- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Macro environment:

In 2023, China's foreign trade orders decreased significantly, and the orders of Chinese foreign trade enterprises plummeted. Similarly, caustic soda enterprises are no exception, the export volume of caustic soda decreased significantly in the first half of the year compared with the same period last year. According to Chinanews.com: the director of the Foreign Trade Department of the Ministry of Commerce said that the global economic and trade situation has become extremely grim in 2023, and the downward pressure has increased significantly. The main contradiction in China's foreign trade field has changed from the obstruction of the supply chain and the lack of performance capacity last year to the current weakening external demand and declining orders, which is an important change.

Foreign trade of caustic soda:

A brief analysis of the total volume of foreign trade in the first half of the year: China's caustic soda exports in the first half of 2023 were 1.4659 million tons, a decrease of 51300 tons compared with 1.5172 million tons last year, or 3.38%. The overall performance of China's caustic soda exports in the first half of the year was not optimistic, and there was no effective boost to China's caustic soda prices.

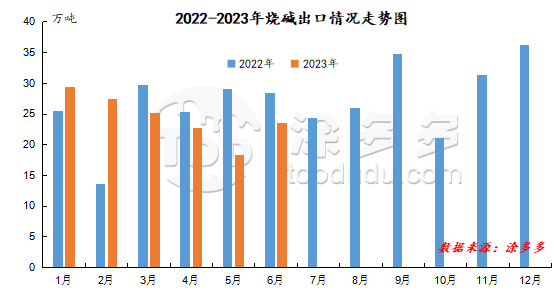

It is not difficult to see from the chart below that China's caustic soda exports decreased month by month and then increased in the first half of 2023. Second, China's caustic soda exports increased from January to February compared with the same period in 2022, especially in February. Among them, it increased by 40300 tons in January and 137500 tons in February. From March to June, China's caustic soda exports decreased compared with last year, especially in May, with a decrease of 45900 tons in March, 26200 tons in April, 107300 tons in May and 49700 tons in June.

Analysis of the reasons for the trend of foreign trade: first of all, from January to February 2023, the signing volume of China's export orders is considerable, the export volume of caustic soda remains relatively high, the market has a strong expectation of recovery of downstream demand, and the export enthusiasm of most foreign trade enterprises is relatively high, coupled with the relatively high transaction price of FOB, which leads to China's caustic soda export, so the performance of caustic soda export data from January to February is OK. But exports were also lower in February than in January. Subsequently, with the rapid recovery of plant start-up in Chinese caustic soda production enterprises, the start-up load increased to a higher level, at the same time, there was no obvious maintenance of foreign devices, their own supply was relatively sufficient, and the import volume decreased. China's foreign supply is relatively sufficient, while the downstream demand of China's foreign market is insufficient, the overall recovery of demand is not as expected, and the overall profit situation of the downstream industry is poor, and the production enthusiasm is not high. Some downstream enterprises take production reduction, maintenance and other means, the overall market is in a situation of oversupply, the contradiction between supply and demand is more prominent, coupled with the first quarter of the main downstream alumina enterprises cut the purchase price of liquid alkali for 13 times, the overall operation of the market is in the doldrums. The export orders of Chinese foreign trade enterprises decreased significantly, and the export volume from March to May declined significantly and was lower than that of the same period last year. In June, some foreign chlor-alkali plants were overhauled, and their own supply was slightly insufficient, which stimulated the rise in outer disk prices, and the enthusiasm of Chinese foreign trade enterprises to sign orders increased, and the amount of orders signed was better than that in the previous period.

Situation of foreign trade countries:

In the first half of the year, China has a total of 133 caustic soda exporting countries, including 38 liquid caustic soda exporting countries with an export volume of 1173913.02 tons, and solid caustic soda exporting countries with an export volume of 307482.091 tons.

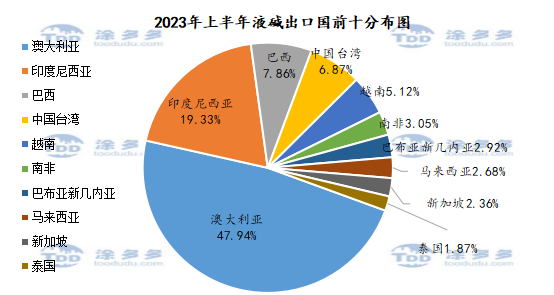

Countries exporting liquid alkali:

In the first half of the year, there were 38 liquid alkali exporting countries in China, of which Australia was the largest exporter, with a total export volume of 541730.484 tons, accounting for 47.94% of the total exporting countries, accounting for nearly half of the total, followed by Indonesia, which accounted for 218362.389 tons, accounting for nearly 20%, while other countries accounted for less than 8%.

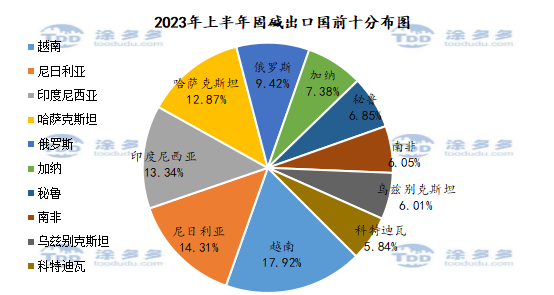

Solid alkali exporting countries:

In the first half of the year, China had a total of 127solid alkali exporters, of which Vietnam was the largest exporter, with an export volume of 29537.45 tons, accounting for 17.92 percent of the total exporters, followed by Nigeria with a share of 23588.875 tons, accounting for 14.31 percent. Indonesia accounted for 21984.25 tons, accounting for 13.34 percent, Kazakhstan 21210.75 tons, accounting for 12.87 percent, and other countries accounted for less than 10 percent.