- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

This week, China's polypropylene market range, the overall price center of gravity has not changed much compared with last week, as of Thursday, the mainstream price of China wiredrawing ranges from 6950 yuan / ton to 7250 yuan / ton. From a macro point of view, the Fed decided to suspend a rate hike and raise the final interest rate at its June meeting, resulting in real marginal easing, but did not want to give the market a long-term expectation of self-easing. For Chinese assets, the Fed's suspension of a rate hike has an indirect positive effect on Chinese assets. China's early interest rate cut made the market expect that the stimulus policy will be launched and issued in advance, and the market pessimism and bearish sentiment has significantly weakened. Futures disk, although PP fundamentals lack of substantial positive, but the early short in the overall commodity rebound at the bottom, there is a certain waver, the current disk to maintain inter-community consolidation, for the spot market guidance is limited. From the perspective of returning to the fundamentals, there is still no major change, and the contradiction between supply and demand in the market is still prominent: on the supply side, the current petrochemical operating rate has increased to 78%. As Lianhong, Bora, Zhejiang Petrochemical and other devices have resumed work one after another, the supply of goods in the field has gradually increased. Superimposed Juzhengyuan Phase II, Anqing Petrochemical is about to be put into production, the market supply pressure is only increasing. Under the off-season of traditional demand, the downstream operating rate is 49%, which is 3% lower than that of the same period last year, and there are generally insufficient orders and weak profits in the terminal, so it is difficult to have a significant increase in demand. Under the comprehensive influence, the short-term PP market is expected to fluctuate mainly, focusing on the expected game of Chinese policy and the actual landing situation in the later stage.

1. Analysis of the market trend of polypropylene in China.

Unit: yuan / ton

|

Region |

June ninth |

June fifteenth |

Rise and fall |

|

North China |

7000-7100 |

6950-7050 |

50/-50 |

|

East China |

7000-7150 |

6980-7150 |

-20/0 |

|

South China |

7150-7250 |

7150-7250 |

0/0 |

This week, China's polypropylene market range, the overall price center of gravity has not changed much compared with last week, as of Thursday, the mainstream price of China wiredrawing ranges from 6950 yuan / ton to 7250 yuan / ton. Fears remain about a possible recession in Europe and the US, and the ECB said it would not stop raising interest rates in the short term, with international oil prices falling on Friday. Concerns about demand weighed on the impact of further production cuts in Saudi Arabia, and international oil prices continued to fall after the market opened on Monday. Futures, reducing positions down, continuous intraday diving, suppressing the spot market mentality. Coal prices fell sharply again over the weekend, with coal companies lowering factory prices as costs loosened and futures fell. At the same time, petrochemical also has a round of price cuts, on-site cost support is loose. Starting from Tuesday, the central bank announced that the winning bid rate for seven-day reverse repo fell 10 basis points to 1.9%, compared with 2% previously. This means that the policy rate, which empirically usually changes in tandem with the MLF, has been cut by 10 basis points, and the rate-cutting boots have officially landed. Subsequently, the release of social finance and M2 data is not much different from the market expectations, and the market expectations for China's future stimulus policies rise again, and the futures trend is stronger. At the same time, Sinopec began to cooperate with the price, on-site cost support reappeared. Traders mainly ship with the market, downstream rigid demand to enter the market, the overall transaction performance is OK. The powder fluctuates with the range of granules and upstream propylene raw materials. As of Thursday, the mainstream price in East China was between 6530 and 6580 yuan per ton, while the mainstream price in Shandong was raised at 6670 yuan per ton.

Fig. 1 trend chart of polypropylene index

2. analysis of the market trend of polypropylene dollar.

The market price of US dollar PP in China is still falling this week, ranging from US $10 to US $30 / ton, in which the decline of wiredrawing continues to be the leading one: as of Thursday, the price of US dollar wiredrawing is about US $870,900 / tonne; the copolymerization price is about US $980,900 / tonne. Although the exchange rate remains high, the cost of imported resources is high. However, due to insufficient orders in downstream factories, low start-up, weak terminal demand, downward market price center of gravity, recent increase in low price delivery and insufficient turnover in the US dollar market, Chinese importers partially let profits to promote trading. In the future, PP US dollar market price has no obvious growth space in the short term, US dollar price short-term or continue the range shock trend.

Table 2 & the change of nbsp; polypropylene dollar market price

Unit: United States dollars / ton

|

Variety |

June 9th price |

June 15th price |

Rise and fall |

|

Wiredrawing |

900 |

870-900 |

-30/0 |

|

Copolymerization |

980-1010 |

980-1000 |

0/-10 |

3. analysis of the trend of polypropylene futures market.

The range of PP2309 contracts is adjusted this week. The PP2309 contract opened at 6945 on June 9, with a weekly high of 7016 and a low of 6824, and closed at 6985 on Thursday. Multi-empty short-term operation, the market is difficult to get out of the trend market. From the point of view of the trading status on Thursday, under the strong long atmosphere of commodities as a whole, the bears left the market after pressing the market, causing the market to rebound after falling. Specifically, the transaction opened 20.9% more than the empty opening of 23.6%, while Duoping was 24.6% flat at 22.3%. The short-term price runs between the middle rail and the lower rail in BOLL, the three-line opening converges, and the short-term runs around 6800-7000.

The overall supply of PP in China continues to decline slightly. Weekly output was 601300 tons, down 11200 tons, or 1.83 percent, from last week. New devices such as China and South Korea, Fulian, Dalian and Sinochem have been stopped, and the amount of equipment maintenance loss has increased slightly this week.

Table 3 Statistics of weekly maintenance of polypropylene plants in China

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

departure time |

|

Dalian Petrochemical Corporation |

Third line |

5 |

August 2, 2006 |

To be determined |

|

Wuhan Petrochemical Corporation |

Old equipment |

12 |

November 12, 2021 |

To be determined |

|

Haiguolong oil |

First line |

20 |

February 8, 2022 |

To be determined |

|

Haiguolong oil |

Second line |

35 |

April 3, 2022 |

To be determined |

|

Tianjin Petrochemical Company |

First line |

6 |

August 1, 2022 |

To be determined |

|

Tianjin Bohua |

Single line |

30 |

September 28, 2022 |

To be determined |

|

Jinxi Petrochemical |

Single line |

15 |

February 16, 2023 |

To be determined |

|

Fushun petrochemical |

First line |

9 |

April 14, 2023 |

To be determined |

|

Luoyang Petrochemical |

First line |

8 |

April 27, 2023 |

To be determined |

|

Wanhua chemistry |

Single line |

30 |

May 5, 2023 |

June 22, 2023 |

|

Daqing Petrochemical |

Single line |

10 |

May 9, 2023 |

July 10, 2023 |

|

Qingdao Refinery |

Single line |

20 |

May 15, 2023 |

June 30, 2023 |

|

Luoyang Petrochemical |

Second line |

14 |

May 16, 2023 |

July 8, 2023 |

|

Jingbo polyolefin |

First line |

20 |

May 23, 2023 |

To be determined |

|

Yan'an Refinery |

First line |

10 |

May 24, 2023 |

July 7, 2023 |

|

Yan'an Refinery |

Second line |

20 |

May 24, 2023 |

July 7, 2023 |

|

Shanghai Secco |

Single line |

25 |

May 25, 2023 |

July 23, 2023 |

|

Lanzhou Petrochemical |

Old line |

4 |

June 1, 2023 |

August 8, 2023 |

|

Zhejiang Petrochemical Corporation |

Third line |

45 |

June 6, 2023 |

June 17, 2023 |

|

Polaroid Anderbasel |

First line |

40 |

June 7, 2023 |

June 15, 2023 |

|

Polaroid Anderbasel |

Second line |

20 |

June 7, 2023 |

June 15, 2023 |

|

CNOOC Daxie |

Single line |

30 |

June 8, 2023 |

June 17, 2023 |

|

Daqing sea tripod |

Single line |

10 |

June 8, 2023 |

July 23, 2023 |

|

Sinopec |

JPP line |

20 |

June 10, 2023 |

June 20, 2023 |

|

Fujian Union |

Old line |

12 |

June 12, 2023 |

To be determined |

|

Gu Lei petrification |

First line |

35 |

June 12, 2023 |

June 16, 2023 |

|

Ningbo Formosa Plastics |

Second line |

28 |

June 13, 2023 |

June 28, 2023 |

|

Langang Petrochemical |

Single line |

11 |

June 13, 2023 |

August 1, 2023 |

|

Lanzhou Petrochemical |

New line |

30 |

June 13, 2023 |

August 1, 2023 |

|

Daqing Refining and Chemical Industry |

Second line |

30 |

June 13, 2023 |

July 24, 2023 |

|

Quanzhou, Sinochem |

First line |

20 |

June 13, 2023 |

June 21, 2023 |

3.1 downstream market analysis of polypropylene

Plastic weaving: at present, the factory order situation is still weak: large enterprise orders are OK, large enterprise orders more than 6-8 days; small and medium-sized plastic knitting enterprises generally order-based production. At present, the profit of finished products downstream is low, and the factory rigid demand for replenishment is in the majority.

BOPP: BOPP prices fell 200 yuan / ton, as of Thursday, the mainstream thick film in East China is 8800-9000 yuan / ton. The price of raw materials is arranged slightly, and the quotation of film enterprises is adjusted accordingly. The follow-up of the new order is not good, the opening rate of the film factory has declined, and some membrane enterprises have purchased an appropriate amount of bargain within the week, and they are still cautious in entering the market.

3.2 Statistics on the operating rate of downstream polypropylene enterprises

Average starts in the downstream industries of PP rose 2.8 per cent to 49.42 per cent. Sub-areas: plastic weaving, PP pipe and other industries started to improve, PP film industry declined slightly, other industries started to change little.

4.1 crude oil trend analysis

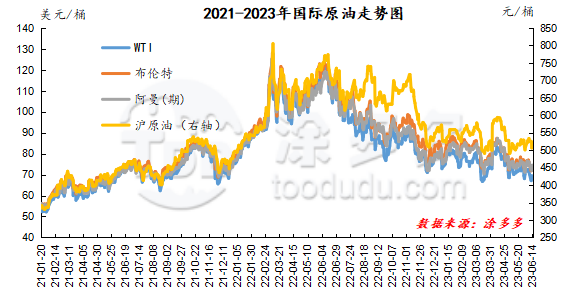

As of June 14, the price of WTI was $68.27 per barrel, down $3.02 from the same period last week; Brent was $73.20 per barrel, down $2.76 from the same period last week; Oman (period) was $74.54 per barrel, down $1.55 from the same period last week; Shanghai crude oil was 521.1 yuan per barrel, down 12.4 yuan per barrel compared with the same period last week.

Figure 2 international crude oil trend chart

4.2 methanol trend analysis

& nbsp Recently, the price of raw material coal is weak and stable, and the cost support is insufficient. At present, the supply in the field is still abundant, and Longxingtai's new 300000-ton methanol plant has been put into operation smoothly, and the supply is expected to continue to increase, but the raw material inventory of some downstream enterprises is on the high side. The mood of manufacturers to take goods continues to be depressed. Although some production enterprises have lowered their quotations for shipment, the buying mentality is still bearish, and the demand margin may be significantly improved in the short term. The trading atmosphere in the market is slightly depressed. In the port market, futures market volatility is strong, spot rigid demand negotiations, the basis is slightly weaker, so far, the port regional inventory performance is different, East China is affected by part of the time closure, the overall unloading speed is general, the mainstream area pick-up is stable, thus showing a narrow range of depots, but although there is normal consumption downstream in South China, imports and domestic trade vessels have arrived at Hong Kong during the week, resulting in a narrow stock accumulation in the region. At present, the macro performance of the methanol market is poor, the contradiction between supply and demand still exists, and the pessimism of the operators in the market continues to be strong. It is expected that the price of methanol market will be weak in the short term, and we need to pay attention to the prices of crude oil and coal and the operation of the plant in the field in the later stage.

From a macro point of view, the Fed decided to suspend a rate hike and raise the final interest rate at its June meeting, resulting in real marginal easing, but did not want to give the market a long-term expectation of self-easing. For Chinese assets, the Fed's suspension of a rate hike has an indirect positive effect on Chinese assets. China's early interest rate cut made the market expect that the stimulus policy will be launched and issued in advance, and the market pessimism and bearish sentiment has significantly weakened. Futures disk, although PP fundamentals lack of substantial positive, but the early short in the overall commodity rebound at the bottom, there is a certain waver, the current disk to maintain inter-community consolidation, for the spot market guidance is limited. From the perspective of returning to the fundamentals, there is still no major change, and the contradiction between supply and demand in the market is still prominent: on the supply side, the current petrochemical operating rate has increased to 78%. As Lianhong, Bora, Zhejiang Petrochemical and other devices have resumed work one after another, the supply of goods in the field has gradually increased. Superimposed Juzhengyuan Phase II, Anqing Petrochemical is about to be put into production, the market supply pressure is only increasing. Under the off-season of traditional demand, the downstream operating rate is 49%, which is 3% lower than that of the same period last year, and there are generally insufficient orders and weak profits in the terminal, so it is difficult to have a significant increase in demand. Under the comprehensive influence, the short-term PP market is expected to fluctuate mainly, focusing on the expected game of Chinese policy and the actual landing situation in the later stage.