- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

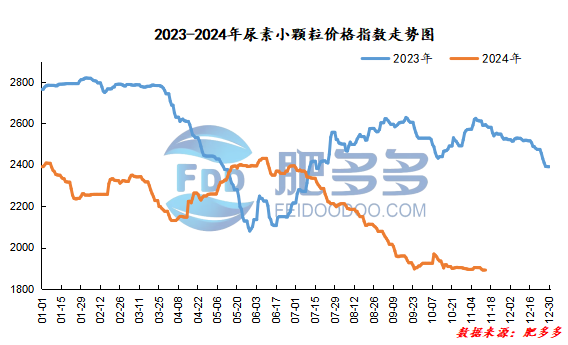

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 14 was 1,886.68, a decrease of 4.36 from yesterday, a month-on-month decrease of 0.23% and a year-on-year decrease of 27.30%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1790, the highest price is 1799, the lowest price is 1778, the settlement price is 1787, and the closing price is 17% lower than the settlement price of the previous trading day, down 0.95% month-on-month. The fluctuation range throughout the day is 1778-1799; the basis of the 01 contract in Shandong is 30; the 01 contract has increased its position by 7467 lots today, and the position held so far is 189461 lots.

Urea futures prices fell slightly today, mainly following the weakening of the overall market environment. The weak pattern of urea itself with large fundamentals is difficult to change, but the current price valuation has been basically fully priced. There is still expected support for supply-side reductions and a narrowing of the supply and demand gap in reserve demand. There is also a certain cost support, and it will continue to be pushed down to the previous low point. It is also difficult to maintain a narrow range of shocks in the short term and wait for new drivers.

Spot market analysis:

Today, the price of urea in China has dropped slightly, and the market has adjusted within a narrow range. After experiencing a low price level, in the face of a continued loose supply and demand situation, it is difficult to see any changes in the market. Corporate inventories continue to fluctuate at high levels, prices are weak upward, and short-term weakness is dominated.

Specifically, prices in Northeast China have been lowered to 1,870 - 1,930 yuan/ton. Prices in East China have been lowered to 1,790 - 1,840 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,800 - 1,950 yuan/ton, and the price of large particles has been lowered to 1,840 - 1,940 yuan/ton. Prices in North China have been lowered to 1,750 - 1,910 yuan/ton. Prices in South China have been lowered to 1,950 - 2,030 yuan/ton. Prices in the northwest region are stable at 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,860 - 2,150 yuan/ton.

Market outlook forecast:

In terms of factories, after a slight reduction in corporate quotations this week and a slight increase in transactions, corporate quotations rebounded and rose slightly. The current price increase lacks motivation to continue to increase, the market growth has slowed down, and prices have stabilized. Supported by short-term pending orders, the quotations have temporarily remained firm. In terms of the market, transactions in some areas on the floor were still okay. After a round of low-price transactions, the trading atmosphere on the floor was slightly boosted. The current follow-up trend has increased. The mentality of the operators has been cautious in following up, and the market continues to operate at a low and volatile level. In terms of supply, Nissan is still at a relatively high level, and corporate inventories continue to increase simultaneously. Inventories and Nissan continue to maintain high levels. The start of gas companies in the second half of this month will show seasonal declines. There is still room for downward supply, and attention will be paid to the dynamics of equipment parking. On the demand side, the current demand for some reserves continues to buy and open positions, and downstream purchases are mainly in need of bargain hunting. The willingness to purchase at high prices in the market after the current price increase has weakened. Many sporadic and small orders are followed up, and the mentality is cautious and wait-and-see. Demand is facing limited upward price support.

On the whole, the current supply and demand fundamentals of China's urea market continue to show a loose trend. The easing trend of supply and demand has not yet been reversed. The market has risen slightly and then stabilized. It is expected that the urea market will mainly fluctuate within a narrow range in a short period of time, and prices may remain stable.