Tu Duoduo Gasoline Industry Special Issue-No. 202311

Gasoline Special issue-202311 issue

Analysis and Forecast of gasoline Market in November

January and November gasoline market analysis

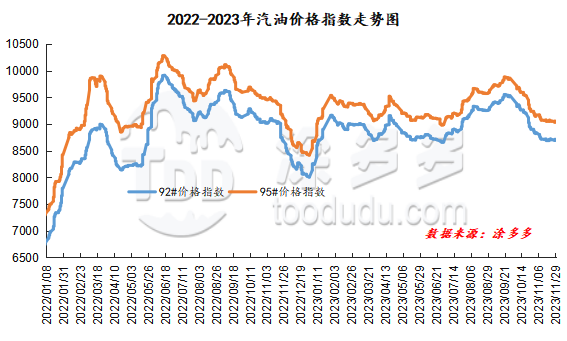

As of November 29, China's gasoline price index was 8715.60, down 115.25, or 1.31%, from November 1, while China's gasoline price index was 9056.23, down 106.31, or 1.16%. The 9-month gasoline index and the 9-month gasoline index were both downgraded, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 340.63.

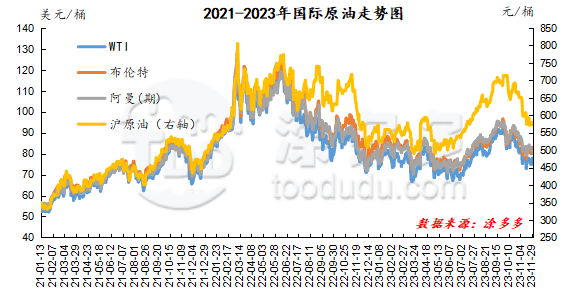

Overall, the decline in China's gasoline market in November 2023 was slower than that in October. Specifically, the downward trend of gasoline prices slowed in early November, and the market rose as gasoline prices fell to relatively low levels, some positive factors appeared and refinery mentality changed. On the whole, China's main wholesale prices were mainly reduced in November, with an adjustment range of 50-400 yuan per ton. the ex-factory prices of georefining increased by 100-280 yuan per ton in Shandong, North China, Central China and East China, and 50-200 yuan per ton in Northeast and Southwest China. The main influencing factors of this month: 1, from the perspective of crude oil, as concerns about the Israeli-Palestinian conflict fade, market attention returns to the level of supply and demand. During the month, the OPEC monthly market report alleviated demand concerns, and the market focus shifted to the upcoming OPEC+ meeting at the end of the month. The postponement of the OPEC+ meeting made the market look erratic. In addition, US commercial crude oil stocks continued to suppress oil prices throughout November. Overall, international oil prices fluctuated downwards during the month. 2. From the point of view of demand, in November, most of the demand maintained the previous level, and traders and other rigid demand were mainly purchased on demand. There are few speculative demand operations in the market, and the enthusiasm for entering the market is low; from the supply side, under the negative background of low refining profits, insufficient crude oil import quotas and poor downstream demand in early November, refineries generally reduce their negative and output. The negative effect of refineries in the first half of the month is significant, and the output in the second half of the month is relatively stable. Overall, the decline in the gasoline market gradually slowed down in November, the monthly tasks of the main units completed better and the trading atmosphere improved at the end of the month, the price-raising mentality of refineries gradually increased, and the market trend rose slightly. 3. From the point of view of the price adjustment mechanism of refined oil, the price adjustment in November and October fell in a total of four consecutive declines, of which the maximum retail price limit for gasoline was lowered by 140 yuan per ton on November 7 and 340 yuan per ton on October 24.

2. Comparison of spot gasoline prices within the month of nbsp;

|

Comparison of main wholesale prices of gasoline in November (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 11.1 |

Price 11.29 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8150-9600 |

8320-9600 |

170/0 |

2.09%/0.00% |

|

95# |

8350-10000 |

8520-9900 |

170/-100 |

2.04%/-1.00% |

|

|

South China |

92# |

8600-9680 |

8600-9700 |

0/20 |

0.00%/0.21% |

|

95# |

8850-9980 |

8850-10000 |

0/20 |

0.00%/0.20% |

|

|

Central China |

92# |

8450-9000 |

8600-8750 |

150/-250 |

1.78%/-2.78% |

|

95# |

8650-9450 |

8750-9050 |

100/-400 |

1.16%/-4.23% |

|

|

East China region |

92# |

8400-9650 |

8400-9300 |

0/-350 |

0.00%/-3.63% |

|

95# |

8600-10000 |

8650-9600 |

50/-400 |

0.58%/-4.00% |

|

|

Northwestern region |

92# |

8330-10000 |

8250-9800 |

-80/-200 |

-0.96%/-2.00% |

|

95# |

8530-10450 |

8350-10100 |

-180/-350 |

-2.11%/-3.35% |

|

|

Southwest China |

92# |

8600-9200 |

8500-9000 |

-100/-200 |

-1.16%/-2.17% |

|

95# |

8850-9500 |

8750-9430 |

-100/-70 |

-1.13%/-0.74% |

|

|

Northeast China |

92# |

8450-9800 |

8345-8850 |

-105/-950 |

-1.24%/-9.69% |

|

95# |

9500-10000 |

8580-9800 |

-920/-200 |

-9.68%/-2.00% |

|

|

Comparison of ex-factory price of gasoline refinery in November (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 11.1 |

Price 11.29 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

7950-8250 |

8170-8510 |

220/260 |

2.77%/3.15% |

|

95# |

8080-8460 |

8350-8630 |

270/170 |

3.34%/2.01% |

|

|

North China region |

92# |

8020-8030 |

8300-8300 |

280/270 |

3.49%/3.36% |

|

95# |

8070-8180 |

8350-8400 |

280/220 |

3.47%/2.69% |

|

|

Central China |

92# |

8260-8260 |

8730-8730 |

470/470 |

5.69%/5.69% |

|

95# |

8460-8460 |

8930-8930 |

470/470 |

5.56%/5.56% |

|

|

East China region |

92# |

8120-8250 |

8220-8450 |

100/200 |

1.23%/2.42% |

|

95# |

8240-8420 |

8340-8580 |

100/160 |

1.21%/1.90% |

|

|

Northwestern region |

92# |

8050-8250 |

7950-8250 |

-100/0 |

-1.24%/0.00% |

|

95# |

8200-8450 |

8400-8450 |

200/0 |

2.44%/0.00% |

|

|

Northeast China |

92# |

8350-8500 |

8300-8300 |

-50/-200 |

-0.60%/-2.35% |

|

95# |

8700-8700 |

8500-8500 |

-200/-200 |

-2.30%/-2.30% |

|

|

Southwest China |

92# |

8650-8650 |

8600-8600 |

-50/-50 |

-0.58%/-0.58% |

|

95# |

8800-8800 |

8750-8750 |

-50/-50 |

-0.57%/-0.57% |

|

3. Future forecast

From the perspective of international crude oil, the current concern is still the meeting of OPEC and its allies on production reduction held today. Further release of good news will strongly boost oil prices, and international oil prices will continue to rise; on the contrary, the downward space for oil prices will be widened. The Fed is more likely to keep its original interest rates in December, but there has been no significant improvement in global economic weakness. China's lower-than-expected November PMI data today also continued to be weak, coupled with continued growth in US commercial crude oil inventories and high growth in gasoline stocks, and the poor demand outlook held back oil prices. In terms of supply, there were no new refineries for maintenance in December. Dongxing in Zhanjiang resumed production after maintenance in early December, and Huaxing No. 2 and No. 3 plants resumed work in December, but some refineries continued to reduce load. Overall, the fluctuation of processing load is limited. From the demand point of view, the frequency of car travel in winter is stable, and the retail delivery of gas stations is OK, but at present, there is no obvious bright spot on the demand side, waiting for new news guidance. From the perspective of market transactions, the gasoline market has fallen to a relatively low level after a continuous decline, investors' short covering has increased, and the gasoline market has shown an upward trend in recent days. Taken together, the gasoline market is expected to fluctuate upwards in December.

II. Trend of gasoline production in China

1. Analysis of gasoline production in 2023

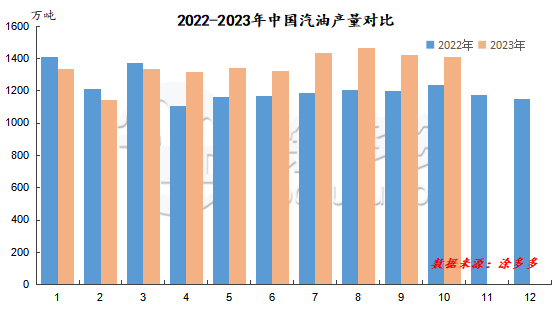

China's gasoline production in October 2023 was 14.084 million tons, an increase of 1.722 million tons, or 13.93 percent, over the same period of 12.362 million tons, and a decrease of 144000 tons, or-1.01 percent, compared with 14.228 million tons. From January to October 2023, China's gasoline production totaled 135.271 million tons, an increase of 12.755 million tons over the same period last year, or 10.41 percent.

2. Analysis of output refinery in 2023

The weekly data of China's refined oil production dropped obviously at the beginning of this month, and then the main recipient increased slightly, and the refined oil output increased slightly in the middle and last ten days, of which the main oil output fluctuated by 64400 tons during the month and 40100 tons by independent refineries.

|

Supply and demand data of China in November |

|||||

|

Date |

Output of oil products |

Main output |

Output of independent refinery |

Independent refinery sales |

Commercial inventory |

|

2023/11/2 |

313.51 |

222.96 |

90.55 |

94.66 |

1324.31 |

|

2023/11/9 |

302.76 |

214.73 |

88.03 |

90.32 |

1328.77 |

|

2023/11/16 |

304.26 |

216.52 |

87.74 |

90.05 |

1328.7 |

|

2023/11/23 |

305.38 |

218.84 |

86.54 |

88.12 |

1336.06 |

III. Analysis of operating rate of refineries in China

1. main refinery operating rate of refined oil products

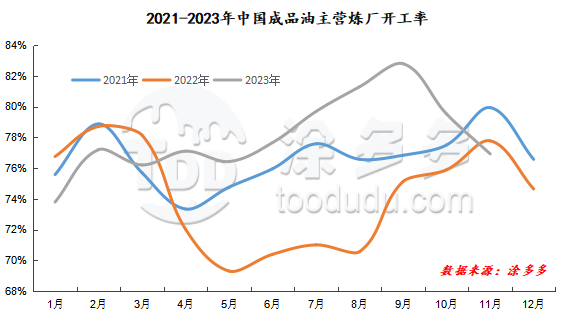

The operating rate of the main refinery in 2023 continued the downward trend in October, of which the operating rate of the main refinery in November was 76.92%, down 1.09% from the same period last year and 3.26% from the previous month.

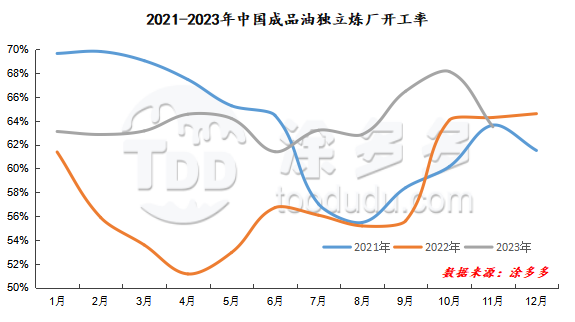

2. operating rate of independent refineries of refined oil products

The negative operation of China's independent refineries was common in November 2023, and the average operating rate decreased significantly at 63.50%, down 1.21% from the same period last year and 6.80% from the previous month.

IV. Analysis of gasoline import and export

1. Gasoline import

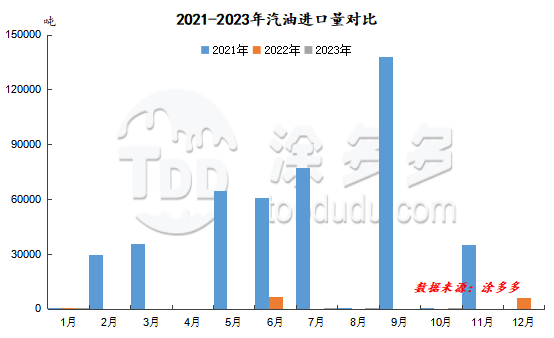

According to customs data, Britain imported 0.43 tons of gasoline in October 2023 and 17.37 tons from January to October.

2. Gasoline export

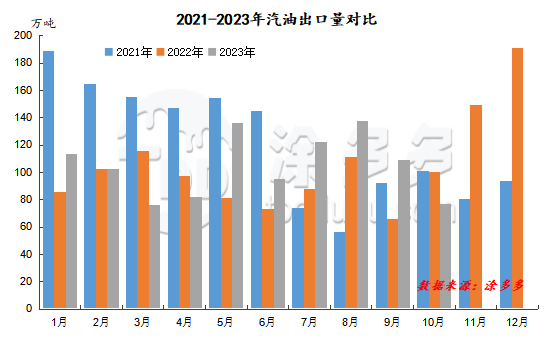

According to customs data, gasoline exports in October 2023 were 766600 tons, a decrease of 237000 tons compared with 1.0036 million tons last year, a decrease of-23.62 percent, and a decrease of 323000 tons, or 29.64 percent, compared with 1.0896 million tons. Exports totaled 10.5246 million tons from January to October 2023, an increase of 1.2996 million tons or 14.09 percent over 9.225 million tons last year.

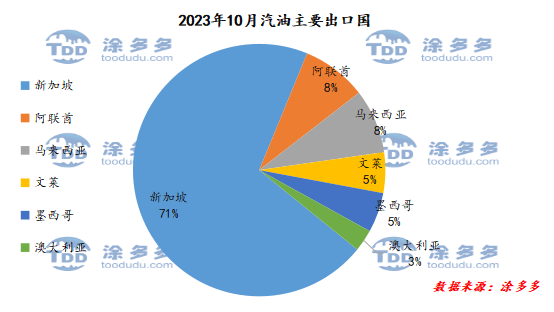

The top four main exporting countries in October: Singapore, United Arab Emirates, Malaysia and Brunei. Specifically, exports to Singapore totaled 498600 tons, accounting for 71% of the major exporters in October. Followed by the United Arab Emirates 58700 tons, accounting for 8%, Malaysia 58300 tons, accounting for 8%, Brunei 36900 tons, accounting for 5%.

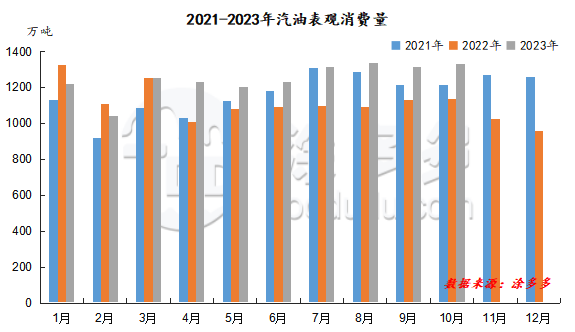

V. Analysis of apparent gasoline consumption

The apparent gasoline consumption in October 2023 was 13.3174 million tons, an increase of 1.959 million tons, or 17.25 percent, over last year's 11.3584 million tons, and an increase of 179,000 tons, or 1.36 percent, over 13.1384 million tons. The apparent gasoline consumption totaled 124.7995 million tons from January to October 2023.

VI. Profit analysis

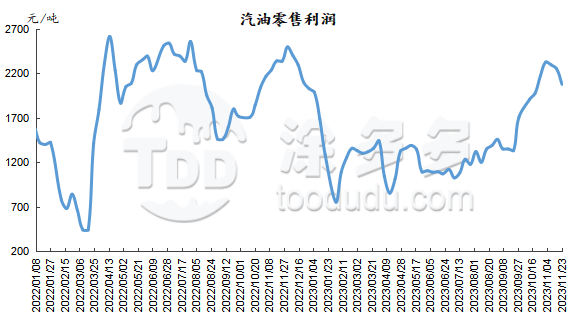

1. Analysis of gasoline retail profit.

The retail profit of gasoline in November 2023 plummeted from 2328 yuan / ton at the beginning of the month to 2078 yuan / ton, but the overall retail profit was higher than that in October.

2. Profit analysis of oil products.

In November, the gross profit of the weekly production of the main comprehensive oil refining rose first and then fell, with a maximum gross profit of 221.34 yuan / ton within the month, while the gross profit of the comprehensive oil refining weekly production increased gradually, with a maximum of 468.71 yuan / ton. The gross profit of atmospheric and vacuum production is 228-517 yuan / ton, FCC production is-481-552 yuan / ton, delayed coking production is 480-552 yuan / ton.

|

October profit data |

|||||

|

Date |

Main comprehensive oil refining weekly production gross margin |

Gross profit of weekly production of geotechnical comprehensive oil refining |

Atmospheric and vacuum weekly production gross margin |

Gross profit of FCC weekly production |

Delayed coking weekly production gross margin |

|

2023/11/2 |

-162.87 |

350.35 |

228 |

-481 |

480 |

|

2023/11/9 |

221.34 |

380 |

517 |

-401 |

522 |

|

2023/11/16 |

114.03 |

419.34 |

417 |

-349 |

552 |

|

2023/11/23 |

-94.94 |

468.71 |

362 |

-241 |

544 |

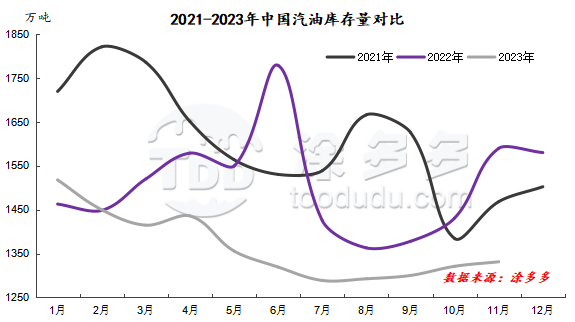

VII. Analysis of gasoline inventory

The average commercial inventory of gasoline in November 2023 was 13.3118 million tons, a decrease of 2.5855 million tons, or-16.26 percent, compared with 15.8973 million tons last year, and an increase of 103,800 tons, or 1.6 percent, compared with 13.2079 million tons.

VIII. International crude Oil Futures Price and its trend

|

Types |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

|

Average price of 202310 |

85.47 |

88.70 |

90.57 |

89.79 |

629.36 |

|

Average price of 202311 |

77.45 |

81.99 |

83.17 |

83.17 |

603.44 |

|

The rate of change compared with the previous month |

-9.38% |

-7.57% |

-8.17% |

-7.37% |

-4.12% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. This month, the WTI/ Brent spread is-4.57, and the Brent / DME Oman spread is-1.18. |

|||||

IX. Price adjustment schedule of refined oil products in 2023

1. 2023 Price Adjustment Summary of Oil products

|

2023 summary of price adjustment of oil products |

||

|

Date |

Gasoline (yuan / ton) |

Diesel oil (yuan / ton) |

|

January third |

↑250 |

↑240 |

|

January seventeenth |

↓205 |

↓195 |

|

February third |

↑210 |

↑200 |

|

February seventeenth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March 3rd |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March seventeenth |

↓100 |

↓95 |

|

March 31st |

↓335 |

↓320 |

|

April seventeenth |

↑550 |

↑525 |

|

April 28th |

↓160 |

↓155 |

|

May 16th |

↓380 |

↓365 |

|

May 30th |

↑100 |

↑95 |

|

June thirteenth |

↓55 |

↓50 |

|

June twenty _ eighth |

↑70 |

↑70 |

|

July twelfth |

↑155 |

↑150 |

|

July twenty _ sixth |

↑275 |

↑260 |

|

August ninth |

↑240 |

↑230 |

|

August twenty _ third |

↑55 |

↑55 |

|

September sixth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

September twentieth |

↑385 |

↑370 |

|

October tenth |

↓85 |

↓80 |

|

October twenty _ fourth |

↓70 |

↓70 |

|

November seventh |

↓140 |

↓135 |

|

November twenty _ first |

↓340 |

↓330 |

So far, the price adjustment of refined oil products has experienced 23 price adjustment days in 2023, of which 10 times have been raised, 10 times reduced and 3 times unadjusted.

2. 2023 price adjustment schedule

|

Price adjustment schedule for 2023 |

|||

|

Price adjustment month |

Specific date |

||

|

January |

January third |

January seventeenth |

|

|

February |

February third |

February 17 |

|

|

March |

March 3rd |

March seventeenth |

March 31st |

|

April |

April seventeenth |

April 28th |

|

|

May |

May 16th |

May 30th |

|

|

June |

June thirteenth |

June twenty _ eighth |

|

|

July |

July twelfth |

July twenty _ sixth |

|

|

August |

August ninth |

August twenty _ third |

|

|

September |

September sixth |

September twentieth |

|

|

October |

October tenth |

October twenty _ fourth |

|

|

November |

November seventh |

November twenty _ first |

|

|

December |

December fifth |

December nineteenth |

|

10. China equipment maintenance Plan

1. Maintenance list of main refinery equipment in 2023

|

Maintenance schedule of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Beihai Refining and Chemical Industry |

Catalytic cracking |

210 |

March 1, 2023 |

March 31, 2023 |

|

Daqing Refining and Chemical Industry |

Whole plant overhaul |

550 |

August 3, 2023 |

September 23, 2023 |

|

Daqing Petrochemical |

Whole plant overhaul |

1000 |

June 15, 2023 |

July 24, 2023 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

500 |

October 15, 2023 |

December 5, 2023 |

|

Harbin Petrochemical |

Whole plant overhaul |

435 |

May 5, 2023 |

June 23, 2023 |

|

Huizhou Refining and Chemical Industry |

The first phase of the whole plant |

1200 |

March 15, 2023 |

Mid-May 2023 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

600 |

April 10, 2023 |

May 26, 2023 |

|

Lanzhou Petrochemical |

Whole plant overhaul |

1050 |

June 11, 2023 |

August 9, 2023 |

|

Liaoyang Petrochemical Company |

Whole plant overhaul |

900 |

April 10, 2023 |

May 24, 2023 |

|

Luoyang Refining and Chemical Industry |

Whole plant overhaul |

1000 |

May 15, 2023 |

July 14, 2023 |

|

Qingdao Refining and Chemical Industry |

Whole plant overhaul |

1200 |

May 16, 2023 |

July 6, 2023 |

|

Sichuan Petrochemical Company |

Whole plant overhaul |

1000 |

September 15, 2023 |

November 15, 2023 |

|

Tahe petrochemical |

Diesel oil hydrogenation |

/ |

March 19, 2023 |

March 31, 2023 |

|

Urumqi petrochemical |

Whole plant overhaul |

850 |

April 15, 2023 |

June 18, 2023 |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 5, 2023 |

December 5, 2023 |

|

Changqing Petrochemical Company |

Whole plant overhaul |

500 |

April 1, 2023 |

May 25, 2023 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

1000 |

March 10, 2023 |

May 5, 2023 |

|

China National Oil and Gas Taizhou |

Whole plant overhaul |

600 |

May 12, 2023 |

End of June 2023 |

|

Qingdao Petrochemical Company |

Whole plant overhaul |

500 |

October 7, 2023 |

November 26, 2023 |

2. 2023 local refinery equipment maintenance table

|

Maintenance schedule of local refinery plant |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

September 15, 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 15, 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 19, 2023 |

September 18, 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

2400 |

August 31, 2023 |

September 15, 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 5, 2023 |

Mid-September 2023 |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

August 30, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

Early September 2023 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Zhonghe petrochemical |

Catalysis |

/ |

November 8, 2023 |

To be determined |

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |

|

Huaxing petrochemical |

Catalysis, coking |

/ |

October 16, 2023 |

November 2023 |