- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:September 2nd V2501 contract opening price: 5581, highest price: 5584, lowest price: 5460, position: 1047337, settlement price: 5516, yesterday settlement: 5604, down 88, daily trading volume: 1146295 lots, precipitated capital: 4.01 billion, capital inflow: 222 million.

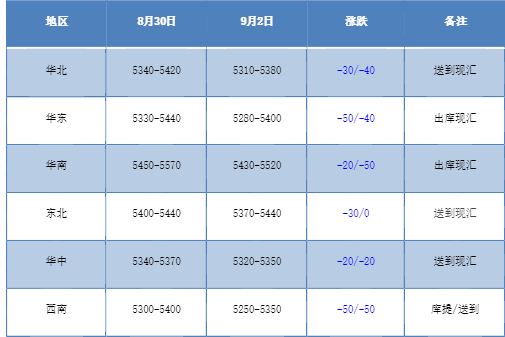

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market began to decline at the beginning of the week, and the market atmosphere was obviously weak. Compared with the valuation, it fell by 30-40 yuan / ton in North China, 40-50 yuan / ton in East China, 20-50 yuan / ton in South China, 30 yuan / ton in Northeast China, 20 yuan / ton in Central China and 50 yuan / ton in Southwest China. At the beginning of the week, the ex-factory price of the upstream PVC production enterprises was partially reduced by 30-50 yuan / ton, and the price of the remote warehouse went down synchronously, but at the beginning of the week, even if the price went down, the signing volume of the contract was not heard of, and the futures were weaker and downward. compared with last Friday, the spot market quotation was mainly reduced compared with last Friday, and the spot price coexisted with a mouthful price, and the basis offer advantage was relatively obvious, among which the base difference offer 01 contract in East China was relatively obvious. South China 01 contract-(0-50-80 or + 20), northern 01 contract-(300-350-400), southwest part of the low-cost supply heard 01 contract-(500). On the whole, the operation of the spot market at the beginning of the week is extremely empty, a single price is difficult to close a transaction, downstream procurement enthusiasm is general, transaction did not see a substantial volume.

From the perspective of futures:PVC2501 contract night trading opened slightly weaker, the overall night trading has been down. After the start of morning trading, the futures price was narrowly arranged on the basis of the night low, but it fell further in the afternoon and closed at a low in late trading. 2501 contracts fluctuated in the range of 5460-5584 throughout the day, with a spread of 124. 01 contracts with an increase of 78427 positions, with 1047337 positions so far, 2505 contracts closing at 5728 and 91523 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2501 contract shows an obvious downward trend. First, the fluctuation range of the futures price expands, and the spread between the high and low points of the whole day. Secondly, the low of the futures price slightly falls through the lower position, showing a large negative column throughout the day. The disk position increases by 7.84 million hands in a single day, and the position successfully breaks through one million. The all-day price goes down all the way, and in terms of transaction, the opening is 24.4% more than the empty opening is 28.7%. The technical level shows that the three-track opening of the Bollinger belt (13, 13, 2) tends to open, and the KD line at the daily level shows an obvious dead-fork trend, and the distance between the two lines of the MACD line is shortened obviously. The futures price has a deep downward situation, in the short term, the operation of the futures price may continue to be short, and observe the support performance of the low range of 5400-5450.

Spot aspect:Since the beginning of the week, there has been an obvious downward trend in the two cities, the futures price has fallen sharply in the futures market, and the transaction price in the spot market has also weakened obviously, including the synchronous decline in the prices of production enterprises. Although the price has declined, the volume of transactions in the spot market has not been reduced, and there are not many contracts signed in the first generation. Although the enthusiasm of spot price inquiry has increased after the futures price has gone down, the transaction performance of the spot market is poor, and some downstream enterprises are weak. And hold a wait-and-see mentality to wait for a lower point price to appear, at present, there are no obvious variables in the supply and demand level. Today, the overall commodity mood is not good. At midday, the main contracts of Chinese futures were floating green, with the European line down more than 11%, glass down nearly 7%, soda ash down nearly 6%, PTA down nearly 5%, industrial silicon, p-xylene (PX), fuel down nearly 5%, iron ore down more than 4%, lithium carbonate and Shanghai silver down nearly 4%, and coking coal, coke, ferrosilicon, bottle chips, cotton yarn and SC crude oil fell more than 3%. On the whole, PVC spot market or low adjustment is the main part in the short term.