- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline monthly issue 202401

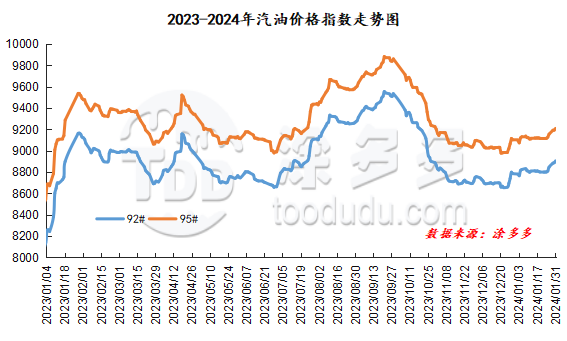

As of January 31, China's gasoline price index was 8904.50, up 124.58, or 1.42%, from January 2, while China's gasoline price index was 9208.86, up 115.17, or 1.27%. The 9-month gasoline index and the 9-month gasoline index both rose, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 304.36.

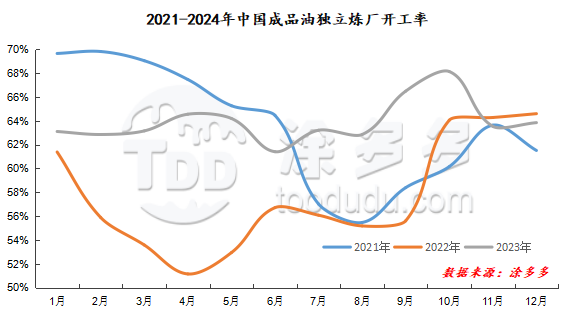

In January 2024, China's gasoline market fluctuated within a narrow range, and the market climbed slowly at the end of the month. In the spot market, China's main wholesale prices rose mainly in December, with regional prices rising 100-200 yuan per ton, with a range of 1.39% and 2.00%. However, high-end gasoline prices in North China have fallen. The ex-factory price of geo-refinery has also increased mostly, with the price of gasoline rising by 80-160 yuan per ton, with a range of 0.95%, 1.93%. Gasoline prices in central China fell slightly by 80 yuan per ton. The main influencing factors of this month are as follows: 1. The market of crude oil has weighed the prospect of supply and demand many times during the month. The geopolitical situation is unstable and the trend of crude oil shock is obvious. The sharp drop in US crude oil production in the last ten days of the month, coupled with the fact that the economy is improving to push up oil prices, but the increase is limited, the crude oil market as a whole fluctuated downward in January. 2. On the supply side, there is no new overhaul or resumption of refineries in January, and the adjustment is limited. The operating rate of the main unit is 76.00%, and the operating rate of independent refineries in January is 66.52%. The overall supply of the market is relatively loose. On the demand side, New Year's Day's post-holiday replenishment efforts are limited, and demand returns to rigid demand procurement; as the Spring Festival holiday approaches, some middle and lower reaches are preparing for bargains, but in the middle of the month, the rain and snow weather in the north increases, and refinery shipments are blocked and transactions are limited; in the second ten days of the month, there has been an increase in centralized replenishment operations in the middle and lower reaches, and refineries are willing to raise prices. On the whole, January coincided with better demand expectations before the Spring Festival, but the overall market performance was relatively moderate and the increase was lower than expected. 3. From the point of view of the price adjustment mechanism of refined oil, at the beginning of 2024, the retail price was raised by 200 yuan per ton, the retail price dropped slightly on January 17, and the gasoline price was reduced by 50 yuan per ton.

|

Comparison of main wholesale prices of gasoline in January (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 1.2 |

Price 1.31 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8430-9600 |

8550-9364 |

120/-236 |

1.42%/-2.46% |

|

95# |

8630-9900 |

8750-9719 |

120/-181 |

1.39%/-1.83% |

|

|

South China |

92# |

8700-9450 |

8950-9680 |

250/230 |

2.87%/2.43% |

|

95# |

8900-9750 |

9050-9980 |

150/230 |

1.69%/2.36% |

|

|

Central China |

92# |

8650-9050 |

8800-9400 |

150/350 |

1.73%/3.87% |

|

95# |

8850-9350 |

8950-9700 |

100/350 |

1.13%/3.74% |

|

|

East China region |

92# |

8500-8990 |

8680-9100 |

180/110 |

2.12%/1.22% |

|

95# |

8570-9200 |

8900-9500 |

330/300 |

3.85%/3.26% |

|

|

Northwestern region |

92# |

8550-9600 |

8680-9765 |

130/165 |

1.52%/1.72% |

|

95# |

8750-9860 |

8880-10070 |

130/210 |

1.49%/2.13% |

|

|

Southwest China |

92# |

8800-9200 |

8980-9400 |

180/200 |

2.05%/2.17% |

|

95# |

9000-9650 |

9160-9850 |

160/200 |

1.78%/2.07% |

|

|

Northeast China |

92# |

8480-8950 |

8650-9000 |

170/50 |

2.00%/0.56% |

|

95# |

8650-9600 |

8730-9600 |

80/0 |

0.92%/0.00% |

|

|

Comparison of ex-factory price of gasoline refinery in January (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 1.2 |

Price 1.31 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8300-8620 |

8360-8810 |

60/190 |

0.72%/2.20% |

|

95# |

8400-8780 |

8510-8970 |

110/190 |

1.31%/2.16% |

|

|

North China region |

92# |

8420-8450 |

8500-8530 |

80/80 |

0.95%/0.95% |

|

95# |

8500-8520 |

8550-8630 |

50/110 |

0.59%/1.29% |

|

|

Central China |

92# |

8750-8750 |

8670-8670 |

-80/-80 |

-0.91%/-0.91% |

|

95# |

8950-8950 |

8870-8870 |

-80/-80 |

-0.89%/-0.89% |

|

|

East China region |

92# |

8300-8540 |

8460-8590 |

160/50 |

1.93%/0.59% |

|

95# |

8420-8670 |

8580-8700 |

160/30 |

1.90%/0.35% |

|

|

Northwestern region |

92# |

8250-8650 |

8400-8600 |

150/-50 |

1.82%/-0.58% |

|

95# |

8500-8850 |

8550-8800 |

50/-50 |

0.59%/-0.56% |

|

|

Northeast China |

92# |

8300-8380 |

8400-8430 |

100/50 |

1.20%/0.60% |

|

95# |

8500-8500 |

8600-8600 |

100/100 |

1.18%/1.18% |

|

|

Southwest China |

92# |

8800-8800 |

8950-8950 |

150/150 |

1.70%/1.70% |

|

95# |

8950-8950 |

9100-9100 |

150/150 |

1.68%/1.68% |

|

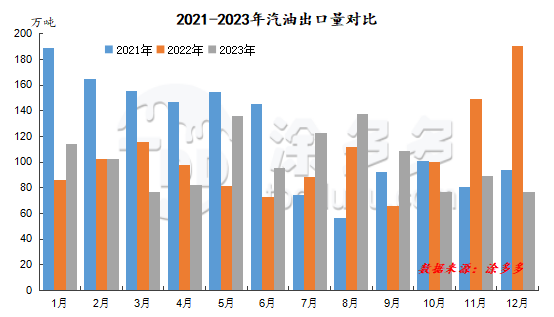

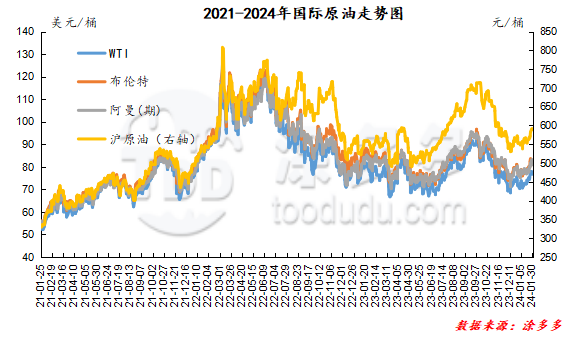

From the international crude oil point of view, OPEC production reduction sentiment still exists, OPEC held a meeting in early February, pay more attention to whether the meeting situation brings new guidelines. In addition, geopolitical events are continuing, China has introduced economic stimulus policies, superimposed by the expectation of a decline in crude oil stocks in the United States, positive factors in the crude oil market increased in February, and there is room for international oil prices to rise. From the demand point of view, the blizzard and heavy snow weather is common in many places across the country in early February, coupled with the end of stock preparation before the Spring Festival, the market will return to dull. During the Spring Festival, residents travel increased, travel radius expanded, sales of terminal gas stations are expected to rise, there are certain replenishment operations after the festival, and then there is no good support for the gasoline market or will return to rigid demand procurement. On the supply side, the local refinery Shenchi Chemical began maintenance in early February, and the main units did not have any new maintenance plants in February. Coupled with the Spring Festival holiday, China's gasoline production in February was limited, with a high probability of decline. In terms of exports, gasoline exports are planned to be 640000 tons in February, down 390000 tons from January, to a certain extent, affected by the Spring Festival holiday. Taken together, it is expected that the downward channel of the gasoline market may be opened in the later period of February.

In December 2023, China's gasoline output was 12.962 million tons, an increase of 1.448 million tons, or 12.58 percent, over 11.514 million tons, and an increase of 272000 tons, or 2.14 percent, over 12.69 million tons. From January to December 2023, China's gasoline output totaled 160.923 million tons, an increase of 15.156 million tons or 10.40% over the same period of 145.767 million tons.

In January, China's refined oil output increased slightly, the output of the main unit was relatively stable, and the output of independent refineries increased narrowly, of which the monthly weekly output of the main refinery was concentrated at 2.2776 million million tons, and the weekly output of independent refineries was up to 993900 tons. Commercial inventories accumulated, with an increase of 199700 tons.

|

Data of supply and demand in China in December |

|||||

|

Date |

Output of oil products |

Main output |

Output of independent refinery |

Independent refinery sales |

Commercial inventory |

|

2024/1/4 |

319.4 |

221.74 |

97.66 |

92.16 |

1311.07 |

|

2024/1/11 |

324.69 |

227.76 |

96.93 |

94.73 |

1323.06 |

|

2024/1/18 |

326.14 |

227.76 |

98.38 |

93.49 |

1333 |

|

2024/1/25 |

327.15 |

227.76 |

99.39 |

100.67 |

1331.04 |

In January 2024, the operating rate of independent refineries gradually increased, with an average monthly operating rate of 66.52%, an increase of 5.40% over the same period last year.

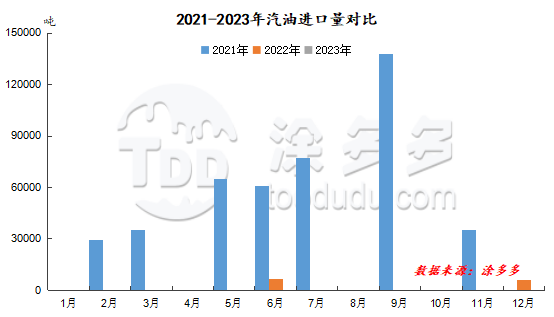

According to customs data, there was no gasoline import in December 2023, and a total of 17.37 tons of gasoline were imported from January to December.

According to customs data, gasoline exports in December 2023 were 767900 tons, a decrease of 1.1402 million tons, or-59.76 percent, compared with 1.9081 million tons last year, and a decrease of 120300 tons, or-13.54 percent, compared with 888200 tons. Exports totaled 12.1807 million tons from January to December 2023, a decrease of 443400 tons from 12.6241 million tons last year, or-3.51 percent.

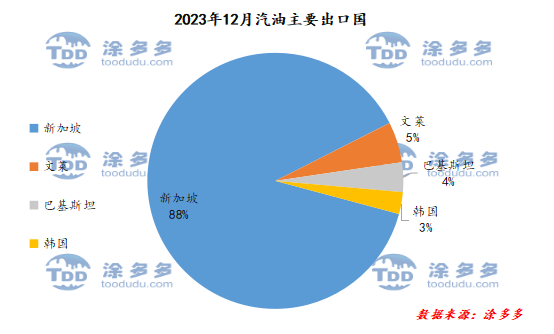

Among them, the main exporters in December were Singapore, Brunei, Pakistan and South Korea, accounting for 88%, 5%, 4% and 3% of the total exports respectively. Singapore is in the top position.

The apparent gasoline consumption in December 2023 was 12.1941 million tons, an increase of 2.582 million tons, or 26.86 percent, over last year's 9.6121 million tons, and an increase of 392,300 tons, or 3.32 percent, over 13.3174 million tons. The apparent gasoline consumption totaled 148.7954 million tons from January to December 2023.

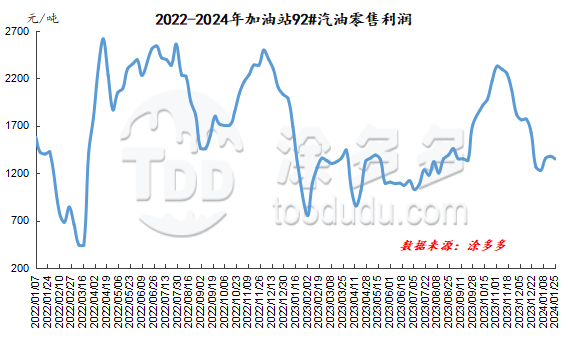

In January 2024, the retail profit of gasoline at the gas station increased at first and then decreased, with the highest retail profit of 1378 yuan / ton and the lowest retail profit of 1230 yuan / ton.

In January, the gross profit of the weekly production of the main comprehensive oil refining increased first and then decreased, with the highest gross profit of 820.06 yuan / ton during the month, while the gross profit of the comprehensive oil refining weekly production gradually decreased by 116 yuan / ton during the month. The gross profit of atmospheric and vacuum production is concentrated at 313-358 yuan / ton, that of FCC production is-123 murmur38 yuan / ton, and that of delayed coking production is concentrated at 367.13-465.79 yuan / ton.

|

Weekly production margin of oil products in January |

|||||

|

Date |

Main comprehensive oil refining production gross profit |

Gross profit of georefining comprehensive oil refining |

Atmospheric and vacuum production gross profit |

Production of gross profit by catalytic cracking |

Delayed coking production gross profit |

|

2024/1/4 |

508.8 |

503.23 |

319 |

-123 |

446.28 |

|

2024/1/11 |

755.75 |

451.88 |

358 |

-62 |

465.79 |

|

2024/1/18 |

820.06 |

405.61 |

322 |

-38 |

394.69 |

|

2024/1/25 |

590.18 |

387.33 |

313 |

-111 |

367.13 |

In January 2024, the average monthly commercial inventory of gasoline was 13.2454 million tons, a decrease of 1.9332 million tons compared with the same period last year, or-12.74 percent.

|

Types |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

|

Average price of 202312 |

72.12 |

77.32 |

76.65 |

77.21 |

555.34 |

|

Average price of 202401 |

73.55 |

78.84 |

78.29 |

78.51 |

562.39 |

|

The rate of change compared with the previous month |

1.98% |

1.97% |

2.14% |

1.68% |

1.27% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. 2. This month, the WTI/ Brent spread is-5.29 and the Brent / DME Oman spread is 0.33. |

|||||

|

2024 summary of price adjustment of oil products |

||

|

Date |

Gasoline (yuan / ton) |

Diesel oil (yuan / ton) |

|

January third |

↑200 |

↑190 |

|

January seventeenth |

↓50 |

↓50 |

|

Price adjustment schedule for 2024 |

|

|

January 2024 |

January 3, January 17, January 31 |

|

February 2024 |

February nineteenth |

|

March 2024 |

March 4, March 18 |

|

April 2024 |

April 1, April 16, April 29 |

|

May 2024 |

May 15, May 29 |

|

June 2024 |

June 13, June 27 |

|

July 2024 |

July 11, July 25 |

|

August 2024 |

August 8, August 22 |

|

September 2024 |

September 5, September 20 |

|

October 2024 |

October 10th, October 23rd |

|

November 2024 |

November 6th, November 20th |

|

December 2024 |

December 4, December 18 |

|

Maintenance list of main refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

March 15, 2024 |

May 10, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 10, 2024 |

May 22, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 3, 2024 |

August 31, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

150 |

March 15, 2024 |

April 30, 2024 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

March 10, 2024 |

April 25, 2024 |

|

Wuhan Petrochemical Corporation |

Whole plant overhaul |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 15, 2024 |

June 15, 2024 |

|

China Asphalt Sichuan |

Whole plant overhaul |

60 |

March 1, 2024 |

March 31, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

March 15, 2024 |

May 1, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Aoxing petrochemical |

Atmospheric and vacuum |

240 |

November 30, 2023 |

January 1, 2024 |

|

Liaoning Huajin |

Whole plant overhaul |

600 |

May 1, 2024 |

June 1, 2024 |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

March 1, 2024 |

April 1, 2024 |

|

Shenchi chemical industry |

Whole plant overhaul |

260 |

At the end of January 2024 |

April 2024 |