- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

index

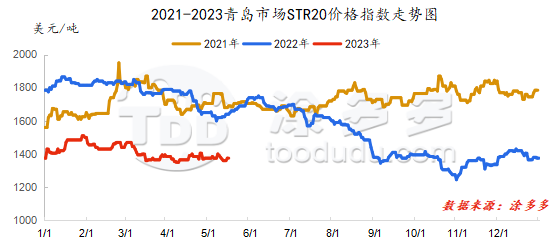

On May 16, the STR20 price index of natural rubber in the Qingdao market was US$1375/ton, which was stable from the previous trading day.

market analysis

Futures market: On May 16, the opening price of RU2309 contract: 12285 yuan/ton, the highest price: 12385 yuan/ton, the lowest price: 12185 yuan/ton, and the closing price was 12200 yuan/ton, down 45 yuan/ton from the previous trading day; The opening price of NR2307 contract: 9575 yuan/ton, the highest price: 9600 yuan/ton, the lowest price: 9525 yuan/ton, and the closing price was 9550 yuan/ton, up 10 yuan/ton from the previous trading day.

spot market

Supply:

Foreign countries: Thailand's production areas are basically in the early stages of cutting and have not been fully increased.

China: The rainfall and weather in China's production areas have improved recently. The opening of Yunnan production areas is around 2- 3%, and the opening of Hainan production areas is better than that of Yunnan.

|

price type |

on May 15 |

May 16 |

rise and fall |

units |

||

|

raw material prices |

Thailand |

glue |

43.1 |

43.1 |

0 |

baht/kg |

|

cup glue |

39.85 |

39.75 |

-0.1 |

baht/kg |

||

|

Yunnan |

Glue (into the dry glue factory) |

10000 |

10200 |

200 |

Yuan/ton |

|

|

rubber block |

10100 |

10300 |

200 |

Yuan/ton |

||

|

Hainan |

Glue (into the dry glue factory) |

10900 |

11300 |

400 |

Yuan/ton |

|

|

Glue (Jinnong Dairy Factory) |

11400 |

11600 |

200 |

Yuan/ton |

||

On the demand side: There is still a gap in domestic sales orders for tire companies. Coupled with the support of foreign trade orders, most companies are more motivated to start construction. In addition, the overall shipment performance of the company in the first half of the month was average. With the tire exhibition held and the company's policies followed up, downstream shipments may improve, and the company is actively starting work to ensure normal supply of products.

Futures spot price list

|

price type |

on May 15 |

May 16 |

rise and fall |

units |

||

|

price of finished products |

Shandong |

China All Latex |

11900 |

11950 |

50 |

Yuan/ton |

|

Qingdao |

Thailand No. 20 standard glue |

1375 |

1375 |

0 |

us dollars/ton |

|

|

Qingdao |

Thailand No. 20 mixed glue |

10700 |

10650 |

-50 |

Yuan/ton |

|

|

Ningbo |

Hainan |

8400 |

8400 |

0 |

Yuan/ton |

|

|

Ningbo |

Thailand Non-Yellow Bulk |

9100 |

9100 |

0 |

Yuan/ton |

|

|

futures prices |

SHFE |

RU main contract closing price |

12305 |

12200 |

-105 |

Yuan/ton |

|

INE |

NR main contract closing price |

9565 |

9550 |

-15 |

Yuan/ton |

|

|

the current price difference |

Main force-Thailand No. 20 mixed glue |

1605 |

1550 |

-55 |

Yuan/ton |

|

|

Main force-China All Latex |

405 |

250 |

-155 |

Yuan/ton |

||

|

relevant exchange rate |

us dollar against the RMB |

6.9814 |

6.9764 |

-0.005 |

Yuan |

|

|

Thai Baht to RMB |

0.2132 |

0.2126 |

-0.0006 |

Yuan |

||

market outlook

The raw material glue in China's foreign producing areas has not yet fully entered the stage of increasing quantity, and there is still support on the cost side. The start of tire on the demand side has rebounded. However, the terminal demand is close to the seasonal off-season in the Chinese market. There is accumulated pressure on the finished product inventory of tire factories, and natural rubber social inventories Still maintain a trend of accumulation. In the later period, China's arrival in Hong Kong may be caused by the seasonal low production period. However, the actual demand situation is weak, dragging rubber prices out of motivation and maintaining a volatile trend in the short term.