- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Special issue-20231221 issue

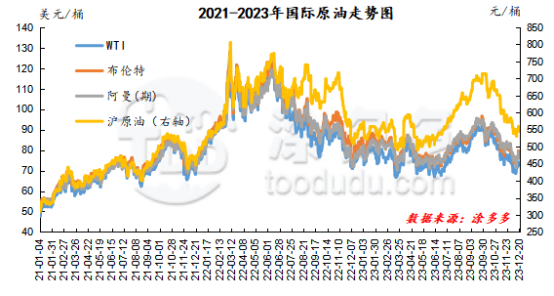

I. International crude oil futures price

|

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20231213 |

69.47 |

74.26 |

73.88 |

71.42 |

535.2 |

-4.79 |

2.84 |

|

20231220 |

74.22 |

79.7 |

79.54 |

78.98 |

559.8 |

-5.48 |

0.72 |

|

The rate of change compared with last week |

6.84% |

7.33% |

7.66% |

10.59% |

4.60% |

14.41% |

-74.65% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

II. Summary of gasoline market

Gasoline prices in China have fallen and risen this week (20231215-20231221). The fluctuation range of the main wholesale price is concentrated in 30-100 yuan / ton, and the high-end price falls in some areas. The price of the refinery is adjusted in a narrow range, with a range of 10-50 yuan / ton. The main factors of the gasoline market this week: 1. With the fermentation of the Red Sea incident, international oil prices have risen to a two-week high. 2. Demand has improved. Recently, the gasoline market has remained weak, the price is relatively low, and the fuel consumption support of passenger cars brought about by today's great cooling has been strengthened. New Year's Day's holiday is approaching, and the market pessimism has improved. 3. The annual task completion of the main unit is better, and the price-up mentality is in the majority. After the retail price limit has been lowered during the week, the market has less mentality to follow the decline.

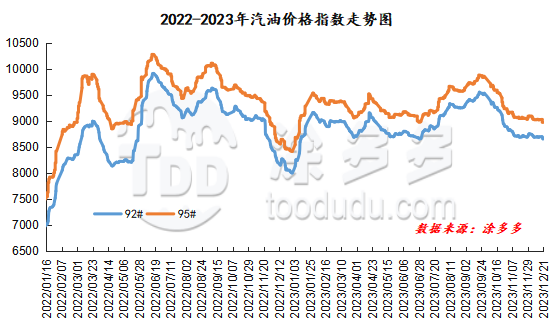

III. Gasoline price index

According to Tudor data, as of December 21, China's gasoline price index was 8667.08, down 22.25% from last week, or 0.26%, down 0.26%. The gasoline price index fell 39.71, or 0.44%, from last week. The 9-month and 9-month gasoline indices were both downgraded, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 315.40.

IV. Spot market for gasoline

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8350-9600 |

8250-9600 |

-100/0 |

-1.20%/0.00% |

|

95# |

8480-9900 |

8430-9900 |

-50/0 |

-0.59%/0.00% |

|

|

South China |

92# |

8500-9600 |

8600-9300 |

100/-300 |

1.18%/-3.13% |

|

95# |

8700-9900 |

8800-9600 |

100/-300 |

1.15%/-3.03% |

|

|

Central China |

92# |

8550-8800 |

8550-8850 |

0/50 |

0.00%/0.57% |

|

95# |

8750-9100 |

8750-9150 |

0/50 |

0.00%/0.55% |

|

|

East China region |

92# |

8400-9300 |

8400-9300 |

0/0 |

0.00%/0.00% |

|

95# |

8600-9600 |

8600-9600 |

0/0 |

0.00%/0.00% |

|

|

Northwestern region |

92# |

8350-9760 |

8350-9600 |

0/-160 |

0.00%/-1.64% |

|

95# |

8500-10020 |

8500-9860 |

0/-160 |

0.00%/-1.60% |

|

|

Southwest China |

92# |

8600-9000 |

8630-9000 |

30/0 |

0.35%/0.00% |

|

95# |

8800-9350 |

8830-9350 |

30/0 |

0.34%/0.00% |

|

|

Northeast China |

92# |

8350-8800 |

8350-8800 |

0/0 |

0.00%/0.00% |

|

95# |

8600-9800 |

8600-9800 |

0/0 |

0.00%/0.00% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8050-8400 |

8050-8400 |

0/0 |

0.00%/0.00% |

|

95# |

8220-8540 |

8200-8540 |

-20/0 |

-0.24%/0.00% |

|

|

North China region |

92# |

8150-8200 |

8160-8250 |

10/50 |

0.12%/0.61% |

|

95# |

8200-8300 |

8210-8350 |

10/50 |

0.12%/0.60% |

|

|

Central China |

92# |

8410-8410 |

8430-8430 |

20/20 |

0.24%/0.24% |

|

95# |

8610-8610 |

8630-8630 |

20/20 |

0.23%/0.23% |

|

|

East China region |

92# |

8200-8390 |

8200-8390 |

0/0 |

0.00%/0.00% |

|

95# |

8320-8520 |

8320-8520 |

0/0 |

0.00%/0.00% |

|

|

Northwestern region |

92# |

8050-8350 |

8050-8350 |

0/0 |

0.00%/0.00% |

|

95# |

8500-8550 |

8500-8550 |

0/0 |

0.00%/0.00% |

|

|

Northeast China |

92# |

8300-8300 |

8250-8300 |

-50/0 |

-0.60%/0.00% |

|

95# |

8500-8500 |

8450-8500 |

-50/0 |

-0.59%/0.00% |

|

|

Southwest China |

92# |

8600-8600 |

8600-8600 |

0/0 |

0.00%/0.00% |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

0.00%/0.00% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8400-8450 |

8400-8450 |

0/0 |

0.00%/0.00% |

|

95# |

9200-9800 |

9200-9600 |

0/-200 |

0.00%/-2.04% |

|

|

Liaoning |

92# |

8350-8800 |

8350-8800 |

0/0 |

0.00%/0.00% |

|

95# |

8650-9300 |

8650-9300 |

0/0 |

0.00%/0.00% |

|

|

Heilongjiang Province |

92# |

8380-8380 |

8350-8350 |

-30/-30 |

-0.36%/-0.36% |

|

95# |

8720-8720 |

8650-8650 |

-70/-70 |

-0.80%/-0.80% |

(2) East China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

8400-8600 |

8400-8600 |

0/0 |

0.00%/0.00% |

|

95# |

8600-8800 |

8600-8800 |

0/0 |

0.00%/0.00% |

|

|

Shandong |

92# |

8690-9300 |

8790-9300 |

100/0 |

1.15%/0.00% |

|

95# |

8840-9600 |

8940-9600 |

100/0 |

1.13%/0.00% |

|

|

Jiangsu Province |

92# |

8580-8630 |

8600-8630 |

20/0 |

0.23%/0.00% |

|

95# |

8830-8930 |

8850-8930 |

20/0 |

0.23%/0.00% |

|

|

Zhejiang |

92# |

8450-8750 |

8650-8850 |

200/100 |

2.37%/1.14% |

|

95# |

8650-8950 |

8850-9050 |

200/100 |

2.31%/1.12% |

(3) Central China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

8550-8650 |

8550-8700 |

0/50 |

0.00%/0.58% |

|

95# |

8700-8800 |

8700-8850 |

0/50 |

0.00%/0.57% |

|

|

Jiangxi Province |

92# |

8700-8800 |

8700-8850 |

0/50 |

0.00%/0.57% |

|

95# |

9000-9100 |

9050-9100 |

50/0 |

0.56%/0.00% |

|

|

Hubei province |

92# |

8550-8800 |

8550-8800 |

0/0 |

0.00%/0.00% |

|

95# |

8750-9200 |

8750-9100 |

0/-100 |

0.00%/-1.09% |

|

|

Hunan |

92# |

8600-8750 |

8600-8800 |

0/50 |

0.00%/0.57% |

|

95# |

8800-9000 |

8800-9050 |

0/50 |

0.00%/0.56% |

(4) North China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

8550-8550 |

8550-8550 |

0/0 |

0.00%/0.00% |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

0.00%/0.00% |

|

|

Beijing |

92# |

8700-8700 |

8750-8750 |

50/50 |

0.57%/0.57% |

|

95# |

8900-8900 |

8950-8950 |

50/50 |

0.56%/0.56% |

|

|

Tianjin |

92# |

8300-8430 |

8300-8430 |

0/0 |

0.00%/0.00% |

|

95# |

8500-8600 |

8500-8600 |

0/0 |

0.00%/0.00% |

|

|

Shanxi Province |

92# |

8520-9600 |

8550-9680 |

30/80 |

0.35%/0.83% |

|

95# |

8860-9900 |

8800-9900 |

-60/0 |

-0.68%/0.00% |

|

|

Hebei |

92# |

8570-8680 |

8550-8750 |

-20/70 |

-0.23%/0.81% |

|

95# |

8780-8930 |

8770-8950 |

-10/20 |

-0.11%/0.22% |

|

|

Henan |

92# |

8980-9030 |

8780-8900 |

-200/-130 |

-2.23%/-1.44% |

|

95# |

9270-9320 |

9080-9170 |

-190/-150 |

-2.05%/-1.61% |

(5) South China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

8600-9640 |

8650-9300 |

50/-340 |

0.58%/-3.53% |

|

95# |

8890-9900 |

8900-9600 |

10/-300 |

0.11%/-3.03% |

|

|

Hainan |

92# |

8650-8900 |

8700-8900 |

50/0 |

0.58%/0.00% |

|

95# |

8850-9100 |

8900-9100 |

50/0 |

0.56%/0.00% |

|

|

Fujian |

92# |

8600-8700 |

8700-8900 |

100/200 |

1.16%/2.30% |

|

95# |

8800-8900 |

8800-8950 |

0/50 |

0.00%/0.56% |

(6) Northwest China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8350-9561 |

8450-9121 |

100/-440 |

1.20%/-4.60% |

|

95# |

8550-9922 |

8650-9466 |

100/-456 |

1.17%/-4.60% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9660-9760 |

9220-9320 |

-440/-440 |

-4.55%/-4.51% |

|

95# |

10216-10316 |

9851-9851 |

-365/-465 |

-3.57%/-4.51% |

|

|

Gansu |

92# |

8550-10046 |

8550-9606 |

0/-440 |

0.00%/-4.38% |

|

95# |

8950-10631 |

8750-10166 |

-200/-465 |

-2.23%/-4.37% |

|

|

Xizang Autonomous region |

92# |

9570-9570 |

9470-9470 |

-100/-100 |

-1.04%/-1.04% |

|

95# |

10020-10020 |

9920-9920 |

-100/-100 |

-1.00%/-1.00% |

|

|

Shaanxi |

92# |

8500-9500 |

8350-9480 |

-150/-20 |

-1.76%/-0.21% |

|

95# |

8550-9860 |

8550-9680 |

0/-180 |

0.00%/-1.83% |

|

|

Qinghai |

92# |

9100-9100 |

9000-9000 |

-100/-100 |

-1.10%/-1.10% |

|

95# |

9550-9550 |

9450-9450 |

-100/-100 |

-1.05%/-1.05% |

(7) Southwest China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

8700-8930 |

8700-8900 |

0/-30 |

0.00%/-0.34% |

|

95# |

9230-9380 |

9230-9450 |

0/70 |

0.00%/0.75% |

|

|

Sichuan |

92# |

8750-9000 |

8750-9000 |

0/0 |

0.00%/0.00% |

|

95# |

9250-9300 |

9250-9300 |

0/0 |

0.00%/0.00% |

|

|

Guangxi Zhuang Autonomous region |

92# |

8600-10215 |

8750-9775 |

150/-440 |

1.74%/-4.31% |

|

95# |

8800-10810 |

8900-10346 |

100/-464 |

1.14%/-4.29% |

|

|

Guizhou |

92# |

8800-9000 |

8800-9000 |

0/0 |

0.00%/0.00% |

|

95# |

9100-9300 |

9000-9300 |

-100/0 |

-1.10%/0.00% |

|

|

Chongqing |

92# |

8600-9200 |

8630-9100 |

30/-100 |

0.35%/-1.09% |

|

95# |

8900-9550 |

8850-9500 |

-50/-50 |

-0.56%/-0.52% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8300-8300 |

8250-8300 |

-50/0 |

-0.60%/0.00% |

|

95# |

8500-8500 |

8450-8500 |

-50/0 |

-0.59%/0.00% |

|

|

Liaoning |

92# |

- |

- |

- |

- |

|

95# |

- |

- |

- |

- |

(9) East China geochemistry

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8200-8390 |

8200-8390 |

0/0 |

0.00%/0.00% |

|

95# |

8320-8520 |

8320-8520 |

0/0 |

0.00%/0.00% |

(10) Central China Refinery

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

8410-8410 |

8410-8410 |

0/0 |

0.00%/0.00% |

|

95# |

8610-8610 |

8610-8610 |

0/0 |

0.00%/0.00% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8150-8200 |

8160-8250 |

10/50 |

0.12%/0.61% |

|

95# |

8200-8300 |

8210-8350 |

10/50 |

0.12%/0.60% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8050-8400 |

8050-8400 |

0/0 |

0.00%/0.00% |

|

95# |

8220-8540 |

8200-8540 |

-20/0 |

-0.24%/0.00% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8200-8300 |

8150-8250 |

-50/-50 |

-0.61%/-0.60% |

|

95# |

8350-8450 |

8300-8400 |

-50/-50 |

-0.60%/-0.59% |

|

|

Shaanxi |

92# |

8350-8350 |

8350-8350 |

0/0 |

0.00%/0.00% |

|

95# |

8550-8550 |

8550-8550 |

0/0 |

0.00%/0.00% |

|

|

Xinjiang Uygur Autonomous region |

92# |

8700-8700 |

8650-8650 |

-50/-50 |

-0.57%/-0.57% |

(14) Southwest Refinery

|

Province / city |

Model |

Price 12.14 |

Price 12.21 |

Rise and fall |

Amplitude |

|

Sichuan Province |

92# |

8600-8600 |

8600-8600 |

0/0 |

0.00%/0.00% |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

0.00%/0.00% |

V. Future forecast

From the perspective of international crude oil, how the Red Sea incident evolved into a focus of attention in the near future, increased attention, the positive support brought by the incident still exists. However, it should be noted that US commercial crude oil inventories, Cushing crude oil inventories and US crude oil production are all showing an upward trend. If geopolitical events weaken, traders will return to the fundamentals of supply and demand. From the perspective of the Chinese market, with New Year's Day's holiday approaching next week, terminal consumption may increase. In addition, a new round of refined oil retail price limit adjustment is expected to be raised, the news side is positive guidance. And the refinery price mentality still exists, or there is a willingness to explore. It is expected that there is room for growth in China's gasoline market in the short term.

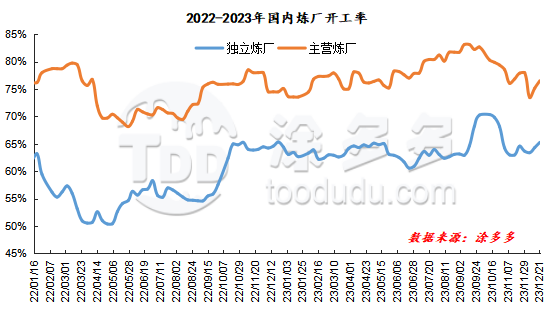

VI. Operating rate

The operating rate of Chinese refineries continued to increase this week (20231215-20231221). Specifically, the operating rate of main units increased by 1.34%, and that of independent refineries increased by 65.26%, or 0.94% .

Supply and demand & profit

Supply and demand: this week, China's oil product output is 3.0556 million tons, China's main output is 2.1554 million tons, China's independent refineries output 900200 tons, China's independent refinery gasoline sales of 843300 tons, China's commercial inventory of 13.1712 million tons.

Profit: main comprehensive oil refining weekly production gross profit 448.25 yuan / ton, georefining comprehensive oil refining weekly production gross profit 433.22 yuan / ton, atmospheric and vacuum weekly production gross profit 612 yuan / ton, FCC weekly production gross profit-71 yuan / ton, delayed coking weekly production gross profit 379.64 yuan / ton.

VIII. Plant maintenance schedule

|

Maintenance list of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 8, 2023 |

December 4, 2023 |

|

Cangzhou Petrochemical |

Whole plant overhaul |

350 |

August 25, 2024 |

October 25, 2024 |

|

Dalian Petrochemical Corporation |

Whole plant overhaul |

2050 |

March 15, 2024 |

May 10, 2024 |

|

Dalian West Pacific |

Atmospheric and vacuum decompression |

450 |

May 25, 2024 |

July 13, 2024 |

|

Dushanzi petrification |

Whole plant overhaul |

1000 |

May 15, 2024 |

July 5, 2024 |

|

Fujian Union |

Whole plant overhaul |

1200 |

November 1, 2024 |

December 20, 2024 |

|

Guangxi Petrochemical Corporation |

Whole plant overhaul |

1000 |

October 10, 2024 |

November 30, 2024 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

520 |

October 15, 2023 |

December 11, 2023 |

|

Jilin Petrochemical Corporation |

Whole plant overhaul |

980 |

August 24, 2024 |

October 14, 2024 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

800 |

November 15, 2024 |

December 31, 2024 |

|

Jinzhou Petrochemical |

Whole plant overhaul |

650 |

April 10, 2024 |

May 22, 2024 |

|

Maoming Petrochemical |

Atmospheric and vacuum decompression |

500 |

May 25, 2024 |

July 5, 2024 |

|

Ningxia Petrochemical Company |

Whole plant overhaul |

500 |

July 3, 2024 |

August 31, 2024 |

|

Qilu Petrochemical |

Atmospheric and vacuum decompression |

800 |

June 10, 2024 |

July 20, 2024 |

|

Shengli Oilfield |

Whole plant overhaul |

300 |

September 1, 2024 |

November 1, 2024 |

|

Tahe petrochemical |

Atmospheric and vacuum decompression |

150 |

March 15, 2024 |

April 30, 2024 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

March 10, 2024 |

April 25, 2024 |

|

Wuhan Petrochemical Corporation |

The whole plant |

850 |

October 13, 2024 |

December 15, 2024 |

|

Changling Petrochemical Company |

Atmospheric and vacuum |

800 |

December 1, 2024 |

To be determined |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

800 |

April 15, 2024 |

June 15, 2024 |

|

CNOOC Orient |

Whole plant overhaul |

200 |

March 15, 2024 |

May 1, 2024 |

|

Chinese Science Refining and Chemical Industry |

Whole plant overhaul |

1000 |

March 20, 2024 |

May 20, 2024 |

|

Maintenance list of local refinery equipment |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

September 15, 2023 |

|

Huaxing petrochemical |

Catalytic, diesel oil hydrogenation |

/ |

October 16, 2023 |

December 4, 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 15, 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 19, 2023 |

September 18, 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

1400 |

July 31, 2023 |

September 15, 2023 |

|

|

Diesel oil hydrogenation |

300 |

October 27, 2023 |

November 20, 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Liaoning Huajin |

The whole plant |

600 |

May 1, 2024 |

June 1, 2024 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 5, 2023 |

Mid-September 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

August 30, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

Early September 2023 |

|

Xinhai Sinopec |

Atmospheric and vacuum |

300 |

March 1, 2024 |

April 1, 2024 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

2023 / end of February |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

Catalysis, reforming, gasoline hydrogenation |

/ |

November 8, 2023 |

To be determined |

|

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |