China's ethanol industry semi-annual report in 2023

I. Analysis of ethanol market in the first half of 2023

The price of ethanol in China continued to weaken in the first half of 2023, and the expectation of non-Chinese economy in the post-epidemic era was optimistic. judging from the economic performance in the first half of 2023, the expectation deviated from the reality, and the bulk chemical market was depressed in the first half of 2023. Ethanol industry chain can not escape the situation of continuous price reduction. In the first half of the year, the supply side of ethanol went from stable to reduced, the cost side had no favorable support, and enterprises lost money. Due to the negative factors such as the continuous weakening of demand side and the continuous weakening of prices, enterprises entered into maintenance ahead of time, and uncompetitive enterprises continued to shut down their machines. China's ethanol supply declined, and the trend of continuous price reduction at the end of the second quarter slowed or stopped after the large factories had maintenance plans one after another. In the post-epidemic era, the travel rate of fuel ethanol increases, which leads to the consumption of refined oil, the consumption of fuel ethanol increases, the price is relatively strong, and the enterprise still has a small profit in production, and the enthusiasm of enterprises in producing fuel is increased. Coal-based ethanol capacity release, the initial price to win the market, the effect is immediate, but based on the equipment technology is not mature to start unstable.

The average price of ethanol market in some regions of China from January to June 2023

|

|

Average price in January |

Average price in February |

Average price in March |

April average price |

Average price in May |

Average price in June |

|

The general level in northern Jiangsu |

6921.67 |

6841.96 |

6698.15 |

6578.33 |

6497.92 |

6412.50 |

|

Jilin Puji class |

6600.00 |

6485.71 |

6433.33 |

6358.67 |

6287.50 |

6110.00 |

|

General level in Heilongjiang |

6426.67 |

6350.00 |

6322.22 |

6290.00 |

6204.17 |

6000.00 |

|

Henan excellent grade |

6742.93 |

6784.82 |

6641.48 |

6636.00 |

6595.21 |

6451.50 |

Unit: yuan / ton

Data source: Tu Duoduo

In the first half of 2023, the general-grade average price of cassava ethanol in northern Jiangsu was 6658.42 yuan / ton, which was 6.02% lower than the same period last year. Jilin corn ethanol average price in the first half of 2023 was 6379.20 yuan / ton, and Heilongjiang corn ethanol price was 6265.51 yuan / ton in the first half of 2023 compared with the same period last year. Henan corn ethanol price in the first half of 2023 was 6641.99 yuan / ton, 7.50% lower than the same period last year.

Specifically, the ethanol market in the first quarter was better than that in the second quarter. During the Spring Festival in the first quarter, large factories in Northeast China maintained normal production, and outages occurred in East China and Henan. In the post-epidemic era, travel increased, fuel ethanol consumption increased, the price of fuel ethanol was firm, and the output of large factories was dominated by fuel. After the reduction of supply in Northeast China, prices rose in stages, the start of cassava ethanol plants in East China was not high, the chemical industry was purchasing with rigid demand, prices were adjusted more frequently in Henan, and inventory changes affected prices to rise or fall rapidly. the surrounding areas are also constrained by its prices, affecting the pace of sales. The second quarter entered a continuous downward trend, the downstream part of the chemical industry reduced or stopped production under the pressure of unbearable costs and capital and terminal demand, the sales volume of ethanol decreased significantly, while the supply was relatively stable, and the price continued to weaken as a result of market supply exceeding demand. In the first half of the year, although the price of raw material corn weakened during the inventory sales period, and the cost decreased in terms of data, the demand for feed was sluggish in the peak season, the sales of by-products were restricted, and the long-term backlog of by-products had to be reduced in price sales to subsidize the reduction of ethanol cost. ethanol production and consumption has been at a loss for a long time. News of overhauling by large factories continues to be released to ease the declining ethanol market. With the release of new food production in the second quarter, large factories in East China's Anhui Province have changed their fuel production to general food production, the general market supply has increased, and the new incremental market share is bound to be proportional to cost and price. This aggravates the inner volume of ethanol market price.

II. Analysis on the profit situation of ethanol Industry in the first half of 2023

China's food and industrial ethanol in the first half of 2023, the profit of cassava ethanol production in East China and Jiangsu Province was-93.66 yuan / ton, down 120.25% from the same period last year. The profit of cassava ethanol in northern Jiangsu was 216.56 yuan / ton in January, and the previous high ethanol price reached 7000 yuan / ton. the basic ethanol price in January was between 6900 yuan and 7000 yuan / ton. enterprises made profits in the first ten days of January and February. The profit of cassava ethanol in northern Jiangsu is 51.38 yuan / ton. The profit of cassava ethanol in northern Jiangsu was 171.63 in March. Yuan / ton, RMB exchange rate fluctuated around 6.7-6.95 from January to March, Thai cassava fluctuated at fob265-277USD / ton, ethanol price fell 5.36% from 7000 yuan / ton to 6625 yuan / ton. Profits from cassava ethanol continued to fall in the second quarter-225.42 in April. Yuan / ton, May-195.13 yuan / ton, April-May, the main Thai exports to China decreased, mainly because the price of ethanol in China continues to weaken, the enthusiasm of enterprises to produce losses is not high, the amount of cassava dried feed purchased in the early stage decreased with the low prices of other alternatives in China, Thailand reduced price sales, with the general foreign trade, sea freight began to weaken. In June, the profit of cassava ethanol production fell to- 284.75 yuan per ton, RMB depreciated, import costs increased, ethanol market prices continued to bottom, ethanol production profits continued to decline.

China's food and industrial ethanol in the first half of 2023, the profit of corn ethanol production in Heilongjiang, northeast of China was-142.60 yuan / ton, down 177.42% from the same period last year. Heilongjiang corn ethanol profit-27.21 yuan / ton in January, Heilongjiang corn ethanol profit-210.96 yuan / ton in February, and Heilongjiang corn ethanol profit-220.53 yuan / ton in March. The main reasons for the big losses are: first, the price of ethanol has weakened; second, the price of raw corn has risen to a high of 2650-2700 yuan per ton. Third, the by-product ddgs price peak season has not arrived, the supply is sufficient, the price continues to weaken, and the cost of subsidized ethanol production is reduced. Heilongjiang corn ethanol profit-97.83 yuan / ton in April, Heilongjiang corn ethanol profit-70.81 yuan / ton in May, production profit rebounded from April to May, the reason for the decline in raw material prices and costs. Although the prices of ethanol and by-products are also falling at the same time, the overall decline is less than that of corn. The profit of corn ethanol in Heilongjiang in June is-276.67 yuan / ton. Ethanol enterprises in order to reduce ddgs inventory sales, corn prices began to rebound slightly, ethanol market prices continued to fall to a low, what's more, large terminal customers dropped to less than 6000 yuan / ton, corn ethanol production profits continued to lose.

III. Analysis of supply and demand of ethanol market in the first half of 2023

1. Production and supply analysis

In the first half of 2023, China's effective production capacity of food and industrial ethanol is 14.178 million tons (including enterprises within three years of shutdown), including corn ethanol capacity of 8.53 million tons / year, cassava ethanol capacity of 4.005 million tons / year, coal ethanol of 960000 tons / year, molasses ethanol and wheat and other ethanol 683000 tons / year. Other new production capacity is concentrated in the lack of water, mostly for enterprises to change production. Shandong Zhongyu anhydrous ethanol production, Heilongjiang Shenglong anhydrous production (old plant modification), Anhui COFCO production, part of the production capacity began to produce general grade, Hualu Hengsheng anhydrous plant put into production. The situation of supply exceeding demand has led to no new food production and 45000 tons of fuel ethanol production. It is expected that most of the new capacity in 2023 will be concentrated in coal-based ethanol, and it is expected to increase production capacity by 1.3 million tons per year in the second half of the year.

2. Output and production capacity analysis

China produced 2.5581 million tons of edible and industrial ethanol in the first half of 2023. The output of edible and industrial ethanol in the first quarter totaled 1.305 million tons. The installation in Mengzhou area of Henan Province is unstable, and the device is shut down during the Spring Festival and restored after the festival. In the later stage, the device stopped for a short time due to boiler problems. The small factory in Heilongjiang in Northeast China has been put into production again, but the production is unstable. The food output of large factories is relatively low, and the equipment is overhauled before the Spring Festival and restarted after the festival. Jilin Fukang end-of-season sub-line rotation inspection, the other to maintain normal production. East China cassava ethanol flower hall pre-season small-line production, late recovery. Guannan has a long downtime. Longhe has a long downtime in January and the production of raw materials is relatively stable after arriving in Hong Kong. The installations in other factories in northern Jiangsu are unstable. Shandong Fulaichun continues to shut down, and other production is relatively stable. Anhui Wanshen opened after a short stop, and COFCO took a long time to eat and repair. The production of May and Spring is unstable. Coal ethanol: the output of Liyuan in Henan Province was unstable in the early stage and returned to normal in the later stage. At the beginning of March, Elm was put into production again. The output of edible and industrial ethanol in the second quarter was 1.25305 million tons, and the output in June was less than 400000 tons. Due to high costs in East China, ethanol market prices continued to weaken, uncompetitive enterprise devices began to shut down, and the load of large factories was halved. The start-up was reduced to about 37%. Large corn ethanol factories in Northeast China were overhauled. Because the profit of fuel ethanol production was higher than that of edible, the enthusiasm of enterprises to produce fuel increased. The output of fuel is higher than that of food. The equipment of large factories in coal-based ethanol is unstable, and the output fluctuates slightly.

3. Consumption demand analysis

Downstream is mainly divided into chemical consumption and liquor consumption and other food consumption. In terms of chemical industry, ethyl acetate did not increase production capacity by an average of 46.89% in the first half of 2023. In the first half of the year, Huizhou Yuxin butanone by-product ethyl acetate 130000 tons / year plant was put into production, but from the point of view of start-up, the plant was unstable and the start time was not long. Methyl ethyl ester started about 27% in the first half of 2023, although Hualu expanded production, but due to the high loss of downstream products, the start of the industry is low. The demand for spirits has decreased. China's liquor production in the first quarter of 2023 was 1.483 million liters, down 19% from the same period last year. The second quarter data are not available, from the market feedback, liquor production decreased, ethanol consumption decreased synchronously.

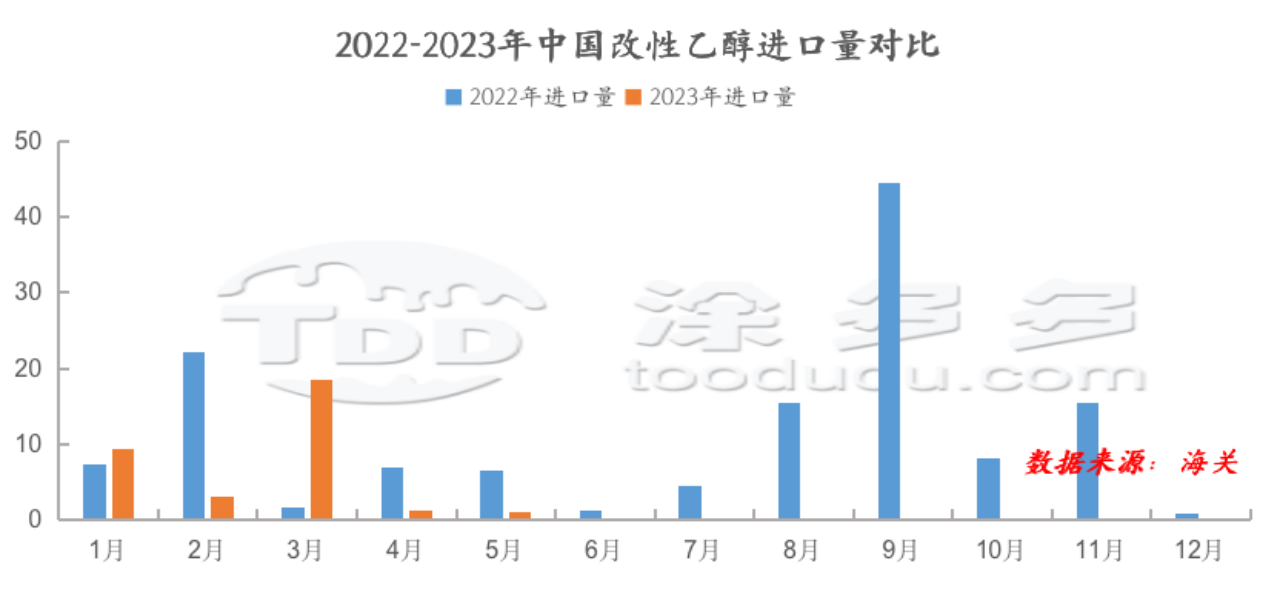

4. Import and export analysis

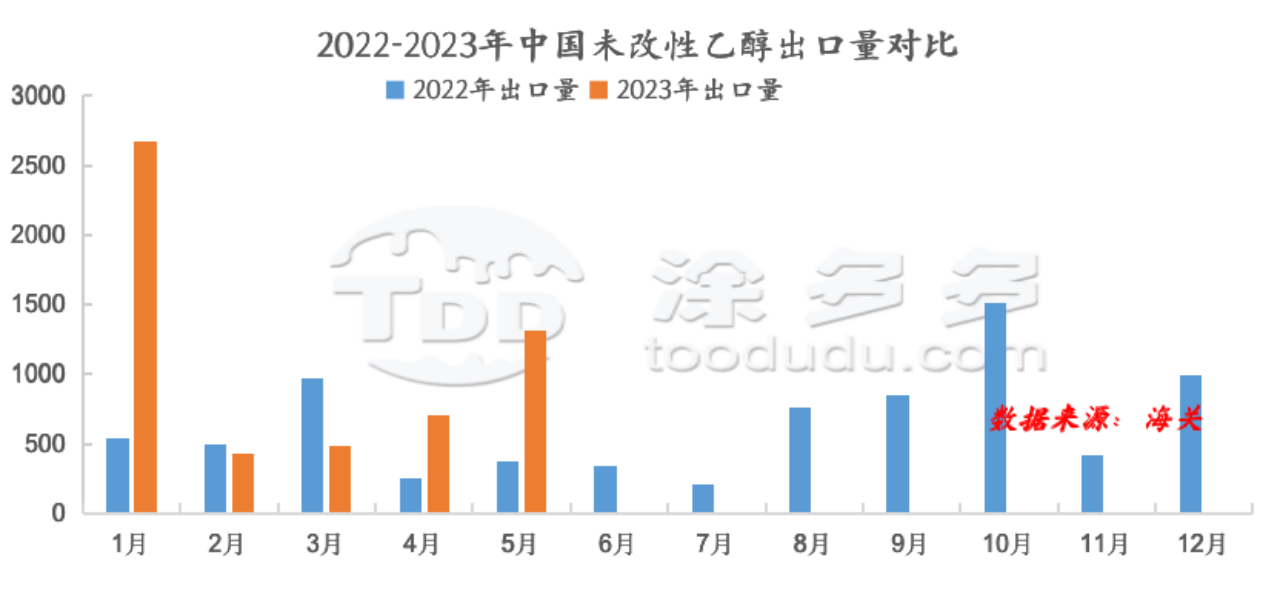

The total import volume of unmodified ethanol from January to May in 2023 is 30.683 tons.

From January to May in 2023, the total import volume of modified ethanol was 32.925 tons.

In the first half of 2023, China imported less modified and unmodified ethanol, the market price in China was not high, and the supply of ethanol in China was sufficient.

The total export volume of unmodified ethanol from January to May in 2023 is 5611.177 tons.

exports a total of 38.04 tons of modified ethanol from January to May 2023.

exports a total of 38.04 tons of modified ethanol from January to May 2023.

The amount of modified and unmodified ethanol exported by China in the first half of 2023 was small, and after the equipment in the United States was normal, part of the export volume was concentrated in the United States and other countries.

IV. Ethanol Market Forecast in the second half of 2023

In the second half of 2023, the new production capacity of coal-based ethanol is expected to increase by 1.3 million tons, Shandong Hengxin 500000 tons / year, Anhui carbon Xin 600000 tons / year, and Baling Petrochemical by-products 200000 tons / year. At present, there is no new capacity for fermented ethanol.

After the summer overhaul in July, the large factories resumed one after another in August when the supply increased. The start of cassava ethanol in East China is expected to remain low in the third quarter. After the new raw materials are put on the market, it may lead to a wave of construction.

The downstream chemical ethyl acetate has a new production capacity plan, which is expected to be 200000 tons / year. Whether it can be put into production as scheduled depends on the actual situation. Whether the new production capacity of methyl ethyl carbonate is as scheduled remains to be further observed. It is estimated that the production capacity will be 700000 tons in the second half of the year. Liquor market in the third quarter off-season, large manufacturers rigid demand procurement, demand is limited, liquor demand will increase in the fourth quarter.