- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

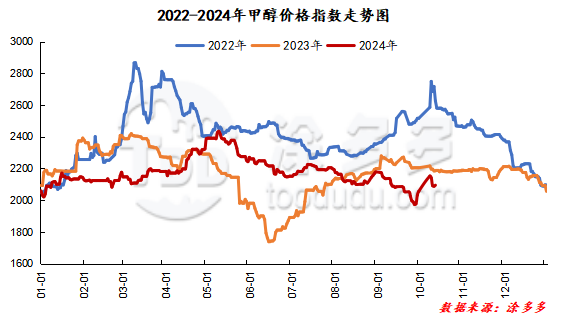

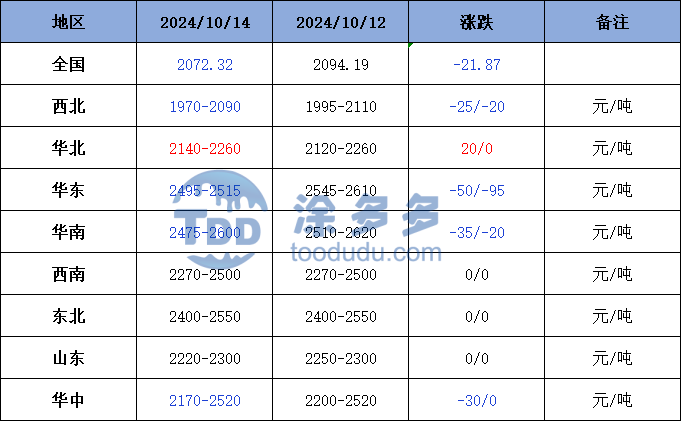

On October 14, the methanol market price index was 2072.32, down 21.87 from the previous working day, and 1.04% lower than the previous working day.

Outer disk dynamics:

Methanol closed on October 11:

China CFR 300-304USD / ton, up US $1 / ton

Us FOB 110111cents per gallon, flat

Southeast Asia CFR US $347-348 per ton, Ping

European FOB 361.5-362.5 euros / ton, flat.

Summary of today's prices:

East China: Taicang: 2495-2515 (- 50), Zhejiang: 2560-2580 (- 40), Anhui: 2440-2450 (- 10)

South China: Guangdong: 2475-2480 (- 35), Fujian: 2540-2600 (- 10)

Shandong: southern Shandong: 2220 (0), Northern Shandong: 2250-2270 (0), Linyi: 2280-2290 (0)

North China: Shanxi: 2140-2200 (20), Hebei: 2230-2260 (0)

Central China: Henan: 2170-2190 (- 30), Lianghu: 2360-2520 (0)

Northwest: Guanzhong: 2090 (- 20), Northern Shaanxi: 2010 (0), Inner Mongolia North Line: 1970-2000 (- 25), Inner Mongolia South Line: 2040 (0), Xinjiang: 2010-2150 (0)

Northeast: Liaoning: 2400-2520 (0), Heilongjiang: 2550 (0)

Southwest: Yungui: 2270-2450 (0), Sichuan-Chongqing: 2300-2500 (0)

Spot market analysis:

Today, the methanol market price is adjusted in a narrow range, the futures market range is volatile, the wait-and-see mood of the market is obvious, most traders are not willing to hold goods, the transfer price has fallen, and some bidding enterprises in the Chinese market keep and sell. Specifically, the market price in the main producing areas is adjusted narrowly. The quotation on the southern line of Inner Mongolia revolves around 2040 yuan / ton, maintaining the last working day. The quotation of the northern line of Inner Mongolia revolves around 1970-2000 yuan / ton, and the high end is reduced by 25 yuan / ton. Rongxin methanol's starting price is quoted at 2000 yuan / ton, the quantity is 7000 tons, all failed auction. Yulin Yanzhou Mining starting price quoted to 2000 yuan / ton factory cash exchange, the quantity of 5000 tons, all failed auction, the terminal downstream and traders are still bearish to the future, the overall trading atmosphere in the market is not good, some manufacturers still have pre-order execution. The market price fluctuation in Shandong, the main consumer area, is limited, with 2220 yuan / ton in southern Shandong and 2250-2270 yuan / ton in northern Shandong. Methanol futures fluctuate downward, the market operators are in a strong wait-and-see mood, and operators are mainly cautious in entering the market. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2230-2600 yuan / ton today, which is stable. At the beginning of the week, most manufacturers in the region hold a wait-and-see mood; Shanxi quotation today is 2140-2200 yuan / ton, the low end is raised by 20 yuan / ton, and the downstream demand is poor. The mentality of user purchasing price reduction is obvious, and the market transaction continues to be dominated by rigid demand.

Port market:Methanol futures fluctuated in a narrow range today. Spot rigid demand procurement. Paper goods sell actively in the morning, the cash spread is weak, and the afternoon futures are low and stable. Goods are exchanged frequently in recent months. The overall transaction throughout the day is not bad. Taicang main port transaction price: spot transaction: 2495-2505, basis 01x3Universe 7cross 10: 2500-2515, base 01x5max 13x 10x: 2505-2520, base 01x10max 17x 11: 2510, base + 15pm 18X 11: 2525-2540, base difference 01x 32bp 33.

Future forecast:Recently, the price of methanol market fluctuates obviously under the influence of macro policy, but considering that the performance of methanol itself is still poor, and the market still needs to return to rationality, manufacturers in the main producing areas still discharge stocks mainly in the short term under the influence of increased inventory pressure, but the traditional downstream market replenishment only maintains rigid demand, the overall trading atmosphere of the market is general, and the terminal downstream operators and traders are more cautious in entering the market. At present, it is expected that the short-term methanol market price may continue to be weak, but in the later stage, we should pay close attention to the macro policy, crude oil, coal prices, plant operation and downstream demand follow-up.