Tu Duoduo Gasoline Industry Monthly-No. 202312

Gasoline monthly issue 202312

Analysis and Forecast of gasoline Market in December

Analysis of gasoline market in January and December

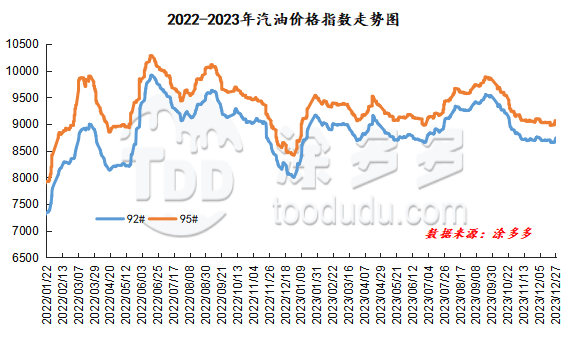

As of December 27, China's gasoline price index was 8740.17, down 16.16% or 0.18% from December 1, while China's gasoline price index was 9064.48, down 32.70 or 0.36% from December 1. The 9-month gasoline index and the 9-month gasoline index were both downgraded, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 324.32.

In December 2023, China's gasoline market continued to be weak in the early stage, but rose at the end of the month, and the overall volatility was limited. In the spot market, China's main wholesale prices rose and fell in December, and high-end gasoline prices in Northwest China, South China and East China fell significantly, with a range of 100-350 yuan per ton. Gasoline prices in North China, Central China, Southwest China and Northeast China have been raised by 50-200 yuan per ton. The ex-factory price of geo-refinery has mainly increased, and gasoline prices have increased in most areas, with a range of 20-200 yuan per ton. Low-end prices in the northwest and northeast regions fell slightly. The main influencing factors of this month are as follows: 1. The negative factors in the crude oil market increased in the first ten days of the month, the situation of strong supply and weak demand is obvious, traders are worried about the prospect of crude oil market demand, and international oil prices continue to fall. However, with the ferment of the Red Sea incident, international oil prices rose, but the incident did not have a direct impact on the actual supply of crude oil. On the whole, international oil prices fell first and then rose during the month. 2. On the supply side, the negative operation of the refinery still exists at the beginning of the month, especially the utilization rate of the main capacity decreases greatly. After the negative reduction of the refinery reached a low level, there is insufficient room for further downside, coupled with the improvement of refinery profits, the main processing load has increased, but the utilization rate of refining capacity is relatively stable. The demand side is relatively weak throughout December, the demand side of the month continued to be weak in November, the weather dropped sharply in the middle of the month, the blizzard weather in many places in the north increased, logistics and transportation difficulties, refinery shipments were blocked, and market trading was light. However, the annual task of the main unit is basically completed, Poly mentality is in the majority, and the decline in the gasoline market is limited. The end of the month is approaching New Year's Day's holiday, and the fuel consumption support of passenger cars brought about by the great cooling has been strengthened, the willingness to hoard goods in the middle and lower reaches has gradually increased, refinery quotations have been raised one after another, and market trading has improved. 3. From the point of view of the price adjustment mechanism of refined oil products, the price adjustment of refined oil products in 2023 ended with six consecutive falls, and the maximum retail price limit for gasoline was reduced by 470 yuan per ton in mid-December.

2. Comparison of spot gasoline prices within the month of nbsp;

|

Comparison of main wholesale prices of gasoline in December (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 12.1 |

Price 12.27 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8360-9600 |

8430-9600 |

70/0 |

0.84%/0.00% |

|

95# |

8560-9900 |

8630-9900 |

70/0 |

0.82%/0.00% |

|

|

South China |

92# |

8650-9700 |

8700-9450 |

50/-250 |

0.58%/-2.58% |

|

95# |

8900-10000 |

8900-9750 |

0/-250 |

0.00%/-2.50% |

|

|

Central China |

92# |

8600-8900 |

8650-9050 |

50/150 |

0.58%/1.69% |

|

95# |

8800-9250 |

8850-9350 |

50/100 |

0.57%/1.08% |

|

|

East China region |

92# |

8450-9300 |

8500-8950 |

50/-350 |

0.59%/-3.76% |

|

95# |

8700-9600 |

8600-9600 |

-100/0 |

-1.15%/0.00% |

|

|

Northwestern region |

92# |

8250-9800 |

8550-9600 |

300/-200 |

3.64%/-2.04% |

|

95# |

8350-10100 |

8750-9860 |

400/-240 |

4.79%/-2.38% |

|

|

Southwest China |

92# |

8600-9080 |

8800-9250 |

200/170 |

2.33%/1.87% |

|

95# |

8850-9510 |

9000-9600 |

150/90 |

1.69%/0.95% |

|

|

Northeast China |

92# |

8375-8850 |

8400-8950 |

25/100 |

0.30%/1.13% |

|

95# |

8580-9800 |

8650-9950 |

70/150 |

0.82%/1.53% |

|

|

Comparison of ex-factory price of gasoline refinery in December (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 12.1 |

Price 12.27 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8200-8490 |

8200-8650 |

0/160 |

0.00%/1.88% |

|

95# |

8360-8630 |

8300-8740 |

-60/110 |

-0.72%/1.27% |

|

|

North China region |

92# |

8300-8320 |

8390-8500 |

90/180 |

1.08%/2.16% |

|

95# |

8370-8370 |

8490-8550 |

120/180 |

1.43%/2.15% |

|

|

Central China |

92# |

8680-8680 |

8700-8700 |

20/20 |

0.23%/0.23% |

|

95# |

8880-8880 |

8900-8900 |

20/20 |

0.23%/0.23% |

|

|

East China region |

92# |

8260-8500 |

8300-8570 |

40/70 |

0.48%/0.82% |

|

95# |

8360-8630 |

8420-8700 |

60/70 |

0.72%/0.81% |

|

|

Northwestern region |

92# |

8050-8350 |

8250-8550 |

200/200 |

2.48%/2.40% |

|

95# |

8500-8550 |

8500-8750 |

0/200 |

0.00%/2.34% |

|

|

Northeast China |

92# |

8300-8300 |

8250-8350 |

-50/50 |

-0.60%/0.60% |

|

95# |

8500-8500 |

8450-8500 |

-50/0 |

-0.59%/0.00% |

|

|

Southwest China |

92# |

8700-8700 |

8780-8780 |

80/80 |

0.92%/0.92% |

|

95# |

8850-8850 |

8930-8930 |

80/80 |

0.90%/0.90% |

|

3. Future forecast

From the perspective of international crude oil, on the supply side, US crude oil production continues to increase to the highest level in recent years, and single-well production is also increasing, and US crude oil production is expected to remain relatively high. OPEC+2024 implemented the production reduction in the first quarter of the year, but there are doubts in the market that the implementation of the actual production reduction may be poor. Russia will lower its export tariff to US $0 from January 2024, but it is expected to have little impact on international oil prices. On the demand side, the economic development of China and the United States will still be the driving force of global crude oil demand growth in 2024, and whether the Sino-US economy can open up to promote future crude oil demand growth. The Federal Reserve relaxed its policy interest rate by 75 basis points in 2024, boosting international oil prices against the backdrop of expected interest rate cuts. Geopolitically, the military conflict in the Red Sea region continues to evolve and needs to be observed. It is expected that there is some room for international oil prices to rise in January. From the demand point of view, January is approaching the Spring Festival, the Spring Festival transport mobility, private car travel radius enlarged, favorable support is obvious. In addition, a new round of retail price limit adjustment is expected to be raised, the news side is a positive guide. On the supply side, there is no new refinery overhaul in January, superimposed by the expected demand before the Spring Festival, and refineries are expected to increase their processing load. In addition, in January, the performance pressure of the main unit at the beginning of the year is small, and the price-raising mentality is in the majority. Generally speaking, the fundamentals of supply and demand in the gasoline market are expected to be better in January 2024, and the price of the gasoline market is mainly rising.

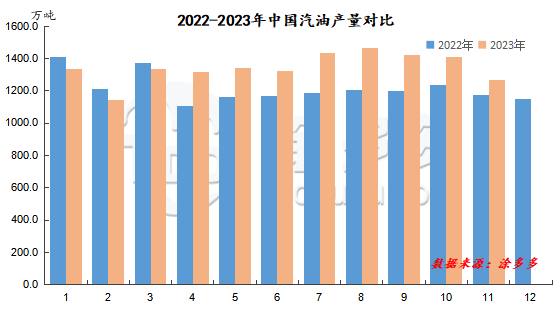

II. Trend of gasoline production in China

1. Analysis of gasoline production in 2023

In November 2023, China's gasoline production was 12.69 million tons, an increase of 953000 tons over the same period of 11.737 million tons, an increase of 8.12 percent, and a decrease of 1.394 million tons, or-9.90 percent, compared with 14.084 million tons. From January to November 2023, China's gasoline output totaled 147.961 million tons, an increase of 13.708 million tons, or 10.21 percent, over the same period of 134.253 million tons.

2. Analysis of output refinery in 2023

China's refined oil output has increased this month, with both the main refinery and independent refineries increasing by 78200 tons and 56100 tons respectively. Commercial inventories increased by 282900 tons.

|

Data of supply and demand in China in December |

|||||

|

Date |

Output of oil products |

Main output |

Output of independent refinery |

Independent refinery sales |

Commercial inventory |

|

2023/12/7 |

292.13 |

207.72 |

84.41 |

88.96 |

1307.72 |

|

2023/12/14 |

300.12 |

212.29 |

87.83 |

84.33 |

1317.12 |

|

2023/12/21 |

305.56 |

215.54 |

90.02 |

93.65 |

1336.01 |

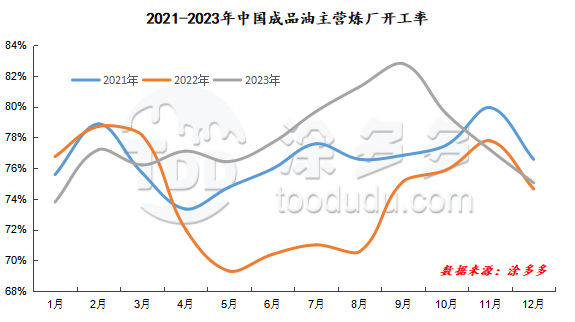

III. Analysis of operating rate of refineries in China

1. main refinery operating rate of refined oil products

The monthly operating rate of the main refinery in December 2023 increased gradually, but decreased as a whole compared with November, of which the main operating rate in December was 75.04%, an increase of 0.53% over the same period last year, and a decrease of 2.78% compared with the previous month.

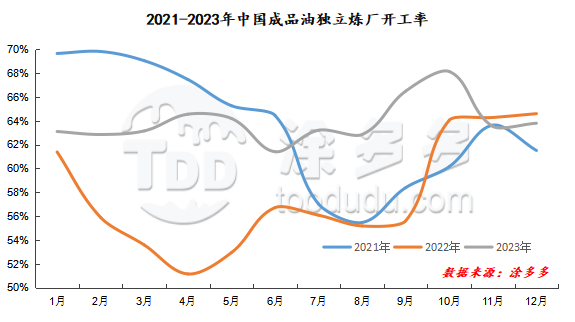

2. operating rate of independent refineries of refined oil products

The average operating rate of independent refineries in December 2023 fluctuated less than that in November, with an operating rate of 63.80%, a year-on-year decrease of 1.24% and a month-on-month increase of 0.41%.

IV. Analysis of gasoline import and export

1. Gasoline import

According to customs data, there was no gasoline import in November 2023, and a total of 17.37 tons of gasoline were imported from January to November.

2. Gasoline export

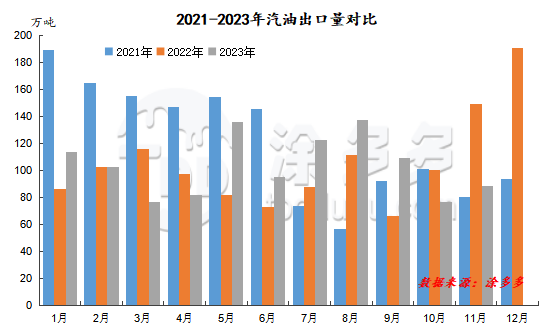

According to customs data, gasoline exports in November 2023 were 888200 tons, a decrease of 602800 tons, or-40.43 percent, compared with 1.491 million tons last year, and an increase of 121600 tons, or 15.86 percent, compared with 766600 tons. Exports totaled 11.4128 million tons from January to November 2023, an increase of 696800 tons or 6.50 percent over 10.716 million tons last year.

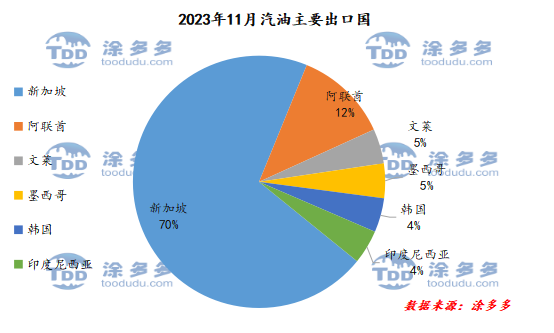

The top four main exporting countries in November: Singapore, United Arab Emirates, Brunei and Mexico. Specifically: 577700 tons were exported to Singapore, accounting for 70 per cent of the major exporters in November. This was followed by 98800 tons in the United Arab Emirates, accounting for 12 percent, Brunei 36500 tons, accounting for 5 percent, and Mexico 36500 tons, accounting for 5 percent.

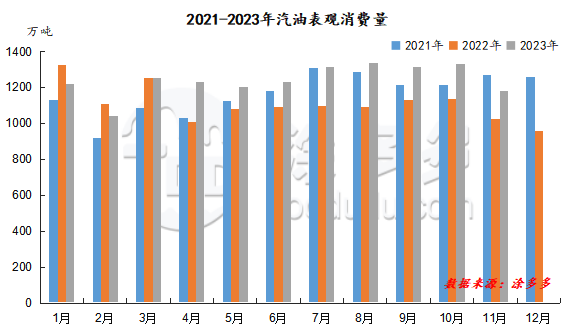

V. Analysis of apparent gasoline consumption

The apparent gasoline consumption in November 2023 was 11.8018 million tons, an increase of 1.5558 million tons, or 15.18 percent, compared with 10.246 million tons last year, and a decrease of 1.515 million tons, or-11.38 percent, compared with 13.3174 million tons. The apparent gasoline consumption totaled 136.6013 million tons from January to November 2023.

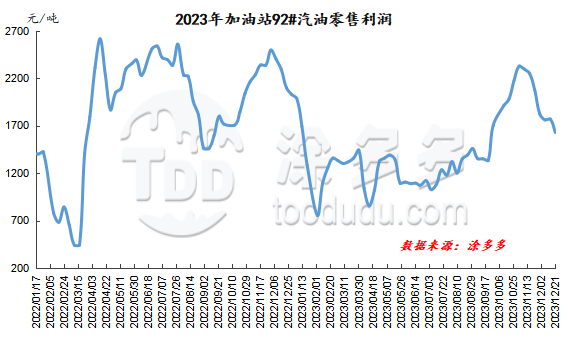

VI. Profit analysis

1. Analysis of gasoline retail profit.

Gasoline retail profits declined overall in December 2023, falling by 133 yuan per ton in the month, far lower than November retail profits, and gas station retail profits narrowed.

2. Weekly production margin of oil products

In December, the gross profit of the weekly production of the main comprehensive oil refining increased progressively, with the highest gross profit of 448.25 yuan / ton within the month; the gross profit of the comprehensive oil refining weekly production of geo-refining first increased and then decreased, with a maximum of 716.5 yuan / ton. The gross profit of atmospheric and vacuum distillation production, FCC production and delayed coking production are 334-728 yuan / ton,-189 murmur71 yuan / ton and 379.64-441 yuan / ton respectively.

|

Gross margin of weekly production of oil products in December |

|||||

|

Date |

Main comprehensive oil refining production gross profit |

Gross profit of georefining comprehensive oil refining |

Atmospheric and vacuum production gross profit |

Production of gross profit by catalytic cracking |

Delayed coking production gross profit |

|

2023/12/7 |

185.06 |

631.62 |

728 |

-157 |

441 |

|

2023/12/14 |

432.1 |

716.5 |

612 |

-71 |

440 |

|

2023/12/21 |

448.25 |

433.22 |

334 |

-189 |

379.64 |

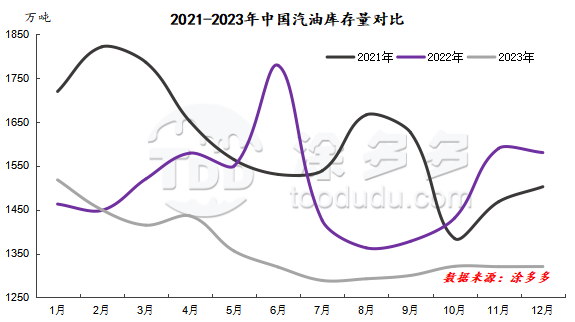

VII. Analysis of gasoline inventory

The commercial inventory of gasoline gradually increased in December 2023, with an average of 13.2028 million tons in December, a decrease of 2.5982 million tons, or-16.44%, compared with 15.801 million tons last year, and an increase of 0.21 million tons, or 0.02%, compared with 13.2007 million tons.

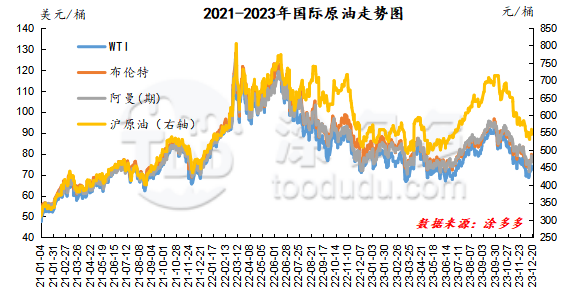

VIII. International crude Oil Futures Price and its trend

|

Types |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

|

Average price of 202311 |

77.38 |

82.03 |

83.24 |

83.17 |

602.51 |

|

Average price of 202312 |

71.57 |

76.56 |

76.65 |

76.65 |

551.84 |

|

The rate of change compared with the previous month |

-7.51% |

-6.67% |

-7.91% |

-7.84% |

-8.41% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. This month, the WTI/ Brent spread is-4.99, and the Brent / DME Oman spread is-0.09. |

|||||

IX. Price adjustment schedule of refined oil products in 2023

1. 2023 Price Adjustment Summary of Oil products

|

2023 summary of price adjustment of oil products |

||

|

Date |

Gasoline (yuan / ton) |

Diesel oil (yuan / ton) |

|

January third |

↑250 |

↑240 |

|

January seventeenth |

↓205 |

↓195 |

|

February third |

↑210 |

↑200 |

|

February seventeenth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March 3rd |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March seventeenth |

↓100 |

↓95 |

|

March 31st |

↓335 |

↓320 |

|

April seventeenth |

↑550 |

↑525 |

|

April 28th |

↓160 |

↓155 |

|

May 16th |

↓380 |

↓365 |

|

May 30th |

↑100 |

↑95 |

|

June thirteenth |

↓55 |

↓50 |

|

June twenty _ eighth |

↑70 |

↑70 |

|

July twelfth |

↑155 |

↑150 |

|

July twenty _ sixth |

↑275 |

↑260 |

|

August ninth |

↑240 |

↑230 |

|

August twenty _ third |

↑55 |

↑55 |

|

September sixth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

September twentieth |

↑385 |

↑370 |

|

October tenth |

↓85 |

↓80 |

|

October twenty _ fourth |

↓70 |

↓70 |

|

November seventh |

↓140 |

↓135 |

|

November twenty _ first |

↓340 |

↓330 |

|

December fifth |

↓55 |

↓50 |

|

December nineteenth |

↓415 |

↓400 |

So far, the price adjustment of refined oil products has experienced 25 price adjustment days in 2023, of which 10 times have been raised, 12 times have been reduced and 3 times have not been adjusted.

2. 2024 price adjustment schedule

|

Price adjustment schedule for 2024 |

|

|

January 2024 |

January 3, January 17, January 31 |

|

February 2024 |

February nineteenth |

|

March 2024 |

March 4, March 18 |

|

April 2024 |

April 1, April 16, April 29 |

|

May 2024 |

May 15, May 29 |

|

June 2024 |

June 13, June 27 |

|

July 2024 |

July 11, July 25 |

|

August 2024 |

August 8, August 22 |

|

September 2024 |

September 5, September 20 |

|

October 2024 |

October 10th, October 23rd |

|

November 2024 |

November 6th, November 20th |

|

December 2024 |

December 4, December 18 |

10. China equipment maintenance Plan

1. The latest maintenance list of the main refinery equipment

|

Maintenance list of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 8, 2023 |

December 4, 2023 |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

March 15, 2024 |

May 10, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

520 |

October 15, 2023 |

December 11, 2023 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 10, 2024 |

May 22, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 3, 2024 |

August 31, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

150 |

March 15, 2024 |

April 30, 2024 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

March 10, 2024 |

April 25, 2024 |

|

Wuhan Petrochemical Corporation |

Whole plant overhaul |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 15, 2024 |

June 15, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

March 15, 2024 |

May 1, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

2. & the latest inspection and repair table of nbsp; local refinery equipment

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

September 15, 2023 |

|

Huaxing petrochemical |

Catalytic, diesel oil hydrogenation |

/ |

October 16, 2023 |

December 4, 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 15, 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 19, 2023 |

September 18, 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

1400 |

July 31, 2023 |

September 15, 2023 |

|

|

Diesel oil hydrogenation |

300 |

October 27, 2023 |

November 20, 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Liaoning Huajin |

Whole plant overhaul |

600 |

May 1, 2024 |

June 1, 2024 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 5, 2023 |

Mid-September 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

August 30, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

Early September 2023 |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

March 1, 2024 |

April 1, 2024 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

Catalysis, reforming, gasoline hydrogenation |

/ |

November 8, 2023 |

To be determined |

|

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |