- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

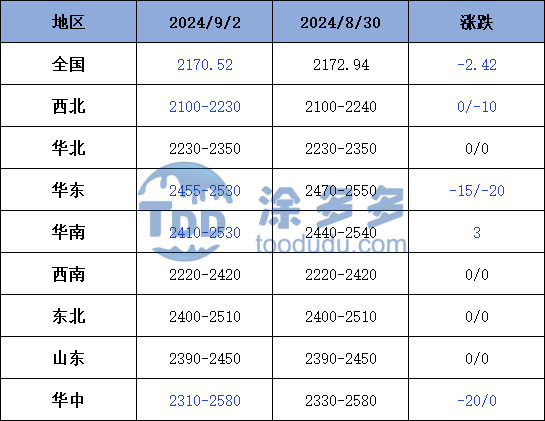

On September 2nd, the methanol market price index was 2170.52, down 2.45 from yesterday, down 0.11% from the previous month.

Outer disk dynamics:

Methanol closed on August 30:

China CFR 295-298USD / ton, Ping

Us FOB 108109 cents per gallon, flat

CFR in Southeast Asia: us $346-347 per ton, Ping

European FOB 349-350 euros / ton, up 4 euros / ton.

Summary of today's prices:

Guanzhong: 2200-2230 (0), North: 2100 (0), South: 2110 (0), Lunan: 2395-2400 (0), Henan: 2310-2315 (- 15), Shanxi: 2230-2290 (0), Port: 24552465 (- 15)

Freight:

North Line-North Shandong 245-290 (0amp 5), North Line-South Shandong 310-335 (0max 0), South Line-North Shandong 230-270 (0ax 0), Guanzhong-Southwest Shandong 160-240 (0max 0)

Spot marketToday, the methanol market price is adjusted in a narrow range, the futures market is weak and volatile, and the port spot market price is adjusted with the market. At present, there is little pressure on manufacturers in the main producing areas to sort out inventory, and there is a certain expectation of downstream demand, and some manufacturers have a certain price sentiment, but the futures market is weak and volatile, the enthusiasm of operators to enter the market to replenish stock is not high, and rigid demand is mainly. Specifically, the market prices in the main producing areas are running at a high level, with the quotation on the southern route around 2110 yuan / ton and the northern line around 2100 yuan / ton, maintaining the previous working day, the futures market fluctuates downwards, and the market wait-and-see mood is relatively strong, but considering that the inventory pressure of some enterprises is not great, the manufacturers are not willing to lower the quotation. Market prices in Shandong, the main consumer area, are arranged in a narrow range, with 2395-2400 yuan / ton in southern Shandong and 2390-2420 yuan / ton in northern Shandong. The futures market is weak and volatile, and the enthusiasm of operators to enter the market and replenish stocks is not high. Pay attention to the bidding situation in tomorrow's market. The market quotation in North China is running. Hebei quotes 2320-2350 yuan / ton today. The trading volume of new orders in the region is less, and the market wait-and-see mood is obvious. Shanxi quoted 2320-2350 yuan / ton today, and some of the devices in the field are parked and overhauled. The market supply in the region has been reduced, but the terminal demand is still weak, and the market transaction atmosphere is limited.

Port marketMethanol futures fell in volatility today. Near-end bargain replenishment is active, arbitrage shipments are the main, the basis is strong; long-term trading is general, the basis is stable. The price difference has narrowed in recent months, and the overall transaction is OK. Taicang main port transaction price: 9 transaction price: 2455-2465, base difference 01-30 picture22 position 9 in transaction: 2460-2470, base difference 01-25 buyer 20 transaction 9 transaction: 2470-2485, base difference 01-10 Ultram 7 cross 10 transaction: 2500-2510, basis difference 01-2510 20.

Future forecast:Recently, under the support of little supply pressure and good demand from the main downstream, the quotation of manufacturers has remained high, and with the gradual cooling of the temperature, the demand of the traditional downstream market may gradually resume. Some operators in the market have a certain positive mood towards the future, but at present, the futures market is high, and with the rapid increase in market prices last week, some downstream hold a certain wait-and-see mood towards high prices. The overall enthusiasm for restocking in the market is not high. At present, the short-term Chinese market price range is mainly volatile, but in the later stage, we need to pay attention to coal prices, plant operation and downstream demand follow-up.