- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

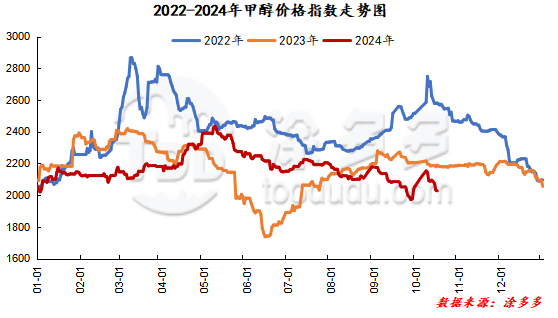

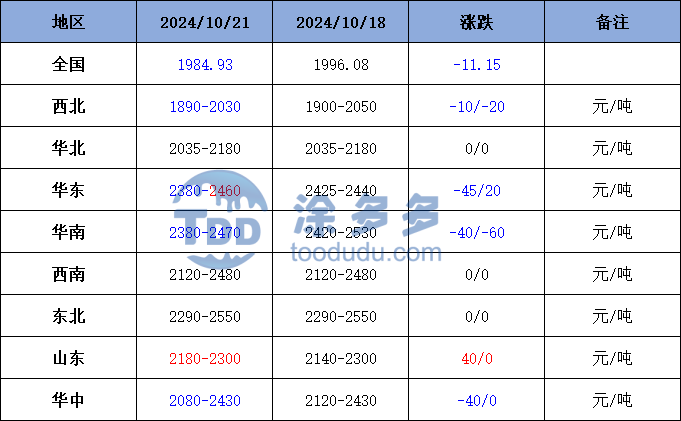

On October 21, the methanol market price index was 1,984.93, down 11.15 from the previous working day and a month-on-month decrease of 0.56%.

External disk dynamics:

Methanol closing on October 18:

China CFR 289-292 US $/ton, down 2 US $/ton;

U.S. FOB 114-115 cents/gallon, up 1 cent/gallon;

Southeast Asia CFR 346-347 US $/ton, flat;

European FOB 393-394 euros/ton, up 13.5 euros/ton.

Today's price summary:

East China: Taicang: 2380-2400 (-45), Zhejiang: 2450-2460 (-40), Anhui: 2340-2350 (-10),

South China: Guangdong: 2380-2390 (-40), Fujian: 2420-2470 (-40)

Shandong: South Shandong: 2220 (0), North Shandong: 2180-2200 (40), Linyi: 2250 (0)

North China: Shanxi: 2035-2100 (0), Hebei: 2130-2180 (0)

Central China: Henan: 2080-2110 (-40), Two Lakes: 2280-2430 (0)

Northwest: Guanzhong: 1980-2030 (-20), northern Shaanxi: 1900-1910 (0), northern Inner Mongolia: 1890-1920 (-10), southern Inner Mongolia: 1930 (-10), Xinjiang: 1900-2030 (0)

Northeast: Liaoning: 2290-2400 (-110), Heilongjiang: 2550 (0)

Southwest: Yungui: 2190-2350 (0), Sichuan and Chongqing: 2120-2480 (0)

Spot market analysis:

Today, methanol market prices continued to operate in a weak position. Futures fell below the 2400 mark, which was negative for the mentality of players in the market. Coupled with the current poor performance of downstream market demand, players were not enthusiastic about entering the market to replenish stocks, and the market transaction atmosphere was mixed. Specifically, the market prices in the main producing areas have been adjusted within a narrow range. The price of the Inner Mongolia southern line is around 1930 yuan/ton, down 10 yuan/ton, the price of the Inner Mongolia northern line is around 1890- 1,920 yuan/ton, and the low-end is down 10 yuan/ton. Rongxin today auctioned for 8000 tons of methanol, and finally all 1890 yuan/ton were sold; at present, the methanol market still maintains a pattern of strong supply and weak demand. Most operators hold a bearish and wait-and-see attitude towards the future outlook, and traders actively ship mainly. The market price fluctuations in Shandong, the main consumer area, are limited, with 2220 yuan/ton in southern Shandong and 2,180 - 2,200 yuan/ton in northern Shandong. The futures market continues to fall, and the mentality of players in the market is not good. At the beginning of the week, the market wait-and-see attitude is more obvious, and they are concerned about tomorrow's market bidding situation. Market quotes in North China fluctuated and fell back. Today, Hebei quoted 2,130 - 2,180 yuan/ton. The market wait-and-see atmosphere is strong, and methanol manufacturers have not yet issued new prices; Shanxi quoted 2,035 - 2,100 yuan/ton today. Currently, methanol futures are in a poor market, and there is no good information on the market to boost, and the industry has an obvious wait-and-see attitude.

Port Market:Today, methanol futures fell violently. A small amount of cash is just needed, and the transaction is at the right price. Paper goods received unilaterally on dips, and the basis stabilized slightly; the idea of replacing goods continued. The overall transaction was okay. Transaction price at Taicang Main Port: Spot transaction: 2380-2400, basis 01-12/-10; transaction under 10:2380-2400, basis 01-5/-1; transaction under 11:2405-2430, basis 01+20/+24.

Market outlook forecast:At present, the overall performance of methanol fundamentals is average. Most units in the China market are operating relatively stably, and the market starts have maintained a high level. In the short term, it may be difficult to see a significant gap in the supply side, and the futures market continues to weaken. The pessimism of players in the market is more obvious, and the overall market transaction atmosphere is mixed. In terms of the port market, the ports where ships and cargo have been imported have been relatively stable recently, and the inventory in the port market may continue to accumulate. At present, the overall fundamentals of methanol itself are weak, and some industry operators still have a certain wait-and-see attitude towards the future outlook. In the later stage, they still need to pay close attention to the release of macro policies and the operation of on-site equipment.