- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:October 8th V2501 contract opening price: 5970, highest price: 5982, lowest price: 5634, position: 791885, settlement price: 5773, yesterday settlement: 5688, up 85, daily trading volume: 1219644 lots, precipitated capital: 4.045 billion, capital inflow: 96.17 million.

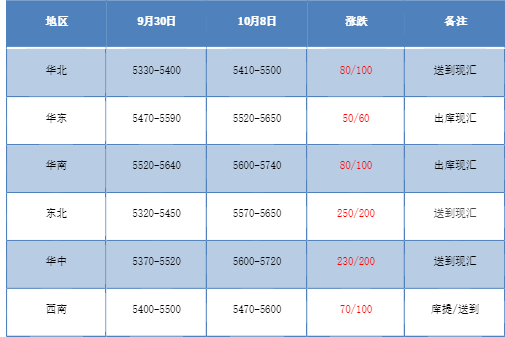

List of comprehensive prices by region: yuan / ton

PVC spot market:China's PVC market mainstream transaction prices rose mainly, the first day after the festival to a good run. Compared with the valuation, the price of North China rose 80-100 yuan / ton, the high end of East China rose 50-60 yuan / ton, South China increased 80-100 yuan / ton, Northeast China increased 200-250 yuan / ton, Central China increased 200-230 yuan / ton, and Southwest China rose 70-100 yuan / ton. The ex-factory prices of upstream PVC production enterprises have increased significantly, with an increase of 70-100-150 yuan per ton, which varies from region to region. The futures market jumped high and fell back in the afternoon. The mood in the spot market was high in the morning, and the spot price also rose sharply at the same time. The spot price and the spot price coexisted, in which the East China base offer 01 contract-(100-150-200), the South China 01 contract-(50), the northern 01 contract-(490), although the prices of the two markets rose, especially the futures market highs. However, the spot market transaction has not been heard to improve, high-price transactions blocked, with the downward price of futures, the point price advantage slightly increased, but the downstream mentality is relatively cautious.

From the perspective of futures:The PVC2501 contract opened sharply higher in early trading, with a peak of 5982 at the start of trading, but then the price fell back, the decline was relatively obvious, and the afternoon price was further weakened. 2501 contracts range from 5634 to 5982 throughout the day, with a spread of 348,01and an increase of 35223 positions, with 791885 positions so far, 2505 contracts closing at 5949 and 102789 positions.

PVC Future Forecast:

In terms of futures:PVC2501 contract prices opened high on Sunday after the holiday, with a high of 5982 or even approaching the prefix 6 at one time, but then the price fell, the opening curse reappeared after the National Day, and the main PVC contract increased its positions and declined. In terms of transactions, the short opening was 28.0% higher than that of 24.2% more, and the market was once more flat. The technical level shows that the opening of the three tracks of the Bolin belt (13,13,2) expands obviously, and the MACD line at the daily level continues to show the trend of golden fork with large opening, but the distance between the KD line and the KD line is shortened. The whole-day trend of the main contract price shows an expanded range of fluctuations, and the entity negative pillar. Judging from the current mood and early intensive policies, although there is a pullback in the trend of futures prices in the short term, it is not expected to withdraw deeply.

Spot aspect:From the perspective of the operation of the futures market, the recent rise in futures prices mainly depends on intensive policy stimulus. First of all, on the 8th, 1. The deputy director of the National Development and Reform Commission said that according to relevant research, the construction and renovation of local pipe networks is expected to reach a total of 600000 kilometers in the next five years, with a total investment demand of 4 trillion yuan. 2. Bank credit funds are strictly forbidden to enter the stock market illegally, and leverage is strictly controlled. 3. The Information Office of the State Council held a press conference to introduce the relevant situation of "systematically implementing a package of incremental policies to promote the upward structure of the economy, and the development trend continues to improve." Judging from the current policy, we still focus on supporting and pulling. PVC fundamentals, calcium carbide prices rose sharply 100-150 yuan / ton, its PVC supply and demand level variables are small. However, due to the high opening of futures price, the entry of hedging should be considered when the basis of the first day after the festival is more appropriate. However, there is a big repetition in the current market, and the increase in spot market prices may be magnified in the short term.