- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5680, highest price: 5694, lowest price: 5536, position: 826998, settlement price: 5600, yesterday settlement: 5773, down 173,daily trading volume: 1607048 lots, precipitated capital: 3.23 billion, capital outflow: 83.94 million.

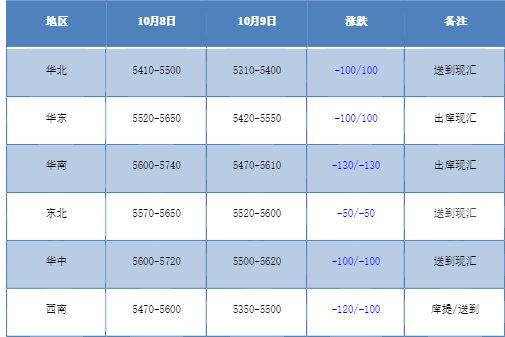

List of comprehensive prices by region: yuan / ton

PVC spot market:Mainstream transaction prices in China's PVC market fell slightly, with some cooling on the floor. Compared with the valuation, it fell by 100 yuan / ton in North China, 100 yuan / ton in East China, 130 yuan / ton in South China, 50 yuan / ton in Northeast China, 100 yuan / ton in Central China and 100-120 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices began to lower quotations, price adjustment range is basically 50-100-150 yuan / ton, individual enterprises to stimulate a larger decline in shipments, some enterprises do not participate in the second round of prices rise and fall, mainly to wait-and-see mentality. The futures price continued to fall, the spot market price and the spot price coexisted, and the basis adjusted slightly, in which East China base offer 01 contract-(80-150-180), South China 01 contract-(0-50), North 01 contract-(450), southwest part of the supply 01 contract-(560), after the futures price weakens, the spot market is mainly traded, and the downstream products enterprises have rigid demand for replenishment, facing the repetition of the market. There is a wait-and-see mentality on the spot.

From the perspective of futures:The opening price of PVC2501 contract continued to decline in night trading, with the market weakening and falling below 5600. The price rose slightly after the start of morning trading, but the increase was small and then fell back, mainly due to the poor overall performance in the afternoon. 2501 contracts fluctuated in the range of 5536-5694 throughout the day, with a spread of 158. 01 contracts with an increase of 35113 positions, with 826998 positions so far, 2505 contracts closing at 5846 and 107114 positions.

PVC Future Forecast:

In terms of futures:The futures price of PVC2501 contract showed a trend of further correction, with futures prices running between tracks in the Bollinger Belt (13, 13, 2), but in the face of yesterday's high of 5982, today's low of 5536 fell 446 points, financial markets cooled further, and Chinese futures contracts closed at noon. China's main futures contracts were mixed, glass and soda ash fell more than 6%, container index (European) and lithium carbonate fell more than 5%, and coking coal, coke and industrial silicon fell more than 4%. Iron ore, hot rolls and Shanghai silver fell by more than 3.5%. For the main force of PVC, there has been a certain change in the technical closing line, especially the KD line at the daily line level is the first to cross. At present, there is a certain game mentality in the market, in the face of emotional market trend, it is recommended to participate cautiously and wait and see more in the short term.

Spot aspect:First of all, from the perspective of intensive policies, after the strong guidance has a direct effect on the financial market, the overall stock market and financial derivatives react quickly, but most commodity sentiment has cooled down after the National Day, showing varying degrees of correction performance. In the PVC period, the two cities are also back-tested, and the gap between the high jump and the high jump is quickly filled. For the spot market, with the overall futures price adjustment, spot prices also showed a downward trend today, including upstream PVC production enterprises to reduce factory prices. Fundamentals still maintain some early factors, in the face of repeated speculative demand is still less, to rigid demand-based spot market, especially the downstream performance is relatively rational. Therefore, put aside the emotional fluctuations, there are no obvious variables in the fundamentals, the offer entered under the appropriate basis can be enough to form pressure on the disk, but today's disk in the downward trend, there is a certain number of single entry. As far as the spot market is concerned, we still think that it is more effective to participate in the spot market combined with the spot market, and the spot market may enter a period of volatility in the short term.