- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Analysis of PVC futures: On November 12, the opening price of the V2501 contract: 5320, the highest price: 5358, the lowest price: 5311, the position: 843369, the settlement price: 5335, yesterday's settlement: 5338, down 3, daily trading volume: 671277 lots, deposited funds: 3.533 billion, and capital outflow: 64.77 million.

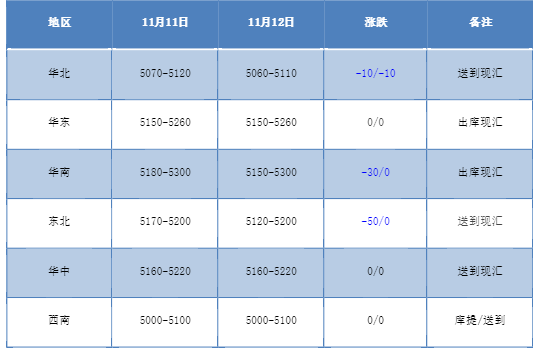

Comprehensive price list by region: RMB/ton

PVC spot market: Mainstream transaction prices in China's PVC market remained weak, with slight flexible adjustments in various regions. Comparison of valuation: North China fell by 10 yuan/ton, East China remained stable, South China's low-end fell by 30 yuan/ton, Northeast China's low-end fell by 50 yuan/ton, Central China's stable, and Southwest China's stable. Most of the quotations from upstream PVC production companies remained stable, with some prices making up for the decline slightly. The quotations from production companies were relatively positive, but the contract base volume was the main one. Futures are arranged in a narrow range at low positions. The quotes of merchants in the spot market are slightly flexibly adjusted based on their own shipments, and the basis adjustment is not large. Among them, the basis for Eastern China is 01 contract-(150-180), South China is 01 contract-(0-80), Northern China is 01 contract-(360-400), Southwest China is 01 contract-(620), and some goods is 01 contract-(200). Overall, traders reported that transactions were flat today, there were still slight discussions on actual orders, and some point-priced sources had price advantages. Downstream procurement enthusiasm is average.

From a futures perspective: The night price of the PVC2501 contract was slightly adjusted, and the range of fluctuations in the futures price narrowed. Prices continued to consolidate and operate in early trading and later periods, with a slight increase in intraday trading. Afternoon futures prices fluctuated until the end on the basis of a small rise. The 2501 contract fluctuated throughout the day from 5,311 to 5,358, with a spread of 47.01 contracts reduced its position by 19984 lots. As of now, 943369 lots have been held. The 2505 contract closed at 5681, with 147191 lots held.

PVC market outlook forecast:

Futures: The PVC2501 contract futures market has been adjusted within a narrow range. First, the fluctuation range of the futures price is relatively small, only 47 points throughout the day. Secondly, the futures price lacks a certain direction of fluctuation at the low level, and the low point of the futures price is under the lower track of the Bollinger Band. The support level works temporarily. The technical level shows that the three-track opening of the Bollinger Band (13, 13, and 2) diverges, and the daily DK line and MACD line continue to show a dead fork trend. The market showed a certain trend of reducing positions. From the perspective of transactions, the number of transactions was flat at 25.2%, compared with the number of positions was flat at 24.3%. The number of transactions increased. The cultural goods index continued to weaken. At the close of the afternoon, it still fell more and more. However, as far as PVC single products are concerned, there is a lack of directionality at the lower rail position, and fluctuations in futures prices in the short term continue to observe the range of 5,280 - 5,400 between the middle and lower rails.

In terms of spot: Currently, the two cities remain weak today, especially the spot market, which is dominated by small flexible consolidation. From the perspective of PVC supply and demand, the starting load of PVC units is high, the supply is abundant and stable, and the demand continues to be dominated by demand, and no additional demand has been generated. And as time goes on, demand is expected to weaken to a certain extent. There are still certain contradictions at the supply and demand level, and the constraints of high inventories are relatively obvious. On the external front, prices in the international crude oil futures market fell sharply. The market was waiting for new policies from the U.S. government. The supply risks brought by the U.S. hurricane have weakened, lingering concerns about slowing global oil demand, and the prospect of easing geopolitical tensions have also dragged down the decline in oil prices. In addition, China announced a massive debt swap plan last week, but did not introduce new stimulus measures, dampening market sentiment. Overall, the PVC spot market will continue to be mainly low in the short term.