- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

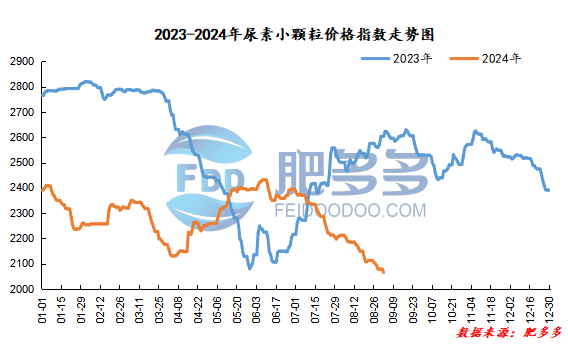

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 2 was 2,065.27, a decrease of 13.18 from yesterday, a month-on-month decrease of 0.63% and a year-on-year decrease of 20.67%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1860, the highest price is 1867, the lowest price is 1843, the settlement price is 1857, and the closing price is 1862. The closing price is 14 lower than the settlement price of the previous trading day, down 0.75% month-on-month. The fluctuation range of the whole day is 1843-1867; the basis of the 01 contract in Shandong is 108; the 01 contract has increased its position by 9835 lots today, and so far, it has held 176492 lots.

Today's urea futures prices opened sharply lower due to the weakening market environment at night trading last Friday, and then fluctuated mainly within a narrow range.The general logic of urea's own fundamentals such as strong supply and weak demand and policy supervision continue to suppress prices. It is difficult to form a strong driving force while maintaining the cautious mentality in the downstream of the spot market. However, although the demand for urea is weak, follow-up game points still exist, and the overall market sentiment has been affected in the near future. Price elasticity still exists. In the short term, urea itself lacks driving force or still fluctuates within a narrow range with the overall market environment.

Spot market analysis:

Today, China's ureaThe transaction of new orders in the market slowed down again. As the offers of individual companies increased slightly, the market had no obvious positive guidance, and the market was in a stalemate.。

Specifically, prices in Northeast China have been lowered to 2,050 - 2,090 yuan/ton. Prices in East China have been lowered to 1,950 - 2,030 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,980 - 2,230 yuan/ton, and the price of large particles has been lowered to 2,070 - 2,120 yuan/ton. Prices in North China have been lowered to 1,980 - 2,090 yuan/ton. Prices in South China have been lowered to 2,070 - 2,150 yuan/ton. Prices in Northwest China have been lowered to 2,060 - 2,110 yuan/ton. Prices in Southwest China are stable at 2,050 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have increased their orders, and offers have been arranged in a narrow range during successive shipments. Some companies are still facing the pressure of balancing production, sales and shipments. The short-term fluctuations in inventories are small, and local inventory conditions vary greatly. The pressure on enterprises still exists. In terms of the market, the market continues to maintain a stalemate. As low-end price orders improve, high external prices make up for the decline and promote transactions. The current market lacks favorable support, and the market is volatile downward. Lower prices once again attract downstream players to enter the market to buy. On the supply side, there are still many equipment failures in the industry, Nissan is recovering slowly, some enterprises have experienced stock reductions, and some enterprises in the main production and marketing area only maintain a balance of production and sales. In terms of demand, partial shipments of some finished downstream compound fertilizers have improved slightly, but overall shipments are not as good as in previous years. There is a backlog of raw materials and costs. There is insufficient support for the urea market, and we are still cautious in follow-up replenishment.

On the whole, the current supply and demand fundamentals in the urea market are relatively generous, and there is no substantial positive news guidance in the market. Based on the support of pending orders, it is expected that the urea market price may be dominated by a stalemate in consolidation in the short term.