PVC Weekly: Futures positions are gradually approaching one million positions, intentions of bottom-hunting are gradually emerging, and spot stocks are weakening and falling during the week

I. Analysis of China's PVC market

1. Summary of China's PVC market.

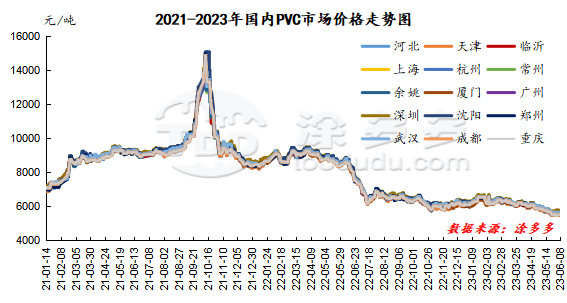

The overall comparison of spot market prices in this week (2023.06.02-2023.03.08) is still mainly down and weakening. After the prices of the two markets rose on Friday, the high rebound was suppressed, and the prices of the two markets have been showing a downward trend since Monday. The spot market is also weak, and spot trading is light during the week, and the decline in spot prices did not lead to an improvement in transactions. The influencing factors of the week: 1, futures positions exploded, close to one million positions as of Thursday, including a substantial increase of more than 93000 positions on Wednesday, although the short positions are menacing, the overall futures market is still temporarily better than short positions. Since the rebound in futures prices hit the head last Friday, futures prices have continued to increase and fall, but low prices have encountered bullish resistance. 2. The fundamental support of PVC is insufficient, in which the prices of calcium carbide and blue carbon fell during the week, and the price of calcium carbide fell by 100-300 yuan / ton. The downward price of calcium carbide alleviates the cost pressure of PVC, but the overall support is negative for PVC. 3. There is nothing new in the level of supply and demand, but the supply is still temporarily stable, the demand is difficult to generate better speculative demand in the weak pattern, and the real rigid demand can not drive the reversal of prices. Under the cost pressure, although some production enterprises in North China have reduced their burden or stopped, the loss is far from enough to cause the reversal of the two cities. 4. During the week, the overall commodity sentiment is weak, the black department continues to perform poorly, the related commodities with coal as the source are in an empty situation, and the macro policy has not led to a good trend. the weakness of macro rhythm has not been substantially improved. 5. There is no good bullish factor in the outer disk during the week, and the economic pressure persists. On the whole, the overall performance of the two cities in the week is weak. From the comparison of valuation, it fell 40-85 yuan / ton in North China, 50-75 yuan / ton in East China, 75 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and 10 yuan / ton in Southwest China.

Futures: week PVC09 contract price lowest point 5633 close to the week before last week low 5614, the single did not effectively fall below, the low price has a certain overopening. Position changes during the week, including an increase of 63353 positions on Monday, a reduction of 22564 positions on Tuesday and an increase of 93252 positions on Wednesday. On Thursday, the overall low and narrow range of futures fluctuated mainly, in which the fluctuation range of high and low points was 52 points, showing a small increase in positions throughout the day, but the fluctuation range of futures prices narrowed and the trend was insufficient. On Thursday, the position was increased by 11263 lots, and the position in the PVC09 contract closed at 955004 lots, with the closing price of 5658.

|

Comparison of the lowest and highest prices for PVC09 contracts |

|||

|

Date |

Lowest price |

The highest price |

Rise and fall |

|

6.2d |

5727 |

5849 |

122 |

|

6.5 days |

5695 |

5854 |

159 |

|

6.6 days |

5698 |

5777 |

79 |

|

6.7 days |

5633 |

5728 |

95 |

|

6.8 |

5641 |

5693 |

52 |

2. Market analysis of mainstream consumer areas in China.

North China: Hebei PVC market prices fell slightly in the week, futures are weak and volatile, spot trading is general, real single demand is the main. As of Thursday, type 5 materials including tax 5430-5470 yuan / ton, Inner Mongolia factory to 5250-5300 yuan / ton. no, no, no. Northern region basis offer 09 contract-(350-400-500).

East China: trading in Changzhou PVC market is lukewarm during the week. Traders mainly point price shipments, general downstream demand, cautious rigid demand, spot prices continue to fall slightly during the week. As of Thursday, the reference for the current remittance of type 5 calcium carbide materials is 5530-5620 yuan / ton (excluding packing). East China basis offer 09 contract-(50-110).

South China: Guangzhou PVC market prices weakened slightly in the week, after the reduction of PVC futures, the point price supply part has an advantage, but the downstream purchasing enthusiasm is general, the spot transaction in the market is mediocre, and the overall market atmosphere is weak. As of Thursday, ordinary type 5 calcium carbide spot pick-up mainstream transaction reference 5640-5680 yuan / ton. South China base offer 09 contract-(0-20) good fans + 20. Ethylene method offer 1000 to 5720-5770 yuan / ton, Dagu 1000 spot basis difference V0930.

Formosa Plastics of China announced the pre-sale price of PVC in June, which was 20 US dollars / ton lower than that in May. The preliminary understanding is that CIF India is at US $800 / ton, CFR China is at US $785 / tonne, and FOB China Taiwan is at US $740 / tonne. Spot PVC demand remains bearish, with some producers offering lower prices than the original ones, and market sources expect new offers to decline again in July.

Formosa Plastics, Taiwan Province, China, June shipping quotation: (USD / ton)

|

Region / time |

CFR India |

CFR China |

CFR Southeast Asia |

FOB Taiwan of China |

|

January |

840 |

805 |

800 |

770 |

|

February |

930 |

875-885 |

870-880 |

840 |

|

March |

970 |

925 |

920 |

880 |

|

April |

900 |

865 |

860 |

820 |

|

May |

820 |

805 |

800 |

760 |

|

June |

800 |

785 |

780 |

740 |

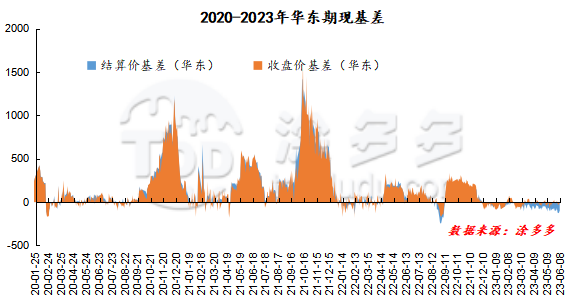

3. Comparison of cash base difference in PVC period

|

Arbitrage Analysis of PVC spread |

||||||

|

PVC |

Contract price difference |

6.2d |

6.5 days |

6.6 days |

6.7 days |

6.8 |

|

V2309 collection |

5845 |

5698 |

5732 |

5655 |

5658 |

|

|

Average spot price in East China |

5660 |

5640 |

5625 |

5575 |

5560 |

|

|

Average spot price in South China |

5760 |

5735 |

5720 |

5670 |

5650 |

|

|

PVC2309 basis difference |

-185 |

-58 |

-107 |

-80 |

-98 |

|

|

V2401 collection |

5830 |

5697 |

5731 |

5668 |

5668 |

|

|

V2309-2401 closed |

15 |

1 |

1 |

-13 |

-10 |

|

|

PP2309 collection |

6996 |

6965 |

6942 |

6893 |

6945 |

|

|

Plastic L2309 collection |

7799 |

7717 |

7739 |

7700 |

7756 |

|

|

V--PP basis difference |

-1151 |

-1267 |

-1210 |

-1238 |

-1287 |

|

|

Vmure-L basis difference of plastics |

-1954 |

-2019 |

-2007 |

-2045 |

-2098 |

|

4. PVC warehouse receipt daily

|

Variety |

Warehouse / branch warehouse |

6.2 warehouse orders |

6.5 warehouse order volume |

6.6 warehouse orders |

6.7 warehouse receipts |

6.8 warehouse orders |

|

Polyvinyl chloride |

Zhejiang International Trade |

801 |

801 |

801 |

801 |

801 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

609 |

609 |

609 |

609 |

609 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

1,162 |

1,162 |

1,162 |

1,162 |

1,387 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

345 |

325 |

325 |

325 |

325 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,681 |

1,681 |

1,681 |

1,681 |

1,681 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

900 |

900 |

900 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

300 |

300 |

300 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

798 |

798 |

798 |

798 |

798 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

2,399 |

2,399 |

2,399 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,313 |

1,313 |

1,313 |

1,313 |

1,313 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

1,238 |

1,238 |

1,238 |

|

PVC subtotal |

|

11,546 |

11,526 |

11,526 |

11,526 |

11,751 |

|

Total |

|

11,546 |

11,526 |

11,526 |

11,526 |

11,751 |

5. Future forecast

Futures: PVC09 contract prices are narrow and low, with a range of only 52 points throughout the day. However, there is still competition between the long and short sides, of which 25.3% are open compared with 23.4% more. The current trend of futures price operation tends to be considered. on the one hand, the weakness of the market has become a consensus, but the bullish resistance of low prices can also be seen that futures prices continue to have greater risk considerations downwards. on the one hand, in the absence of obvious bearish factors, the low price of futures is easy to form a risk closing trample, and the rebound brought by the closing of short positions may engulf some of the profits in the early period of short positions. Therefore, in the low state, it is more likely to appear the trend of horizontal plate narrow fluctuation. The technical level shows that the futures price is running between the middle and lower rails, we still maintain the previous point of view, and further observe the performance of 5600 at the lower rail support position of the Bollinger belt (13, 13, 2).

Spot aspect: First of all, for the bottom-reading psychology of the current spot market, our view is that under the current time node, the performance of the two cities is close to the previous low position, but in the case of more than half of this year, PVC may consider that the prices of the two cities after the Spring Festival will become the annual highs, so even if the prices of the two cities are running low at present. However, for bottoming and hoarding, it will also face the situation of repeated prices and tentative bottoming for a long time, and the cost of capital should also be included in the hoarding cost and become the primary consideration. For the current two markets in the short term, in the absence of positive factors, it is very difficult for the prices of the two cities to attract a better upward rebound, and even the upward caused by the air level will show a trend that each rebound is not as high as before, so it is difficult to change the trend that the low continues to fluctuate. China's exports fell 7.5 per cent in dollar terms in May and imports fell 4.5 per cent, according to data released by the General Administration of Customs, as Chinese consumption remains depressed and exports continue to come under pressure. On the whole, the price of PVC will still be low and narrow in the short term.

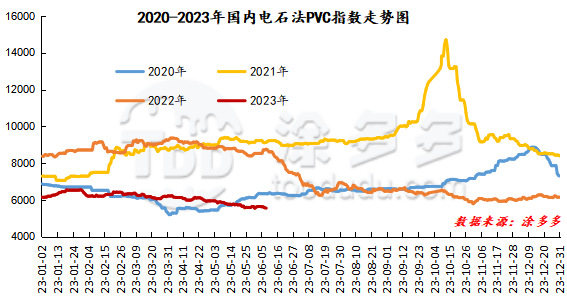

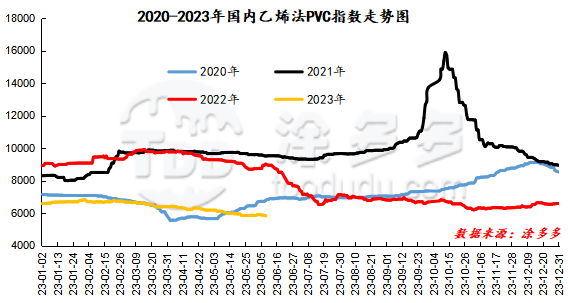

6. China PVC Index

According to Tuduoduo data, the spot index of China's calcium carbide PVC fell 20.1%, or 0.361%, to 5548.49 on June 8. The ethylene method PVC spot index was 5832.99, down 21.87%, with a range of 0.374%. The calcium carbide method index fell, the ethylene method index dropped, and the ethylene-calcium carbide index spread was 284.5.

7. The market price of PVC this week

Unit: yuan / ton

|

Region |

Date |

Price specification |

Price range |

2023/6/1 |

2023/6/8 |

Rise and fall |

|

North China |

Hebei |

Send to cash remittance |

5440-5480 |

5545 |

5460 |

-85 |

|

Tianjin |

Send to cash remittance |

5440-5480 |

5545 |

5460 |

-85 |

|

|

Linyi |

Send to cash remittance |

5470-5520 |

5535 |

5495 |

-40 |

|

|

East China |

Shanghai |

Cash out of the warehouse |

5460-5600 |

5605 |

5530 |

-75 |

|

Hangzhou |

Cash out of the warehouse |

5550-5630 |

5640 |

5590 |

-50 |

|

|

Changzhou |

Cash out of the warehouse |

5510-5610 |

5635 |

5560 |

-75 |

|

|

Yuyao |

Cash out of the warehouse |

5430-5590 |

5585 |

5510 |

-75 |

|

|

Xiamen |

Cash out of the warehouse |

5620-5680 |

5725 |

5650 |

-75 |

|

|

South China |

Guangzhou |

Cash out of the warehouse |

5620-5680 |

5725 |

5650 |

-75 |

|

Shenzhen |

Cash out of the warehouse |

5580-5760 |

5745 |

5670 |

-75 |

|

|

Northeast China |

Shenyang |

Send to cash remittance |

5500-5550 |

5525 |

5525 |

0 |

|

Central China |

Zhengzhou |

Send to cash remittance |

5530-5590 |

5580 |

5560 |

-20 |

|

Wuhan |

Send to cash remittance |

5600-5610 |

5605 |

5605 |

0 |

|

|

Southwest |

Chengdu |

Send to cash remittance |

5330-5600 |

5455 |

5465 |

10 |

|

Chongqing |

Send to cash remittance |

5330-5600 |

5455 |

5465 |

10 |

8. List of equipment in production enterprises this week

|

List of equipment maintenance in PVC Enterprises in China |

|||

|

Technics |

Enterprise name |

Production capacity |

Device change |

|

Calcium carbide method |

Salinization of Mount Tai |

10 |

Parking on September 29th, 2022, recovery time to be determined |

|

Henan Shenma |

30 |

Parking on August 12, 2022, recovery time to be determined |

|

|

Hengyang Kingboard |

22 |

Parking on March 1, 2023, recovery time to be determined |

|

|

Salt lake Haina |

20 |

Parking maintenance on March 28, 2023, recovery time to be determined |

|

|

Shandong Dongyue |

13 |

Overhauled on March 25, 2023, recovery time to be determined |

|

|

Yibin Tianyuan |

38 |

First-line overhaul, resumed on June 9th |

|

|

Haohua Aerospace |

40 |

It is expected to be overhauled on May 24, and the recovery time will be determined. |

|

|

Shanxi Yushe |

40 |

Scheduled for overhaul on June 15, 2023 |

|

|

Shanxi Jintai |

30 |

Planned for overhaul on June 5, 2023 and expected to resume on June 15 |

|

|

Sino-Thai chemistry |

82 |

Planned for maintenance on June 6, 2023 and expected to resume on June 26 |

|

|

Heilongjiang Haohua |

30 |

It is expected to be overhauled on June 20 and resumed on June 25. |

|

|

Ordos |

40 |

It is expected that the first factory will be overhauled from June 5 to 20. |

|

|

Inner Mongolia is suitable for change. |

30 |

Planned maintenance from June 10 to 17, 2023 |

|

|

Medium salt Inner Mongolia |

40 |

Plan to overhaul for about 7 days on July 25, 2023 |

|

|

Ethylene process |

Yangmei Hengtong |

30 |

It will be overhauled for about a month on May 10, 2023, and it will be restored on June 9. |

|

Suzhou Huasu |

13 |

Parking maintenance on June 5, 2023 and expected to resume on June 25 |

|

|

Shanghai chlor-alkali |

6 |

Planned maintenance from June 15 to July 15, 2023 |

|

|

The development of Tianjin Bohua |

80 |

One-line rest on May 25, 2023, scheduled for recovery on June 10 |

|

2. PVC paste resin

1. Market analysis and forecast of PVC this week.

This week (2023.06.02-2023.03.08) PVC paste resin market trend is relatively stable, the market transaction atmosphere is lukewarm, the start of enterprise equipment is stable, downstream rigid demand procurement, the price range changes little, but the overall reduction in the price of calcium carbide during the week is insufficient to support the market. Market price: PVC paste resin large plate price 6700-7500 yuan / ton, glove material sent to the price 7200-7500 yuan / ton, the actual transaction price negotiation. At present, the price adjustment mentality of enterprises is more cautious, the trend of raw material calcium carbide market is weak, insufficient support for PVC paste resin market, short-term market lack of positive factors, short-term PVC paste resin market is expected to maintain a weak situation.

2. Statistics on the start-up of PVC paste resin manufacturers this week

This week (2023.06.02-2023.03.08) PVC paste resin enterprise operating rate is 60.21%. Sichuan Xinjin Road Group Co., Ltd. PVC paste resin device (20 000 tons / year) has not been put into production; Jiyuan Fangsheng Chemical Co., Ltd. PVC paste resin device (60 000 tons / year) production process is micro-suspension method, paste resin device is still shut down. Binzhou Zhenghai Group-Wudi Xinchuang Ocean Technology Co., Ltd. PVC paste resin device (40, 000 tons / year) was stopped for maintenance on April 23, 2021, but not in production. Inner Mongolia Yidong Group Dongxing Chemical Co., Ltd. PVC paste resin device (100000 tons / year) stop and repair around March 27th, 2022. Qinghai Salt Lake Haina Chemical Co., Ltd. PVC paste resin device (35000 tons / year) parking maintenance, start-up time to be determined.

|

Manufacturer name |

Production capacity (10,000 tons / year) |

Maintenance plan |

|

Shenyang Chemical Industry |

20 |

Normal |

|

Shandong Langhui Oil |

14 |

Normal |

|

Anhui Tianchen |

13 |

Normal |

|

Inner Mongolia Junzheng |

10 |

Normal |

|

Yidong Dongxing, Inner Mongolia |

10 |

Overhaul on March 27, 2022, recovery time to be determined |

|

Jiangsu Corning Chemistry |

10 |

Normal |

|

Xinjiang Tianye |

10 |

Normal |

|

Medium salt Inner Mongolia |

9 |

Normal |

|

Xinjiang Zhongtai |

9 |

Normal |

|

Three friends of Tangshan |

8 |

Normal |

|

Inner Mongolia Chenghongli |

8 |

Normal |

|

Formosa Plastics Industry (Ningbo) |

7 |

Normal |

|

Ningxia Yinglite |

4 |

Normal |

|

Jining Bank of China |

4 |

Parking on March 29th, 2023, no recovery plan for the time being |

|

Landscape in Yichang, Hubei Province |

4 |

Normal |

|

Binzhou Zhenghai Group-Wudi newly created Ocean |

4 |

Maintenance on April 23, 2021, no recovery plan for the time being |

|

Qinghai Salt Lake Haina Chemical Industry |

3.5 |

Overhauled in mid-April 2022, no recovery plan for the time being |

|

Sichuan Xinjin Road Group |

2 |

Normal |

III. Key analysis of related chlor-alkali products

1. Calcium carbide

This week (2023.06.02-2023.03.08) China's calcium carbide market showed an overall downward trend, the mainstream ex-factory quotations and receiving prices in various regions were reduced to varying degrees, including factory quotations down 100-250 yuan / ton, downstream receiving prices down 100-225 yuan / ton, the overall operation of the market is relatively low. First of all, during the week, the market trend of blue carbon, the raw material at the cost end, went down, and the price dropped frequently, which played little role in supporting the calcium carbide market. From a fundamental point of view, the market as a whole is in a situation where supply exceeds demand, with the increase in sales of calcium carbide outside the market, sufficient supply of goods on the market, insufficient demand for downstream device maintenance, sufficient inventory of downstream raw materials, poor overall procurement of calcium carbide, greater shipping pressure on calcium carbide enterprises, and weak PVC market in the week, downstream price reduction behavior, there is a certain drag on the calcium carbide market, so prices in various regions are mainly reduced. During the week, the cost side and the basic face of the market are negative, the performance of the industry mentality is poor, and the overall operation of the market is weak and difficult to change.

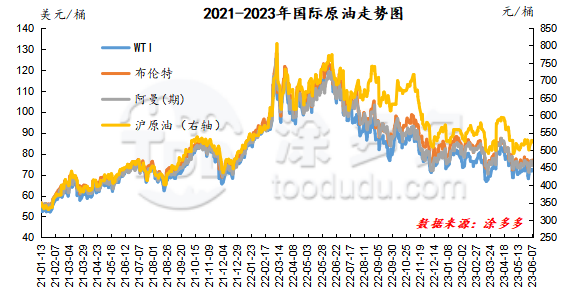

2. Crude oil

As of June 7, the price of WTI was $72.53 per barrel, up $4.44 from the same period last week; Brent was $76.95 per barrel, up $4.29 from the same period last week; Oman was $74.9 per barrel, up $3.19 from the same period last week; Shanghai crude oil was 523.7 yuan per barrel, up 14.3 yuan per barrel from the same period last week.

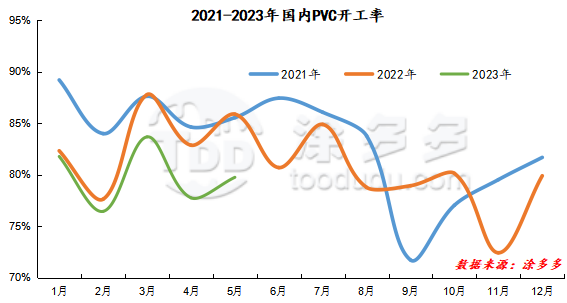

Statistics on the operating rate of the PVC plant this week

This week (2023.06.02-2023.03.08) the capacity utilization rate of PVC production enterprises was 73.03%, up 0.01% from the previous month; of which the calcium carbide method was 71.72%, 0.63% higher than the previous month, and the ethylene process was 77.39%, which decreased by 2%.

V. International market price analysis

1. This week's international VCM market price

International VCM: June 1st: CFR far East fell 10%, CFR Southeast Asia fell 30%, FOB Northwest European Stability, FAS Houston 10.

|

VCM/ area |

2023/5/25 |

2023/6/1 |

Rise and fall |

Unit |

|

CFR far East |

619-621 |

609-611 |

-10 |

$/mt |

|

CFR Southeast Asia |

669-671 |

639-641 |

-30 |

$/mt |

|

FOB Northwest Europe |

748-752 |

748-752 |

0 |

$/mt |

|

FAS Houston |

460-470 |

450-460 |

-10 |

$/mt |

2. International PVC market price this week

International PVC: June 7: CFR far East stable, CFR Southeast Asia rose 5%, CFR India stable, FOB Northwest Europe (futures) fell 20%, FD Northwest Europe (futures) fell 30 minutes Fas Houston stable, Germany, Netherlands, Italy, France, Spain fell 40%, UK fell 35%.

|

Country |

2023/5/31 |

2023/6/7 |

Rise and fall |

Unit |

|

CFR far East |

749-751 |

749-751 |

0 |

Eur/mt |

|

CFR Southeast Asia |

759-761 |

764-766 |

5 |

Eur/mt |

|

FD Northwest Europe (Futures) |

1498-1502 |

1468-1472 |

-30 |

Eur/mt |

|

FOB Northwest Europe |

818-822 |

798-802 |

-20 |

Eur/mt |

|

FAS Houston |

685-695 |

685-695 |

0 |

GBP/mt |

|

CFR India |

769-771 |

769-771 |

0 |

Eur/mt |

|

Germany |

1414-1417 |

1374-1377 |

-40 |

$/mt |

|

Netherlands |

1414-1417 |

1374-1377 |

-40 |

cts/lb |

|

Italy |

1423-1427 |

1383-1387 |

-40 |

$/mt |

|

France |

1407-1422 |

1367-1382 |

-40 |

$/mt |

|

The United Kingdom |

1204-1206 |

1169-1171 |

-35 |

$/mt |

|

Spain |

1403-1407 |

1363-1367 |

-40 |

$/mt |

3. List of unit prices this week

|

Product Name |

Area |

6.1 days |

6.2d |

6.5 days |

6.6 days |

6.7 days |

|

Propylene monomer |

CFR China |

778.00 |

778.00 |

758.00 |

758.00 |

758.00 |

|

Propylene monomer |

FOB Korea |

768.00 |

768.00 |

743.00 |

743.00 |

743.00 |

|

Ethylene monomer |

CFR Northeast Asia |

818.00 |

818.00 |

768.00 |

768.00 |

758.00 |

|

Ethylene monomer |

CFR Southeast Asia |

868.00 |

868.00 |

818.00 |

818.00 |

808.00 |

|

Styrene |

Asia |

963.00 |

963.00 |

960.00 |

954.00 |

942.00 |

|

Butadiene |

CFR Taiwan |

775.00 |

775.00 |

775.00 |

775.00 |

775.00 |

4. Ethylene price list this week

|

The country |

Price type |

6.1 days |

6.2d |

6.5 days |

6.6 days |

6.7 days |

|

Northeast Asia |

CIF (USD / t) |

820 |

820 |

770 |

770 |

760 |

|

Southeast Asia |

CIF (USD / t) |

870 |

870 |

820 |

820 |

810 |

|

China |

CFR (USD / t) |

775 |

760 |

760 |

750 |

750 |

|

Taiwan of China |

CIF (USD / t) |

820 |

820 |

820 |

820 |

820 |

|

Japan |

FOB (USD / t) |

870 |

870 |

820 |

820 |

810 |

|

Northwest Europe |

CIF (USD / t) |

748 |

748 |

746 |

744 |

744 |

|

FD futures price (EUR / ton) |

731 |

731 |

731 |

731 |

731 |

|

|

America |

FD (cents / lb) |

16.5 |

16.1 |

16.8 |

15.8 |

16 |

|

South Korea |

FOB (USD / t) |

820 |

820 |

820 |

820 |

820 |

VI. Holding the list of dragons and tigers (June 8)