- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Special issue-202308 issue

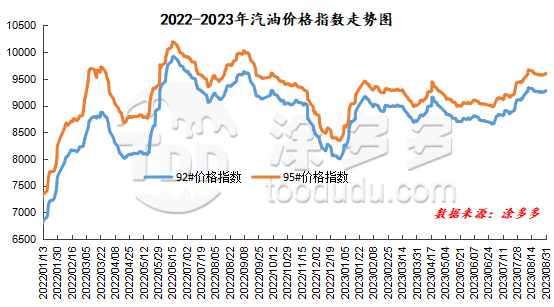

As of August 31, China's gasoline price index was 9280.47, up 178.86, or 1.97%, from August 1, while China's gasoline price index was 9602.63, up 173.61, or 1.84%. The 9-month gasoline index and the 9-month gasoline index both rose, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 322.16.

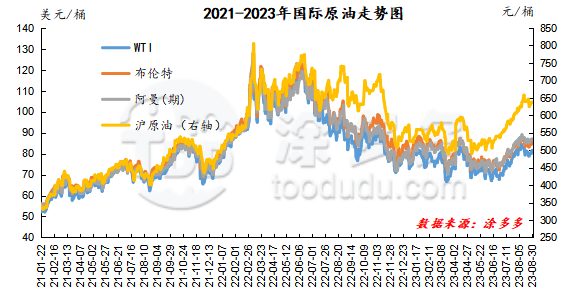

After the trend of China's gasoline market rose and fell in August 2023, the tail rose. Specifically, at the beginning of the month, after continuing the rising trend in July to reach a relatively high level (92percent), 9331.73 and 9666.39), the positive market also followed the decline, but the price rose slightly at the end of the month. Overall, in August, China's main wholesale price rose 100-280 yuan / ton, and the ex-factory price increased 100-310 yuan / ton. The main influencing factors of this month: 1, from the perspective of crude oil, the weak global economic data gradually gained the upper hand to offset the tightening of the supply side and the fall in high oil prices. The later announced decline in US commercial crude oil inventories improved to boost oil prices, but the uncertainty of raising interest rates in September restrained the rise in international oil prices. 2. From the point of view of supply, the capacity utilization of independent refineries changes relatively steadily, while the increase in capacity utilization of main refineries drives the relative surplus on the supply side in China. On the other hand, in terms of Chinese demand, Jinjiu Silver hoarding began to set off in July, and phased replenishment came to an end in mid-August. in the middle and late ten days, as the end of the summer vacation approached and the weather turned cooler, the fuel consumption support of superimposed vehicle air conditioners for returning to school in autumn weakened, and the overall performance fluctuated slightly. 3. From the export point of view, the market has begun to set off the third batch of export quotas since late July. The atmosphere of issuing the third batch of export quotas has not yet been fulfilled, and the good support of the export news has gradually been digested, but the news of the planned export volume in late August and September has fermented. In April and August, the rate of change of international crude oil narrowed but still extended, and the price limit of oil products in China was raised twice.

|

Comparison of main wholesale prices of gasoline in August (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 8.1 |

Price 8.31 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8800-9350 |

8950-9710 |

150/360 |

1.70%/3.85% |

|

95# |

9050-9700 |

9150-10090 |

100/390 |

1.10%/4.02% |

|

|

South China |

92# |

9000-9250 |

9100-9530 |

100/280 |

1.11%/3.03% |

|

95# |

9250-9550 |

9350-9830 |

100/280 |

1.08%/2.93% |

|

|

Central China |

92# |

8950-9150 |

9020-9300 |

70/150 |

0.78%/1.64% |

|

95# |

9100-9350 |

9200-9600 |

100/250 |

1.10%/2.67% |

|

|

East China region |

92# |

8850-9300 |

9000-9600 |

150/300 |

1.69%/3.23% |

|

95# |

9100-9650 |

9200-9900 |

100/250 |

1.10%/2.59% |

|

|

Northwestern region |

92# |

8850-9890 |

9000-10134 |

150/244 |

1.69%/2.47% |

|

95# |

9050-10640 |

9200-10910 |

150/270 |

1.66%/2.54% |

|

|

Southwest China |

92# |

9100-9400 |

9150-9470 |

50/70 |

0.55%/0.74% |

|

95# |

9320-9830 |

9350-9820 |

30/-10 |

0.32%/-0.10% |

|

|

Northeast China |

92# |

8800-9700 |

9045-9800 |

245/100 |

2.78%/1.03% |

|

95# |

9200-10300 |

9395-10400 |

195/100 |

2.12%/0.97% |

|

|

Comparison of ex-factory price of gasoline refinery in August (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 8.1 |

Price 8.31 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8400-8810 |

8740-9110 |

340/300 |

4.05%/3.41% |

|

95# |

8570-9010 |

8900-9250 |

330/240 |

3.85%/2.66% |

|

|

North China region |

92# |

8700-8790 |

8780-9030 |

80/240 |

0.92%/2.73% |

|

95# |

8840-8850 |

8910-9080 |

70/230 |

0.79%/2.60% |

|

|

Central China |

92# |

8880-8880 |

9030-9030 |

150/150 |

1.69%/1.69% |

|

95# |

9080-9080 |

9230-9230 |

150/150 |

1.65%/1.65% |

|

|

East China region |

92# |

8490-8670 |

8830-8980 |

340/310 |

4.00%/3.58% |

|

95# |

8640-8820 |

8950-9150 |

310/330 |

3.59%/3.74% |

|

|

Northwestern region |

92# |

8700-8850 |

8950-9000 |

250/150 |

2.87%/1.69% |

|

95# |

8800-9050 |

9100-9200 |

300/150 |

3.41%/1.66% |

|

|

Northeast China |

92# |

8950-8950 |

9050-9050 |

100/100 |

1.12%/1.12% |

|

95# |

9150-9150 |

9250-9250 |

100/100 |

1.09%/1.09% |

|

From the perspective of international crude oil, on the supply side, Russia and other production reduction allies restrict crude oil exports and add Saudi Arabia's production reduction plan to October, and the tight supply side once again leads the international oil price to improve. However, the peak season for traditional fuel demand in the United States is coming to an end, and bearish sentiment remains on the global economic level. From the supply point of view, the main refinery Tianjin Petrochemical carried out atmospheric and vacuum unit overhaul in early September, Sichuan Petrochemical planned to start the whole plant overhaul in the middle of the year, Daqing Refining and Chemical Industry is expected to restart in the next ten days, and the local refinery Yongping Refinery was overhauled at the beginning of the month. Qicheng Petrochemical and Lijin Refining and Chemical end of the month overhaul. From the point of view of demand, at the end of the summer vacation, the number of tourists is less than that of summer travel; coupled with the cooling weather, the fuel consumption support of car air conditioners is weakened; the rigid demand for gasoline consumption is mainly. September is approaching the National Day October 1 holiday, there is a certain replenishment demand in the middle and lower reaches. However, the penetration of the new energy market is growing rapidly, or the holiday replenishment purchasing efforts may be restrained. In addition, the third batch of oil products export quotas issued a total of 12 million tons. Taken together, there is still room for the gasoline market to rise in September, but it may not be as good as expected.

In July 2023, China's gasoline production was 14.352 million tons, an increase of 21.09 percent over the same period last year and 8.21 percent from the previous month. From January to July, China's gasoline output totaled 92.273 million tons.

The overall weekly output of oil products in China does not fluctuate much this month, with the output of oil products in the range of 342.99-3.4545 million tons, of which the main output is 244.36-2.505 million tons, and the output of independent refineries is increased, with an output of 94.42-1.0021 million tons.

|

Supply and demand data of China in August |

|||||

|

Date |

Output of oil products |

Main output |

Output of independent refinery |

Independent refinery sales |

Commercial inventory |

|

2023/8/3 |

344.57 |

244.36 |

100.21 |

97.95 |

1279.25 |

|

2023/8/10 |

342.99 |

244.67 |

98.32 |

105.35 |

1284.43 |

|

2023/8/17 |

345.45 |

250.5 |

94.95 |

89.63 |

1298.09 |

|

2023/8/24 |

344.92 |

250.5 |

94.42 |

90.69 |

1307.92 |

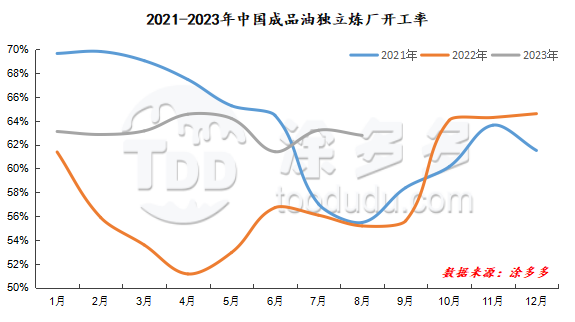

In 2023, the operating rate of China's refined oil independent refineries was stable and fluctuated less than that of the main units, of which the operating rate in August was 62.78%, an increase of 7.60% over the same period last year and a decrease of 0.43% from the previous month.

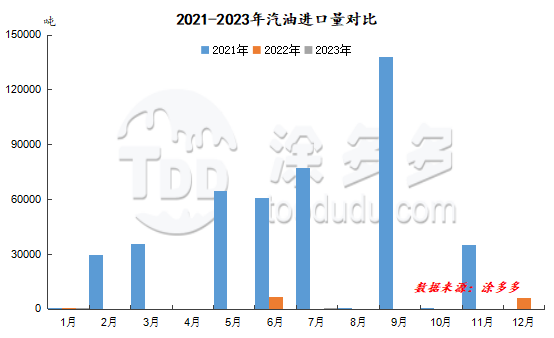

According to customs data, there is a big difference between 2023 imports and 2022 gasoline imports. There is no continuous import in April, May and June in 2023, with 8.83 tons in July and 11.63 tons from January to July.

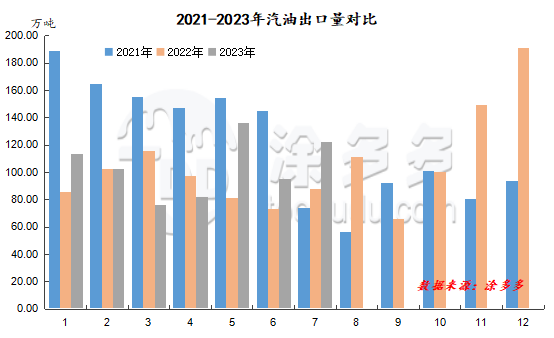

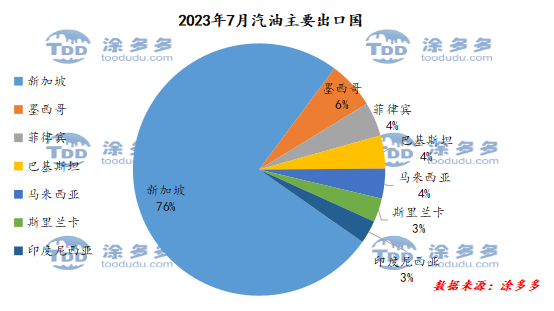

According to customs data, gasoline exports totaled 1.224 million tons in July 2023, an increase of 39.06 percent over the previous year and 28.26 percent month-on-month.

Singapore, the exporter, remained the top exporter in July, with exports of 885500 tons, accounting for 76 per cent of total exports in July. This was followed by Mexico's exports of 71300 tons, accounting for 6 percent, while the Philippines exported 51200 tons, Pakistan 49700 tons and Malaysia 44900 tons, each accounting for about 4 percent of the total.

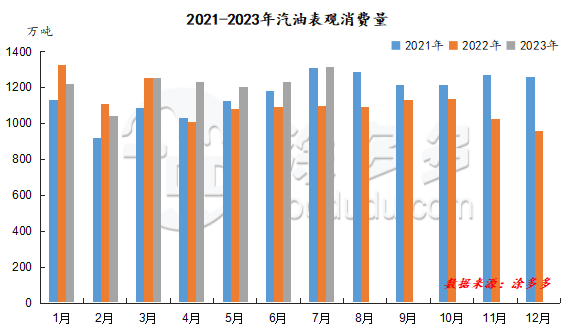

The apparent gasoline consumption from January to July 2023 totaled 84.9822 million tons. Among them, the apparent gasoline consumption in July 2023 was 13.128 million tons, an increase of 19.65% over the same period last year and 6.66% month-on-month.

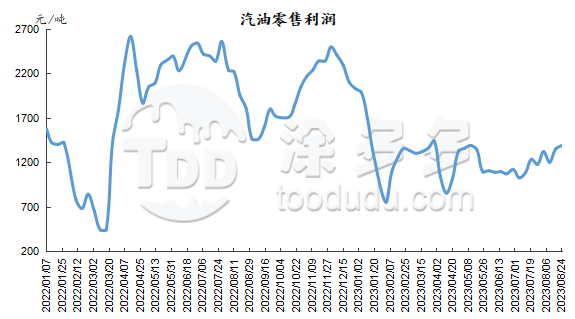

Gasoline retail profits fluctuated upwards in August 2023, keeping in the range of 1202-1391 yuan / ton.

This month, the main comprehensive oil refining weekly production gross margin is 885.13-1028.11 yuan / ton, georefining comprehensive oil refining weekly production gross profit is 912.11-990.07 yuan / ton. The gross profit of atmospheric and vacuum production is 218-428 yuan / ton, FCC production is 149-359 yuan / ton, and delayed coking production is 500-737 yuan / ton.

|

Profit data for August |

|||||

|

Date |

Main comprehensive oil refining weekly production gross margin |

Gross profit of weekly production of geotechnical comprehensive oil refining |

Atmospheric and vacuum weekly production gross margin |

Gross profit of FCC weekly production |

Delayed coking weekly production gross margin |

|

2023/8/3 |

997.41 |

912.11 |

428 |

149 |

500 |

|

2023/8/10 |

1028.11 |

937.23 |

218 |

283 |

620 |

|

2023/8/17 |

989.88 |

959.51 |

351 |

326 |

688 |

|

2023/8/24 |

885.13 |

990.07 |

274 |

359 |

737 |

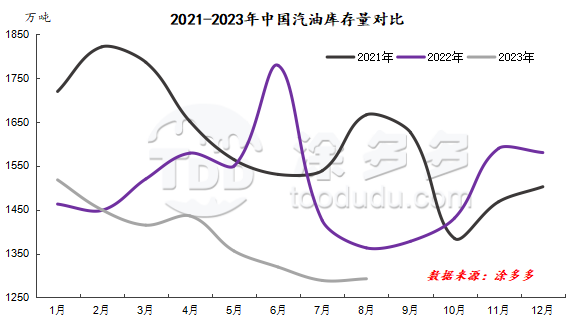

Commercial gasoline inventories averaged 12.9242 million tons in August 2023, down 5.17% from the same period last year and up 0.30% month-on-month.

|

Types |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

|

Average price of 202307 |

75.73 |

79.89 |

80.97 |

80.26 |

577.13 |

|

Average price of 202308 |

81.22 |

85.02 |

87.20 |

86.53 |

633.08 |

|

The rate of change compared with the previous month |

7.24% |

6.43% |

7.69% |

7.81% |

9.69% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. 2. This month, the WTI/ Brent spread is-3.81, and the Brent / DME Oman spread is-1.50. |

|||||

|

Cumulative price adjustment of refined oil products in 2023 |

||

|

Date |

Petrol |

diesel oil |

|

January third |

↑250 |

↑240 |

|

January seventeenth |

↓205 |

↓195 |

|

February third |

↑210 |

↑200 |

|

February seventeenth |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March 3rd |

The price adjustment amount is less than 50 yuan per ton and has not been adjusted. |

|

|

March seventeenth |

↓100 |

↓95 |

|

March 31st |

↓335 |

↓320 |

|

April seventeenth |

↑550 |

↑525 |

|

April 28th |

↓160 |

↓155 |

|

May 16th |

↓380 |

↓365 |

|

May 30th |

↑100 |

↑95 |

|

June thirteenth |

↓55 |

↓50 |

|

June twenty _ eighth |

↑70 |

↑70 |

|

July twelfth |

↑155 |

↑150 |

|

July twenty _ sixth |

↑275 |

↑260 |

|

August ninth |

↑240 |

↑230 |

|

August twenty _ third |

↑55 |

↑55 |

|

Price adjustment schedule for 2023 |

|||

|

Price adjustment month |

Specific date |

||

|

January |

January third |

January seventeenth |

|

|

February |

February third |

February 17 |

|

|

March |

March 3rd |

March seventeenth |

March 31st |

|

April |

April seventeenth |

April 28th |

|

|

May |

May 16th |

May 30th |

|

|

June |

June thirteenth |

June twenty _ eighth |

|

|

July |

July twelfth |

July twenty _ sixth |

|

|

August |

August ninth |

August twenty _ third |

|

|

September |

September sixth |

September twentieth |

|

|

October |

October tenth |

October twenty _ fourth |

|

|

November |

November seventh |

November twenty _ first |

|

|

December |

December fifth |

December nineteenth |

|

|

Maintenance schedule of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Beihai Refining and Chemical Industry |

Catalytic cracking |

210 |

March 1, 2023 |

March 31, 2023 |

|

Daqing Refining and Chemical Industry |

Whole plant overhaul |

550 |

August 3, 2023 |

September 23, 2023 |

|

Daqing Petrochemical |

Whole plant overhaul |

1000 |

June 15, 2023 |

July 24, 2023 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

500 |

October 15, 2023 |

December 5, 2023 |

|

Harbin Petrochemical |

Whole plant overhaul |

435 |

May 5, 2023 |

June 23, 2023 |

|

Huizhou Refining and Chemical Industry |

The first phase of the whole plant |

1200 |

March 15, 2023 |

Mid-May 2023 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

600 |

April 10, 2023 |

May 26, 2023 |

|

Lanzhou Petrochemical |

Whole plant overhaul |

1050 |

June 11, 2023 |

August 9, 2023 |

|

Liaoyang Petrochemical Company |

Whole plant overhaul |

900 |

April 10, 2023 |

May 24, 2023 |

|

Luoyang Refining and Chemical Industry |

Whole plant overhaul |

1000 |

May 15, 2023 |

July 14, 2023 |

|

Qingdao Refining and Chemical Industry |

Whole plant overhaul |

1200 |

May 16, 2023 |

July 6, 2023 |

|

Sichuan Petrochemical Company |

Whole plant overhaul |

1000 |

September 15, 2023 |

November 20, 2023 |

|

Tahe petrochemical |

Diesel oil hydrogenation |

/ |

March 19, 2023 |

March 31, 2023 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

September 5, 2023 |

October 31, 2023 |

|

Urumqi petrochemical |

Whole plant overhaul |

850 |

April 15, 2023 |

June 18, 2023 |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 5, 2023 |

December 5, 2023 |

|

Changqing Petrochemical Company |

Whole plant overhaul |

500 |

April 1, 2023 |

May 25, 2023 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

1000 |

March 10, 2023 |

May 5, 2023 |

|

China National Oil and Gas Taizhou |

Whole plant overhaul |

600 |

May 12, 2023 |

End of June 2023 |

|

Maintenance schedule of local refinery plant |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

Early September 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 1, 2023 |

October 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

2400 |

August 1, 2023 |

September 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

End of July 2023 |

End of September 2023 |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

Early September 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

End of August 2023 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |