- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

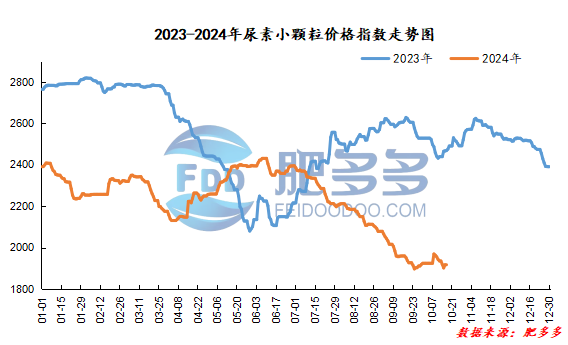

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on October 17 was 1,916.68, which was the same as yesterday, down 22.38% year-on-year.

Urea futures market:

Today, the opening price of the urea UR501 contract is 1835, the highest price is 1843, the lowest price is 1795, the settlement price is 1816, and the closing price is 1797. The closing price is 54 lower than the settlement price of the previous trading day, down 2.92% month-on-month. The fluctuation range of the whole day is 1795-1843; the basis of the 01 contract in Shandong is 23; the 01 contract has reduced its position by 1319 lots today, and so far, the position is 186642 lots.

Futures prices fell sharply today. Mainly due to the weakening of overall commodity market sentiment and weak fundamentals. At present, the general logic of excess urea itself and policy supervision still have a high degree of suppression of price rebound. Under the premise of loose supply, it is difficult to improve downstream willingness to hold goods, and prices lack a strong driver. Although the spot market sentiment has adjusted due to the market's market, actual downstream demand procurement is still cautious and has not formed too strong positive feedback. However, the current policy expectations and macro atmosphere have not completely subsided. Price fluctuations still generally follow the market environment. During the policy window, the market may be driven by weak shocks waiting and suppressing disk profits.

Spot market analysis:

Today, the price of urea in China is consolidating and stable. The transaction volume of factories in some mainstream regions is still increasing. Company quotations are stable and consolidated, and the shipment situation is still acceptable. With the recent increase in quotations, the industry's continued follow-up sentiment has weakened. The on-site price increase has slowed down, and today's quotations are mostly stable.

Specifically, prices in Northeast China have stabilized at 1,910 - 1,940 yuan/ton. Prices in East China have stabilized at 1,800 - 1,850 yuan/ton. The price of small and medium-sized particles in Central China has been raised to 1,820 - 2,000 yuan/ton, and the price of large particles has been raised to 1,930 -2010 yuan/ton. Prices in North China have been raised to 1,750 - 1,950 yuan/ton. Prices in South China are stable at 1,970 - 2,000 yuan/ton. Prices in the northwest region are stable at 1,920 - 1,960 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers in mainstream regions have been receiving orders at low prices recently. Some spot supplies are tight. Coupled with the support of companies 'pending orders, the quotations have increased slightly. Currently, there are a certain amount of new orders. Today, the quotations are stable and the price adjustment mentality is cautious. On the market side, after a round of orders acquisitions, the market transaction activity is still acceptable, the trading atmosphere on the floor has been boosted, and the focus of transaction negotiations has shifted. Based on the increase in manufacturers 'offers, the current industry is a little cautious in continuing to follow up, and the market has turned into a stalemate. On the supply side, the industry's daily output remains at around 190,000 tons, corporate inventories have also increased to a high level, the short-term supply and demand fundamentals are still loose, and the upward trend of prices is blocked. In terms of demand, there is still a suitable amount of autumn fertilizer demand in some mainstream areas at this stage. The demand for compound fertilizer production is sweeping, and a certain amount of industrial demand is added. Domestic sales demand is still supported. However, it is unlikely that goods will be exported, and it is difficult for enterprises to export sales. Real realization.

On the whole, the current atmosphere in the urea market in China has cooled down, and merchants have different shipping attitudes. The lower prices in the early stage have attracted a certain amount of transactions for companies. However, on-site demand is limited and prices continue to rise. It is expected that in a short period of time, the urea market will slow down, and prices will stabilize and remain stagnant.