- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

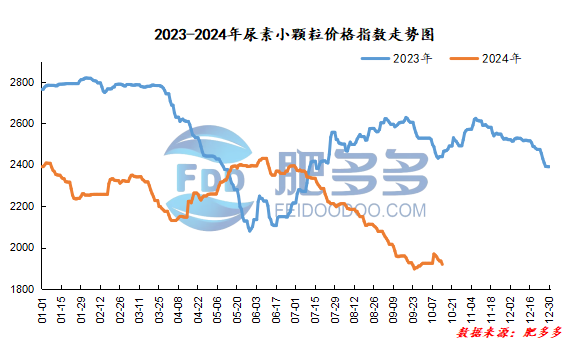

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 14 was 1,918.64, a decrease of 16.36 from yesterday, a month-on-month decrease of 0.85% and a year-on-year decrease of 21.35%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1825, the highest price is 1826, the lowest price is 1780, the settlement price is 1800, and the closing price is 1800. The closing price is 16% lower than the settlement price of the previous trading day, down 0.88% month-on-month. The fluctuation range throughout the day is 1780-1826; The basis of the 01 contract in Shandong is 0; the 01 contract has increased its position by 12599 lots today, and the position is 188869 lots so far.

Today, urea futures prices continue to open high and move low. The general logic of strong supply and weak demand for urea itself continues to suppress prices. However, the recent macro trading logic has not exceeded expectations for the time being, which can drive a significant rebound in sentiment. Moreover, urea itself has a relatively limited speculative demand due to the characteristics of the variety. Under this influence, downstream demand has regained its cautious attitude. Under the premise of easing overall supply, although demand has improved in the short term, it is still difficult to improve the supply-demand relationship. In the short term, before the macro atmosphere strengthens again, the negative feedback between prices and the willingness of the entire industry chain to hold goods may continue.

Spot market analysis:

Today, the market price of urea in China continued to fall.There is no obvious good news in the market, and prices are weak and downward. The current demand is slow to follow up. Supply pressure continues to increase, and corporate quotations are forced to be lowered.。

Specifically, prices in Northeast China have stabilized at 1,940 - 1,970 yuan/ton. Prices in East China have been lowered to 1,790 - 1,830 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,800 - 2,000 yuan/ton, and the price of large particles has been lowered to 1,880 -2010 yuan/ton. Prices in North China have been raised to 1,750 - 1,980 yuan/ton. Prices in South China have been lowered to 1,960 - 2,000 yuan/ton. Prices in Northwest China have been lowered to 1,940 - 2,030 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have stable shipments and poor new receipts. They continue to reduce quotations and receipts one after another. Their mentality is weak, and their quotations continue to be consolidated downward. In terms of the market, the buying and selling atmosphere in the market is weak, the fundamentals of supply and demand are loose, the sentiment in the market has cooled, the operators have a cautious wait-and-see attitude, and the market transaction situation has not improved significantly. The urea market has once again returned to the fundamentals. In a short period of time, the mood of the operators has continued to remain weak and the market fluctuates weakly. In terms of supply, the urea industry currently has sufficient supply, and the overall supply and demand fundamentals are biased towards ample. Some companies are facing a trend of increasing stocks. Under the influence of combined shipping difficulties, the negative supply situation affects the market. On the demand side, the purchasing sentiment of downstream operators has changed, their willingness to continue to follow up is weak, and their enthusiasm to enter the market has decreased. With the end of autumn fertilizer use, there is a large number of difficulties in follow-up demand, and the market is highly likely to be weak.

On the whole, the current urea market atmosphere in China is weak and there are few positive factors on the market. It is expected that the urea market price will be mainly reduced in a short period of time, with a small downward trend.