- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

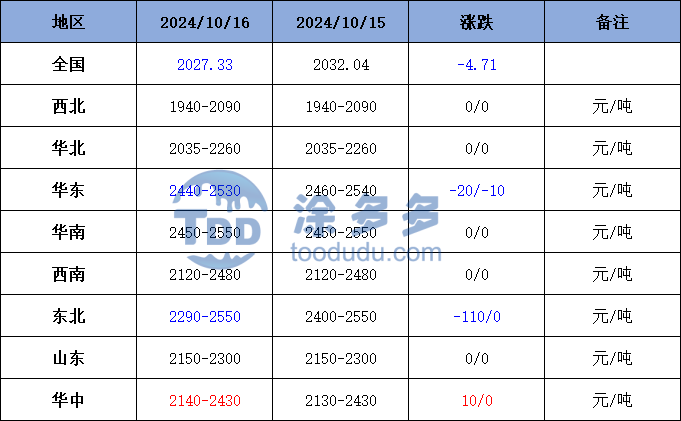

On October 16, the methanol market price index was 2027.33, down 4.71 from yesterday and 0.23% from the previous month.

Outer disk dynamics:

Methanol closed on October 15:

China CFR 293-300USD / ton, down US $2 / tonne

Us FOB 112-113cents per gallon, up 2 cents per gallon

Southeast Asia CFR US $347-348 per ton, Ping

European FOB 371.5-372.5 euros / ton, up 10 euros / ton.

Summary of today's prices:

East China: Taicang: 2450-2465 (- 10), Zhejiang: 2520-2530 (- 10), Anhui: 2380-2390 (0)

South China: Guangdong: 2450-2470 (0), Fujian: 2490-2550 (0)

Shandong: southern Shandong: 2220 (0), Northern Shandong: 2150-2180 (0), Linyi: 2250-2260 (- 10)

North China: Shanxi: 2035-2105 (0), Hebei: 2130-2180 (- 100)

Central China: Henan: 2140-2160 (10), Lianghu: 2280-2430 (0)

Northwest: Guanzhong: 2030-2090 (0), Northern Shaanxi: 1940-1950 (0), Inner Mongolia North Line: 1940-1980 (- 10), Inner Mongolia South Line: 2040 (0), Xinjiang: 2010-2150 (0)

Northeast: Liaoning: 2290-2420, Heilongjiang: 2550 (0)

Southwest: Yungui: 2190-2450 (- 60), Sichuan-Chongqing: 2120-2480 (0)

Spot market analysis:

Today, the methanol market price continues to run weakly, the futures market continues to adjust, and the spot quotation is weak. At present, the market demand in the lower reaches of the market is poor, the raw material inventory of some downstream factories remains abundant, and the enthusiasm of entering the market and replenishing stock is not high. More storage and price reduction operation, some manufacturers in the region continue to let profits and goods, and the main transaction is at a low price. Specifically, the market price in the main producing areas is adjusted narrowly, and the quotation on the southern route of Inner Mongolia revolves around 2040 yuan / ton, maintaining that yesterday, the quotation of the northern line of Inner Mongolia revolves around 1940-1980 yuan / ton, the lower end is reduced by 10 yuan / ton, the spot market is low and fluctuating, the follow-up of terminal downstream demand is limited, the market transaction atmosphere is light, and the overall inventory discharge of upstream enterprises is general. The market price fluctuation in Shandong, the main consumer area, is limited, with 2220 yuan / ton in southern Shandong and 2150-2180 yuan / ton in northern Shandong. Methanol futures are fluctuating downwards, the trading atmosphere is dull, and the mentality of operators is not good. The market quotation in North China has fluctuated and dropped. Hebei quotation is 2130-2180 yuan / ton today, and the purchasing mood of the factories downstream in the region is poor, and the rigid demand is mainly; Shanxi quotation today is 2035-2105 yuan / ton, maintaining yesterday, the downstream demand is not good, the user purchasing price reduction mentality is obvious, the market transaction continues the rigid demand mainly.

Port market:Methanol futures fluctuated downwards today. Spot a small amount of rigid demand. Some paper goods are shipped at moderate unilateral prices, buying cautiously, and the basis continues to weaken; afternoon low buying increases slightly, and replacements continue. The overall transaction throughout the day is mediocre. Taicang main port transaction price: spot / 10: 2445-2475, basis 01-7 Maxim 3: 10 deal: 2450-2485, base difference 01x0amp 5px11: 2475-2510, base difference 01x25pm 28.

Methanol market freight on October 16th

Future forecast:Recently, the forward price of the main contract of methanol continues to run weakly, the wait-and-see mood of the operators in the market is more obvious, the enthusiasm of the operators to enter the market and replenish the stock is limited, and some manufacturers in the main producing areas have reduced the price in order to reduce the inventory pressure. however, considering that the spot price has fallen to a lower position, the downward adjustment of the market price in the region has slowed down slightly. At present, there is still a contradiction between supply and demand in the Chinese market, and there is no bright performance in the terminal demand market in the short term. Operators have a strong wait-and-see mood towards the future, and it is expected that methanol market prices may continue to be weak in the short term, but in the later stage, we need to pay close attention to macro policies, crude oil and coal prices, plant operation and downstream demand follow-up.