PE Monthly Report: High-pressure has become the biggest dark horse, with North China rising by as much as 500 yuan/ton. The proportion of low-pressure production has risen and the market has weakened.

Core point of view this month

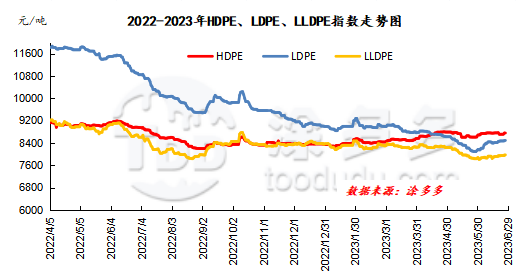

This month, China's PE market trend differentiation between varieties, of which high pressure has become the biggest dark horse, linear under the guidance of the market to stop falling rebound, low pressure, the performance is relatively insipid, some prices even appear 100-250 yuan / ton pullback. By the end of the month, linear mainstream prices in China range from 7770 to 8150 yuan per ton, high-pressure prices range from 8300 to 8750 yuan per ton, low-pressure membrane prices range from 8000 to 9000 yuan per ton, and low-pressure wire drawing ranges from 7830 to 9950 yuan per ton. In July, it was in the gap period when the PE plant was put into production in China, while the devices such as Yanneng, Yanshan and Zhongsha stopped one after another at the beginning of the month, and most of the parking devices resumed production in May and June, so the overall market supply will decline in the first half of the month, and there will be a gradual increase in the second half of the month, but the pressure is still small. On the demand side, July is still in a relatively off-season, rigid demand for the market boost is not obvious. Market variables exist more in speculative demand, at present, the inventory in the middle and lower reaches is low, under the signs of rising market, do not rule out the demand to build a database step by step. On the cost side, international oil prices are volatile and coal prices are gradually stabilizing. at the same time, the progress of destocking of raw materials in the upper reaches of China is accelerating, and the cost side still plays a strong role in supporting the market and driving the market. Market variables are more likely to appear in the macro aspect: from the Chinese point of view, we look forward to favorable stimulus policies such as policy finance, real estate relaxation and interest rate cuts in monetary policy. Market essays occur frequently, in the context of commodities falling to a low level, the market short-term volatility intensified, for the macro level to pay more attention to the expected landing after the transaction, focusing on the relevant policy guidance brought about by the meeting of the political Bureau of the CPC Central Committee at the end of the month. Overseas, the probability of the Fed raising interest rates in July is now more than 80%, and it continues to focus on the impact of inflation and employment data on monetary policy at a later stage. Overall, China's PE market is expected to run with strong shocks in July, taking into account the large number of macro black swan events, market fluctuations will be more frequent.

Chapter one, Review of Polyethylene Market this month

1.1 Analysis of the Market trend of Polyethylene in China

Table 1 polyethylene spot market price change

Unit: yuan / ton

|

Brand number |

Region |

June 1st |

June twenty _ ninth |

Rise and fall |

|

Linear |

North China |

7680-7800 |

7770-7900 |

90/100 |

|

East China |

7850-8000 |

7900-8000 |

50/0 |

|

|

South China |

7800-7950 |

8000-8150 |

200/200 |

|

|

high pressure |

North China |

8100-8250 |

8570-8750 |

470/500 |

|

East China |

8150-8300 |

8350-8550 |

200/250 |

|

|

South China |

8050-8250 |

8300-8400 |

250/150 |

|

|

Low pressure film |

North China |

8300-8800 |

8200-8900 |

-100/100 |

|

East China |

8300-8700 |

8180-9000 |

-120/300 |

|

|

South China |

7950-8700 |

8000-8900 |

50/200 |

|

|

Low pressure wire drawing |

North China |

7850-8950 |

7830-8700 |

-20/-250 |

|

East China |

8100-9400 |

7900-9700 |

-200/300 |

|

|

South China |

9250-9900 |

9350-9950 |

100/50 |

This month, China's PE market is divided among varieties, of which high pressure has become the biggest dark horse, reversing the decline since last year and rebounding strongly. The main reason is that the supply has obviously shrunk: Daqing Petrochemical, National Energy Xinjiang, Lanzhou Petrochemical, Daqing LDPE second Line, Yanshan Petrochemical New LDPE and other devices have planned to start overhauling, making the market price all the way up. Linear aspect, more under the guidance of the market to stop the rebound. China cut interest rates and the Federal Reserve suspended interest rate hikes in June, resulting in a marked weakening of pessimistic bearish sentiment in the market. Futures rebounded at the bottom and the center of gravity of linear spot prices followed. And low pressure, the performance is relatively flat, some prices even appear 100-250 yuan / ton pullback. Mainly due to the adequate supply of goods in the market, the increase in the proportion of low-pressure injection molding, film, wiredrawing and hollow production, and the abundant supply of imports, under the condition that the demand is difficult to improve synchronously, the market price is unstable and there are signs of decline. By the end of the month, linear mainstream prices in China range from 7770 to 8150 yuan per ton, high-pressure prices range from 8300 to 8750 yuan per ton, low-pressure membrane prices range from 8000 to 9000 yuan per ton, and low-pressure wire drawing ranges from 7830 to 9950 yuan per ton.

Fig. 1 trend chart of polyethylene variety index

1.2 Analysis of Polyethylene Dollar Market trend

This month, China's PE dollar market gradually stabilized, high-pressure rising trend is obvious. As of the end of the month, the linear price of US dollars was between US $920 and US $940 per ton, stable; the price of high-pressure membrane material was between US $950 and US $980 per ton, up by US $10-30 per ton; and the price of low-pressure membrane was between US $950 and US $990 per tonne, as the arrival price of low-priced goods from Qatar fell by US $20 per ton at the bottom. The arrival of imports has increased since the middle of the year, but the transaction is still difficult to increase, and exports are also mediocre. From the point of view of the price difference between inside and outside, the window of high-pressure products is open, the window of low-pressure film is once open, and other categories are closed. Pay attention to the new quotations made by foreign businessmen and the trend of RMB market.

Analysis on the trend of Polyethylene Futures Market of 1.3

Even plastic main contract L2309 moved up slowly as a whole. Specifically: the L2309 contract opened 7600 on June 1, hit a monthly low of 7570 on the same day and then fluctuated upwards, hitting the month's highest point of 7899 in the second half of the month and closing at 7867 on the 29th. Judging from the trading status on the 29th, the deal opened 26.1% more than the empty opening of 23.1%; Duoping was 18.6% flat. At present, the L09 contract runs between the upper rails in the BOLL (13meme12recovery2). Although it once went down the middle rail but fell but not broken, it was treated as a concussion train of thought in the later stage, with the upper pressure level 7900 and 8000.

Chapter II Analysis of the supply of Polyethylene in China

2.1 yield analysis of polyethylene

China's polyethylene output in June 2023 was 2.237 million tons, down 115800 tons from the previous month, down 4.92 percent from the previous month, an increase of 219400 tons over the same period last year, and an increase of 10.63 percent over the same period last year. In June, there were still many parking devices in China, the loss of devices increased, and the capacity utilization rate shrank slightly.

2.2 maintenance statistics of polyethylene enterprises

Table 2 overhaul statistics of polyethylene plants in China in June

|

Enterprise name |

Inspection and repair device |

Maintenance capacity |

Parking Duration |

departure time |

|

North China brocade |

Old HDPE first line / second line |

15 |

June 12, 2014 |

Long-term parking |

|

Shenyang Chemical Industry |

LLDPE |

10 |

October 15, 2021 |

Uncertain for the time being |

|

Haiguolong oil |

Full density |

40 |

April 3, 2022 |

Uncertain for the time being |

|

Wanhua chemistry |

HDPE |

35 |

November 12, 2022 |

Uncertain for the time being |

|

Fushun petrochemical |

Full density |

8 |

April 6, 2023 |

June 30, 2023 |

|

Daqing Petrochemical |

HDPE B line |

8 |

April 27, 2023 |

July 1, 2023 |

|

Shanghai Secco |

Full density |

30 |

May 19, 2023 |

July 14, 2023 |

|

Daqing Petrochemical |

LDPE first line |

6.5 |

May 20, 2023 |

July 25, 2023 |

|

Shanghai Secco |

HDPE |

30 |

May 21, 2023 |

July 17, 2023 |

|

Lanzhou Petrochemical |

Old total density |

6 |

June 1, 2023 |

July 20, 2023 |

|

Lanzhou Petrochemical |

HDPE old line |

8.5 |

June 1, 2023 |

July 20, 2023 |

|

Lanzhou Petrochemical |

HDPE new line |

8.5 |

2023 |

July 20, 2023 |

|

Daqing Petrochemical |

LLDPE |

8 |

June 10, 2023 |

July 25, 2023 |

|

Daqing Petrochemical |

HDPE A line |

8 |

June 10, 2023 |

July 25, 2023 |

|

Daqing Petrochemical |

HDPE C line |

8 |

June 10, 2023 |

July 25, 2023 |

|

Daqing Petrochemical |

LDPE second line |

20 |

June 10, 2023 |

July 25, 2023 |

|

Daqing Petrochemical |

Full density front line |

30 |

June 10, 2023 |

July 25, 2023 |

|

Daqing Petrochemical |

Full density second line |

25 |

June 10, 2023 |

July 25, 2023 |

|

Lanzhou Petrochemical |

New full density |

30 |

June 12, 2023 |

August 4, 2023 |

|

National energy Xinjiang |

LDPE |

30 |

June 14, 2023 |

June 29, 2023 |

|

Lanzhou Petrochemical |

LDPE |

20 |

June 15, 2023 |

August 2, 2023 |

|

Zhongsha Petrochemical |

LLDPE |

30 |

June 16, 2023 |

June 23, 2023 |

|

Lianyungang Petrochemical |

HDPE |

40 |

June 16, 2023 |

June 26, 2023 |

|

Yanshan Petrochemical |

New LDPE |

20 |

June 19, 2023 |

June 22, 2023 |

Table 3 overhaul statistics of polyethylene plant in China in July

|

Production enterprise |

Device |

Plant production capacity |

Start date |

End date |

|

Yan'an Nenghua |

HDPE |

42 |

July 1, 2023 |

August 20, 2023 |

|

Yanshan Petrochemical |

HDPEA line |

7 |

July 7, 2023 |

July 10, 2023 |

|

Yanshan Petrochemical |

HDPEB line |

7 |

July 7, 2023 |

July 10, 2023 |

|

Zhongsha Petrochemical |

HDPE |

30 |

July 10, 2023 |

July 24, 2023 |

|

Yanshan Petrochemical |

The old LDPE front line |

6 |

July 15, 2023 |

July 22, 2023 |

|

Yanshan Petrochemical |

New LDPE |

20 |

July 17, 2023 |

July 18, 2023 |

|

Yanshan Petrochemical |

HDPEA line |

7 |

July 20, 2023 |

July 22, 2023 |

|

Yanshan Petrochemical |

HDPEB line |

7 |

July 20, 2023 |

July 22, 2023 |

Chapter III Analysis of the upstream market of polyethylene

3.1 crude oil trend analysis

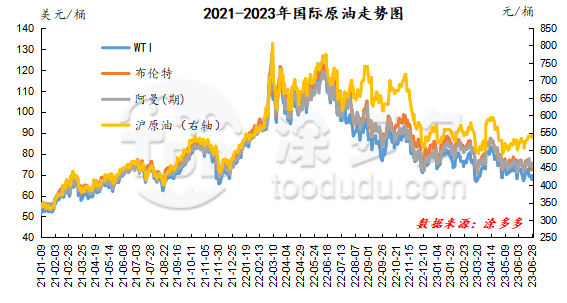

As of June 28, the price of WTI is US $69.56 per barrel, the price of Brent is US $74.03, the price of Oman is US $73.81 per barrel, and the price of Shanghai crude oil is 536 yuan per barrel. Compared with the beginning of the month, WTI fell 54 cents per barrel, Brent fell 0.25 US dollars per barrel, Oman (expected) rose 2.62 US dollars per barrel, and Shanghai crude oil fell 35.1 yuan per barrel.

Fig. 2 international crude oil trend chart of 2021-2023

Analysis of the trend of methanol

On the supply side: recently, the equipment in the field is in the alternating process of overhaul and restart, and the overall market supply performance is relatively abundant, and the market inventory in the port area during the week is affected by the Dragon Boat Festival holiday, and the market pick-up volume has decreased, coupled with a reduction in some downstream demand, resulting in an increase in the total port inventory compared with the previous period, but considering that after July, there are maintenance plans for some installations in the northwest region. Local market supply is expected to be reduced, and in the later stage, attention should be paid to the implementation of equipment maintenance and the impact of the power restriction policy in the southwest region on the plant in the future. On the demand side: with the continuous reduction of methanol prices, the profits of downstream olefin enterprises have been repaired, and some olefin enterprises have extracted methanol from outside, and the terminal demand is slowly increasing, but considering that the traditional downstream is in the off-season of consumption, it is less likely to increase demand in the short term. At present, coal prices are weak and stable, and the cost support is limited. Although methanol prices have been raised recently, operators still hold wait-and-see sentiment towards the future market, with general enthusiasm for entering the market, and solid single continuation of rigid demand. It is expected that the short-term methanol market price will be mainly arranged in a narrow range, and in the later stage, we should also pay attention to crude oil, coal prices and the operation of the plant in the field.

Chapter IV & Analysis of Import and Export of nbsp; Polyethylene

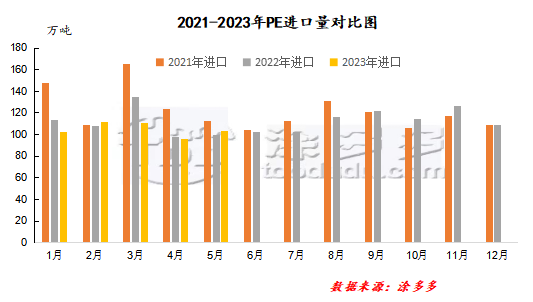

Total PE analysis: according to customs data, China imported 1.035 million tons of polyethylene in May 2023, an increase of 8.16% over the previous month, with an average import price of US $1086.27 per ton. Among them, the import of HDPE was 365900 tons, an increase of 0.25% from the previous month to 258900 tons, and an increase of 16.10% from the previous month to 410200 tons, an increase of 11.20% over the previous month.

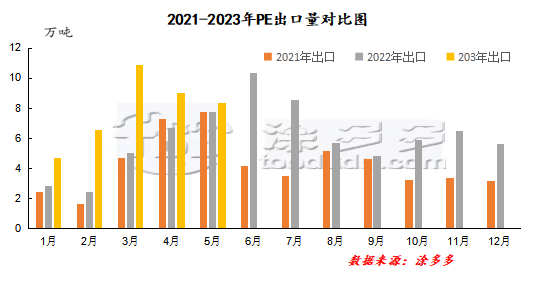

In May 2023, China's polyethylene exports reached 83500 tons, down 7.78 percent from the previous month, with an average export price of US $1336.13 per ton. Among them, the export volume of HDPE was 48100 tons, down 4.16% from the previous month, the export volume of LLDPE was 21500 tons; the export volume of LLDPE was down 2.33% from the previous month to 13900 tons, and decreased by 28.78% from the previous month.

From January to May in 2023, the cumulative import volume was 5.2469 million tons, an increase of 4.01% over the same period last year, and the cumulative export volume was 395000 tons, an increase of 59.54% over the same period last year.

Fig. 3 monthly import volume of PE from 2021 to 2023

Fig. 4 comparison of monthly export volume of PE in 2021-2023

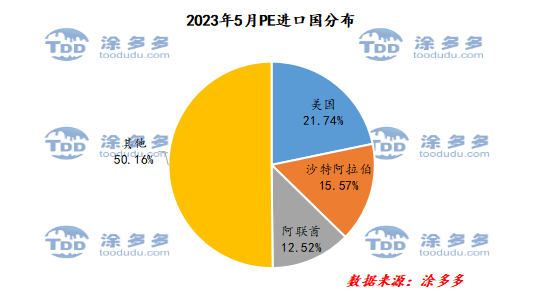

Analysis of PE importing countries:

According to customs data, in May 2023, China imported 225000 tons of PE from the United States, accounting for 21.74 percent of the total imports, 161200 tons from the United States, accounting for 15.57 percent of the total imports, and 129600 tons from the United Arab Emirates, accounting for 12.52 percent of the total imports.

Fig. 5 PE import country distribution in May 2023

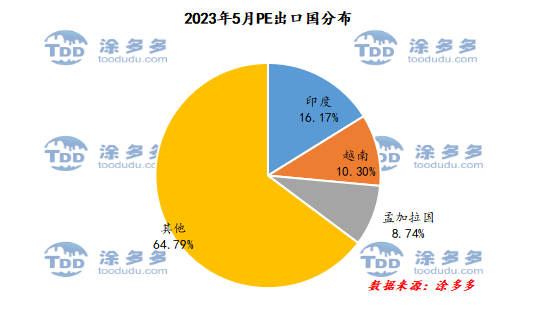

Analysis of PE exporting countries:

According to customs data, in May 2023, China exported 13500 tons of PE to India, accounting for 16.17 percent of total exports, 8600 tons to Vietnam, accounting for 10.3 percent of total exports, and 7300 tons to Bangladesh, accounting for 8.74 percent of total exports.

Fig. 6 PE export country distribution in May 2023

Chapter 5 & Forecast of the trend of nbsp; Polyethylene

In July, it was in the gap period when the PE plant was put into production in China, while the devices such as Yanneng, Yanshan and Zhongsha stopped one after another at the beginning of the month, and most of the parking devices resumed production in May and June, so the overall market supply will decline in the first half of the month, and there will be a gradual increase in the second half of the month, but the pressure is still small. On the demand side, July is still in a relatively off-season, rigid demand for the market boost is not obvious. Market variables exist more in speculative demand, at present, the inventory in the middle and lower reaches is low, under the signs of rising market, do not rule out the demand to build a database step by step. On the cost side, international oil prices are volatile and coal prices are gradually stabilizing. at the same time, the progress of destocking of raw materials in the upper reaches of China is accelerating, and the cost side still plays a strong role in supporting the market and driving the market. Market variables are more likely to appear in the macro aspect: from the Chinese point of view, we look forward to favorable stimulus policies such as policy finance, real estate relaxation and interest rate cuts in monetary policy. Market essays occur frequently, in the context of commodities falling to a low level, the market short-term volatility intensified, for the macro level to pay more attention to the expected landing after the transaction, focusing on the relevant policy guidance brought about by the meeting of the political Bureau of the CPC Central Committee at the end of the month. Overseas, the probability of the Fed raising interest rates in July is now more than 80%, and it continues to focus on the impact of inflation and employment data on monetary policy at a later stage. Overall, China's PE market is expected to run with strong shocks in July, taking into account the large number of macro black swan events, market fluctuations will be more frequent.