- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

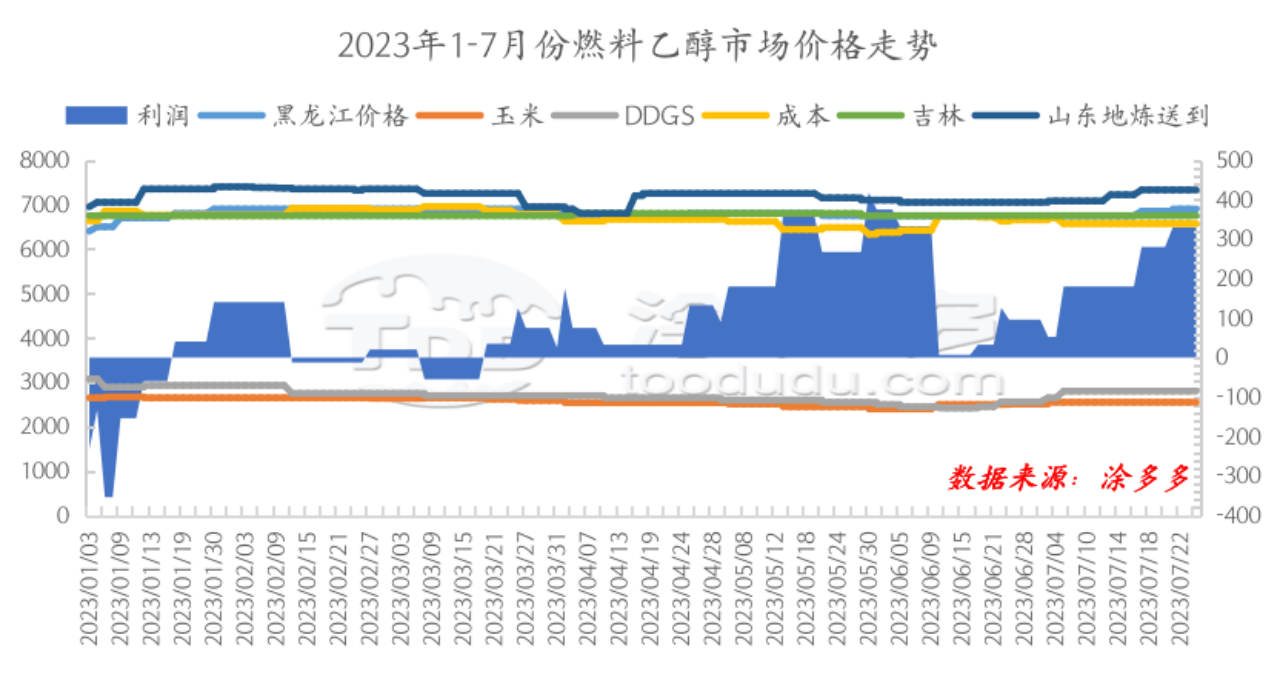

Unit: yuan/ton

In the first half of 2023, China's fuel ethanol market price will be relatively firm compared to edible ethanol. It basically remained high in the first half of the year, weakening slightly in April-May, and remained firm in other times. Recently, the quotations of fuel ethanol companies have seen a slight increase.

The price of fuel ethanol increased significantly last week. As of press time, the price of fuel ethanol in Heilongjiang in Northeast China rose to 6,900 - 7,000 yuan/ton, an increase of 100 yuan/ton from the previous quotation. The price of coal-based ethanol rose by 150 yuan/ton. The purchase price of local refining rose by 130 yuan/ton, and the main price remained stable.

The main reasons for the increase in fuel ethanol prices are as follows: First, the supply of fermented ethanol has declined. Specific decline details: Heilongjiang Wanli Runda plant was shut down on July 15, and the expected shutdown time is about 15-20 days. Heilongjiang Zhaodong COFCO plant was shut down on July 15, and the expected shutdown time is about 15 days. It is expected that Northeast fermentation fuel ethanol will be reduced by 1800 tons, and fuel ethanol will be reduced in total by at least 27000 tons. Some major manufacturers suspended sales and quotations due to internal reasons. Most of the sales are concentrated in Hongzhan, Heilongjiang. The number of pickup vehicles in front of Hongzhan has increased and the pickup time has been extended. 2. Coal ethanol production decreased. At the same time, the production of ethanol from coal is unstable. Shaanxi plants produce it on one line and Henan plants produce it on a small line. Henan Nanyang Tianguan plans to start up late. 3. Downstream demand has stabilized or increased slightly. With the increase in travel, terminal sales are relatively good, and the purchase volume of oil and local refineries is still acceptable. Due to reduced supply and centralized replenishment, not much of the fuel ethanol arriving at the factory is on the way. As a result, the frequency of downstream procurement has increased, and the freight rates on some routes have been driven to increase after centralized use of vehicles, increasing the cost of delivering downstream. Therefore, the price of fuel ethanol has pushed up significantly, while the price of coal-based ethanol has simultaneously pushed up.

Can fuel ethanol prices continue to push up?

In terms of cost, China sells corn stocks in stock, but traders are reluctant to sell it at low prices. However, the auction of national grain reserves and the arrival of imported grain in Hong Kong have had a certain impact on China's high corn prices. In terms of by-product DDGS, the supply of equipment maintenance by enterprises has dropped and the price has remained high and firm. Parallel substitution products, soybean meal has recently surged in the number of port arrivals and downstream construction has increased. Spot prices have continued to weaken. Changes in the weather may affect the price trend of soybean meal, which has a certain impact on the high price of DDGS. From the perspective of supply and demand: In the short term, fuel ethanol prices are strong, supported by favorable supply and the downstream need to pick up goods. Market rumors are that a large factory has begun to resume bidding, but it is mainly aimed at the main business aspects and the market impact may be limited. However, at the end of July or early August, Heilongjiang Wanli Runda and Heilongzhong COFCO Zhaodong units were restored one after another, and the supply of fuel ethanol increased significantly. As well as the output of major coal-based ethanol factories increased, the overall supply increased. Downstream terminal consumption can basically be maintained, and terminal sales will decline as the summer vacation ends. Short-term equipment did not return to maximum output in early August, and prices remained high.