- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

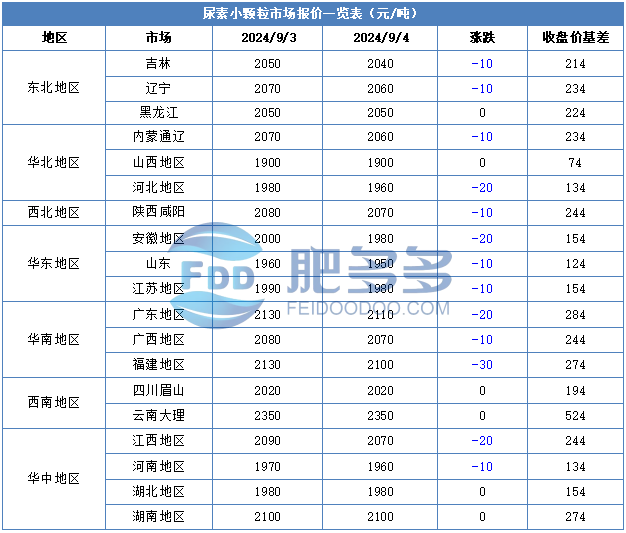

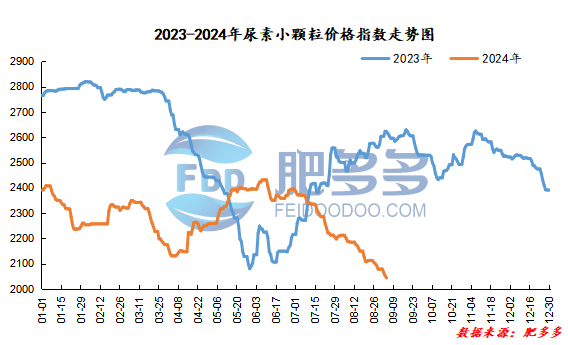

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 4 was 2,043.18, a decrease of 9.36 from yesterday, a month-on-month decrease of 0.46% and a year-on-year decrease of 22.03%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1833, the highest price is 1841, the lowest price is 1822, the settlement price is 1831, and the closing price is 1826. The closing price is 20% lower than the settlement price of the previous trading day, down 1.08% month-on-month. The daily fluctuation range is 1822-1841; the basis of the 01 contract in Shandong is 124; the 01 contract has increased its position by 9103 lots today, and the position so far is 193714 lots.

Today, urea futures prices continued to fluctuate mainly downward. Last night, the U.S. manufacturing PMI was released less than expected. Market worries reappeared, and global risk assets fell under pressure again. Urea mainly fluctuates with the market environment. The logic of strong supply and weak demand cannot be improved temporarily. During the week, corporate inventories have accumulated significantly, and downstream purchasing willingness is still low. The overall market sentiment is temporarily difficult to boost. Short-term urea futures prices are lacking. Driven by themselves or still maintaining weak shocks with the market environment.

Spot market analysis:

Today, China's urea market prices continued to decline, companies were not able to obtain orders, downstream replenishment follow-up was not good, and the market was in a stalemate.

Specifically, prices in Northeast China have been lowered to 2,040 - 2,070 yuan/ton. Prices in East China have been lowered to 1,940 - 1,990 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,950 - 2,200 yuan/ton, and the price of large particles has been lowered to 2,050 - 2,120 yuan/ton. Prices in North China have been lowered to 1,900 - 2,070 yuan/ton. Prices in South China have been lowered to 2,060 - 2,130 yuan/ton. Prices in Northwest China have been lowered to 2020-2070 yuan/ton. Prices in Southwest China are stable at 2,000 - 2,400 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers 'quotations have been lowered one after another, but the actual order acquisition situation has not improved. The shipping and sales pressure of enterprises has gradually emerged. The low-end quotations of factories in some mainstream regions have reached low levels, and new prices are still being tested. The price adjustment mentality is relatively cautious. In terms of the market, transactions at the low-end of the market are rare, new orders are still deadlocked and light, the mood is weak and downward, the downstream follow-up mentality is cautious, and purchasing is limited. The market seems to have no signs of improvement, and the short-term stalemate is the main focus. On the supply side, Nissan has gradually improved, and the supply side has continued to be loose, which has affected the market conditions. On the demand side, low-price transactions on the demand side are average. Downstream merchants are cautiously wait-and-see, and have a strong sentiment of buying up or not buying down. They are waiting for lower prices to appear. The market is still on the wait-and-see trend, with sporadic needs to make up orders to follow up. In terms of printing and labeling, India released news on the bidding for urea imports. The bidding received a total of 3.9201 million tons of bids from 23 suppliers. The lowest price on the East Coast is CFR 349.88 US dollars/ton, and the lowest price on the West Coast is CFR340 US dollars/ton.

On the whole, the current positive support from the supply and demand side of the urea market is insufficient, and the market is in a stalemate. It is expected that the urea market price will still be lowered in a short period of time, waiting for a new round of low-cost replenishment.