- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

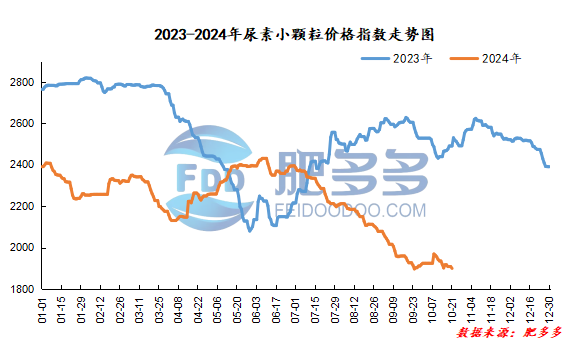

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 21 was 1,899.09, a decrease of 8.95% from last Friday, a month-on-month decrease of 0.47% and a year-on-year decrease of 23.76%.

Urea futures market:

Today, the opening price of the Urea UR501 contract: 1815, the highest price: 1833, the lowest price: 1791, the settlement price: 1813, the closing price: 1829. The closing price increased by 16 compared with the settlement price of the previous trading day, up 0.88% month-on-month, and the fluctuation range throughout the day is 1791-1813; the basis of the 01 contract in Shandong-39; the 01 contract increased its position by 764 lots today, and so far, it has held 179863 lots.

Today, urea futures prices opened significantly lower as sentiment driven by the weakening of the spot market over the weekend and news of loose exports began to fade, but then rebounded following the volatile market environment.At present, the general logic of excess urea itself and policy supervision still have a high degree of suppression of price rebound. Moreover, under the premise of loose supply, it is difficult to improve downstream willingness to hold goods, and prices lack a strong driving force. Although there are future reserve expectations on the demand side, it is unlikely that a concentrated explosive market will occur, and the contradiction between supply and demand will continue to suppress prices. The issue of export liberalization is still unrealistic for the time being, but it cannot be ruled out that there will still be repeated emotions in the future. Short-term market contradictions are mainly related to macro-acceptance issues and expectations that the gap between supply and demand will continue to expand. Before the actual policy relay and the gap between supply and demand narrows, the market may temporarily weaken and fluctuate with market sentiment fluctuations.

Spot market analysis:

Today, the price of urea in China continues to fall. The industry's follow-up mood is unstable. There is a small amount of trading on the floor. There is insufficient progress. The contradiction between supply and demand in the market continues to be prominent, and corporate quotations are low and volatile.

Specifically, prices in Northeast China have been lowered to 1,900 - 1,940 yuan/ton. Prices in East China have been lowered to 1,780 - 1,820 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,780 -2010 yuan/ton, and the price of large particles has been lowered to 1,880 -2010 yuan/ton. Prices in North China have been lowered to 1,760 - 1,930 yuan/ton. Prices in South China have been lowered to 1,960 - 2,000 yuan/ton. Prices in Northwest China have been lowered to 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers still need to place orders to support, and offers are temporarily stable. Currently, with the gradual reduction of sales to be issued, coupled with the high fluctuations in corporate inventories, some manufacturers have great inventory pressure. The quotations for new orders are mostly sorted downwards and actively reduce prices to collect orders. In terms of the market, the current market trading atmosphere is weak, the fundamentals of supply and demand are loose, and there is no obvious positive news in the market to support it. Downstream operators still have a wait-and-see mentality and follow up cautiously. On the supply side, some companies are undergoing maintenance this week, and Nissan will show a downward trend in the near future, but the overall situation remains at a high level and the supply side continues to be loose. In terms of demand, the market demand is lukewarm and scattered, and the agricultural demand is relatively scattered. Maintaining just needs to advance, the purchase mainly consists of wheat base fertilizers; the operating rate of downstream compound fertilizer factories has gradually declined, and the procurement of raw materials has been reduced, and more maintenance A small amount of procurement is mainly needed; the demand in the industrial plate industry is relatively stable, but it still maintains a cautious follow-up and reserve mentality, and the overall demand support is limited.

On the whole, the current supply of urea in the China market continues to be high, and the demand is also weakening slightly. The overall supply and demand fundamentals continue to be weak. It is expected that the urea market price will continue to loosen downward in a short period of time, and the market will be dominated by shocks.