- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:September 4th V2501 contract opening price: 5400, highest price: 5435, lowest price: 5326, position: 1032331, settlement price: 5383, yesterday settlement: 5443, down 60, daily trading volume: 1401888 lots, precipitated capital: 3.879 billion, capital outflow: 149 million.

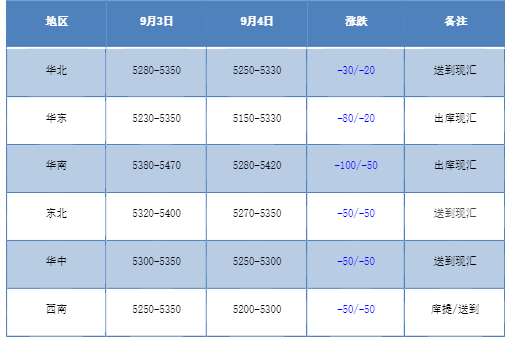

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market continues to decline, and the market weakness in each region is obvious. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 20-80 yuan / ton in East China, 50-100 yuan / ton in South China, 50 yuan / ton in Northeast China, 50 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises remain stable, and the prices of some enterprises are reduced by 50 yuan per ton. at present, production enterprises are facing certain shipping pressure. The futures market continued to weaken, and the price offer in the spot market continued to decline yesterday, and the two markets showed four consecutive declines in the future. after the operation of the low price, the advantage of the basis offer is relatively obvious. Among them, the base difference offer 01 contract in East China-(100-150-210), South China 01 contract-(0-60 or + 20), North 01 contract-(200-250-300) Some low-cost sources in southwest China have heard of 01 contract-(520). Even though the basis has been slightly adjusted and prices have been falling, transactions in the spot market have always been poor.

From the perspective of futures:PVC2501 contract night trading price fell at the beginning of trading, the lowest point of 5326 bottomed out to rebound, futures prices slightly upward repair. After the start of morning trading, futures prices were sorted out in a narrow range, and prices weakened again in late afternoon trading. 2501 contracts fluctuated from 5326 to 5435 throughout the day, with a spread of 109. 01 contracts reduced their positions by 31199 positions, with 1032331 positions so far, 2505 contracts closing at 5600 and 114610 positions.

PVC Future Forecast:

In terms of futures:The operation of PVC2501 contract futures has been falling for four consecutive times, and has been falling continuously since last Friday. Today's futures continue to show a deep decline below the support level of the lower track, and the low of 5326 is approaching the 5299 low before the main contract, and the futures price shows a cross star negative column throughout the day. The technical level shows that the opening of the third rail of the Bolin belt (13, 13, 2) diverges, especially when the depth of the lower rail turns down, the KD line and MACD line at the daily level show an obvious trend of dead forks, and the short ends are arranged at the technical level, and from the point of view of the transaction, the empty opening is 24.8% compared with 20.5% more, on the one hand, it continues to press, on the other hand, it continues to press the disk. In the short term, the operation of futures prices or further test before the low position, observe the low range of 5300-5350 operating support.

Spot aspect:The continuous decline in prices in the two cities has dampened the confidence of the industrial chain. On the one hand, production enterprises are facing a certain supply digestion pressure, and their ex-factory prices once again fall below the 5000 yuan / ton mark. In the early stage, due to the small rise and repair completed by changing positions and changing months, the spot market has also returned to the low range. There are also obvious short roles in millions of futures positions. And at present, the overall commodity sentiment is empty, and the strong supply, weak demand and high inventory of PVC fundamentals make the performance of the two markets continue to be poor. On the outer disk, international oil prices closed down nearly 5 per cent, hitting their lowest level in nearly nine months, as weak economic data raised concerns about a slowdown in energy demand and signs that Libya was on track to reach an agreement to end oil supply disruptions. In the overall negative situation of commodity sentiment, PVC fundamentals are insufficient to support the situation, it is expected that in the short term PVC spot gold and silver performance will be strangled, spot prices may continue to be low.