- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Market analysis

In the second quarter of 2023, China's ethanol supply is sufficient, downstream chemical industry rigid demand procurement, the supply exceeds the demand, the market price continues to decline. However, at the end of the quarter, it was supported by a reduction in supply-side news, as well as a rise in procurement prices for downstream rigid demand.

Comparison of ethanol prices in the second quarter of 2023

|

|

April average price (yuan / ton) |

Average price in May (yuan / ton) |

Average price in June (yuan / ton) |

|

The general level in northern Jiangsu |

6578.33 |

6497.92 |

6412.50 |

|

Jilin Puji class |

6358.67 |

6287.50 |

6110.00 |

|

General level in Heilongjiang |

6290.00 |

6204.17 |

6000.00 |

|

Henan excellent grade |

6636.00 |

6595.21 |

6451.50 |

In April, the price of corn ethanol in Northeast China first stabilized and then became stable. After the price in Henan fell to a low, the order increased and rebounded, driven by the rising atmosphere. At the same time, the Heilongjiang big factory released the downtime news on the 15th of this month. The price rose 100 yuan / ton, but due to the previous release of the price increase news, rigid demand customers concentrated to sign orders, after the price increase, there were not many orders, and enterprises carried out more previous orders. There has been an increase in pre-holiday stock, as well as a rise in high-speed traffic restrictions and ex-factory prices for unfavorable enterprises. This month, large factories and small lines in Jilin region continued to shut down, the inventory was high, and the early price was slightly better than that of Heilongjiang. In the later period, due to the rise in prices in Heilongjiang and Henan, Jilin prices rose by 50 yuan / ton. In addition, Dongfeng plant shut down on April 17, reducing supply is good news, supporting enterprise prices to rise. However, from the demand side, the demand is limited, there are not many orders after rising, the price tends to be stable in the later stage, and the order is executed. The price of fuel ethanol has risen. Three fuel ethanol plants in Heilongjiang were shut down this month, reducing production by a total of 2700 tons / day. On April 17, coal ethanol Yushenneng reduced 500000 tons / year of plant failure, reduced supply by 1350 tons / day, and concentrated stock in two oil and local refineries before the festival. The price of two oil tends to stabilize this month, and the price of receiving goods in local refineries continues to rise due to the reduction of supply. Positive factors supported the rise in fuel ethanol prices this month. Corn ethanol in Henan shows the trend of "N" shape. There are not many early orders, and the surrounding prices are not high, cross-regional arbitrage closes Henan inventory increases, enterprises continue to lower offers to stimulate shipments, when the superior price is reduced to 6520 yuan / ton, regional arbitrage opens, orders increase enterprise depot obviously, in addition, the unstable supply of the three ethanol production plants in Mengzhou reduces to support the price rise. After the price rose to a high level, the shipment began to be unsmooth, the enterprise lowered the quotation slightly, and the news of enterprise downtime in the later period of the month was released, supporting the price to rise. After rising, the market feedback was not high, and the price continued to fall. The price of cassava ethanol in eastern China weakened due to a small downward range supported by costs. The rise in prices in Northeast China and Henan led to shipments in East China, but the overall transaction in East China was limited, which did not drive prices up. The shipping price of the small factory is lower than that of the big factory, and the price of the big factory is reduced by 50 yuan / ton in the last ten days of the month. In the last ten days of this month, Anhui COFCO put into production at the general level, with an increase in supply and a negative market mentality. Before the festival, a small amount of stock in Shandong / northern Jiangsu relieves inventory pressure, but the overall price has not been adjusted. The ethanol market in South China is mainly stable, the start-up load of the main factories in Guangxi first fell and then increased, and the demand in the lower reaches of the market did not increase significantly. Cassava ethanol plants reduced quantity and eliminated inventory in the middle and first ten days, and most production enterprises were reluctant to reduce prices under cost pressure, but downstream profits were not good. There is also resistance in the upstream transmission, and the market maintains a stalemate. Dongguan corn ethanol goods are not fast, price fluctuations are limited.

Ethanol prices in China continued to weaken in May, while corn ethanol prices in Northeast China weakened. The installation of the large factory in Heilongjiang in Northeast China resumed at the beginning of this month, and the enthusiasm of enterprises in producing food is not high, mainly in the production of fuel. Enterprises with weak food demand continuously lowered their offers to stimulate shipments, but the continuous price reduction did not bring large orders. Under the influence of the continuous bearish mentality of the future, the market purchased multiple rigid demand and small orders, and under the positive mentality of other shipments, the terminal shipping price was on the low side. Low-price market fermentation and downstream demand is not high and high-price source of goods is not smooth. In this case, the volume in the market intensified, and the first phase of the plant in Heilongjiang was shut down on May 27. But it did not bring about an improvement in the market. The surrounding market, Jilin Xintianlong downtime and maintenance market, has been in stock for about 15 days. In terms of large factories, individual inventory is high, and the shipping mentality is more positive, but the demand and the price delivered to the sales area are higher than the local source price. Enterprise factory prices continue to weaken to stimulate orders. The price of fuel ethanol weakened slightly. Two fermented fuel ethanol plants resumed this month, with a total increase of 1800 tons per day, but Hongzhan set started on May 6 and Helen began feeding on May 24. The coal-based elm Shenneng chemical plant resumed external sales, and the output of coal-based ethanol increased, impacting part of the fermented ethanol market. The price of refining and receiving goods in China in the region continues to weaken. The prices of the two oil are stable this month, and the price negotiations at the end of the month and next month began to lower the price of PetroChina to varying degrees. The price of corn ethanol in Henan is 200 yuan / ton. The Mengzhou Houyuan plant in Henan area is unstable and opens after a short stop. during the short stop period, it does not have an obvious effect to pull up the market price alone. Liquor has entered the off-season, and the overall demand has declined, but except for Hanyong line production, other full production has been produced. Inventory increases and prices weaken. The weak price of cassava ethanol in East China, the positive shipping mentality of individual enterprises and the low purchase volume of downstream chemical industry lead to the continuous weakness of market price. Some small factories in northern Jiangsu stopped, two factories in southern Jiangsu resumed, the supply in Anhui was sufficient, and the devices of large chemical plants downstream were shut down for overhaul. on the whole, the supply exceeded the demand, and the shipping mentality actively supported the downward price. The ethanol market in South China fluctuates in a narrow range, the main factories in Guangxi are shut down, and there are still factory maintenance plans at the end of May, but the market lacks a boost, prices in the surrounding areas are weak, and the center of gravity of the South China market is slightly weaker. The spot consumption of corn ethanol in Dongguan is slow, there are shipments at the end of April and May, and the price fluctuates limited by cost. During the month, there was a general shutdown of molasses ethanol in Guangxi, which mainly consumed inventory, and high-end supply prices continued to rise.

In June, the price of China's ethanol market remained weak in the first half of the month, the supply fluctuated slightly, the downstream rigid demand was purchased by small orders, and the market supply was greater than the demand. Prices began to rebound in the second half of the month. The news of inspection and repair of some plants of corn ethanol in Northeast China was released, individual factories in Heilongjiang were overhauled, and some factories were restored in the same period, but the overall loss was greater than the new increment, downstream and traders began to purchase large orders under a favorable mentality, and the enterprise inventory was released obviously. the enterprise quotation went up. Specifically, in the market that continued to decline in the first half of the month, downstream and traders purchased many small orders, enterprises shipped sporadically, and corn prices went down to the low point of cost negative impact, prices continued to weaken. In the second half of the month, the exact maintenance time was released and production was reduced, corn prices rebounded, freight rates rose, the market mentality began to change, downstream and traders began to purchase large orders, enterprise inventories declined, and large factories in Heilongjiang rose continuously at the end of the month. Jilin big factory equipment stopped for a short time due to sudden reasons. Fuel ethanol prices fluctuate within a narrow range. Hongzhan Bayan stopped feeding materials on June 20, the early market individual factory inventory higher shipping mentality is positive, the short-term release of low-price contracts to stimulate shipments, low prices after the release of prices to return to normal market levels. Mid-month CNPC procurement, some regional prices slightly rational return. The shipment of coal-based ethanol was good in the last half month, the northwest unit recovered after a short shutdown, the Henan plant recovered and the supply increased. The price of refining and receiving goods in China in the region continues to rise. Two oil prices this month, the price of PetroChina has returned slightly to an ideal level. The price of corn ethanol in Henan continued to weaken to a low price of 6330 yuan / ton in the early month. as the price fell to a low point, cross-regional arbitrage opened, the quantity sent to the chemical sales area increased, after the order increased, the price continued to rise, and there were more vehicles queued in front of enterprises. by the end of the month, the superior offer for ethanol reached 6450 yuan / ton. The price of cassava ethanol in East China weakened in the first half of the month and began to rebound at the end of next month. The start of work in East China was not high and low-load production, but in the first half of the month, the market demand was low and the price continued to weak. in the second half of the month, with the release of the news of maintenance of the main factories in Northeast China, as well as the low willingness of cassava ethanol enterprises in East China to purchase raw materials, the supply side is good to support, and the purchase of large chemical factories downstream is active, and the transaction price is higher. Drive up the positive mentality of the market. The price in South China market is weak at first and then heard later. The start-up load in South China is low, corn ethanol consumption inventory in the northeast of Dongguan is dominant, shipments to South China are still cautious, part of Anhui supply to South China during the month, and market demand in South China has not changed, the market trading atmosphere is deadlocked, and price fluctuations are limited. Guangxi molasses ethanol is generally shut down, mainly consumes inventory, the supply and demand are weak, and the price is mainly stable.

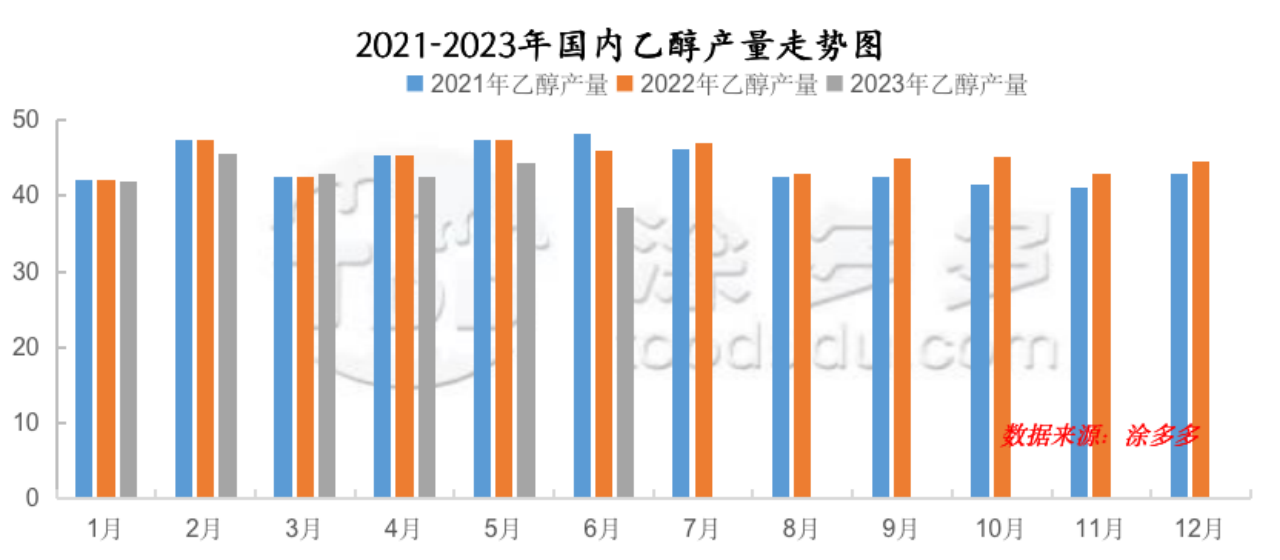

On the supply side

The output of edible and industrial ethanol was 1.25305 million tons in the second quarter and 384300 tons in June. due to the high cost in East China, the market price of ethanol continued to weaken, the uncompetitive enterprise devices began to shut down, and the load of large factories was halved, and the start-up was reduced to about 37%. Large corn ethanol factories in Northeast China have been overhauled. Because the profit of fuel ethanol production is higher than that of edible fuel, the enthusiasm of enterprises to produce fuel has increased. The output of fuel is higher than that of food. The equipment of large factories in coal-based ethanol is unstable, and the output fluctuates slightly.

Cost and profit

Profit trend of cassava ethanol production in East China and North Jiangsu from 2022 to 2023

Profits from cassava ethanol continued to fall in the second quarter-225.42 in April. Yuan / ton, May-195.13 yuan / ton, April-May, the main Thai exports to China decreased, mainly because the price of ethanol in China continues to weaken, the enthusiasm of enterprises to produce losses is not high, the amount of cassava dried feed purchased in the early stage decreased with the low prices of other alternatives in China, Thailand reduced price sales, with the general foreign trade, sea freight began to weaken. In June, the profit of cassava ethanol production fell to- 284.75 yuan per ton, RMB depreciated, import costs increased, ethanol market prices continued to bottom, ethanol production profits continued to decline.

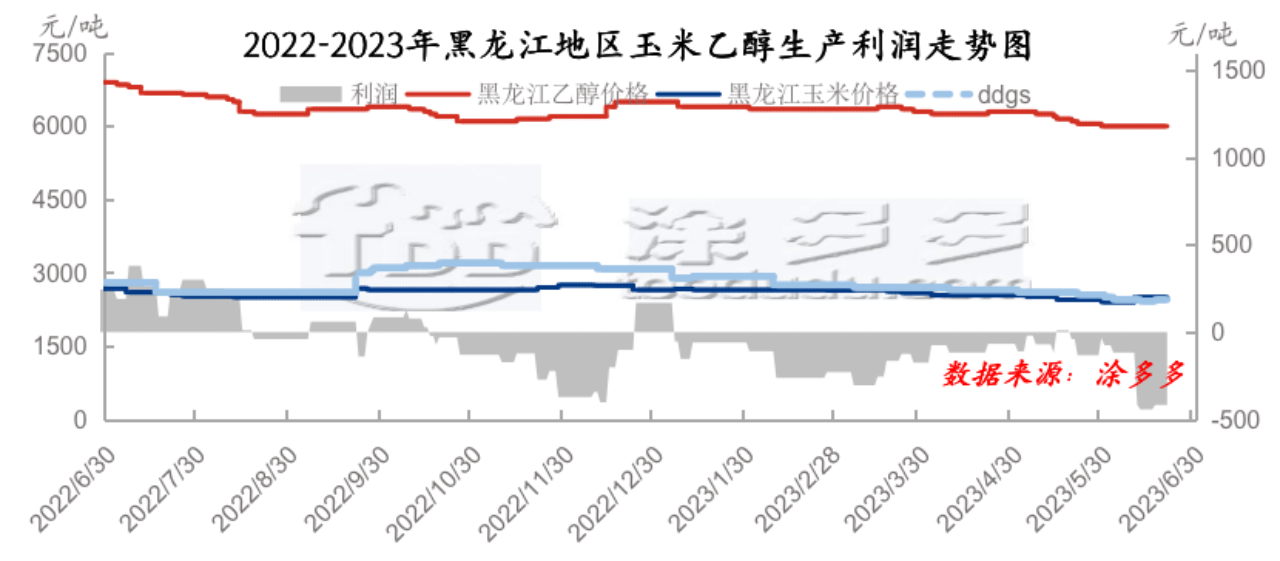

Profit trend of ethanol production in Heilongjiang, Northeast China from 2022 to 2023

Heilongjiang corn ethanol profit-97.83 yuan / ton in April, Heilongjiang corn ethanol profit-70.81 yuan / ton in May, production profit rebounded from April to May, the reason for the decline in raw material prices and costs. Although the prices of ethanol and by-products are also falling at the same time, the overall decline is less than that of corn. The profit of corn ethanol in Heilongjiang in June is-276.67 yuan / ton. Ethanol enterprises in order to reduce ddgs inventory sales, corn prices began to rebound slightly, ethanol market prices continued to fall to a low, what's more, large terminal customers dropped to less than 6000 yuan / ton, corn ethanol production profits continued to lose.

Downstream demand

In 2023, liquor consumption decreased significantly, large factories increased self-brewing, and external production decreased to a low point. The demand for spirits began in the off-season in the late second quarter, and the demand for spirits continued to decline. In the second quarter, chemical demand was worse than expected, ethyl acetate started to decline, Thorpe plant overhaul, Anhui Huayi reduced production, Anhui Ruibo shutdown, Jinjiang unstable. For other chemicals, the market feedback part of the downstream terminal plant demand is too poor and the start-up time is short. Methyl ethyl carbonate planned to increase production capacity failed to put into production as scheduled, upstream and downstream losses, poor start-up of the industry as a whole, enterprises with a long industrial chain put into production a new line, the cost advantage, start-up is relatively stable, the start time of other factories is uneven. The overall start-up is less than 50%.

Future forecast

It is expected that at the beginning of the third quarter, large factories in Northeast China will have an overhaul plan. Construction in East China will reach about 23%, the overall supply will decrease, enterprises will report rising prices, and the supply side will basically end in August. East China will be more cautious in purchasing raw materials as the price of dried cassava remains high due to lower inventory, the RMB exchange rate depreciates, the import cost increases, and the high price in the ethanol market is unstable. The construction of cassava ethanol in East China is not high, and the price of ethanol is high in the case of low supply from July to August. In September, a new round of corn listing in central China, imported corn to Hong Kong, the cost side favorable support gradually weakened. As the temperature drops, the chances of overhauling the northeast corn ethanol plant are not high, and the supply is maintained. Demand side liquor has increased from September to later, but overall liquor demand is reduced. New ethyl ester plants are planned to be put into production in the third and fourth quarters of the chemical industry, and methyl ethyl ester is also planned to be put into production. If the planned production capacity can be put into production as scheduled, the consumption of ethanol production surface will increase, at the same time, the macro positive side will also bring improvement to the demand side of the ethanol market.