- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5633, highest price: 5726, lowest price: 5607, position: 852744, settlement price: 5679, yesterday settlement: 5621, up 58, daily trading volume: 1689708 lots, precipitated capital: 3.348 billion, capital inflow: 88.49 million.

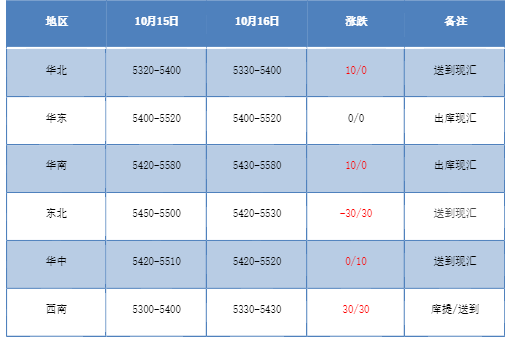

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price in China's PVC market rose slightly, but the price gave up in the afternoon. Compared with the valuation, North China rose 10 yuan / ton, East China stable, South China 10 yuan / ton, Northeast China adjusted 30 yuan / ton, Central China 10 yuan / ton, Southwest China 30 yuan / ton. Some factory prices of upstream PVC production enterprises rose slightly, but the rate of increase was basically relatively moderate in 20-30 yuan / ton. The tentative increase did not lead to an improvement in transactions, and there are still some enterprises that wait and see for stable prices. Spot market price and spot price coexist, but the advantage of spot price under high price is not obvious, including East China base offer 01 contract-(150-180), South China 01 contract-(0-80), North 01 contract-(400-450), southwest part of the supply 01 contract-(560), part of the high-end sent to 01 contract-(120-200). The basis adjustment is not much, the spot market quotation mentality is relatively positive in early trading, and the price is also upward, but the trading is light, the enthusiasm of picking up goods downstream is not good, more rigid demand procurement is maintained, and the increase basically disappears in the afternoon.

From the perspective of futures:The opening price of PVC2501 contract night trading is more obvious, with an inventory of 5726 points. At the beginning of early trading, the late price was high and narrow, the afternoon price was weaker, and the late downside closed at a low. 2501 contracts fluctuated from 5607 to 5726 throughout the day, with a spread of 11901contract reducing 26076 positions to 852744 positions so far, 2505 contracts closing at 5878 and 120025 positions.

PVC Future Forecast:

In terms of futures:PVC2501 contract prices showed an obvious rise in the night trading, with a high of 5726 at one point. In the overall trend of cultural goods, it is one of the few products with better gains, ranking third in the list of gains, and prices closed at a low in the afternoon. In the all-day transaction, the market showed some more strength, but it opened empty in the afternoon and opened 24.7% more than 24.8% more throughout the day. The technical level shows that the Bollinger belt (13, 13, 2) has narrowed, the distance between the two lines of MACD at the daily line level has been shortened, and the trend of the all-day price shows a negative column with a longer shadow line. In the short term, the trend of the futures price may still be relatively wide, and it will continue to be mainly sideways between the middle and upper tracks, but be vigilant against the probability of 5540 of the position of the middle rail.

Spot aspect:Spot market trading has become a better situation today, although spot prices rose slightly, but the rising market did not trigger the downstream release of procurement, the scope continues to maintain rigid demand, and the afternoon market gives up the increase, the current fundamentals, calcium carbide prices sporadically fell, Lanchan also showed a certain downward trend, PVC supply still has maintenance in October, but the demand turns cold with the weather. In the medium and long term, considering that demand continues to weaken, there is still a certain contradiction between supply and demand, but there is still some support for the remaining temperature of the current policy, the potential impact of the political situation and all kinds of news. On the outer disk, international oil prices fell more than 4 per cent to a nearly two-week low as media reports said Israel would not attack Iran's nuclear and oil facilities, easing fears of supply disruptions and a weak outlook for oil demand. On the whole, the spot market of PVC will sort out and run slightly in the short term.