- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5594, highest price: 5690, lowest price: 5561, position: 837525, settlement price: 5617, yesterday settlement: 5574, up 43, daily trading volume: 1485774 lots, precipitated capital: 3.29 billion, capital inflow: 47.23 million.

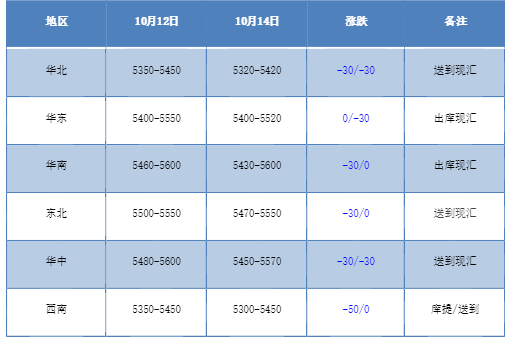

List of comprehensive prices by region: yuan / ton

PVC spot market:Mainstream transaction prices in China's PVC market fell slightly, and the atmosphere weakened slightly at the beginning of the week. Compared with the valuation, the high end of North China fell by 30 yuan / ton, the high end of East China by 30 yuan / ton, the low end of South China by 30 yuan / ton, the low end of Northeast China by 300 yuan / ton, and the low end of Central China by 30 yuan / ton. the low end of the southwest is down 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises mostly remained stable, with a small reduction of 50 yuan / ton by individual enterprises. At the beginning of the week, the upstream factory was basically waiting to see the trend of the market. Futures narrowly arranged night trading rose, the spot market showed a certain weakening trend on Monday, there was room for negotiation, and the price went down slightly, with little change in the price base. Among them, East China base offer 01 contract-(80-150-180), South China 01 contract-(0-80), northern 01 contract-(380-450), southwest part of the source 01 contract-(560). Although the spot market two pricing methods coexist, but the current market next Monday spot turnover is light, downstream rigid demand part, inquiry enthusiasm is not good.

From the perspective of futures:The opening price of PVC2501 contract showed a marked rise in night trading, with an intraday high of 5690. After the beginning of morning trading, the futures price fell slightly, and then arranged in a narrow range, and there was no clear trend in the afternoon futures price. 2501 contracts fluctuated in the range of 5561-5690 throughout the day, with a spread of 129. 01 contracts with an increase of 9518 positions, with 837528 positions so far, 2505 contracts closing at 5889 and 115837 positions.

PVC Future Forecast:

In terms of futures:PVC2501 contract price volatility performed well in the night trading on Friday, together with Monday's trend, the night futures price soared, more inclined to policy fermentation to act in advance in the market, while Monday futures showed a clear downward trend. The technical level shows that the Bollinger belt (13, 13, 2) has narrowed, the KD line at the daily line level shows a dead fork trend, and the MACD continues the golden fork trend. In terms of all-day trading, the blank opening is 24.5% compared with 23.6% more, which is slightly better. At present, the fundamentals of PVC still have no obvious guidance, and the futures price runs between the middle and upper tracks, and today presents a positive pillar with a longer shadow line. In the short term, the trend of futures prices may continue to be horizontal, but high or gradually downward.

Spot aspect:At the beginning of the week, the spot market gave way to profit negotiations, and the spot price also fell slightly compared with the Saturday period. At present, the spot market still follows the logic of PVC fundamentals, and the spot trading has not changed greatly because of the recent fluctuations in the market. Except for the rigid demand, the speculative demand is less, and in the operation process of the high futures price, there are certain hedging policies on the disk. Protect the base profit of spot. In terms of PVC fundamentals, some enterprises still have maintenance plans, calcium carbide prices are also weakening to a certain extent today, and PVC fundamentals under the game of supply and demand are still relatively weak, so after excluding the impact of policies, they closely rely on their own trends and the performance of the two markets is weak in PVC. In addition, the overall commodity sentiment also cooled at the beginning of the week, and it is expected that the PVC spot market will continue this narrow range in the short term.