- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:September 3 V2501 contract opening price: 5480, highest price: 5493, lowest price: 5406, position: 1063530, settlement price: 5443, yesterday settlement: 5516, down 73, daily trading volume: 828310 lots, precipitated capital: 4.028 billion, capital inflow: 17.33 million.

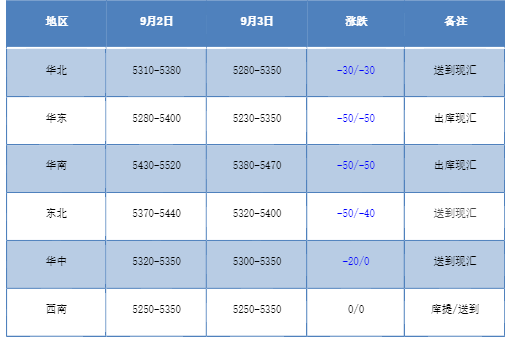

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market continued to decline, and the spot market returned to the low range. Compared with the valuation, it fell by 30 yuan / ton in North China, 50 yuan / ton in East China, 50 yuan / ton in South China, 40-50 yuan / ton in Northeast China, 20 yuan / ton in Central China and stable in Southwest China. The ex-factory prices of upstream PVC production enterprises fell 20-30-50 yuan / ton, the price reduction of each enterprise is different, and the prices of some remote warehouses are down synchronously. The trend of the futures market continued to be weak and downward, and the spot market price offer fell further compared with yesterday, and the spot market basis offer was slightly adjusted, and the offer was slightly confused. among them, East China basis offer 01 contract-(100-150-200-250), South China 01 contract-(0-60 or + 20), North 01 contract-(220-300-350) Some low-cost sources in southwest China have heard of 01 contract-(510). Even if the price continues to decline, but the spot market transaction has always been light, downstream inquiry is not good transaction intention is weak.

From the perspective of futures:The opening price of PVC2501 contract night trading is mainly arranged slightly, and the fluctuation direction of the price is not clear. After the start of morning trading, futures prices weakened, and prices fell further at the end of the morning. The overall trend has been maintained downward, and afternoon prices have been arranged at a low level. 2501 contracts fluctuated from 5406 to 5493 throughout the day, with a spread of 87. 01 contracts with an increase of 16193 positions, with 1063530 positions so far, 2505 contracts closing at 5656 and 100879 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2501 contract continues to fall below the support level of the lower track. from a technical point of view, the opening of the three tracks of the Bollinger belt (13, 13, 2) opens, and the futures price breaks the trend this week after it revolves around the middle rail last week. The high point of the futures price can not even touch the upper track, that is, it is down deeply, the futures price continues to form a negative column after falling through the undertrack position, and the KD line of the daily line continues to show a dead fork trend, and the two lines of the MACD line cross each other. At the technical level, there is an obvious air-bias signal. PVC fundamentals also return to a weak atmosphere under the constraints of poor spot transactions and high inventories, the operation of futures prices in the short term may re-test the low range, and observe the support performance in the lower range of 5350-5400.

Spot aspect:In yesterday's forecast low range, the low trend of the futures price has been verified, on the one hand, the futures price is deep downward, the continuous increase of positions is mainly short, and the short return position is in the millions of positions at the same time, the 2501 contract is redefined as an empty role. PVC fundamentals, first of all, the supply is temporarily stable, and there is no obvious change in the start-up load of PVC units, but in the weakening downward market, the enthusiasm of taking goods downstream is suppressed, on the one hand, downstream to wait for lower prices, on the other hand, the current high inventory makes the spot market is not out of stock, so apart from the rigid demand, the PVC spot market can hardly see the generation of speculative demand. At present, the overall macro mood is also slightly negative, most commodities do not perform well this week, and there is no guidance and support at the policy news level, so the PVC spot market may still be running low in the short term, and the former gold nine silver ten has been strangled.