- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

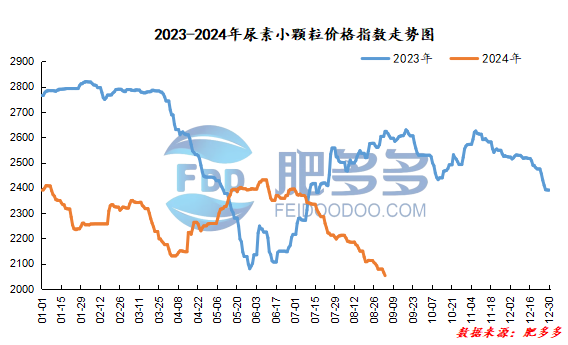

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 3 was 2,052.55, a decrease of 12.73 from yesterday, a month-on-month decrease of 0.62% and a year-on-year decrease of 21.76%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1849, the highest price is 1858, the lowest price is 1837, the settlement price is 1846, and the closing price is 1842. The closing price is 15% lower than the settlement price of the previous trading day, down 0.81% month-on-month. The fluctuation range of the whole day is 1837-1858; the basis of the 01 contract in Shandong is 118; the 01 contract has increased its position by 8118 lots today, and so far, it has held 184611 lots.

Today, urea futures prices continued to fluctuate within a narrow range and mainly fell downward.The general logic of urea's own fundamentals such as strong supply and weak demand and policy supervision continue to suppress prices. It is difficult to form a strong driving force while maintaining the cautious mentality in the downstream of the spot market. However, although urea demand is actually weak, there are still game points in the subsequent autumn. In the short term, urea itself lacks driving force or still fluctuates mainly with the weak overall market environment.

Spot market analysis:

Today, China's urea market prices continued to be weak and downward. The atmosphere in the venue was dull and the market changed little. New orders were traded by companies. The market gradually turned into a downward trend amid a stalemate. Low-end ex-factory prices in mainstream areas were lowered at low levels.

Specifically, prices in Northeast China have been lowered to 2,040 - 2,080 yuan/ton. Prices in East China have been lowered to 1,940 -2010 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,970 - 2,200 yuan/ton, and the price of large particles has stabilized at 2,070 - 2,120 yuan/ton. Prices in North China have been lowered to 1,900 - 2,080 yuan/ton. Prices in South China have been lowered to 2,070 - 2,150 yuan/ton. Prices in Northwest China have been lowered to 2030-2080 yuan/ton. Prices in Southwest China have been lowered to 2,000 - 2,400 yuan/ton.

Market outlook forecast:

In terms of factories, as early orders are shipped one after another, companies are preparing to reduce their sales. Some manufacturers continue to face shipping pressure. The quotations have once again been revised back to collect orders, and their mentality is weak. In terms of the market, the trading atmosphere in the market is average, and the market once again shows a weak trend. Currently, there is a lack of effective positive factors to support the upward trend of prices. Some low prices in the market have attracted industry operators to continue buying. However, after the price rebounded slightly, the industry followed suit and resistance appeared, and new orders The transaction situation has slowed down again, and the current market situation is deadlocked and waiting for guidance. In terms of supply, the daily production of urea has shown a gradual increase in the near future, with early maintenance equipment restored, the industry's supply continues to be sufficient, and the supply and demand side continues to be biased towards a loose trend. On the demand side, there is still a need to wait for replenishment in the autumn fertilizer market. Downstream operators are mainly following up cautiously. There is no substantial positive improvement in the delivery of finished products from compound fertilizer factories, and they are less willing to replenish raw materials, so they maintain on-demand procurement.

On the whole, the current urea market lacks guidance from favorable factors. Manufacturers are shipping orders one after another, and the market is weak and downward. It is expected that the urea market price will continue to loosen and consolidate in a short period of time.