Beijing |

92# |

8900-8950 |

8950-9000 |

50/50 |

0.56%/0.56% |

|

95# |

9050-9100 |

9100-9150 |

50/50 |

0.55%/0.55% |

|

|

Tianjin |

92# |

8430-8600 |

8430-8700 |

0/100 |

0.00%/1.16% |

|

95# |

8630-8800 |

8630-8900 |

0/100 |

0.00%/1.14% |

|

|

Shanxi Province |

92# |

8700-8900 |

8850-9050 |

150/150 |

1.72%/1.69% |

|

95# |

9000-9300 |

9050-9330 |

50/30 |

0.56%/0.32% |

|

|

Hebei |

92# |

8710-8810 |

8760-8940 |

50/130 |

0.57%/1.48% |

|

95# |

8910-9010 |

8960-9140 |

50/130 |

0.56%/1.44% |

|

|

Henan |

92# |

8920-8950 |

9020-9130 |

100/180 |

1.12%/2.01% |

|

95# |

9170-9230 |

9270-9430 |

100/200 |

1.09%/2.17% |

(5) South China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

8850-9570 |

8950-9880 |

100/310 |

1.13%/3.24% |

|

95# |

9100-9870 |

9200-10180 |

100/310 |

1.10%/3.14% |

|

|

Hainan |

92# |

8800-9000 |

8950-9150 |

150/150 |

1.70%/1.67% |

|

95# |

9000-9200 |

9150-9350 |

150/150 |

1.67%/1.63% |

|

|

Fujian |

92# |

8850-8900 |

8850-9000 |

0/100 |

0.00%/1.12% |

|

95# |

8950-9100 |

9050-9200 |

100/100 |

1.12%/1.10% |

(6) Northwest China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8700-9222 |

8800-9439 |

100/217 |

1.15%/2.35% |

|

95# |

8900-9570 |

9000-9796 |

100/226 |

1.12%/2.36% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9429-9529 |

9641-9741 |

212/212 |

2.25%/2.22% |

|

95# |

9969-10069 |

10193-10293 |

224/224 |

2.25%/2.22% |

|

|

Gansu |

92# |

8950-9765 |

9150-9977 |

200/212 |

2.23%/2.17% |

|

95# |

9250-10334 |

9250-10558 |

0/224 |

0.00%/2.17% |

|

|

Xizang Autonomous region |

92# |

9600-9600 |

9720-9720 |

120/120 |

1.25%/1.25% |

|

95# |

10050-10050 |

10170-10170 |

120/120 |

1.19%/1.19% |

|

|

Shaanxi |

92# |

8630-9260 |

8730-9420 |

100/160 |

1.16%/1.73% |

|

95# |

8830-9610 |

8830-9780 |

0/170 |

0.00%/1.77% |

|

|

Qinghai |

92# |

9150-9150 |

9100-9100 |

-50/-50 |

-0.55%/-0.55% |

|

95# |

9600-9600 |

9550-9550 |

-50/-50 |

-0.52%/-0.52% |

(7) Southwest China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

8950-9250 |

9250-9450 |

300/200 |

3.35%/2.16% |

|

95# |

9550-9700 |

9700-9900 |

150/200 |

1.57%/2.06% |

|

|

Sichuan |

92# |

9150-9200 |

9200-9330 |

50/130 |

0.55%/1.41% |

|

95# |

9450-9450 |

9450-9630 |

0/180 |

0.00%/1.90% |

|

|

Guangxi Zhuang Autonomous region |

92# |

8900-9984 |

9050-10146 |

150/162 |

1.69%/1.62% |

|

95# |

9100-10560 |

9300-10738 |

200/178 |

2.20%/1.69% |

|

|

Guizhou |

92# |

8900-9050 |

9300-9500 |

400/450 |

4.49%/4.97% |

|

95# |

9280-9350 |

9700-9800 |

420/450 |

4.53%/4.81% |

|

|

Chongqing |

92# |

8880-9100 |

8980-9150 |

100/50 |

1.13%/0.55% |

|

95# |

9120-9300 |

9280-9300 |

160/0 |

1.75%/0.00% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8300-8430 |

8400-8430 |

100/0 |

1.20%/0.00% |

|

95# |

8500-8600 |

8600-8600 |

100/0 |

1.18%/0.00% |

(9) East China geochemistry

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8360-8500 |

8440-8540 |

80/40 |

0.96%/0.47% |

|

95# |

8480-8610 |

8560-8650 |

80/40 |

0.94%/0.46% |

(10) Central China Refinery

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

8640-8640 |

8670-8670 |

30/30 |

0.35%/0.35% |

|

95# |

8840-8840 |

8870-8870 |

30/30 |

0.34%/0.34% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8420-8430 |

8480-8530 |

60/100 |

0.71%/1.19% |

|

95# |

8470-8530 |

8530-8630 |

60/100 |

0.71%/1.17% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8270-8700 |

8350-8760 |

80/60 |

0.97%/0.69% |

|

95# |

8400-8860 |

8510-8920 |

110/60 |

1.31%/0.68% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8400-8650 |

8400-8650 |

0/0 |

0.00%/0.00% |

|

95# |

8550-8800 |

8550-8800 |

0/0 |

0.00%/0.00% |

|

|

Shaanxi |

92# |

8500-8500 |

8450-8600 |

-50/100 |

-0.59%/1.18% |

|

95# |

8700-8700 |

8800-8800 |

100/100 |

1.15%/1.15% |

|

|

Xinjiang Uygur Autonomous region |

92# |

8500-8500 |

8600-8600 |

100/100 |

1.18%/1.18% |

(14) Southwest Refinery

|

Province / city |

Model |

Price 1.25 |

Price 2.1 |

Rise and fall |

Amplitude |

|

Sichuan Province |

92# |

8800-8800 |

8950-8950 |

150/150 |

1.70%/1.70% |

|

95# |

8950-8950 |

9100-9100 |

150/150 |

1.68%/1.68% |

V. Future forecast

The impact of geopolitical events on international crude oil has weakened, and demand may have improved. The atmosphere of OPEC production reduction still exists, and oil prices are expected to rise next week. Gasoline demand is expected to improve as the Spring Festival approaches. Near the end of the year, from the point of view of demand, there is still procurement demand at some terminals, coupled with the increase in the number of people returning home during the Spring Festival, and the increase in traffic flow. however, at present, the low temperature, rain and snow weather in most parts of China is increasing, and the obstacles to logistics and transportation are increasing, and market trading is expected to turn weak next week. From the supply side, the independent refinery Shenchi Chemical will start overhauling next week, coupled with the refinery holidays one after another, the operating rate of Chinese refineries is expected to decline next week. In addition, at present, the performance pressure of the refinery has obviously weakened, and the willingness to raise the price is OK. Overall, it is expected that China's gasoline market will stabilize in the short term.

VI. Operating rate

This week (20240126-20240201) approaching the Spring Festival, the operating rate of China's independent refineries decreased, falling 1.71% to 65.93%, while the operating rate of the main units increased by 0.14% to 76.16%.

VII. Plant maintenance schedule

|

Maintenance list of main refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

March 15, 2024 |

May 10, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 10, 2024 |

May 22, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 3, 2024 |

August 31, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

150 |

March 15, 2024 |

April 30, 2024 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

March 10, 2024 |

April 25, 2024 |

|

Wuhan Petrochemical Corporation |

Whole plant overhaul |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 15, 2024 |

June 15, 2024 |

|

China Asphalt Sichuan |

Whole plant overhaul |

60 |

March 1, 2024 |

March 31, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

March 15, 2024 |

May 1, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Aoxing petrochemical |

Atmospheric and vacuum |

240 |

November 30, 2023 |

January 1, 2024 |

|

Liaoning Huajin |

Whole plant overhaul |

600 |

May 1, 2024 |

June 1, 2024 |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

March 1, 2024 |

April 1, 2024 |

|

Shenchi chemical industry |

Whole plant overhaul |

260 |

February 6, 2024 |

April 2024 |