343

November 13, 2024, 4:26 PM

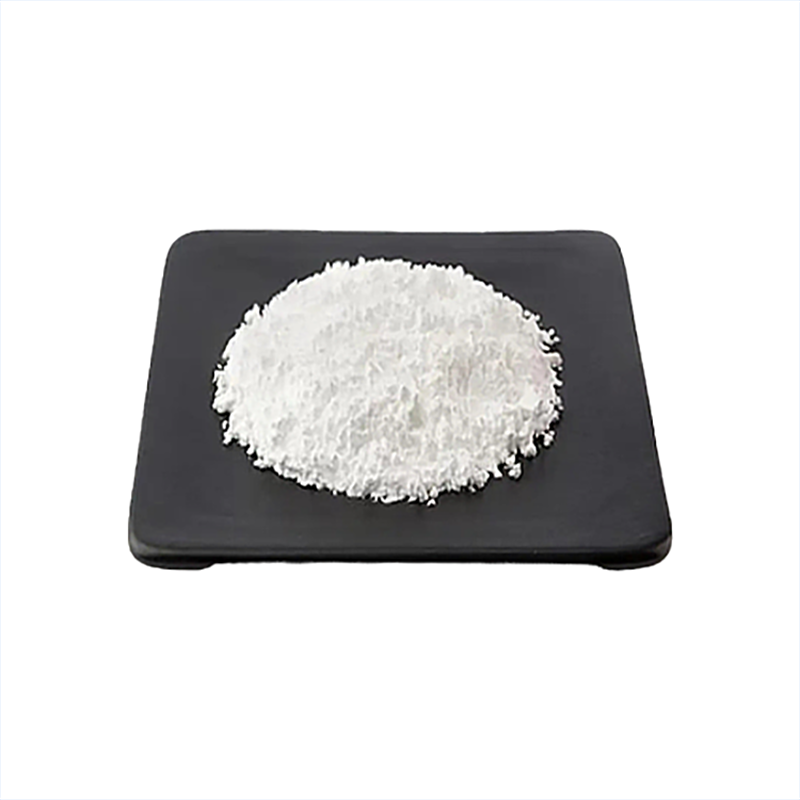

Analysis of soda ash market

Today, China's soda ash market is operating weakly and steadily. As of now, the price of light soda ash in South China is 1,650 - 1,700 yuan/ton, and the price of heavy soda ash is 1,700 - 1,800 yuan/ton; the price of light soda ash in Northeast China is 1,700 - 1,800 yuan/ton, and the price of heavy soda ash is 1,700 - 1,800 yuan/ton. Soda ash units were stable and small, with individual units adjusted slightly; downstream demand fluctuated little, and a small amount of replenishment was maintained, making purchasing caution difficult to change; although futures prices have risen, the spot market transactions performed generally and prices have remained stable.

Futures dynamics

According to Boduo data, the opening price of SA2501, the main contract for soda ash, on November 13, was 1505 yuan/ton, and finally closed at 1524 yuan/ton, an increase of 2.83% within the day. The intraday high was 1524 yuan/ton, the lowest was 1493 yuan/ton, with a total position of 1167590 lots, a month-on-month-on-month.

Today, soda ash futures prices rebounded mainly in shock, following overall market sentiment on the one handGame Tonight's US CPI data stabilizes the Federal Reserve and China's central bank's expectations of interest rates. On the other hand, news of disruption to the supply of soda ash itself continues. The market is worried that high-cost companies will reduce production, and short risk aversion still exists. Overall, the expected logic of increasing and decreasing the fundamentals of soda ash itself cannot be effectively improved, and the price suppression is still strong. However, the current price is supported by the cost support of some companies and the relatively strong downstream glass fundamentals. Support. Follow-up observation is made whether the supply-side disturbance problem is further fermented and given upward drive or downward drive caused by demand collapse after the downstream weakens.

market outlook

Subsequent new soda ash units are planned to be launched, and the market supply will consolidate at a high level; downstream demand will perform poorly, and more low-priced and on-demand purchases will be made, resulting in a strong wait-and-see attitude; the market is expected to remain weak in the short term.