- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Special issue-202310 issue

As of October 30, China's gasoline price index was 8887.64, down 493.58, or 5.26%, from October 7, while China's gasoline price index was 9225.48, down 487.79, or 5.02%, from October 7. The 9-month gasoline index and the 9-month gasoline index were both downgraded, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 337.84.

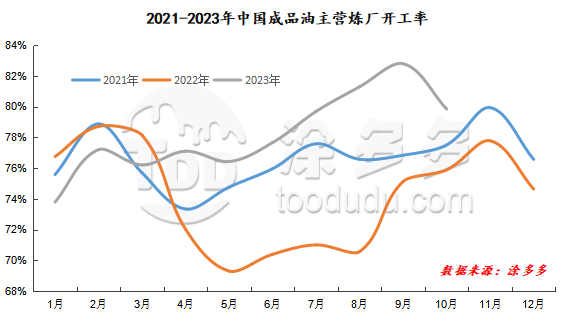

In October 2023, China's gasoline market showed a direct downward trend, specifically, the lack of support in October continued to weaken, the situation of strong supply and weak demand in China is difficult to improve in the short term, and market negative factors guide the downward trend of oil prices. Overall, in October, China's main wholesale price was reduced by 170-550 yuan / ton, and the ex-factory price of georefining was also reduced in various regions, with a reduction of 490-600 yuan / ton. The main influencing factors this month are as follows: 1. From the perspective of crude oil, with the outbreak of the Palestinian-Israeli conflict, geopolitical events have been paid more attention. The market continues to measure whether the Palestinian-Israeli conflict poses a threat to the supply side of crude oil. So far, it has not disrupted global crude oil supply, but geopolitical uncertainty continues, market concerns are also repeated, and international oil prices have ups and downs. In addition, the global economic level of weak bearish sentiment still exists 2, from the demand side, after the first ten days ushered in a short concentrated replenishment period, but the replenishment strength is not as strong as expected. Since then, the market lacks the support of positive factors such as holidays, gasoline consumption has returned to the rigid demand for daily travel, and the demand has declined significantly. On the supply side, the capacity utilization rate of China's local refineries remained relatively high in the first ten days, with the start-up of main refineries above 80%. However, as the demand for gasoline continues to weaken, the trading atmosphere in the market is also weakening, and the pressure on refineries leaving the warehouse is increasing. Some refineries reduced the start-up load, and China's capacity utilization decreased in the second half of the month. 3. Under the influence of the rate of change of international crude oil, the retail price of refined oil in China has been lowered twice in a row, with the maximum retail price of gasoline lowered by 85 yuan per ton at 24:00 on October 10 and 70 yuan per ton at 24:00 on October 24. 4. From the perspective of national policy, the sixth session of the 14th National people's Congress approved the issuance of 1 trillion yuan of special treasury bonds on October 24, but the emotional response to commodities was relatively mild.

|

Comparison of main wholesale prices of gasoline in October (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 10.7 |

Price 10.30 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8800-10130 |

8200-9600 |

-600/-530 |

-6.82%/-5.23% |

|

95# |

9000-10510 |

8400-10000 |

-600/-510 |

-6.67%/-4.85% |

|

|

South China |

92# |

9100-9750 |

8650-9680 |

-450/-70 |

-4.95%/-0.72% |

|

95# |

9350-10050 |

8900-9980 |

-450/-70 |

-4.81%/-0.70% |

|

|

Central China |

92# |

9050-9500 |

8650-9150 |

-400/-350 |

-4.42%/-3.68% |

|

95# |

9200-9700 |

8800-9450 |

-400/-250 |

-4.35%/-2.58% |

|

|

East China region |

92# |

8950-9650 |

8400-9650 |

-550/0 |

-6.15%/0.00% |

|

95# |

9150-10000 |

8600-10000 |

-550/0 |

-6.01%/0.00% |

|

|

Northwestern region |

92# |

8950-10134 |

8330-10000 |

-620/-134 |

-6.93%/-1.32% |

|

95# |

9150-10620 |

8530-10450 |

-620/-170 |

-6.78%/-1.60% |

|

|

Southwest China |

92# |

9250-9760 |

8700-9200 |

-550/-560 |

-5.95%/-5.74% |

|

95# |

9500-10100 |

8900-9550 |

-600/-550 |

-6.32%/-5.45% |

|

|

Northeast China |

92# |

9150-9600 |

8600-9800 |

-550/200 |

-6.01%/2.08% |

|

95# |

9500-10000 |

8900-10000 |

-600/0 |

-6.32%/0.00% |

|

|

Comparison of ex-factory price of gasoline refinery in October (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 10.7 |

Price 10.30 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8510-8970 |

8050-8300 |

-460/-670 |

-5.41%/-7.47% |

|

95# |

8660-9050 |

8130-8470 |

-530/-580 |

-6.12%/-6.41% |

|

|

North China region |

92# |

8700-8740 |

8110-8170 |

-590/-570 |

-6.78%/-6.52% |

|

95# |

8750-8840 |

8250-8230 |

-500/-610 |

-5.71%/-6.90% |

|

|

Central China |

92# |

8960-8960 |

8290-8290 |

-670/-670 |

-7.48%/-7.48% |

|

95# |

9160-9160 |

8490-8490 |

-670/-670 |

-7.31%/-7.31% |

|

|

East China region |

92# |

8670-8800 |

8180-8380 |

-490/-420 |

-5.65%/-4.77% |

|

95# |

8790-8970 |

8300-8550 |

-490/-420 |

-5.57%/-4.68% |

|

|

Northwestern region |

92# |

8800-8950 |

8150-8250 |

-650/-700 |

-7.39%/-7.82% |

|

95# |

8950-9150 |

8250-8450 |

-700/-700 |

-7.82%/-7.65% |

|

|

Northeast China |

92# |

9200-9200 |

8450-8600 |

-750/-600 |

-8.15%/-6.52% |

|

95# |

9400-9400 |

8800-8800 |

-600/-600 |

-6.38%/-6.38% |

|

|

Southwest China |

92# |

9300-9300 |

8650-8650 |

-650/-650 |

-6.99%/-6.99% |

|

95# |

9450-9450 |

8800-8800 |

-650/-650 |

-6.88%/-6.88% |

|

From the perspective of international crude oil, the current geopolitical events are still uncertain, and market worries are constantly repeating. In the future, we still need to pay more attention to whether the geo-conflict market will affect oil prices in the long run. If geopolitical events remain at short-term levels, the market may return to the supply and demand side to dominate oil prices. On the supply side, Chinese refineries Guangdong Petrochemical, Zhanjiang Dongxing, Qingdao Petrochemical, Sichuan Petrochemical and Huaxing Petrochemical are still in the maintenance period in November, but Sichuan Petrochemical, Qingdao Petrochemical and Huaxing Petrochemical may finish the maintenance in late November. On the whole, there are fewer refineries involved in overhaul in November, but at present, there are obvious refineries with more supply than demand or load reduction. In terms of exports, the completion of the first three batches of export quotas is relatively high, followed by a reduction in export quotas and a greater possibility of insufficient export quotas. From the demand point of view, entering the traditional off-season in November, no holidays and other positive support, gasoline demand may continue to remain weak, demand is difficult to have a significant improvement, there is a negative impact on the gasoline market, at the same time, there are more bearish mentality in the market. Taken together, there is still a downside risk in the gasoline market in the later stage.

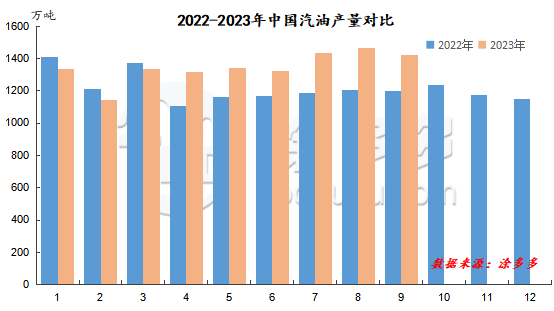

In September 2023, China's gasoline production was 14.228 million tons, of which 2.231 million tons, or 18.60 percent, increased compared with 11.997 million tons, and decreased by 458000 tons, or-3.12 percent, compared with 14.686 million tons. From January to September, China's gasoline output totaled 121.187 million tons.

The weekly data of China's refined oil production this month showed a downward trend, with an output of 322.23-3.3817 million tons, with the highest output of 2.3635 million tons in the main business and 1.022 million tons in independent refineries.

|

Data of supply and demand in China in October |

|||||

|

Date |

Output of oil products |

Main output |

Output of independent refinery |

Independent refinery sales |

Commercial inventory |

|

2023/10/5 |

338.17 |

236.35 |

101.82 |

87.84 |

1263.08 |

|

2023/10/12 |

330.24 |

228.04 |

102.2 |

102.67 |

1293.35 |

|

2023/10/19 |

326.54 |

226.97 |

99.57 |

95 |

1323.86 |

|

2023/10/26 |

322.23 |

225.95 |

96.28 |

92.93 |

1341.65 |

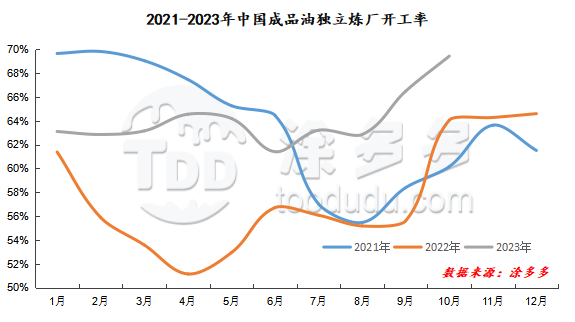

The monthly start-up of China's independent refined oil refineries in October 2023 rose first and then fell, but the overall start-up rate was higher than that in September, with an operating rate of 69.43% in October, an increase of 8.40% over the same period last year, and an increase of 4.42% from the previous month.

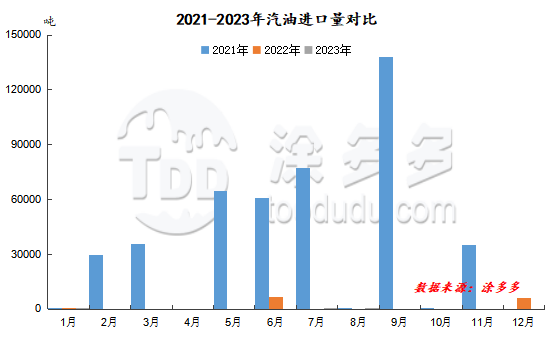

According to customs data, there was no gasoline import in September 2023, and a total of 16.94 tons of gasoline were imported from January to September.

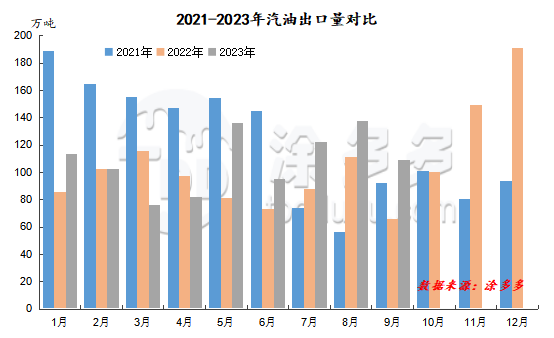

According to customs data, gasoline exports totaled 1.0896 million tons in September 2023, an increase of 428100 tons over last year's 661500 tons, an increase of 64.72 percent, a decrease of 28.80 percent from 1.3776 million tons, or-20.91 percent. Exports totaled 9.758 million tons from January to September 2023, an increase of 1.5366 million tons or 18.69 percent over 8.2214 million tons last year.

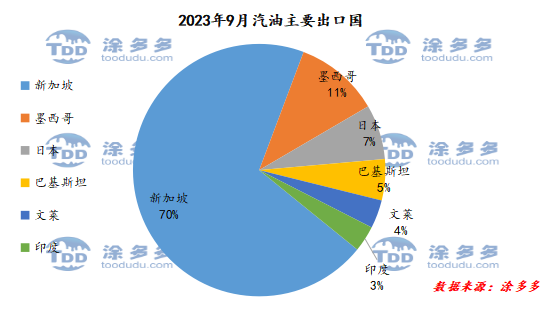

The top four main exporting countries in September: Singapore, Mexico, Japan and Pakistan. Specifically: 711700 tons were exported to Singapore, accounting for 70 per cent of the major exporters in September. This was followed by Mexico with 110500 tons, accounting for 11 percent, Japan with 71500 tons, accounting for 7 percent, and Pakistan with 53700 tons, accounting for 5 percent.

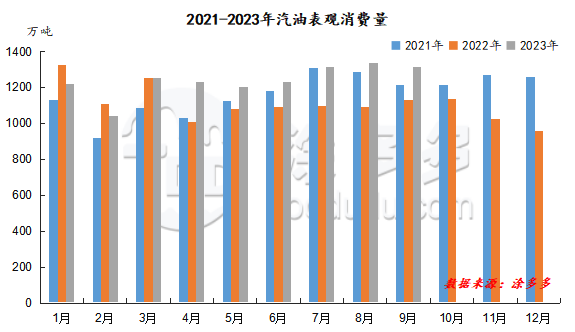

The apparent gasoline consumption in September 2023 was 13.1384 million tons, an increase of 1.8029 million tons, or 15.90 percent, compared with 11.3355 million tons last year, and a month-on-month decrease of 231 tons, or-1.67 percent, compared with 13.3615 million tons. The apparent gasoline consumption accumulated 111.4821 million tons from January to September in 2023.

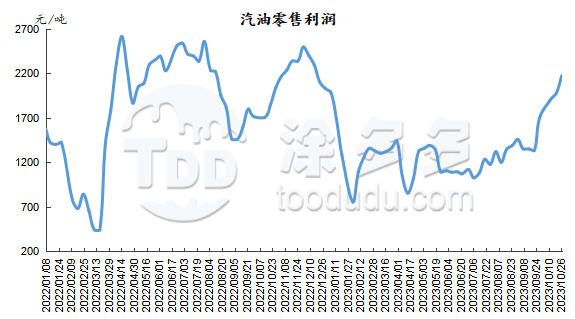

In October 2023, the National Development and Reform Commission lowered the maximum retail price limit for gasoline twice in a row, and the market continued to decline this month, with a significant decline in wholesale gasoline prices and larger retail profits.

In October, the gross profit of the weekly production of the main comprehensive oil refining plummeted, from 560.6 yuan / ton to-12.85 yuan / ton. The highest gross profit of the comprehensive oil refining production was 660.37 yuan / ton, and the difference of the minimum gross profit was more than 300 yuan / ton. The gross profit of atmospheric and vacuum production is concentrated at 18-330 yuan / ton, FCC production is-507 murmur21 yuan / ton, and delayed coking production is concentrated at 435-589 yuan / ton.

|

October profit data |

|||||

|

Date |

Main comprehensive oil refining weekly production gross margin |

Gross profit of weekly production of geotechnical comprehensive oil refining |

Atmospheric and vacuum weekly production gross margin |

Gross profit of FCC weekly production |

Delayed coking weekly production gross margin |

|

2023/10/5 |

560.6 |

560 |

330 |

-214 |

456 |

|

2023/10/12 |

276.45 |

660.37 |

466 |

-325 |

435 |

|

2023/10/19 |

70.79 |

449.77 |

66 |

-358 |

589 |

|

2023/10/26 |

-12.85 |

290.09 |

18 |

-507 |

462 |

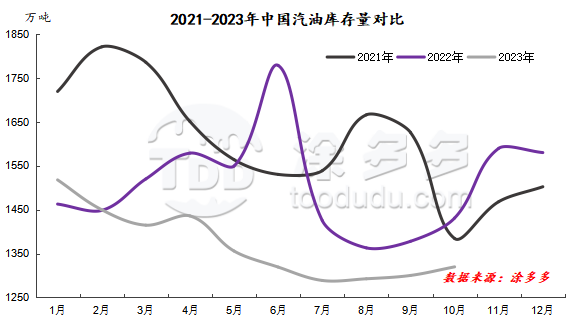

The average commercial inventory of gasoline in October 2023 was 13.1962 million tons, a decrease of 1.1125 million tons, or 7.77%, compared with 14.3087 million tons last year, and an increase of 196,200 tons, or 1.51%, compared with 13 million tons.

|

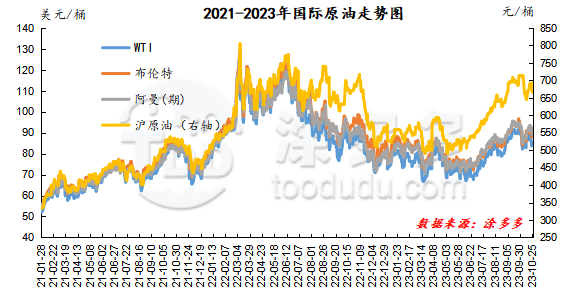

Types |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

|

Average price of 202309 |

89.25 |

92.59 |

94.29 |

92.77 |

690.98 |

|

Average price of 202310 |

85.85 |

88.83 |

90.75 |

89.86 |

625.10 |

|

The rate of change compared with the previous month |

-3.81% |

-4.06% |

-3.75% |

-3.14% |

-9.53% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. This month, the WTI/ Brent spread is-2.99, and the Brent / DME Oman spread is-1.02. |

|||||

|

2023 summary of price adjustment of oil products |

||

|

Date |

Gasoline (yuan / ton) |

Diesel oil (yuan / ton) |

|

January third |

↑250 |

↑240 |

|

January seventeenth |

↓205 |

↓195 |

|

February third |

↑210 |

↑200 |

|

February seventeenth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March 3rd |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March seventeenth |

↓100 |

↓95 |

|

March 31st |

↓335 |

↓320 |

|

April seventeenth |

↑550 |

↑525 |

|

April 28th |

↓160 |

↓155 |

|

May 16th |

↓380 |

↓365 |

|

May 30th |

↑100 |

↑95 |

|

June thirteenth |

↓55 |

↓50 |

|

June twenty _ eighth |

↑70 |

↑70 |

|

July twelfth |

↑155 |

↑150 |

|

July twenty _ sixth |

↑275 |

↑260 |

|

August ninth |

↑240 |

↑230 |

|

August twenty _ third |

↑55 |

↑55 |

|

September sixth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

September twentieth |

↑385 |

↑370 |

|

October tenth |

↓85 |

↓80 |

|

October twenty _ fourth |

↓70 |

↓70 |

So far, the price adjustment of refined oil products has experienced 21 price adjustment days in 2023, of which 10 times have been raised, 8 times have been lowered and 3 times have not been adjusted.

|

Price adjustment schedule for 2023 |

|||

|

Price adjustment month |

Specific date |

||

|

January |

January third |

January seventeenth |

|

|

February |

February third |

February 17 |

|

|

March |

March 3rd |

March seventeenth |

March 31st |

|

April |

April seventeenth |

April 28th |

|

|

May |

May 16th |

May 30th |

|

|

June |

June thirteenth |

June twenty _ eighth |

|

|

July |

July twelfth |

July twenty _ sixth |

|

|

August |

August ninth |

August twenty _ third |

|

|

September |

September sixth |

September twentieth |

|

|

October |

October tenth |

October twenty _ fourth |

|

|

November |

November seventh |

November twenty _ first |

|

|

December |

December fifth |

December nineteenth |

|

|

Maintenance schedule of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Beihai Refining and Chemical Industry |

Catalytic cracking |

210 |

March 1, 2023 |

March 31, 2023 |

|

Daqing Refining and Chemical Industry |

Whole plant overhaul |

550 |

August 3, 2023 |

September 23, 2023 |

|

Daqing Petrochemical |

Whole plant overhaul |

1000 |

June 15, 2023 |

July 24, 2023 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

500 |

October 15, 2023 |

December 5, 2023 |

|

Harbin Petrochemical |

Whole plant overhaul |

435 |

May 5, 2023 |

June 23, 2023 |

|

Huizhou Refining and Chemical Industry |

The first phase of the whole plant |

1200 |

March 15, 2023 |

Mid-May 2023 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

600 |

April 10, 2023 |

May 26, 2023 |

|

Lanzhou Petrochemical |

Whole plant overhaul |

1050 |

June 11, 2023 |

August 9, 2023 |

|

Liaoyang Petrochemical Company |

Whole plant overhaul |

900 |

April 10, 2023 |

May 24, 2023 |

|

Luoyang Refining and Chemical Industry |

Whole plant overhaul |

1000 |

May 15, 2023 |

July 14, 2023 |

|

Qingdao Refining and Chemical Industry |

Whole plant overhaul |

1200 |

May 16, 2023 |

July 6, 2023 |

|

Sichuan Petrochemical Company |

Whole plant overhaul |

1000 |

September 15, 2023 |

November 20, 2023 |

|

Tahe petrochemical |

Diesel oil hydrogenation |

/ |

March 19, 2023 |

March 31, 2023 |

|

Urumqi petrochemical |

Whole plant overhaul |

850 |

April 15, 2023 |

June 18, 2023 |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 5, 2023 |

December 5, 2023 |

|

Changqing Petrochemical Company |

Whole plant overhaul |

500 |

April 1, 2023 |

May 25, 2023 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

1000 |

March 10, 2023 |

May 5, 2023 |

|

China National Oil and Gas Taizhou |

Whole plant overhaul |

600 |

May 12, 2023 |

End of June 2023 |

|

Qingdao Petrochemical Company |

Whole plant overhaul |

500 |

October 7, 2023 |

End of November 2023 |

|

Maintenance schedule of local refinery plant |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

September 15, 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 15, 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 19, 2023 |

September 18, 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

2400 |

August 1, 2023 |

September 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 5, 2023 |

Mid-September 2023 |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

August 30, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

Early September 2023 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |

|

Huaxing petrochemical |

Catalysis, coking |

/ |

October 16, 2023 |

November 2023 |