- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

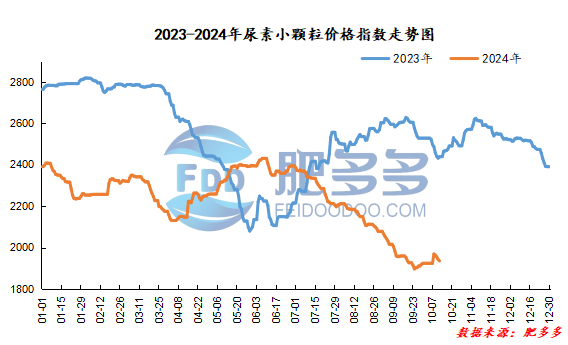

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 12 was 1,935.00, a decrease of 7.27 from yesterday, a month-on-month decrease of 0.37% and a year-on-year decrease of 20.68%.

Spot market analysis:

Today, the price of urea in China continues to decline, and the market continues to decline. The current terminal demand performance is tepid. The mood of industry operators is cautious and wait-and-see, purchases have cooled, and the short-term market continues to fluctuate and adjust downward.

Specifically, prices in Northeast China have stabilized at 1,940 - 1,970 yuan/ton. Prices in East China have been lowered to 1,820 - 1,860 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,850 - 2,000 yuan/ton, and the price of large particles has been lowered to 1,900 -2010 yuan/ton. Prices in North China have been lowered to 1,760 - 1,980 yuan/ton. Prices in South China have been lowered to 1,980 - 2,040 yuan/ton. Prices in the northwest region are stable at 1960-2030 yuan/ton. Prices in Southwest China are stable at 1,900 - 2,250 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction of new orders by manufacturers has weakened, the situation of acquiring orders and goods has not been smooth, and most inventories have shown an upward trend. Factory quotations in some mainstream regions have continued to be lowered. In addition, some traders have reversed factory quotations and shipped goods, and the focus of on-site negotiations has shifted downward. In terms of the market, on-site inquiry transactions have not improved significantly. Under the current influence of the atmosphere of buying up and not buying down, traders have become more bearish and hold a wait-and-see attitude. The activity of on-site trading has gradually loosened and downward in the short term. In terms of supply, although some urea plants are currently undergoing maintenance, the industry's supply is still at a loose level, and short-term supply pressure still exists. On the demand side, the start-up of downstream compound fertilizer factories has gradually declined, and the enthusiasm for follow-up has simultaneously weakened. Under the influence of the market atmosphere, companies have intensified their cautious attitude to cover positions in the next stage. Short-term demand follow-up is limited, and support for the market has weakened.

Overall, the current urea market price in China is relatively high, demand follow-up is not active, and on-site trading is weak. It is expected that the urea market price will continue to decline in a short period of time until it welcomes another wave of macro emotional support and demand replenishment follow-up.