Polypropylene Weekly: Long and short positions have no intention of entanglement, futures are running between small sections, and spot prices are relatively strong at the beginning of the month.

The core point of the week

This week, China's polypropylene market is strong, the overall center of gravity has slightly moved up about 50 yuan / ton, as of Thursday, the mainstream price of wire drawing in China ranges from 7000 yuan / ton to 7250 yuan / ton. For crude oil, although the OPEC+ meeting decided to extend the production reduction agreement and Saudi Arabia cut production increment in July. But the US energy secretary later said that after OPEC + decided to cut production, the US would work with all oil producers and consumers to seek to lower oil prices for the American people. And the economic situation in Europe and the United States is difficult to reverse, and international oil prices continue to be under upward pressure. On the other hand, the coal price is weak, and the market cost-side driving effect is not strong. After going through the price reduction and going to the warehouse at the beginning of the month, there is little pressure on the overall inventory and sales of petrochemical in the short term, and petrochemical still intends to raise the price, which has become one of the important factors in the current bottom market. However, in the middle line, the maintenance of petrochemical plants has entered the final period, and the early maintenance equipment is planned to start up, so it is difficult for China's new parking capacity to cover the start-up increment. At the same time, the second phase of Juzhengyuan and Anqing Petrochemical are scheduled to be put into production in June, and the market supply pressure will gradually increase. Downstream, under the off-season of traditional demand, there are generally insufficient orders and weak profits downstream, so it is difficult to have a significant increase in demand. On the other hand, under the basic short-term almost clear card, the market short-term is more sensitive to macro and commodity atmosphere. Next week, the Fed interest rate meeting and the release of many economic data in China will fluctuate the futures market, which will be transmitted to the spot market. Under the comprehensive influence, it is expected that the short-term PP market shock collation is mainly, the medium-term supply and demand is under pressure, there is still downward space.

Chapter one, Review of Polypropylene Market this week

1. Analysis of the market trend of polypropylene in China.

Unit: yuan / ton

|

Region |

June second |

June eighth |

Rise and fall |

|

North China |

7000-7050 |

7000-7100 |

0/50 |

|

East China |

7000-7150 |

7000-7150 |

0/0 |

|

South China |

7150-7200 |

7150-7250 |

0/50 |

This week, China's polypropylene market is strong, the overall center of gravity has slightly moved up about 50 yuan / ton, as of Thursday, the mainstream price of wire drawing in China ranges from 7000 yuan / ton to 7250 yuan / ton. The macro bearish atmosphere weakened during the week: in China, the PMI of Caixin service industry in May was 57.1, higher than the previous figure of 56.4, the fifth consecutive month above the rise and fall line and the second highest growth rate since December 2020. In the United States, for the mid-term interest rate meeting, the market expects a significant reduction in the probability of raising interest rates. Commodities rebounded to repair previous declines, boosting the spot market to some extent. At the same time, the market was concerned about the good news from the OPEC+ meeting: the voluntary production reduction agreement reached at the end of April was extended from the end of 2023 to the end of 2024, and Saudi Arabia cut production by 1 million b / d in July on the basis of voluntary production cuts, and said it could be extended if necessary, affecting international oil prices to rise 3 per cent at the beginning of the week. At the beginning of the month, there is little pressure on the overall inventory and sales of petrochemical, and the positive price-raising makes the market cost support enhanced. Traders took advantage of the opportunity to overreport shipments, and the overall atmosphere of the market became stronger. Downstream rigid demand to enter the market, rose after the transaction performance in general. The interval arrangement is mainly in the aspect of powder. As of Thursday, the mainstream price in East China was between 6580 and 6600 yuan per ton, while the mainstream price in Shandong was raised at 6750 yuan per ton.

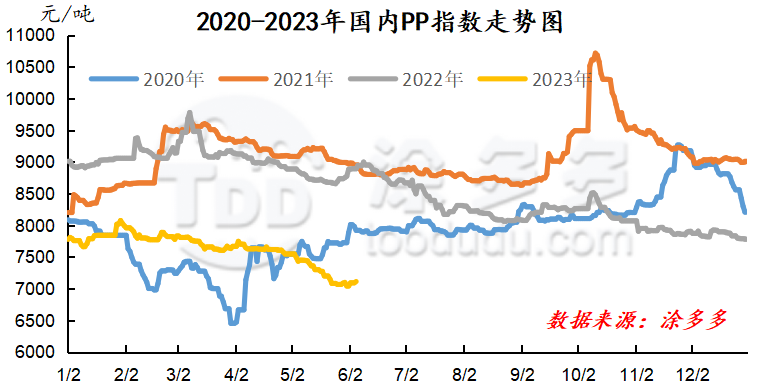

Fig. 1 trend chart of polypropylene index

2. analysis of the market trend of polypropylene dollar.

The market price of US dollar PP in China fell across the board this week, ranging from US $10 to US $30 / ton, in which the decline of wiredrawing was obviously ahead of the copolymerization: as of Thursday, the US dollar wiredrawing price was about US $900USD / ton; the copolymerization price was about US $980,000USD / ton. Although the exchange rate remains high, the cost of imported resources is high. However, due to insufficient orders in downstream factories, low start-up, weak terminal demand, downward market price center of gravity, recent increase in low price delivery and insufficient turnover in the US dollar market, Chinese importers partially let profits to promote trading. In the future, PP US dollar market price has no obvious growth space in the short term, US dollar price short-term or continue the range shock trend.

Table 2 & the change of nbsp; polypropylene dollar market price

Unit: United States dollars / ton

|

Variety |

June 2nd price |

June 8th price |

Rise and fall |

|

Wiredrawing |

930 |

900 |

-30 |

|

Copolymerization |

1000-1020 |

980-1010 |

-20/-10 |

3. analysis of the trend of polypropylene futures market.

The range of PP2309 contracts is adjusted this week. The PP2309 contract opened at 6975 on June 2, with a weekly high of 7028 and a low of 6875, and closed at 6945 on Thursday. Multi-empty short-term operation, the market is difficult to get out of the trend market. Judging from the trading status on Thursday, under the rebound of crude oil, some bears left the market, causing the disk to rebound and repair. Specifically, the transaction opened 21.6% more than the empty opening 25%, Duoping at 21.7% level 24.6%. The short-term futures price hovered near the middle track of BOLL (135013), and the pressure above 7000 was still strong, while the support was given near the lower track, and the short-term fluctuated around 6800-7000.

Chapter II Analysis of the supply of Polypropylene in China

The overall supply of PP in China continues to increase slightly. Weekly output was 612500 tons, an increase of 43400 tons, or 7.63 percent, over last week. Early parking enterprises have resumed work one after another, and the loss of equipment maintenance has decreased slightly this week.

Table 3 Statistics of weekly maintenance of polypropylene plants in China

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

departure time |

|

Dalian Petrochemical Corporation |

Third line |

5 |

August 2, 2006 |

To be determined |

|

Wuhan Petrochemical Corporation |

Old equipment |

12 |

November 12, 2021 |

To be determined |

|

Haiguolong oil |

First line |

20 |

February 8, 2022 |

To be determined |

|

Haiguolong oil |

Second line |

35 |

April 3, 2022 |

To be determined |

|

Tianjin Petrochemical Company |

First line |

6 |

August 1, 2022 |

To be determined |

|

Tianjin Bohua |

Single line |

30 |

September 28, 2022 |

To be determined |

|

Jinxi Petrochemical |

Single line |

15 |

February 16, 2023 |

To be determined |

|

Fushun petrochemical |

First line |

9 |

April 14, 2023 |

To be determined |

|

Luoyang Petrochemical |

First line |

8 |

April 27, 2023 |

To be determined |

|

Wanhua chemistry |

Single line |

30 |

May 5, 2023 |

June 22, 2023 |

|

Ningxia Baofeng |

First line |

30 |

May 8, 2023 |

June 8, 2023 |

|

Daqing Petrochemical |

Single line |

10 |

May 9, 2023 |

July 10, 2023 |

|

Qingdao Refinery |

Single line |

20 |

May 15, 2023 |

June 30, 2023 |

|

Luoyang Petrochemical |

Second line |

14 |

May 16, 2023 |

July 8, 2023 |

|

Jingbo polyolefin |

First line |

20 |

May 23, 2023 |

To be determined |

|

Yan'an Refinery |

First line |

10 |

May 24, 2023 |

July 7, 2023 |

|

Yan'an Refinery |

Second line |

20 |

May 24, 2023 |

July 7, 2023 |

|

Shanghai Secco |

Single line |

25 |

May 25, 2023 |

July 23, 2023 |

|

Pucheng clean energy |

Single line |

40 |

May 26, 2023 |

June 6, 2023 |

|

Lanzhou Petrochemical |

Old line |

4 |

June 1, 2023 |

August 8, 2023 |

|

Lianhong Xinke |

First line |

20 |

2023 |

June 8, 2023 |

|

Lianhong Xinke |

Second line |

8 |

2023 |

June 8, 2023 |

|

Zhejiang Petrochemical Corporation |

Third line |

45 |

June 6, 2023 |

June 17, 2023 |

|

Bora Basel |

First line |

40 |

June 7, 2023 |

June 15, 2023 |

|

Bora Basel |

Second line |

20 |

June 7, 2023 |

June 15, 2023 |

Chapter III demand Analysis of Polypropylene in China

3.1 downstream market analysis of polypropylene

Plastic weaving: at present, the factory order situation is still weak: large enterprise orders are OK, large enterprise orders more than 6-8 days; small and medium-sized plastic knitting enterprises generally order-based production. At present, the profit of finished products downstream is low, and the factory rigid demand for replenishment is in the majority.

BOPP: BOPP prices stopped falling and rebounded, as of Thursday, the mainstream of thick film in East China is 9000-9200 yuan / ton. The price of raw materials rose slightly, and the quotations of film companies moved up. The follow-up of the new order is not good, the opening rate of the film factory has declined, and some membrane enterprises have purchased an appropriate amount of bargain within the week, and they are still cautious in entering the market.

3.2 Statistics on the operating rate of downstream polypropylene enterprises

The average start-up of PP downstream industries rose 0.38 percent to 46.62 percent, 5.97 percent lower than the same period last year. Sub-areas: BOPP, PP pipe and other industries, such as a slight decline in construction, non-woven industry rose slightly, tape master, plastic knitting, CPP and other industries started to maintain stability.

Chapter 4 & upstream market analysis of nbsp; polypropylene

4.1 crude oil trend analysis

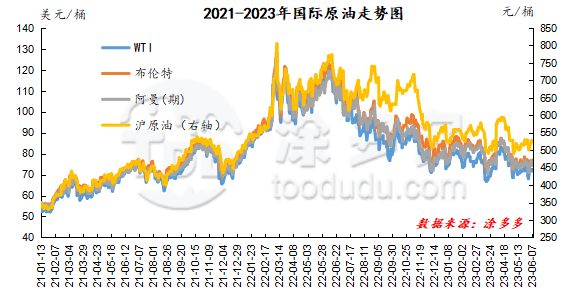

As of June 7, the price of WTI was $72.53 per barrel, up $4.44 from the same period last week; Brent was $76.95 per barrel, up $4.29 from the same period last week; Oman was $74.9 per barrel, up $3.19 from the same period last week; Shanghai crude oil was 523.7 yuan per barrel, up 14.3 yuan per barrel from the same period last week.

Figure 2 international crude oil trend chart

4.2 methanol trend analysis

recent raw material coal price weak and stable operation, lack of cost support, in terms of methanol supply and demand fundamentals, on-site maintenance and restart devices, the supply side ups and downs, but some downstream enterprises raw material inventory is high, procurement enthusiasm is not good, manufacturers multi-rigid demand purchase-based, demand side favorable support is limited, the market transaction atmosphere is slightly depressed. In the port market, the futures market has accelerated decline, and the basis continues to weak. up to now, the performance of the port regional inventory is different, and the ship unloading speed inside and outside the cycle in East China is good. Although there are entrepot ships loading and leaving, the total amount of pick-up in the mainstream area is still reduced, thus showing a tired storehouse. However, a small number of imports and domestic trade vessels arrived in Hong Kong during the week in South China, and against the background of steady pick-up volume in the mainstream region, regional inventory stopped increasing and falling. At present, the macro mood of the methanol market is poor, the supply pressure remains, the improvement of demand is limited, and the pessimism of the operators in the market is strong. It is expected that the price of methanol market will be weak in the short term, and in the later stage, we should pay attention to the prices of crude oil and coal as well as the operation of the plant in the field.

Chapter V trend Forecast of Polypropylene

For crude oil, although the OPEC+ meeting decided to extend the production reduction agreement and Saudi Arabia cut production increment in July. But the US energy secretary later said that after OPEC + decided to cut production, the US would work with all oil producers and consumers to seek to lower oil prices for the American people. And the economic situation in Europe and the United States is difficult to reverse, and international oil prices continue to be under upward pressure. On the other hand, the coal price is weak, and the market cost-side driving effect is not strong. After going through the price reduction and going to the warehouse at the beginning of the month, there is little pressure on the overall inventory and sales of petrochemical in the short term, and petrochemical still intends to raise the price, which has become one of the important factors in the current bottom market. However, in the middle line, the maintenance of petrochemical plants has entered the final period, and the early maintenance equipment is planned to start up, so it is difficult for China's new parking capacity to cover the start-up increment. At the same time, the second phase of Juzhengyuan and Anqing Petrochemical are scheduled to be put into production in June, and the market supply pressure will gradually increase. Downstream, under the off-season of traditional demand, there are generally insufficient orders and weak profits downstream, so it is difficult to have a significant increase in demand. On the other hand, under the basic short-term almost clear card, the market short-term is more sensitive to macro and commodity atmosphere. Next week, the Fed interest rate meeting and the release of many economic data in China will fluctuate the futures market, which will be transmitted to the spot market. Under the comprehensive influence, it is expected that the short-term PP market shock collation is mainly, the medium-term supply and demand is under pressure, there is still downward space.