- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5605, highest price: 5677, lowest price: 5572, position: 826668, settlement price: 5621, yesterday settlement: 5617, up 4, daily trading volume: 1440049 lots, precipitated capital: 3.26 billion, capital outflow: 29.91 million.

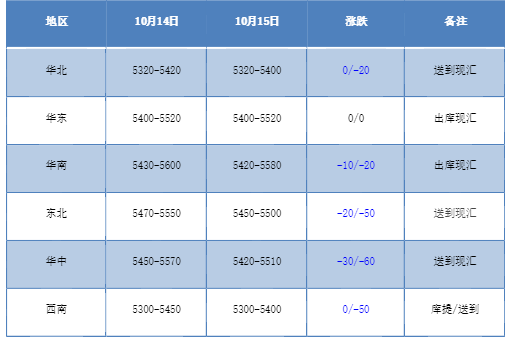

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market fell slightly, and there was a real order profit in the spot market. Compared with the valuation, the high end in North China fell by 20 yuan / ton, East China stable, South China down 10-20 yuan / ton, Northeast China down 20-50 yuan / ton, Central China down 30-60 yuan / ton, and Southwest China's high-end down 50 yuan / ton. Upstream PVC production enterprises factory prices fell 50-70 yuan / ton, most enterprises stable prices wait and see, active shipments to digest inventory. The volatility of the futures market intensified, the offer in the spot market was slightly chaotic, and there was a certain negotiation of 10-20 yuan / ton in the early trading. After the price rose in the late afternoon, most of the interest disappeared and the basis adjusted slightly. Among them, the base difference offer 01 contract in East China-(150-180), South China 01 contract-(0-80), North 01 contract-(400-450), Southwest part of the supply 01 contract-(560) Part of the high-end is sent to 01 contract-(120-200). Although the market fluctuates, the spot market turnover is basically maintained, the improvement has not been heard, and the frequency of rigid demand procurement remains unchanged.

From the perspective of futures:The price of the PVC2501 contract rose after the opening of the night trading, followed by a high decline. After the start of morning trading, a narrow range of arrangement, the price of the lack of a certain direction, late afternoon prices showed a significant rise, the high point is higher than the night market. 2501 contracts fluctuated from 5572 to 5677 throughout the day, with a spread of 105. 01 contracts reduced their positions by 10857 positions, with 826668 positions so far, 2505 contracts closing at 5911 and 117093 positions.

PVC Future Forecast:

In terms of futures:The futures price of PVC2501 contract fluctuated unexpectedly today, rising at night and rising again at the end of the day, and there was a difference in trading volume, with 24.0% more opening than 23.6% short opening. Although it showed a trend of reducing positions throughout the day, the more open price increased, especially in the late afternoon. From the fluctuation range is the same as yesterday, the high point compared with yesterday slightly downward, the technical level shows that the Bollinger belt (13, 13, 2) has narrowed, the daily line level KD line continues to show a dead cross trend, the current technical level direction is not clear, the disk price trend is also unexpected, from the one-day positive line cross star point of view, we still maintain the early point of view, it is expected that the short-term price trend will continue to dominate.

Spot aspect:Spot market in the morning after the weakening of the futures price, there is a certain profit margin, the spot high price transaction is difficult, so it has weakened. From the supply and demand point of view, the recent PVC device is still overhauled, but the demand side is also poor, the cost port calcium carbide price has gone down. On the outer disk, international oil prices fell 2 per cent as the Organization of Petroleum Exporting countries (OPEC) cut its forecast for global oil demand growth this year and next. Hedge fund bearish bets on Brent crude fell at the fastest pace in nearly eight years amid fears of escalating conflict in the Middle East, analysts said. The current PVC period of the two cities sideways collation, with the help of policy from the trough of the market to pull up to this, long and short sides are mainly in wait-and-see, and the spot market is also maintained, the basic volume of production enterprises to sign contracts, the spot market according to their own supply situation of different degrees of profit sales, short-term PVC spot prices continue to be mainly narrow.