Ethylene glycol: Port stocks increased slightly, spot prices fell within a narrow range

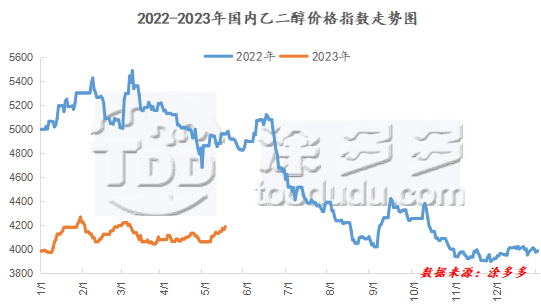

On May 18, the ethylene glycol market price index was 4,168.29, down 18.42 from yesterday.

Market focus:

1. The market is relatively optimistic about the U.S. debt ceiling negotiations. Combined with positive demand expectations, international oil prices have risen. NYMEX crude oil futures 06 contract 72.83 rose US$1.97/barrel or 2.78%;ICE oil futures 07 contract 76.96 rose US$2.05/barrel or 2.74%.

2. The 300,000-ton synthesis gas-to-synthesis MEG unit in Weihe River, Shaanxi Province began to be shut down for maintenance on May 8, which is expected to last for 15-20 days. In the later stage, close attention will be paid to the operation of the unit.

3. Xinjiang Tianye's 600,000-ton ethylene glycol plant was shut down for maintenance. It is planned to be repaired for one month. The 50,000-ton ethylene glycol plant in the old area is operating normally.

Futures dynamics:

On May 18, 2023, the opening price of the EG main contract 2309 of the DSE: 4344, the highest price: 4348, the lowest price: 4240, the settlement price: 4290, the closing price: 4286, and the open position:4176678, down 42 from the previous working day, a decrease of 0.97%.

Spot market: Today, the price of ethylene glycol market fluctuated and fell back. In the morning, the focus of MEG's internal trading was weak and downward, and market negotiations were general. At present, the spot basis is around 95-100 yuan/ton for the 09 contract premium, 4,160 - 4,165 yuan/ton for negotiations, and some transactions are 4,180 - 4,220 yuan/ton. In the afternoon, MEG's internal trading center of gravity was low, and transactions were weak. At present, the spot basis is around 95-100 yuan/ton for the 09 contract premium, and the negotiations are 4,185 - 4,190 yuan/ton, and some transactions are around 4175 yuan/ton. As of press time, the price in South China is around 4400 yuan/ton, down 47 yuan/ton from yesterday; the price in East China is around 4191 yuan/ton, down 47 yuan/ton from yesterday. nbsp;

List of external market prices:

|

market |

price terms |

2023/5/18 |

2023/5/17 |

rise and fall |

units |

|

China |

CFR |

514-516 |

512-514 |

2 |

us dollars/ton |

|

us Gulf |

FOB |

18-20 |

18-20 |

0 |

cents/lb |

|

Southeast Asia |

CFR |

527-529 |

527-529 |

0 |

us dollars/ton |

|

northwestern Europe |

CIF |

458-462 |

458-462 |

0 |

euros/ton |

Mainstream market price list:

|

areas |

2023/5/18 |

2023/5/17 |

rise and fall |

units |

|

National |

4168.29 |

4186.71 |

-18.42 |

|

|

South China |

4400 |

4450 |

-50 |

Yuan/ton |

|

East China |

4191 |

4238 |

-47 |

Yuan/ton |

Company Price List:

Unit: yuan/ton

|

areas |

production enterprises |

2023/5/18 |

2023/5/17 |

rise and fall |

remarks |

|

Northeast China |

Jilin petrochemical |

3950 |

3950 |

0 |

|

|

Fushun petrochemical |

3950 |

3950 |

0 |

|

|

|

northwestern region |

Duzishan Shihua |

4200 |

4200 |

0 |

|

|

Shandong area |

hualu hengsheng |

4100 |

4100 |

0 |

|

|

in North China |

Tianjin petrochemical |

4250 |

4250 |

0 |

|

|

Yanshan petrochemical |

4250 |

4250 |

0 |

|

|

|

Shanxi Woneng |

3800 |

3800 |

0 |

|

|

|

East China |

Shanghai petrochemical |

4250 |

4250 |

0 |

|

|

Sinopec |

4275 |

4275 |

0 |

April settlement |

|

|

Sinopec |

4350 |

4350 |

0 |

Listed in May |

|

|

Yangzi Refining |

4250 |

4250 |

0 |

|

|

|

central China |

China-Korea Petrochemical |

4100 |

4100 |

0 |

|

|

Hubei Sanning |

4230 |

4230 |

0 |

|

|

|

South China |

zhongke refining and chemical |

4250 |

4250 |

0 |

|

|

Maoming petrochemical |

4250 |

4250 |

0 |

|

|

|

southwestern region |

Sichuan petrochemical |

4250 |

4250 |

0 |

|

Market outlook forecast:

The market is relatively optimistic about the U.S. debt ceiling negotiations. Combined with good demand expectations, rising international oil prices, and moderate cost support. Recently, the Chinese market has experienced more equipment maintenance, and the mentality of supporting operators has improved. So far, the market inventory in East China has increased within a narrow range. With the recovery of the arrival of imported ships and cargo at the port and the slowdown of downstream pick-ups, port inventories have increased within a narrow range. Cost pressure in the downstream market has eased slightly, and some operators 'mood to replenish goods in the market has improved. However, the transaction remains as needed. On the whole, the ethylene glycol market price is expected to fluctuate within a narrow range in the short term, and it is necessary to pay close attention to the prices of crude oil and coal and the operation of on-site equipment in the later period.