- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

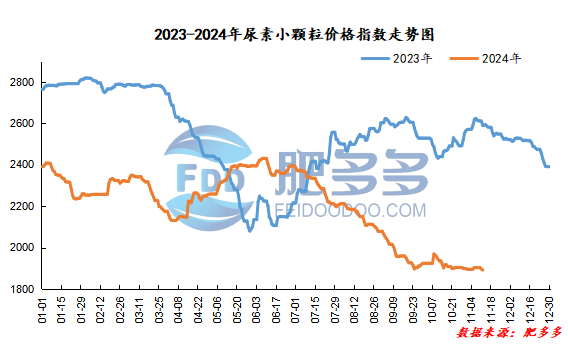

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 12 was 1,891.05, a decrease of 5.00 from yesterday, a month-on-month decrease of 0.26% and a year-on-year decrease of 27.00%.

Urea futures market:

Today, the opening price of the urea UR501 contract is 1781, the highest price is 1798, the lowest price is 1772, the settlement price is 1785, the closing price is 16% lower than the settlement price of the previous trading day, down 0.89% month-on-month, and the fluctuation range throughout the day is 1772-1798; the basis of the 01 contract in Shandong is 15; the 01 contract has increased its position by 8210 lots today, and so far, it has held 187797 lots.

Today, urea futures prices fluctuated mainly within a narrow range with the market environment opening lower.At present, the general logic of excess urea itself and policy supervision still suppress the space above prices, and the support is also weakened by the cooling of overall market macro sentiment. However, in the short term, there are still expected support from supply-side costs and reductions and reserve demand, and low-priced bottom-hunting funds also exist.

Spot market analysis:

Today, the price of urea market in China is weak and downward, and the supply pressure of the urea industry is still high. However, the market with low prices still has a certain "bottom-hunting" mentality, and the market is fluctuating within a narrow range at low prices.

Specifically, prices in Northeast China have stabilized at 1,890 - 1,930 yuan/ton. Prices in East China have been lowered to 1,790 - 1,830 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,800 - 1,960 yuan/ton, and the price of large particles has stabilized at 1,860 - 1,940 yuan/ton. Prices in North China have stabilized at 1,750 - 1,930 yuan/ton. Prices in South China have been lowered to 1,950 -2020 yuan/ton. Prices in the northwest region are stable at 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,860 - 2,150 yuan/ton.

Market outlook forecast:

In terms of factories, market follow-up is not good, and new orders are relatively limited. Currently, production and sales in various regions are at low levels. The pressure on enterprises to go to the warehouse is still obvious. The pressure on industry inventories is great. The prices of enterprises in some mainstream regions have been significantly lowered, and offers have been slightly loosened. In terms of the market, mainstream regional companies have been light in new orders, operators are cautious in receiving goods, market activity is limited, lack of obvious news guidance, and the overall market is weak and moving downward. In terms of supply, the current supply continues to be high, and Nissan continues to show an increasing trend. In addition, gas companies will gradually show seasonal parking in November and December, and the industry's Nissan is still expected to decline. On the demand side, the demand side has always been weak. Downstream operators are in a wait-and-see attitude towards the current low prices of enterprises, waiting for the company's quotations to continue to be lowered, and maintaining a cautious mentality of purchasing appropriately at bargain prices. Most of them are mainly buying just needed, with weak support on the demand side. In terms of printing and labeling, India's IPL today released a tender for urea imports, requiring that it be only for the West Coast. A total of 24 suppliers were received, with a total volume of 2.37515 million tons, and a CFR price of US$362/ton.

On the whole, the fundamentals of supply and demand in China's urea market continue to be loose, and the fundamentals still need to wait for the opportunity. It is expected that the urea market will be in a stalemate and volatile operation in a short period of time, and prices will be weakened.