- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

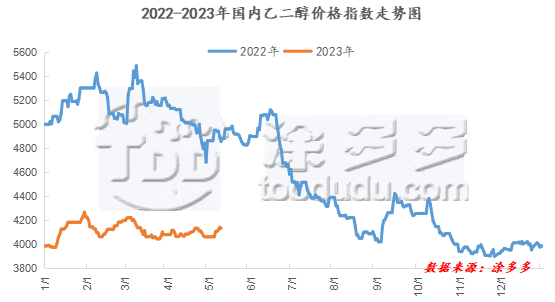

On May 16, the market price index of ethylene glycol was 4159.54, down 12.72 from yesterday.

Market focus:

1. OPEC+ production cuts are still expected to tighten supply, adding that the United States may replenish strategic reserves in June, and international oil prices will rise. Ice crude oil futures 06 rose by US $1.07 per barrel or 1.53% by NYMEX crude oil futures 07 or 1.43% by US $1.06 per barrel or 1.43%.

2. The 300000-ton syngas MEG plant in Weihe, Shaanxi Province began to be shut down and overhauled on May 8th, which is expected to last for 15-20 days.

3. Xinjiang Tianye 600000-ton ethylene glycol plant is stopped for maintenance, which is planned for one month, and the 50, 000-ton ethylene glycol plant in the old area operates normally.

Futures trends:

On May 16, 2023, the opening price of the EG main contract 2309 is 4353, the highest price is 4361, the lowest price is 4295, the settlement price is 4321, the closing price is 4321, and the position is 423188, down 45 or 1.03% from the previous working day.

Spot market: today, the price of ethylene glycol market is fluctuating, and the futures market is fluctuating in a narrow range. Although there is still some support in the cost side, due to the weak demand downstream, the cautious mood of the operators in the market is gradually rising. Specifically, the center of gravity of the MEG inner disk is weak in the morning, and the market talks are general. At present, the spot base difference is near the 09 contract discount of 95-100 yuan / ton, the negotiation is 4205-4210 yuan / ton, and part of the transaction revolves around 4210-4235 yuan / ton. In the afternoon, the center of gravity of MEG inner disk is weak, and the market buys gas in general. At present, the spot base difference is near the 09 contract discount of 95-100 yuan / ton, the negotiation is 4215-4220 yuan / ton, and part of the family revolves around 4210-4220 yuan / ton. As of press time, the quotation in South China revolves around 4450 yuan / ton, maintaining that yesterday, some manufacturers' quotations are strong, and the overall trading atmosphere in the market is light; the quotation in East China is around 4245 yuan / ton, down 18 yuan / ton from yesterday.

List of market prices on the outer disk:

|

Market |

Price terms |

2023/5/16 |

2023/5/15 |

Rise and fall |

Unit |

|

China |

CFR |

514-516 |

514-516 |

0 |

Us Dollar per ton |

|

Gulf of America |

FOB |

18-20 |

18-20 |

0 |

Cents per pound |

|

Southeast Asia |

CFR |

527-529 |

527-529 |

0 |

Us Dollar per ton |

|

Northwest Europe |

CIF |

458-462 |

458-462 |

0 |

Euro per tonne |

List of mainstream market prices:

|

Area |

2023/5/16 |

2023/5/15 |

Rise and fall |

Unit |

|

The whole country |

4159.54 |

4172.26 |

-12.72 |

|

|

South China |

4450 |

4450 |

0 |

Yuan per ton |

|

East China region |

4245 |

4263 |

-18 |

Yuan per ton |

Enterprise price list:

Unit: yuan / ton

|

Area |

Production enterprise |

2023/5/16 |

2023/5/15 |

Rise and fall |

Remarks |

|

Northeast China |

Jilin Petrochemical Corporation |

3950 |

3950 |

0 |

|

|

Fushun petrochemical |

3950 |

3950 |

0 |

|

|

|

Northwestern region |

Duzishan petrochemical |

4200 |

4200 |

0 |

|

|

Shandong area |

Hua Lu Hengsheng |

4100 |

4100 |

0 |

|

|

North China region |

Tianjin Petrochemical Company |

4250 |

4250 |

0 |

|

|

Yanshan Petrochemical |

4250 |

4250 |

0 |

|

|

|

Shanxi Woneng |

3800 |

3800 |

0 |

|

|

|

East China region |

Shanghai Sinopec |

4250 |

4250 |

0 |

|

|

Sinopec |

4275 |

4275 |

0 |

April settlement |

|

|

Sinopec |

4350 |

4350 |

0 |

Listed in May |

|

|

Yangtze Refining and Chemical Industry |

4250 |

4250 |

0 |

|

|

|

Central China |

Sinopec |

4100 |

4100 |

0 |

|

|

Sanning, Hubei |

4230 |

4230 |

0 |

|

|

|

South China |

Chinese Science Refining and Chemical Industry |

4250 |

4200 |

50 |

|

|

Maoming Petrochemical |

4250 |

4200 |

50 |

|

|

|

Southwest China |

Sichuan Petrochemical Company |

4150 |

4150 |

0 |

|

Future forecast:

Recently, although the crude oil price is weak and the cost is generally supported, the current market price of ethylene glycol is less affected by this. With the plant overhaul landing, Zhejiang Petrochemical Line 1 750000, Xinjiang Tianye 600000 and Shaan Coal 600000, market start-up has declined, local supply has been reduced, supply pressure has been alleviated to support the mentality of operators, and with the reduction of raw material prices. The cost pressure of some downstream enterprises has been alleviated, and the mentality of some operators has improved slightly. At present, with the easing of the contradiction between supply and demand in the Chinese market, the mentality of some operators in the market is good, and it is expected that the high price of ethylene glycol market will be arranged in the short term, and in the later stage, we need to pay close attention to the prices of crude oil and coal as well as the operation of the plant in the field.