Polyethylene Weekly: High pressure has become the weekly leader, linear operation is strong, and low pressure range is sorted out

The core point of the week

This week, there is an obvious differentiation among the varieties in China's PE market: among them, the high pressure one rides off the dust, leading the market, with a weekly increase of as high as 150,300 yuan / ton; linear strong operation, East China and South China go up 50-150 yuan / ton; low-pressure interval finishing is mainly, local varieties slightly rise and fall 50-150 yuan / ton. In terms of crude oil, the positive atmosphere brought about by the continued production reduction of OPEC+ remains, and some economic data show that Europe and the United States are still at risk of falling into recession, with support and pressure under lower levels, and international oil prices fluctuate mainly. At present, oil-to-olefins show a small loss. The weak operation of coal price enlarges the profit of coal-to-olefin at present. On the spot side, Sinopec experienced the last wave of price cuts to the warehouse, the short-term willingness to push up is obvious, gradually began to rise at the beginning of the month, and the cost support is strong. However, at present, the demand for traditional agricultural plastic film is off-season, the operating rate is low, other categories, packaging film, hollow and other orders are slightly better, but there are generally insufficient orders and weak profits, so it is difficult to increase demand obviously in the off-season. At the same time, from the point of view of the supply side, there has been a marked increase in the start-up of maintenance devices at the beginning of the month, and the new parking capacity in China is difficult to cover the increment of start-up and market supply. Under the comprehensive influence, the short-term market shock is expected to run mainly, waiting for the emergence of new drivers.

Chapter one, Review of Polyethylene Market this week

1. Analysis of the market trend of polyethylene in China

Unit: yuan / ton

|

Brand number |

Region |

June second |

June eighth |

Rise and fall |

|

Linear |

North China |

7750-7850 |

7750-7850 |

0/0 |

|

East China |

7900-8000 |

7900-8050 |

0/50 |

|

|

South China |

7800-7950 |

7950-8100 |

150/150 |

|

|

high pressure |

North China |

8200-8350 |

8500-8600 |

300/250 |

|

East China |

8150-8300 |

8350-8500 |

200/200 |

|

|

South China |

8050-8250 |

8350-8400 |

300/150 |

|

|

Low pressure membrane material |

North China |

8350-8800 |

8250-8900 |

-100/100 |

|

East China |

8300-8800 |

8300-8900 |

0/100 |

|

|

South China |

8000-8700 |

7950-8700 |

-50/0 |

|

|

Low pressure wire drawing |

North China |

7850-9450 |

8000-9500 |

150/50 |

|

East China |

8100-9400 |

8000-9350 |

-100/-50 |

|

|

South China |

9250-9900 |

9350-10000 |

100/100 |

This week, there is an obvious differentiation among the varieties in China's PE market: among them, the high pressure one rides off the dust, leading the market, with a weekly increase of as high as 150,300 yuan / ton; linear strong operation, East China and South China go up 50-150 yuan / ton; low-pressure interval finishing is mainly, local varieties slightly rise and fall 50-150 yuan / ton. Starting on Friday, the market expected China to introduce economic stimulus policies in June, while the market took advantage of the resurgence of positive rumors about the real estate market. It is not known whether the rumors can be fulfilled, but China's stock market and commodity market rose sharply, with real estate stocks and commodity building materials leading the rise. Plastic futures continued to rebound, driving the spot market trend. Petrochemical quickly dropped its storage at the beginning of the month, falling as low as 690000 tons last Friday, and the ex-factory prices of the two oils changed from the previous downward trend to rising one after another, with a maximum increase of 250yuan / ton under high pressure, and an increased bullish atmosphere in the field. Traders ship goods at a high price and hesitate to sell at too low prices. But the good failed to cash, the futures market, including spot linear aspects, midweek to give up the previous gains. However, the petrochemical side is willing to increase, and the cost side plays a strong role in supporting the market floor and driving the market. Travel rigid demand to enter the market, in addition to the need to take goods outside the firm offer is still cautious, the general situation of goods in the week. As of Thursday, China's linear prices were 7750-8100 yuan / ton; high-voltage film prices were 8350-8600 yuan / ton; low-voltage film prices were 7950-8900 yuan / ton; and low-voltage wiredrawing prices were 8000-10000 yuan / ton.

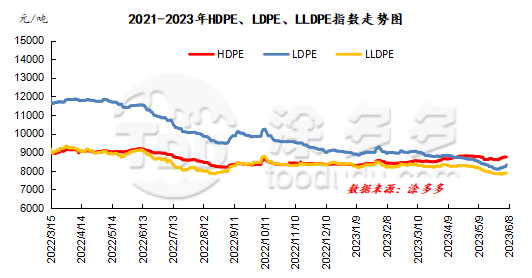

Figure 1 polyethylene sub-variety index trend chart

2. Analysis of the market trend of polyethylene dollar

This week, China's US dollar PE market diverged among varieties, with high pressure, linear rise of 20 US dollars / ton and low pressure of 10 US dollars / ton. There has been an increase in import arrivals this week, especially the high pressure in the Middle East and North America, where the supply of goods was basically finalised in March and April. The deal is a little in the house, but the exit is still mediocre. From the point of view of the price difference between inside and outside, the window of high-voltage and low-pressure film products is open, while other categories are closed. From an expected point of view, imports in June will be expected to increase.

Table 2 & changes of nbsp; polyethylene market price in US dollars

Unit: United States dollars / ton

|

Variety |

June second |

June eighth |

Rise and fall |

|

Linear |

910 |

930 |

20 |

|

high pressure |

920 |

940 |

20 |

|

Low pressure membrane material |

960 |

950 |

-10 |

3. Analysis of the trend of polyethylene futures market

The main plastic cubicle runs this week. The L2309 contract opened at 7752 on June 2nd, with a weekly high of 7824, a weekly low of 7670, and closed at 7756 on Thursday. In terms of Thursday's transaction: an extra 20%, an empty opening of 21.8%, and Duoping at 22.9%, a flat of 24%. At present, L09 contract 7500 support is effective in the short term, but the pressure on track 7820 is still strong, the opening of the BOLL line narrows, and the short-term concussion around the 7500-7820 range is dominated.

Chapter II Analysis of the supply of Polyethylene in China

Previous parking Depu City clean energy, Maoming Petrochemical, Wanhua Chemical and other plants have resumed production one after another, resulting in an increase in capacity utilization of Chinese polyethylene production enterprises. This week's capacity utilization rate is 86.65%, up 2.6% from the previous cycle.

Table 3 overhaul statistics of polyethylene plants in China

Unit: ten thousand tons

|

Enterprise name |

Inspection and repair device |

Maintenance capacity |

Parking Duration |

departure time |

|

North China brocade |

Old HDPE first line / second line |

15 |

June 12, 2014 |

Long-term parking |

|

Shenyang Chemical Industry |

LLDPE |

10 |

October 15, 2021 |

Uncertain for the time being |

|

Haiguolong oil |

Full density |

40 |

April 3, 2022 |

Uncertain for the time being |

|

Wanhua chemistry |

HDPE |

35 |

November 12, 2022 |

Uncertain for the time being |

|

Liaoyang Petrochemical Company |

HDPE A line |

3.5 |

April 1, 2023 |

June 15, 2023 |

|

Liaoyang Petrochemical Company |

HDPE B line |

3.5 |

April 1, 2023 |

June 15, 2023 |

|

Fushun petrochemical |

Full density |

8 |

April 6, 2023 |

June 30, 2023 |

|

Daqing Petrochemical |

HDPE B line |

8 |

April 27, 2023 |

July 1, 2023 |

|

Ningxia Baofeng Phase I |

Full density |

30 |

May 4, 2023 |

June 8, 2023 |

|

Qilu Petrochemical |

HDPE B line |

7 |

May 17, 2023 |

June 10, 2023 |

|

Shanghai Secco |

Full density |

30 |

May 19, 2023 |

July 14, 2023 |

|

Daqing Petrochemical |

LDPE first line |

6.5 |

May 20, 2023 |

July 25, 2023 |

|

Shanghai Secco |

HDPE |

30 |

May 21, 2023 |

July 17, 2023 |

|

Lanzhou Petrochemical |

Old total density |

6 |

June 1, 2023 |

July 20, 2023 |

|

Lanzhou Petrochemical |

HDPE old line |

8.5 |

June 1, 2023 |

July 20, 2023 |

|

Sinopec |

Phase 1 HDPE |

30 |

2023 |

June 8, 2023 |

|

Lanzhou Petrochemical |

HDPE new line |

8.5 |

2023 |

July 20, 2023 |

|

Yanshan Petrochemical |

Old LDPE second line |

6 |

June 5, 2023 |

June 8, 2023 |

|

Zhejiang Petrochemical Phase II |

Full density |

45 |

June 6, 2023 |

June 13, 2023 |

|

Yangzi petrification |

Full density |

20 |

June 6, 2023 |

June 10, 2023 |

Chapter III demand Analysis of Polyethylene in China

3.1 downstream market analysis of polyethylene

The agricultural film market is weak this week. As of Thursday, the mainstream price of double-protective film in North China was 9200-10100 yuan / ton, the mainstream price in East China was 9300-10200 yuan / ton, and the mainstream price in South China was 9200-10200 yuan / ton. Agricultural film production is traditionally off-season, orders are scarce, most enterprises shut down for maintenance, and other enterprises produce in stages. It is expected that the demand for PE raw materials in agricultural film enterprises will decrease in the later period.

3.2 Statistics on the operating rate of downstream polyethylene enterprises

capacity utilization in downstream industries this week is 0.37% lower than last week. The utilization rate of agricultural film capacity decreased by 0.28% compared with last week. The utilization rate of pipe capacity is down 0.50% from last week. The utilization rate of hollow capacity increased by 0.12% over last week, and that of packaging film increased by 0.10% compared with last week.

Chapter IV & Analysis of the upstream market of nbsp; polyethylene

4.1 crude oil trend analysis

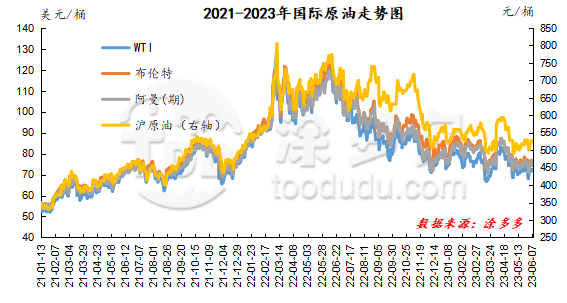

As of June 7, the price of WTI was $72.53 per barrel, up $4.44 from the same period last week; Brent was $76.95 per barrel, up $4.29 from the same period last week; Oman was $74.9 per barrel, up $3.19 from the same period last week; Shanghai crude oil was 523.7 yuan per barrel, up 14.3 yuan per barrel from the same period last week.

Figure 2 international crude oil trend chart

4.2 methanol trend analysis

recent raw material coal price weak and stable operation, lack of cost support, in terms of methanol supply and demand fundamentals, on-site maintenance and restart devices, the supply side ups and downs, but some downstream enterprises raw material inventory is high, procurement enthusiasm is not good, manufacturers multi-rigid demand purchase-based, demand side favorable support is limited, the market transaction atmosphere is slightly depressed. In the port market, the futures market has accelerated decline, and the basis continues to weak. up to now, the performance of the port regional inventory is different, and the ship unloading speed inside and outside the cycle in East China is good. Although there are entrepot ships loading and leaving, the total amount of pick-up in the mainstream area is still reduced, thus showing a tired storehouse. However, a small number of imports and domestic trade vessels arrived in Hong Kong during the week in South China, and against the background of steady pick-up volume in the mainstream region, regional inventory stopped increasing and falling. At present, the macro mood of the methanol market is poor, the supply pressure remains, the improvement of demand is limited, and the pessimism of the operators in the market is strong. It is expected that the price of methanol market will be weak in the short term, and in the later stage, we should pay attention to the prices of crude oil and coal as well as the operation of the plant in the field.

Chapter 5 & Forecast of the trend of nbsp; Polyethylene

In terms of crude oil, the positive atmosphere brought about by the continued production reduction of OPEC+ remains, and some economic data show that Europe and the United States are still at risk of falling into recession, with support and pressure under lower levels, and international oil prices fluctuate mainly. At present, oil-to-olefins show a small loss. The weak operation of coal price enlarges the profit of coal-to-olefin at present. On the spot side, Sinopec experienced the last wave of price cuts to the warehouse, the short-term willingness to push up is obvious, gradually began to rise at the beginning of the month, and the cost support is strong. However, at present, the demand for traditional agricultural plastic film is off-season, the operating rate is low, other categories, packaging film, hollow and other orders are slightly better, but there are generally insufficient orders and weak profits, so it is difficult to increase demand obviously in the off-season. At the same time, from the point of view of the supply side, there has been a marked increase in the start-up of maintenance devices at the beginning of the month, and the new parking capacity in China is difficult to cover the increment of start-up and market supply. Under the comprehensive influence, the short-term market shock is expected to run mainly, waiting for the emergence of new drivers.