- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

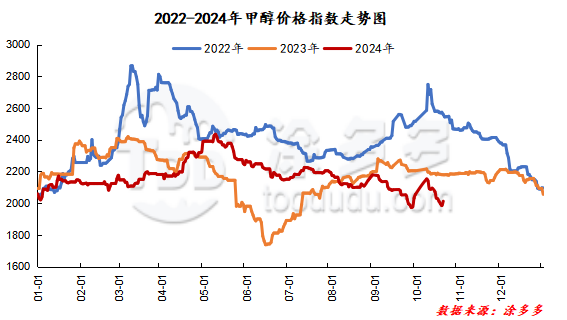

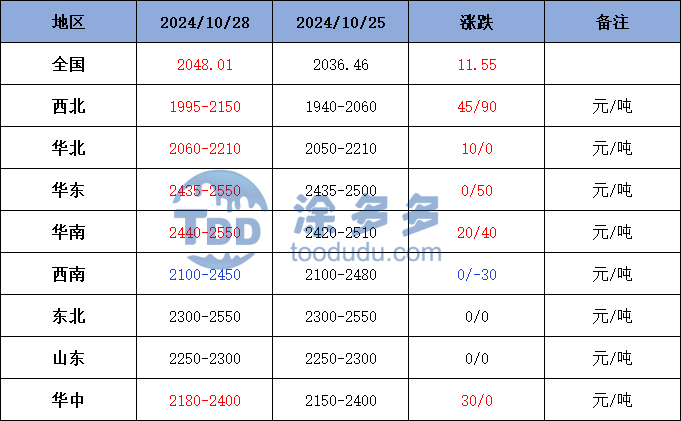

On October 28, the methanol market price index was 2,048.01, an increase of 11.55 from the previous working day and an increase of 0.57% month-on-month.

Spot market analysis:

Today, the increase in methanol market prices increased, and futures prices fluctuated upwards, which supported the mentality of market operators to a certain extent. The quotation in the China market was increased along with the market. The bidding performance of some companies in the main producing areas was fair, and many transactions were sold at a premium. Specifically, the market prices in the main producing areas have been adjusted within a narrow range. The price for the southern line of Inner Mongolia is around 2000 yuan/ton, and the price for the northern line of Inner Mongolia is around 1980 yuan/ton. The low-end is increased by 40 yuan/ton. The futures market has fluctuated higher, which has a lot to the spot market. Boosted, manufacturers in the region bid and companies all traded at a premium, and the downstream receiving mood is still good. The starting price of methanol in Yulin Yankuang is 1970 yuan/ton, and the factory withdrawal of 5000 tons is finally all sold at 2010 yuan/ton; Changqing's price this week rose by 70 yuan/ton to 2150 yuan/ton of factory cash withdrawal, and the price for small orders was 2160 yuan/ton of factory cash withdrawal. The market price fluctuations in Shandong, the main consumer area, are limited, with 2,250 - 2,260 yuan/ton in southern Shandong and 2,280 - 2,300 yuan/ton in northern Shandong, with an increase of 20 yuan/ton at the low-end. Recently, freight prices have remained high, and some downstream parties hold certain resistance to the current high prices., and the inventory of raw materials in the downstream market is currently at a high position, and operators are generally enthusiastic about replenishing goods in the market. The market quotation in North China is arranged at a high level. Today, the price in Hebei is 2,180 - 2,210 yuan/ton. The downstream receiving of goods is mainly in need, and the overall trading atmosphere is average; the price in Shanxi is 2,060 - 2,140 yuan/ton today, with an increase of 10 yuan/ton at the low-end. The market trading atmosphere is positive, and manufacturers are very enthusiastic about supporting prices.

Port Market:Today, methanol futures rose and then fluctuated. In recent months, replenishment has been mainly needed, and forward arbitrage has been active and the basis has strengthened. In the afternoon, the atmosphere of negotiations weakened, the basis stabilized, and the monthly difference between the distance and the distance widened slightly. The overall transaction was okay. Transaction price at Taicang Main Port: 10:2435-2490, basis 01-7/-5; 11:2450-2490, basis 01-5/+0; 11:2485, basis 01+8;11:2455-2510, basis 01+15/+20; 12:2520-2540, basis 01+40/+45.

Market outlook forecast:Recently, methanol futures have been strongly volatile, which has supported the mentality of players in the market to a certain extent. The quotations of most manufacturers in China have pushed up, and the overall trading atmosphere in the region is good. However, considering that there is no substantial positive support in the downstream market and some players have certain resistance to the current high prices, players still have caution. In terms of the port market, the current inventory in the port market is still at a high position, but some units in overseas regions are currently operating unstable, and the arrival of imported ships and cargo in the port may decrease in the later period. However, it is necessary to pay close attention to the arrival of imported ships and cargo in the later period. On the whole, it is expected that the methanol market price will adjust within a narrow range in the short term, and market quotes in some regions may continue to push up slightly. However, in the later period, we need to pay close attention to crude oil and coal prices, on-site equipment operation and downstream demand follow-up.