- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on October 23 was 1,902.86, an increase of 1.82% from yesterday, a month-on-month increase of 0.10% and a year-on-year decrease of 24.47%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1828, the highest price is 1844, the lowest price is 1821, the settlement price is 1832, and the closing price is 1828. The closing price is 2 lower than the settlement price of the previous trading day, down 0.11% month-on-month. The fluctuation range throughout the day is 1821-1844; The basis of the 01 contract in Shandong is-18; the 01 contract has reduced its position by 23 lots today, and so far, it has held 175672 lots.

Today, urea futures prices maintained a narrow range of fluctuations, and intraday trends mostly fluctuated with the overall market environment. At present, urea itself lacks actual driving force, and the general logic of overcapacity suppresses the space above, but there is also expected support from cost and reserve demand below. Before new supply and demand drivers emerge, the market may still remain volatile and wait and see whether the overall market environment and important meetings in China at the end of the month can give a strong emotional response from the market.

Spot market analysis:

Today, the price of urea in China is stabilizing and upward. Mainstream regional companies have traded moderate prices at low-end prices, and downstream companies have appropriately followed up on dips. Companies have closed well, and prices have continued to be stable and moderate.

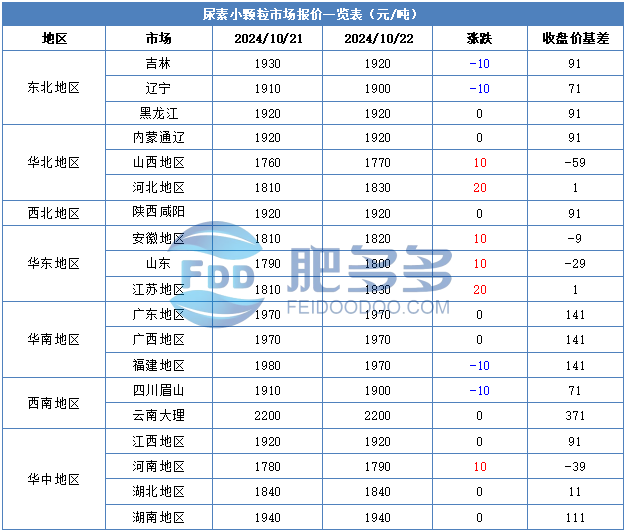

Specifically, prices in Northeast China have stabilized at 1,890 - 1,930 yuan/ton. Prices in East China have been raised to 1,790 - 1,840 yuan/ton. The price of small and medium-sized particles in Central China has been raised to 1,800 - 2,000 yuan/ton, and the price of large particles has been lowered to 1,880 - 1,960 yuan/ton. Prices in North China have stabilized at 1,780 - 1,930 yuan/ton. Prices in South China have been raised to 1,950 - 2,000 yuan/ton. Prices in the northwest region are stable at 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, after the recent downward revision of the quotations of factories in mainstream regions, individual companies have increased their quotations in new orders. Orders to be collected are pending, and subsequent quotations may continue to increase steadily and moderately based on their actual orders. In terms of the market, the futures market has strengthened recently and the market is developing in a positive manner, which has simultaneously driven the purchasing sentiment in the spot market to pick up. Downstream bargains are appropriately followed up. Most low-priced transactions are carried out on the market, and the market's focus is slightly rising. On the supply side, in order to maintain a balance between production and sales, the company has recently stopped some equipment for maintenance, and the industry's output has dropped slightly. The overall daily output has continued to be high, maintaining fluctuations around 190,000 tons. The supply side continues to be sufficient, and the output decline is expected to be limited. On the demand side, after the wheat fertilizer was completed, the demand side followed up and shifted to winter storage. At this stage, the follow-up was less than expected. Downstream operators mainly maintained appropriate purchasing. Most of the external companies just needed to follow up. The demand side performance was flat, and the new orders were only sold.

On the whole, the current focus of urea market negotiations in China has shifted slightly, the fundamentals of supply and demand continue to remain loose, and it is difficult to have strong support for the market to continue to rise. It is expected that urea market prices may continue to stabilize and increase in the short term.