- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

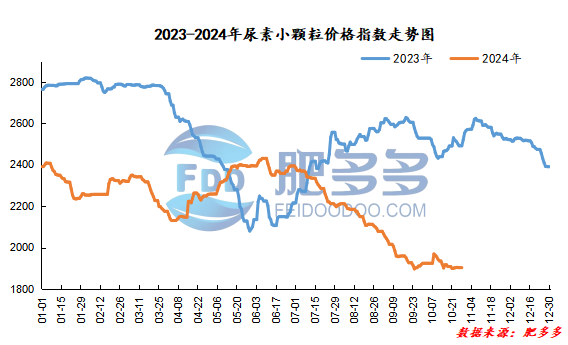

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 28 was 1,901.95, a decrease of 0.91 from last Friday, a month-on-month decrease of 0.05% and a year-on-year decrease of 23.68%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1831, the highest price is 1856, the lowest price is 1811, the settlement price is 1835, and the closing price is 1836. The closing price is 2 lower than the settlement price of the previous trading day, down 0.11% month-on-month. The fluctuation range throughout the day is 1811-1856; The basis of the 01 contract in Shandong is-48; the 01 contract has increased its position by 7166 lots today, and has held 182886 lots so far.

Today's overall urea futures prices fluctuated mainly in a narrow range, mostly following fluctuations in the market environment. At present, the logic of strong fundamentals and weak demand for urea itself still continues. However, recently, macro policy expectations have been frequently disturbed, and market emotional fluctuations have dominated. In the short term, the space above the market is suppressed by fundamentals and regulations, and the space below is suppressed by macro expectations and cost and reserve demand. Support, until there are no new changes in the above two major issues, the market temporarily lacks the drive to break the deadlock, or it will still follow the market environment to maintain a narrow range of shocks.

Spot market analysis:

Today, the price of urea in China has stabilized and dropped slightly. The fundamentals of supply and demand in the market are still loose. The demand for downstream replenishment has weakened. The market has stabilized and is deadlocked, with no significant improvement.

Specifically, prices in Northeast China have stabilized at 1,890 - 1,930 yuan/ton. Prices in East China have stabilized at 1,790 - 1,840 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 1,800 - 2,000 yuan/ton, and the price of large particles has been lowered to 1,870 - 1,960 yuan/ton. Prices in North China have been lowered to 1,750 - 1,930 yuan/ton. Prices in South China have been raised to 1,960 - 2,030 yuan/ton. Prices in the northwest region are stable at 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, orders from manufacturers continue to support, and goods are being shipped one after another, but the number of shipments is gradually reduced. Currently, orders and inventories of urea factories are both high, and the motivation for price increases is still insufficient. Companies are mainly taking orders at low prices, and offers remain stable and adjusted downward.marketWeak and unstable. In terms of the market, market transactions are tepid, the atmosphere is sluggish, the fundamentals of supply and demand continue to be loose, and prices remain low and volatile. The current lack of sustained good news in the market makes the market difficult to move upwards. The downstream purchasing mentality is cautious, and the bargain hunting mentality is appropriate. Follow up mainly. In terms of supply, the autumn fertilizer market has entered the final stage, with reduced fertilizer use. Production in some mainstream areas has been restricted by environmental factors. Supply expectations are expected to decline. Currently, Nissan continues to operate at a high level, and the market spot supply continues to be sufficient. On the demand side, demand continues to advance slowly. After appropriate follow-up and replenishment in the early stage, it will continue to follow up difficulties in the short term. The mentality of waiting and waiting is not to chase after the high, and the demand is maintained in a small amount, mainly based on reserve demand; the start-up of compound fertilizer factories continues to decline, and the consumption of raw materials has been significantly reduced, and the demand of other industries has remained mainly pre-purchased.

On the whole, the current winter storage of urea market in China has been slow to start, the demand atmosphere in the market is sluggish, and the enthusiasm of enterprises for production has begun to decline. Under the loose supply and demand fundamentals, it is expected that the urea market will fluctuate mainly in a narrow range in a short period of time, with high probability of price weakness and low level.