- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

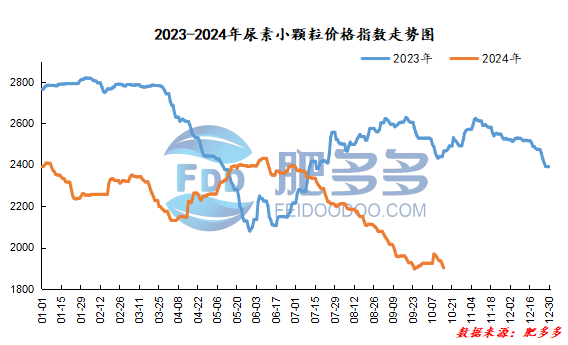

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 15 was 1,901.36, a decrease of 17.27 from yesterday, a month-on-month decrease of 0.90% and a year-on-year decrease of 22.89%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1791, the highest price is 1861, the lowest price is 1790, the settlement price is 1831, and the closing price is 40% higher than the settlement price of the previous trading day, up 2.22% month-on-month. The fluctuation range throughout the day is 1791-1861; the basis of the 01 contract in Shandong is-40; the 01 contract has reduced its position by 9999 lots today, and so far, it has held 178870 lots.

Urea futures prices rebounded strongly today. On the one hand, they were affected by news of the overall market fiscal incremental policy, and on the other hand, they were rumored to be loose in the market. At present, the fundamentals of urea are still weak. Although there are demand expectations such as reserves in the future, the loose supply and demand pattern is still difficult to break, and the news of export liberalization may be difficult to confirm. Observe how market sentiment evolves in the short term.

Spot market analysis:

Today, urea market prices in ChinaStill focus on downward,The downstream needs to advance on a weak basis, and some production areas have seen good results when selling goods at low prices. However, they have insufficient support for the overall market trend. The mentality of the operators is full of pessimism, and the market remains low and volatile for a short time.。

Specifically, prices in Northeast China have been lowered to 1,900 - 1,930 yuan/ton. Prices in East China have been lowered to 1,780 - 1,840 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,790 - 2,000 yuan/ton, and the price of large particles has stabilized at 1,880 -2010 yuan/ton. Prices in North China have been lowered to 1,760 - 1,930 yuan/ton. Prices in South China have been lowered to 1,930 - 1,980 yuan/ton. Prices in northwest China have been lowered to 1,920 - 1,960 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, after several consecutive days of price cuts and orders, the transactions of some low-end quotations in the market have improved significantly. Today, some quotations have been slightly increased. With the small accumulation of orders, the low-end market has steadily increased in the short term. In terms of the market, although there has been a slight increase in transactions at the low-end of the market, the mentality of the operators is still more pessimistic. The time for supporting good on the market is limited. The downstream has insufficient confidence in the future outlook. The price decline is still dominant. The current mainstream regional quotations have dropped to the lowest level before the holiday. The market is running weak. In terms of supply, the industry's daily output continues to fluctuate at a high level around 190,000 tons, much higher than the level of the same period last year. Spot supply is sufficient, pressure still exists, and supply and demand fundamentals continue to be loose. On the demand side, downstream demand is advancing slowly, and most people maintain appropriate replenishment on dips, and have a cautious wait-and-see attitude. The current production of compound fertilizer factories is gradually entering the later stage, and the consumption of raw material urea is gradually decreasing. On the demand side, the just-needed procurement model is maintained.

Overall, the current supply and demand fundamentals in the urea market in China continue to be abundant, with limited benefits on the market, insufficient support just needed, and the main follow-up is low. It is expected that the urea market price will be weak and deadlocked in a short period of time, and the market decline may slow down.