- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

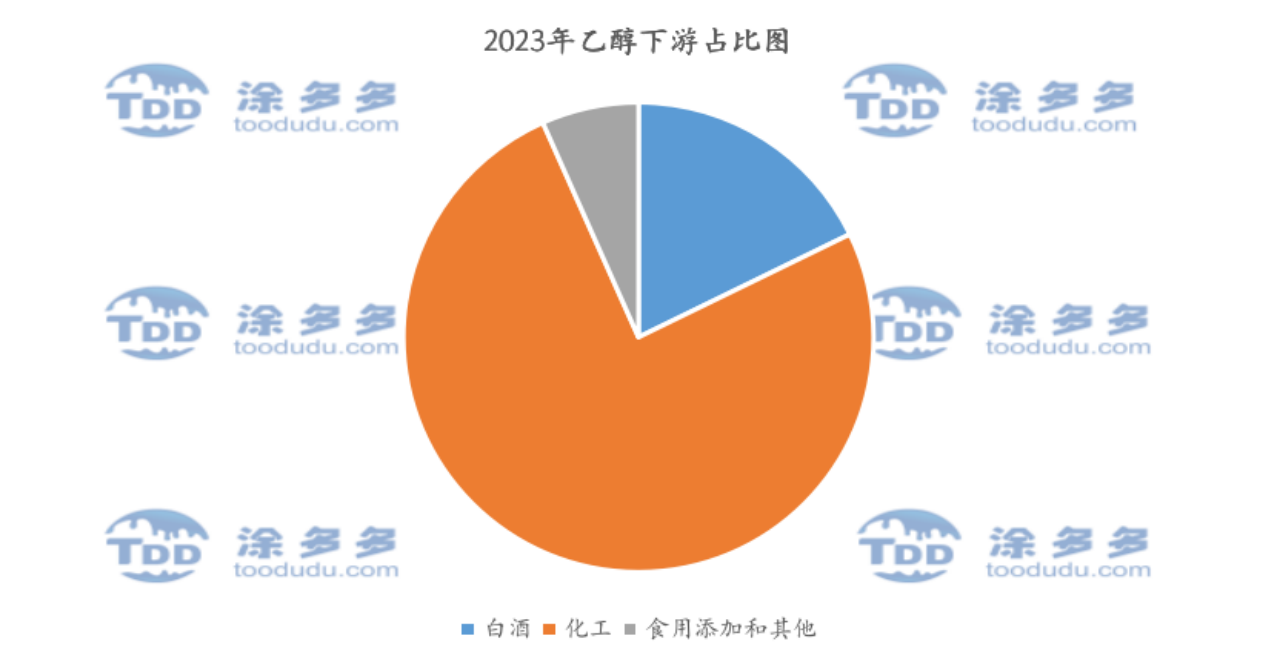

The downstream stream of ethanol is divided into liquor, chemicals, other edible parts, etc.

In the early days, liquor was the largest consumer of ethanol, but gradually decreased under the influence of policies and other factors. In 2017, we will strictly investigate the impact of the epidemic at the end of 2019 in the late period of drunk driving. The proportion of liquor in the downstream reaches of ethanol has declined year by year, with a significant decline. The new national standard for liquor will be implemented on June 1, 2022, and the consumption of liquor in ethanol will continue to decline. Low over the years. Some small wineries have reduced their start-ups due to problems such as funding and environmental protection. Large factories have maintained just production, but large factories have increased their own brew volume, and the amount of ethanol purchased has been greatly reduced or stopped purchasing. Terminal output From January to May 2023, the liquor output of Chinese enterprises above designated size was 1.86 million kiloliters, a year-on-year decrease of 13.6%; among them, the liquor output of Chinese enterprises above designated size in May was 347,000 kiloliters, a year-on-year decrease of 14.7%. (National Bureau of Statistics data).

The main chemical components are ethyl acetate, ethylamine, ethyl acrylate, acetaldehyde, diethyl ether, ethyl methyl carbonate, sodium ethoxide, flame retardant, silicone, ink resin, electronic cleaning, pesticide intermediates, disinfection, pharmaceutical intermediates, daily chemical and fine chemicals, etc.

A brief introduction to several main chemicals: The total national production capacity of ethyl acetate is 3.68 million tons/year. The main production capacity is concentrated in Shandong and Jiangsu. The annual start of ethyl acetate is only maintained at about 50%. The annual consumption of ethanol in ethyl acetate was about 1.0672 million tons. The annual production capacity of ethylamine is about 220,000 tons, with the main production capacity in Shandong, Jiangsu and Zhejiang provinces. In 2023, the shipment situation of downstream terminals is average. Upstream start-ups will decline compared with previous years. It is expected that the consumption of ethanol this year will drop to about 210,000 tons. The total production capacity of ethyl acrylate is 175,000 tons, but there are sporadic start-up companies, mainly Shanghai Huayi and Zhejiang Satellite Petrochemical, Shenyang Wax Chemical produces a small amount, and others are basically not produced. The acetaldehyde factory has less external extraction volume, and most companies have ethanol equipment such as Hongda in Shandong and Ruiyang in Chifeng, Inner Mongolia. Ether is mainly consumed without water, and its production capacity is mainly concentrated in East China. In the first half of 2023, the production capacity of ethyl methyl carbonate will be 600,000 tons/year. The main production capacity of anhydrous ethanol will be concentrated in Shandong and Northeast China. It is expected that the new production capacity will be 990,000 tons in the second half of the year. However, whether these production capacity can be put into production as scheduled depends on the actual production of the enterprise. Pesticide intermediates In North and East China, after international trade weakened, export business declined, which also affected the export business of end product pesticide products. Most of China's daily chemical products are concentrated in South China, and basically maintain procurement needs. Eat some major food additives, flavors and fragrances, etc.

The growth point of downstream demand for ethanol in the later period is mainly the increase in demand for chemical industries. Ethyl acetate is expected to increase production capacity by 200,000 tons, and the newly added by-product ethyl acetate is not included. There are plans to add new production capacity in the later stage of acetaldehyde, but the current time is uncertain. The added production capacity of ethyl methyl carbonate is 990,000 tons, which is based on the actual production of the enterprise.